Market Review - Last Session

In yesterday’s trade plan we had the following bullish bias trade ideas…

Above 4275 target 4285

If VIX continues going down then a breakout of 4285 targets 4295-4300

If VIX continues going down then a breakout of 4300 targets 4310 then 4320

SPX opened at 4270, quickly sold down to 4264 where it found support near this level twice in the first hour of the trading session - remember our bearish bias didn’t begin until we broke 4260. Once it found buyers in this area the rest was game over for the bears as we hit our upside targets to 4310 and then came within 4pts of the high of the days target which was 4316. All and all this was an easier trading day than the prior day where we made an adjustment to the trade plan in the RTH session.

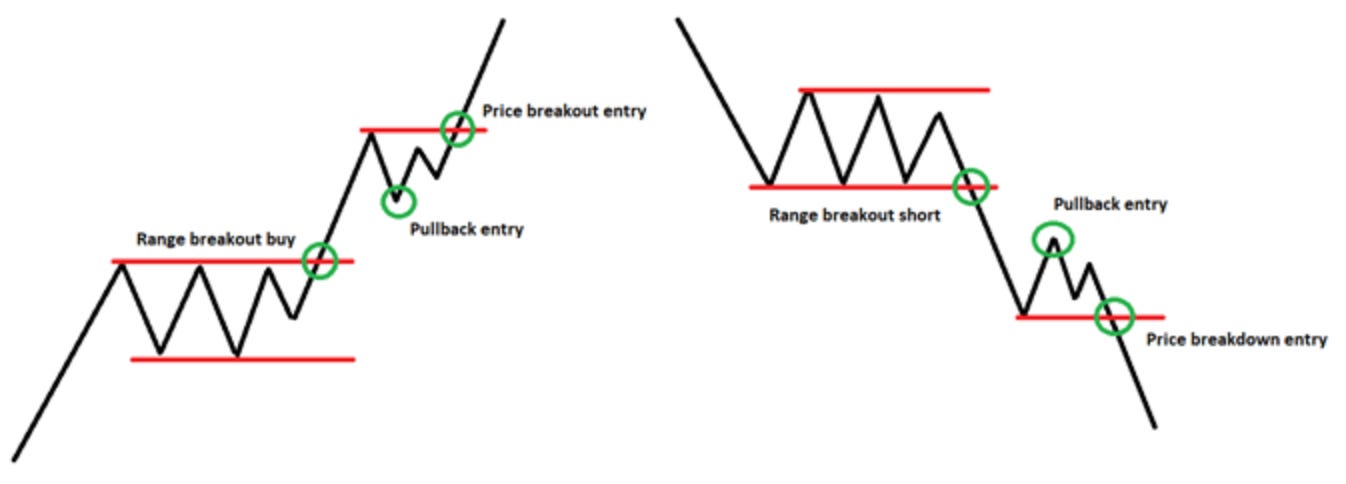

Many of you have asked what does a breakout or breakdown look like and one of the better visuals I can share with you is the below. Please see my intraday trading strategy posting for more details and a video walkthrough.

Speaking about our chat room…for more details on how you can access it see our post below. We are excited to provide this to all of our paid subscriber where we can discuss the days trading session.

In terms of our key levels we need to stay above the bullish/up trendline at 4232, but we will continue to monitor this level and its importance for the bulls. What’s interesting with this trendline is that SPY and ES both tested this trendline and held it. So I am looking at this trendline across all 3 SPX/SPY/ES tickers.

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.