October 30, 2023 SPX, SPY, ES Trade Plan

Weekly Market Overview

This week well what can we say but that the bears did some major damage. The ATH voice is dying fast. I have been in the camp that we could retest the 52 week highs and even that doesn’t look so great with all of the geopolitical issues in the world. If you are in this camp though the zones we are at and even another 100 pts below IF we were to find a base would be an explosive end of the year. Again these are my opinion and we will only trade what the price shows us.

In last Sunday’s plan we discussed how important 4250 was for the bulls to retake and hold. What happened? We tested and flirted above this level on Monday and Tuesday only to close below it both days and begin an aggressive selloff that finally saw us finding some footing at 4103.

So what level is critical for this week? IMO the 4100-4050 zone is of utmost importance for the bulls to maintain and hold. This is where buyers need to come in and build a base for any sort of rally going into the end of the year.

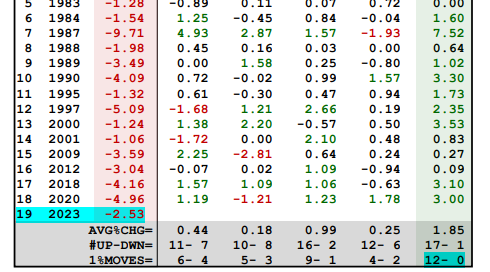

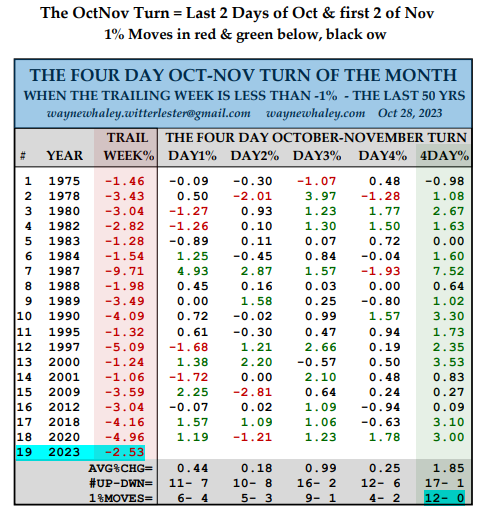

I also want to bring in a view from Wayne Whaley - who I have used in previous letters - for direction on the quarterly and monthly timeframes. What Wayne has provided in this post on X is that we typically see a major green day during this October to November switch where on the 3rd day of this week - the first trading day of November - we see a large green day. Quite funny how that day is Wednesday with the FOMC…

Day 1 and Day 2 on avg see .44% or .18% changes and it is pretty even on how many times it ends up or down. Then when you shift into the 3rd day, the first trading day in November, you see a higher avg change and with it 16 times up and 2 times down and with it at least a .99% move is expected to happen. Take a look at the post insightful information we can add as a data point to our trading plan.

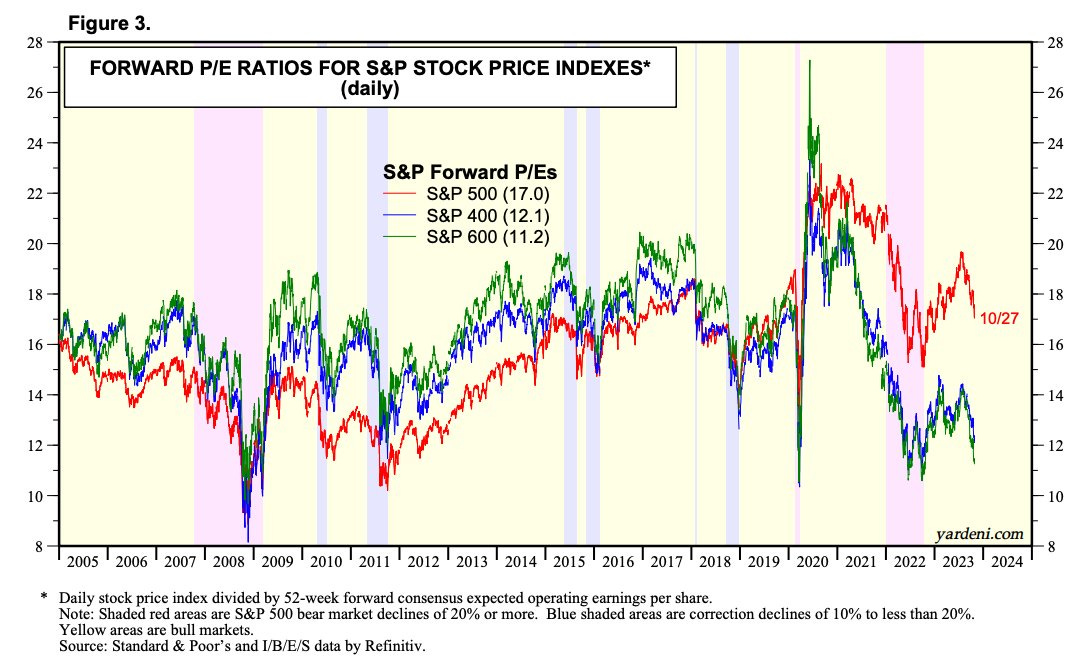

The other reason I want to see if the market bases in this area is that we are starting to hit the avg value of the forward p/e ratio of the SPX. The SPX is trading at about 17 forward p/e with its avg at 16.8. The only concern with this view is the NQ is still trading above its avg valuation…

So in summary we have different views and views that you want aligned if you are a bull or bear. If you are looking to swing LEAPS this is not the time still. Need to let it play out and first find an area where we can find basing and other key indicators showing a push back up or further sustained selloff…

As it relates to news this week we have FOMC and interest rate decisions. Along with that we have jobs data coming out Wednesday and Friday. Let’s also not forget about Apple’s earnings Thursday after the bell.

SPX/SPY/ES Intraday Overview (TL;DR)

Tomorrow could be a weird range day if we cannot break 4130 to the upside. If we are capped to the upside there price could come back towards 4115 then 4105.

So this level between 4105 and 4130 is all range bound and can reverse quick.

Thus if you are a bull you want price…

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.