SPY 5/30 Trade plan

AI Frenzy!

Readers,

I hope you all have had a great weekend! This AI craze is bonkers to say the least and it seems they might have a deal on the debt ceiling. Should make for some good moves in the market to capitalize on. The market makers are expecting a 8.08 dollar move in SPY this week, giving us a upper range of 428.10 and a lower range of 411.94.

Here is what the current monthly profile looks like. We are currently at a monthly imbalance to the upside, above the current value area. Value area high is at 416.85, POC at, 411.49 and value area low comes in at 409.87.

Here is what those other values are. Bulls want to see April’s value area hold and bears want to see price under 408.28.

On the weekly profile, look how last weeks POC and VAL held as support and then price took back that 414 level that we talked about last week, I said if the bulls can take back 414 there was a good chance that we were going to see 417+ again.

Again, the bulls need to defend 414, or we could see 407-403. Above 420.55 opens the door to 425-426. This is also the first week in some time were the MMs expected move on the week is higher than $7 and its a short week! What’s that tell you? News!

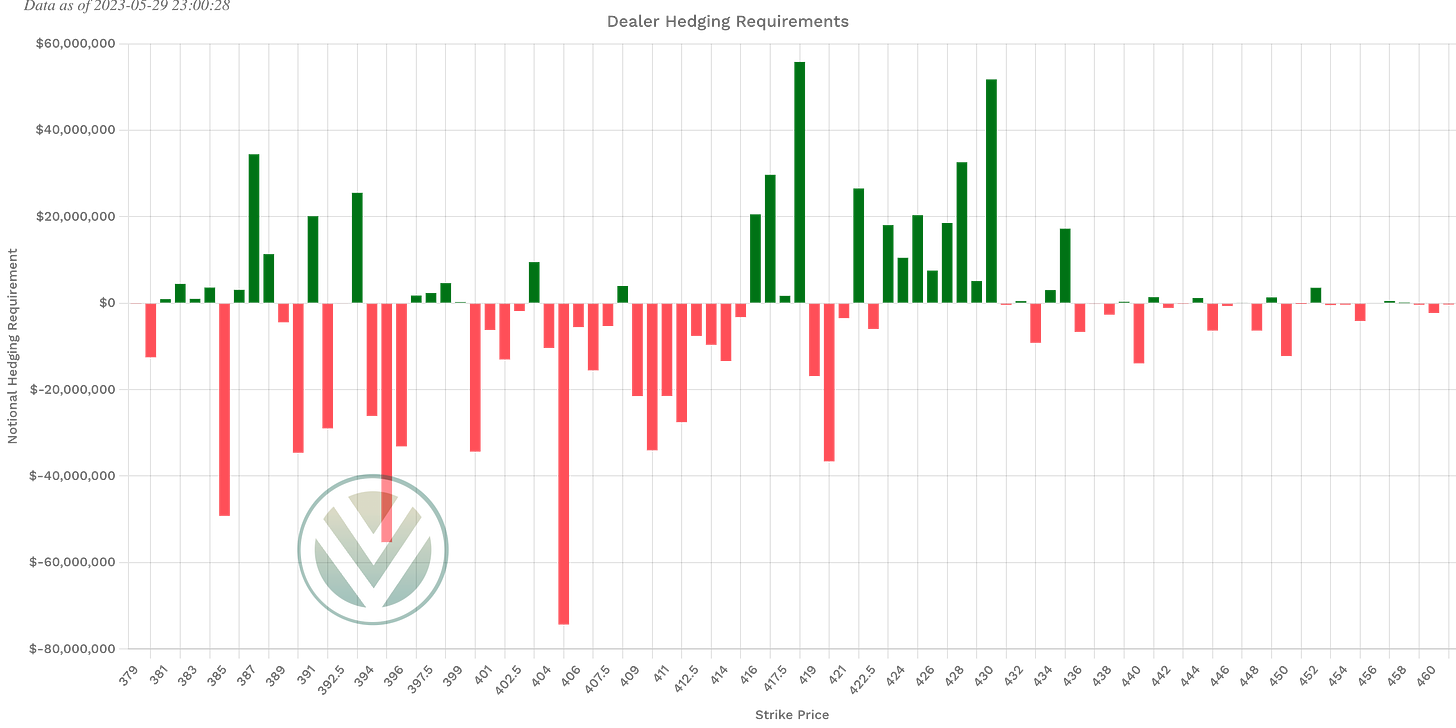

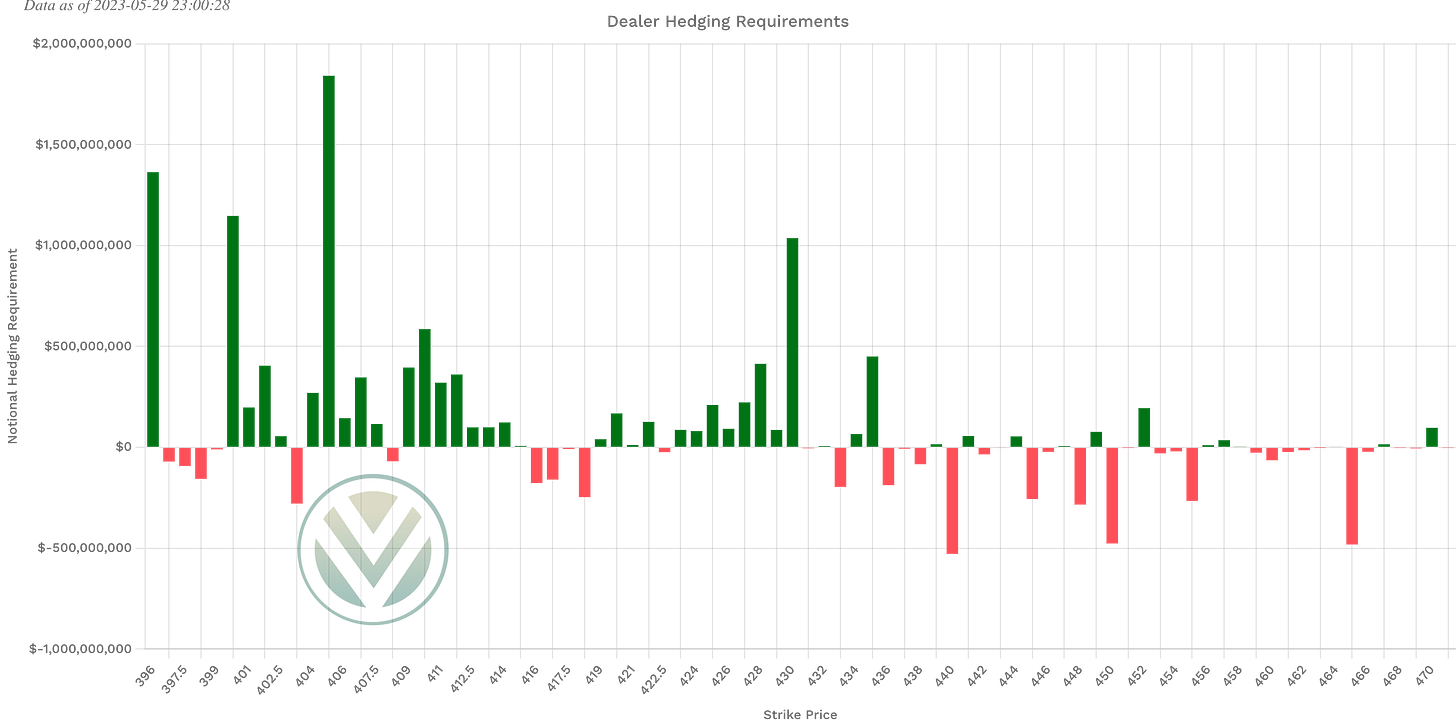

Positive Gamma

403, 408, 416-418, 422-430

It’s pretty critical for the bulls to hold 418-416 the next level under 416 is showing 408. These are also key volume profile levels.

Negative Vanna

403, 408, 416-418, 422.50, 433

This adds more conviction to the 418-416 level, this is also saying that over 422.50 we could see 430-433. *Not 0dte*

Key levels above (previous close - 420.02)

420.36-420.55

August 22’ VAH and last weeks VAH

421.22-421.87

Supply & 422 is positive Gamma (resistance)

423.73-424.70

Supply & 422.50 is negative Vanna (but small) 423 is positive Gamma (resistance)

425.53-426.53

Naked weekly VAL and POC

Positive Gamma

427.40, 427.99, 428.10, 428.50

427.99 was April 22’ VAL (not naked), 428.10 is the weekly MMs expected high.

Key levels below (previous close - 420.02)

419.82, 419.47, 419.08

Demand, 419.08 is last weeks POC

418.50-418

418 positive Gamma and negative Vanna (support)

417.65-417.40

Demand, 417 positive Gamma and negative Vanna (support)

416.85-416.19

Demand, 416 positive Gamma and negative Vanna (support)

415.33-414.85

Demand

414.13, 414, 413.50

Last weeks VAL and April’s VAH

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.

Thanks but its a Important need of day vanna charm of SPX