Market Review - Last Session

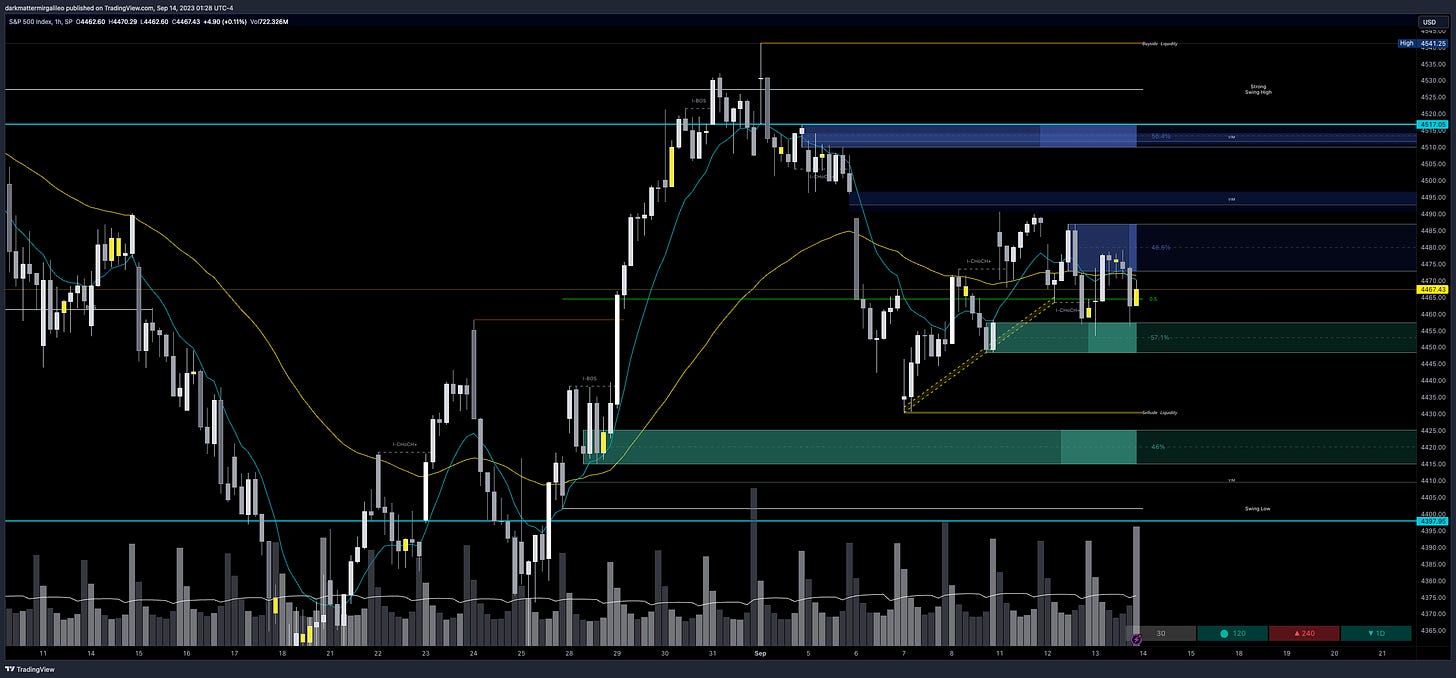

Hello team. Quite an interesting day today with the CPI data out in the premarket where we saw the good ole fakeout trapping traders to the downside and then targeting the highs on ES at 4530.

I won’t bore you with the details of the CPI data - there are people out there who have provided a lot of opinions and others with facts. Personally, I follow Steven Anastasiou who provides one of the best economic newsletters. His data forecasts and analysis of what they mean has really helped me understand and prepare myself before days like today. Give him a follow…

Going back to the trading session, today was all about #paytience. We opened right in the middle and hadn’t hit one of our levels to determine direction/trend until we hit 4455 - where we had a classic failed breakdown - which then went on to target our expected move to 4480. Remember, we opened at 4463, went as high as 4473 before trading all the way back to 4455.

For those of you not following on X I did share a few Posts and replies on potential moves during the session. If you haven’t make sure to follow and turn on notifications for all Posts and replies. @DarkMatterTrade

Now personally for me I wouldn’t have traded the open as an options trader. If I was scalping or trading futures maybe different, but what I want to iterate is most times then not I stay out. It’s like joining a fight when you have no reason to be in it, but are. Wait for those key levels, what the trade plan states and then react.

Please keep this in mind if a level hasn’t been touched in the trade plan once we open RTH most times than not those levels and the trade plan are in tact. Please feel free and go back to any of our trade plans and backtest and you will see exactly what I mean. Once one of those levels hit like 4455 or 4480 today this is where I rely on live data from Volland to ensure I don’t overextend my welcome to the party.

I hope this gives you more insight in how I trade and my mental thoughts to how I use the trade plan as I trade. This place will never be a signal service nor do I want it to be, but having a plan and then formulating your own thoughts and trade plans is even more satisfying IMO.

Tomorrow we have premarket data that will drive price action. That is PPI and Retail Sales while we get the latest unemployment claims as well. Will be extremely interesting to see what happens…

No major changes to our key levels besides the current September profile which changes daily. 4484 is now the VAH - 4488 previously. POC is now 4464 previously 4453. VAL is now 4444 previously 4443. You can see that profile continues to shrink and shrink.

Let’s discuss some important levels that I will be keeping an eye out for this month…

Above Spot:

4471 - the VAH of last weeks - 9/5 - value area high

4484 - Septembers VAH - value area high - still forming and could change as we go through the month - it will be important for bulls to break above this for more upside

4516 - this is August’s POC - point of control on the volume profile. We are trading below this level and closed below it at 4515 on Friday.

4532 - this is August’s VAH - value area high on the volume profile. We rejected from this level on Friday and closed below it

4557 - this is July’s POC - point of control on the volume profile. We are trading below it, but if we can capture 4532 and hold it we will then navigate to this level next

4596 - this is July’s VAH - value area high on the volume profile. If we can break above 4557 and hold it we will target this area.

Below Spot:

4464 - Septembers POC - still forming and could change as we go through the month - we are currently trading above it which is critical for more upside

4458 - this is June’s VAH on the volume profile. While we broke below this we did come back strong this week to push back above it. It becomes an important level we follow

4444 - Septembers VAL - still forming and this range could continue to change and dynamically go up or down

4417 - this is August’s VAL - value area low on the volume profile. This would be a major defense by the bulls so we don’t have further selloff.

4400 - we have an uptrend line starting from May 24 and toughing August’s lows.

4368 - this is June’s POC - point of control - and price will look to see if it finds buyers here and balance

4309 - this is June’s VAL - value area low - we lose this and we get 4250-4200 pretty fast then. Why? There is not a lot of volume in this area that pushed price up so it will rip down pretty fast then

With that, let’s jump into the trade plan.

SPX/SPY/ES Intraday Overview (TL;DR)

We have a gap up in futures and slowed down near 4530-4535 - this is approx 4480-4485 on SPX.

For the bulls they want to keep price above 4485 to target 4500.

For the bears they want to defend 4485 to target 4455 and a breakdown there will cause a trend day selling off to 4410.

ADBE ER

No major changes. Although 580 seems like the likely course - just an opinion…

Quite the beat down on ADBE yesterday. For the past week or so we held that 560-555 zone pretty well until it caved yesterday and sending us all the way towards the value area low at 540 - our target should we break below 556.

525-530 now becomes the key critical zone for ADBE to defend to push it back to the upside. It all comes down to ADBE’s ER this Thursday after the bell. Complete 50/50 toss up on this chart.

This chart will either go towards 500-490 zone or carry the ticker back up towards 580 and even 610.

So ultimately, I think the following scenarios will play out:

If ER beat AND guides higher - 600-610 will come where we will find sellers

If ER beat AND no guidance higher - 580-590 hits where we will find sellers

If ER no beat AND no guidance lower - 520 trades where we may find buyers

If ER no beat AND guides lower - 490-500 trades where we may find buyers

Important levels:

501 - July’s VAL

511 - Augusts VAL

511-539 - bullish orderblock on daily chart

520 - August’s POC

532 - August’s VAH

556 - last weeks VAL

560.56 - last week’s POC

563 - last week’s VAH

567.5 - negative vanna

572-580 - bearish orderblock on daily chart

580-590 - negative vanna

610 - negative vanna

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

8:30am est - PPI and Core PPI

8:30am est - Retail Sales and Core Retail Sales

8:30am est - Unemployment Claims

10:00am est - Business Inventories

For more information on news events, visit the Economic Calendar

9/14 - SPX/ES/SPY Trade Plan

Bullish bias:

Above 4485 target 4500

If VIX continues going down then a breakout of 4500 targets 4515

Bearish bias:

Below 4470 target 4455

If there is a failed breakout of 4480 target 4470

If VIX continues going up then a breakdown of 4450 targets 4410

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 50pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.01.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4475-4480 - negative vanna

4474-4487 - OB 30min chart)

4480 midline

4485-4496 - 448.07-449.21 - $15.92B

4500 negative vanna

4505-4510 - OB (30min chart)

4507 midline

4515 negative vanna

4510-4516 - OB (1hr, 2hr chart)

4508 midline

4505-4516 -450.12-451.16 - $17.57B

4535 negative vanna

4550 negative vanna

Below Spot:

4457-4448 - OB (1hr chart)

4453 midline

4471-4458 - 446.66-445.42 - $21.75B

4435-4415 - OB (30min chart)

4425 midline

4434-4431 - 442.98-442.73 - $10.62B

4410 - negative vanna

4417-4401 - OB (2hr chart)

4409 midline

4404-4385 - 439.97-438.09 - $18.55B

4390-4385 - negative vanna

4416-4356 - OB (4hr chart)

4386 midline

4370 - negative vanna

4375-4367 - 437.03-436.29 - $12.66B

Dark Pool Levels

No major prints or changes to our dark pool. We had $1.47B print at the 4463 level. You can clearly see this zone and 4485 is where the whales have been accumulating. Break one of these and it could give us that leg to the next dark pool zone.

Above Spot:

4485-4496 - 448.07-449.21 - $15.92B

4505-4516 -450.12-451.16 - $17.57B

4568-4580 - 456.43-457.64 - $10.38B

Below Spot:

4471-4458 - 446.66-445.42 - $21.75B

4434-4431 - 442.98-442.73 - $10.62B

4404-4385 - 439.97-438.09 - $18.55B

4375-4367 - 437.03-436.29 - $12.66B

4340-4336 - 433.65-433.19 - $12.14B

4316-4283 - 431.26-427.92 - $18.46B

4205-4180 - 420.16-417.60 - $18.8B

I get my dark pool levels from Quant Data. How you want to view these levels is potential magnets. A lot of consolidation will happen at these levels so when we are trading away from one level price will then target the next area of interest whales have.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break. I use Sonarlab’s indicator on Tradingview to plot these.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4474-4487 - OB 30min chart)

4480 midline

4505-4510 - OB (30min chart)

4507 midline

4510-4516 - OB (1hr, 2hr chart)

4508 midline

4572-4582 - OB (2hr, 4hr chart)

4577 midline

4573-4594 - OB (1D chart)

4584 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4458-4375 - OB (1D chart)

4416 midline

4457-4448 - OB (1hr chart)

4453 midline

4435-4415 - OB (30min chart)

4425 midline

4425-4414 - OB (1hr chart)

4419 midline

4417-4401 - OB (2hr chart)

4409 midline

4416-4356 - OB (4hr chart)

4386 midline

4362-4328 - OB (1D chart)

4345 midline

4345-4328 - OB (1hr, 2hr, 4hr chart)

4336 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~59.55 points. SPY’s expected move is ~6.27. That puts us at 4517.05 to the upside and 4397.95 to the downside. For SPY these levels are 451.79 and 439.25.

Remember over 68% of the time price will resolve it self in this range by weeks end.

Volland Data

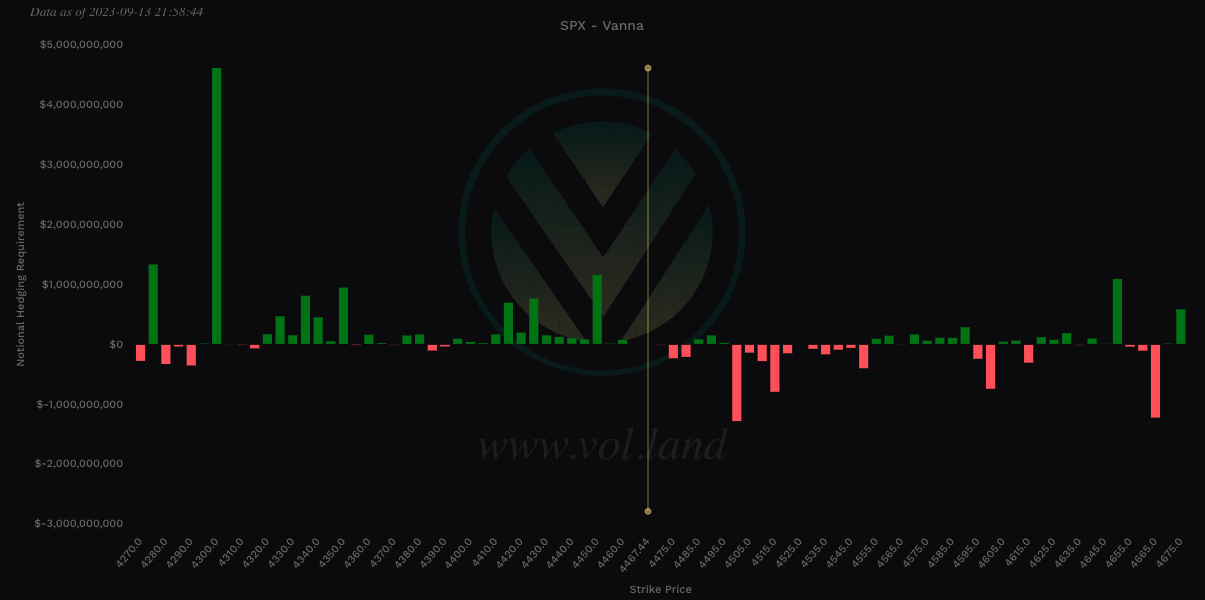

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4475-4480 - negative vanna

4500-4550 - negative vanna

4500 negative vanna

4515 negative vanna

4535 negative vanna

4550 negative vanna

Below Spot:

4410 - negative vanna

4390-4385 - negative vanna

4370 - negative vanna

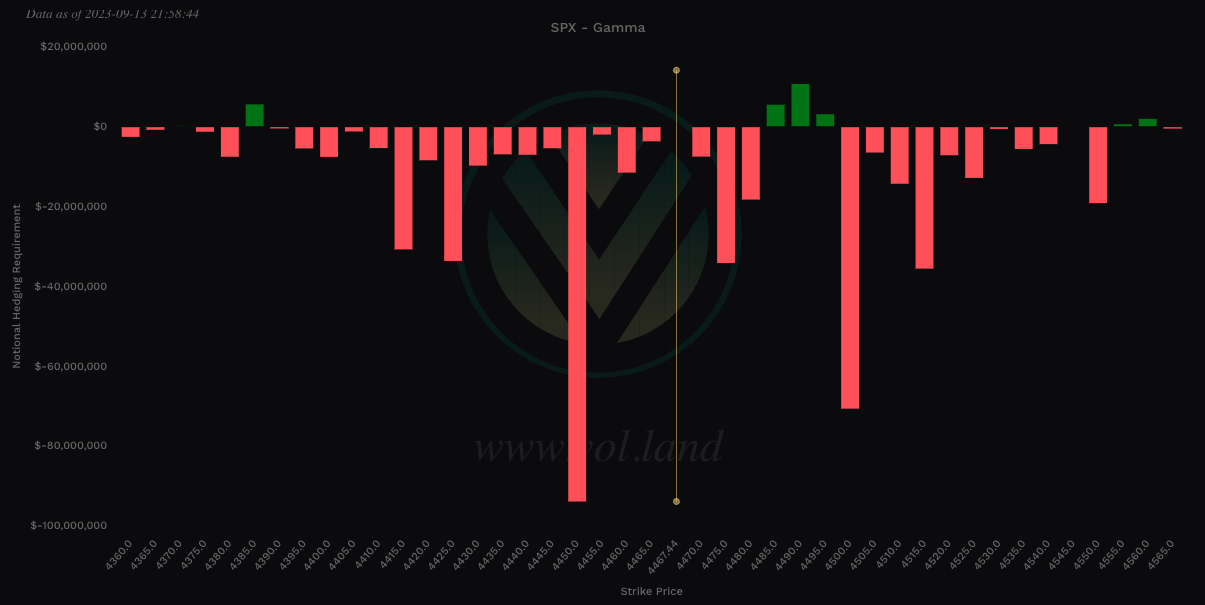

Gamma

Positive Gamma Above Spot - acts as resistance

Positive Gamma Below Spot - acts as support

Negative Gamma - becomes permissive to price as it moves there - aka neither resistance nor support - simply just chillin and watching what’s happening…

Above Spot:

4485-4495 - positive gamma

4555-4560 - positive gamma

Below Spot:

4410 - positive gamma

4385 - positive gamma

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.