Market Session Review

I won’t spend too much time reviewing today’s trading session as our trade plan provided you 2 great trade ideas to take on the day. We had…

Below 4485 target 4460

If there is a breakdown of 4455 target 4440

These trading sessions rare where we get a nice trend day with very little moment going the other way on the day.

Let’s quickly review some of the key levels I mentioned. While we lost 4516 on Tuesday we did breach 4458 today and closed back above it. If this level holds we can start to see price head back towards 4507 which is this months POC - although it is forming still. Before we get there we need to get back above Septembers VAL which is 4480.

Let’s discuss some important levels that I will be keeping an eye out for this month…

4596 - this is July’s VAH - value area high on the volume profile. If we can break above 4557 and hold it we will target this area.

4557 - this is July’s POC - point of control on the volume profile. We are trading below it, but if we can capture 4532 and hold it we will then navigate to this level next

4532 - this is August’s VAH - value area high on the volume profile. We rejected from this level on Friday and closed below it

4516 - this is August’s POC - point of control on the volume profile. We are trading below this level and closed below it at 4515 on Friday.

4507 - Septembers POC - still forming and could change as we go through the month

4480 - Septembers VAL - still forming and this range could continue to change and dynamically go up or down

4458 - this is June’s VAH on the volume profile. While we broke below this we did come back strong this week to push back above it. It becomes an important level we follow

4417 - this is August’s VAL - value area low on the volume profile. This would be a major defense by the bulls so we don’t have further selloff.

With that, let’s jump into the trade plan.

SPX/SPY/ES Intraday Overview (TL;DR)

The bulls want to push price above 4475 targeting 4490. If VIX continues to fall a breakout of 4490 will target 4500-4505.

The bears want to push price below 4460 while defending 4475. If 4460 breaks we target 4445.

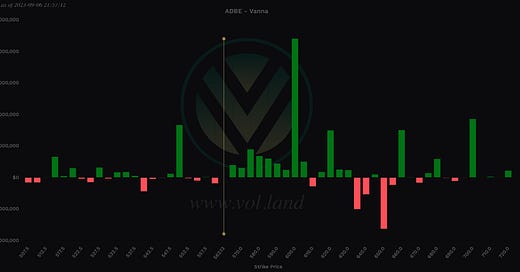

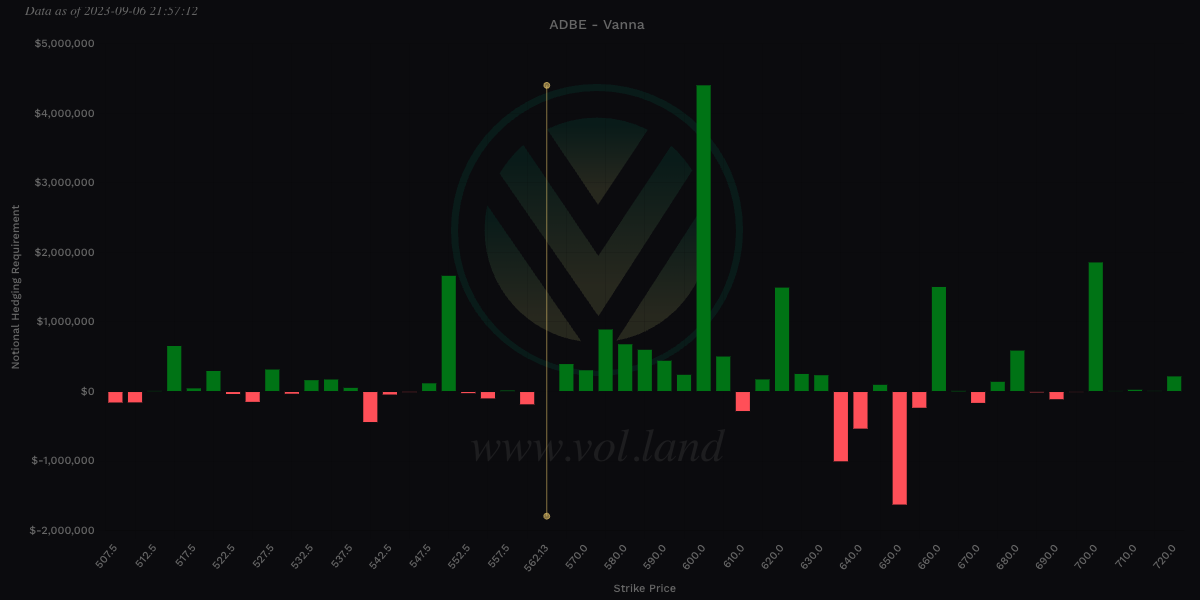

ADBE

No major changes to our ADBE trade plan. It doesn’t seem like it wants to target that 540 level so our main price levels to watch are 560 and 555. These levels hold and if the market starts to act bullish we could start to see ADBE start to take off.

Important levels:

511-539 - bullish orderblock on daily chart

540-545 - negative vanna and last weeks VAL

555 - negative vanna

560 - last week’s POC - breached and holding

569 - last week’s VAH

570 - negative vanna

572-580 - bearish orderblock on daily chart

Trade Idea:

Above 540 OR 560 target 610 - swing trade

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

8:30am est - Unemployment Claims

10:00am est - FOMC Member Harker Speaks

11:45am est - FOMC Member Goolsbee Speaks

3:30pm est - FOMC Member Williams Speaks

For more information on news events, visit the Economic Calendar

9/7 - SPX/ES/SPY Trade Plan

Bullish bias:

Above 4475 target 4490

If VIX continues going down then a breakout of 4490 targets 4500-4505

If there is a failed breakdown of 4445 target 4460 then 4475

Bearish bias:

Below 4460 target 4445

If there is a failed breakout of 4475 or 4490 target 4460

If there is a breakdown of 4445 target 4430

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 6pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.01.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4475 - negative vanna

4490 - negative vanna

4485-4496 - 449.21-448.07 - $11.37B

4500 - negative vanna

4501-4507 - OB (15min chart)

4504 midline

4505-4516 -450.12-451.16 - $17.57B

4510-4515 - negative vanna

4510-4516 - OB (1hr, 2hr chart)

4508 midline

4550 - negative vanna

Below Spot:

4465-4460 - negative vanna

4471-4458 - 446.66-445.42 - $14.42B

4445 - negative vanna

4458-4375 - OB (1D chart)

4416 midline

4435-4415 - OB (30min chart)

4425 midline

4434-4431 - 442.98-442.73 - $10.62B

4425-4414 - OB (1hr chart)

4419 midline

4405-4400 - negative vanna

4417-4401 - OB (2hr chart)

4409 midline

Dark Pool Levels

We had approx. $2.27B in dark pool prints at the 4466 level (446.16).

Above Spot:

4496-4485 - 449.21-448.07 - $11.37B

4505-4516 -450.12-451.16 - $17.57B

4568-4580 - 456.43-457.64 - $10.38B

Below Spot:

4471-4458 - 446.66-445.42 - $14.42B

4434-4431 - 442.98-442.73 - $10.62B

4404-4385 - 439.97-438.09 - $18.55B

4375-4367 - 437.03-436.29 - $12.66B

4340-4336 - 433.65-433.19 - $12.14B

4316-4283 - 431.26-427.92 - $18.46B

4205-4180 - 420.16-417.60 - $18.8B

I get my dark pool levels from Quant Data.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break. I use Sonarlab’s indicator on Tradingview to plot these.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4501-4507 - OB (15min chart)

4504 midline

4510-4516 - OB (1hr, 2hr chart)

4508 midline

4572-4582 - OB (2hr, 4hr chart)

4577 midline

4573-4594 - OB (1D chart)

4584 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4458-4375 - OB (1D chart)

4416 midline

4435-4415 - OB (30min chart)

4425 midline

4425-4414 - OB (1hr chart)

4419 midline

4417-4401 - OB (2hr chart)

4409 midline

4416-4356 - OB (4hr chart)

4386 midline

4362-4328 - OB (1D chart)

4345 midline

4345-4328 - OB (1hr, 2hr, 4hr chart)

4336 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~47.61 points. SPY’s expected move is ~4.89. That puts us at 4563.39 to the upside and 4468.17 to the downside. For SPY these levels are 456.10 and 446.32.

Remember over 68% of the time price will resolve it self in this range by weeks end.

Volland Data

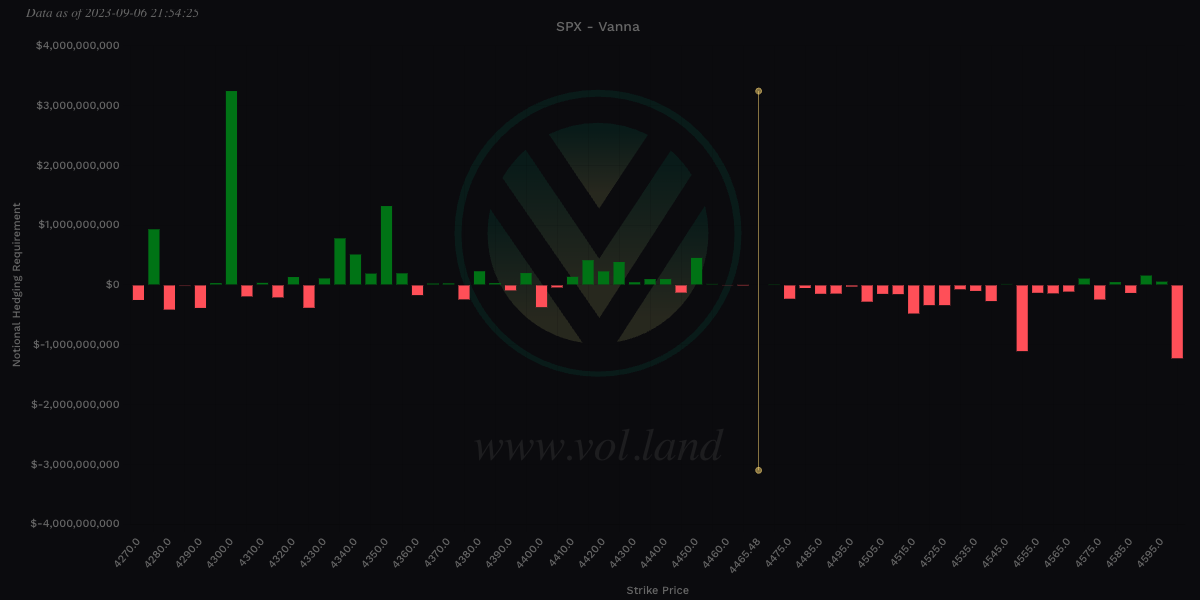

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4475-4565 - negative vanna

4475 - negative vanna

4490 - negative vanna

4500 - negative vanna

4515 - negative vanna

4550 - negative vanna

Below Spot:

4465-4460 - negative vanna

4445 - negative vanna

4405-4400 - negative vanna

4390 - negative vanna

4375 - negative vanna

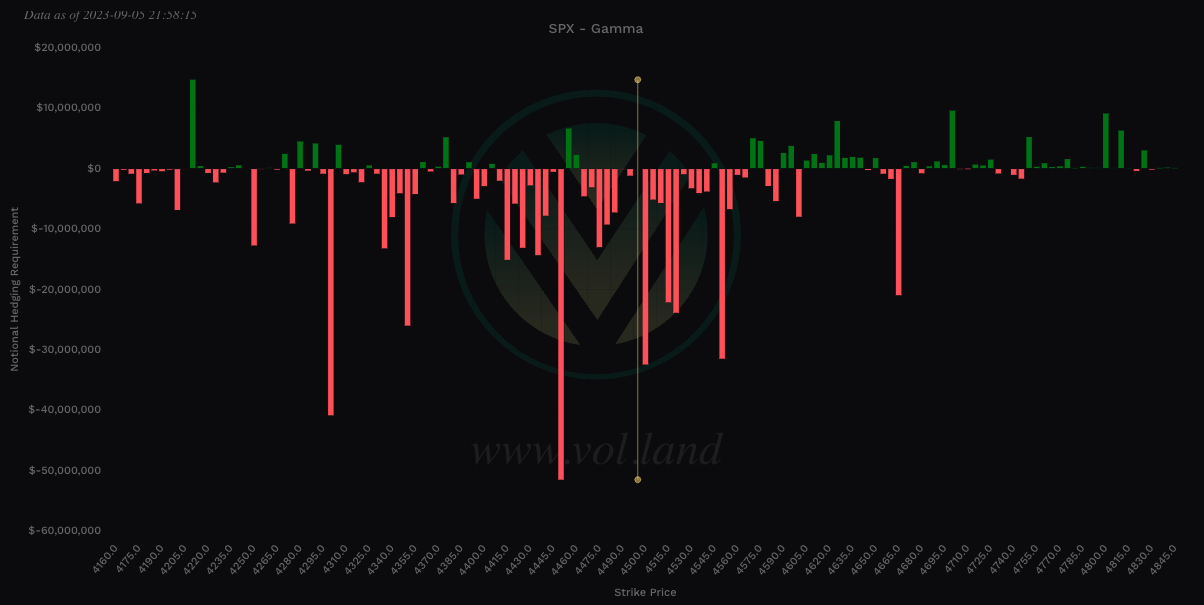

Gamma

Positive Gamma Above Spot - acts as resistance

Positive Gamma Below Spot - acts as support

Negative Gamma - becomes permissive to price as it moves there - aka neither resistance nor support - simply just chillin and watching what’s happening…

Above Spot:

4470 - positive gamma

4480 - positive gamma

4500 - positive gamma

4545 - positive gamma

4570 - positive gamma

Below Spot:

4460 - positive gamma

4445 - positive gamma

4405-4400 - positive gamma

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.