Market Review - Last Session

Hello fellow traders. What an amazing session we had at least for the bulls. With low volume the bulls were able to overtake the gap down selloff in futures action after the Middle East conflict in Israel.

I don’t want to boost, but we provided a perfect trade plan and kept everyone from going short at the open and guided everyone overnight and into the market open. No need for a chat - simply follow the trade plan - don’t trade 0DTE - and boom you walked away with some nice profits today.

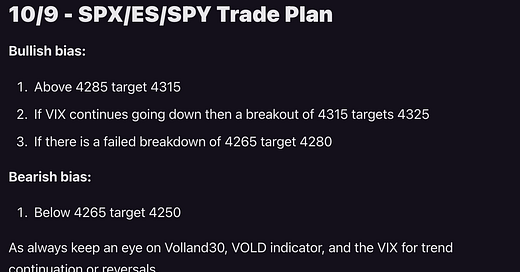

If you forgot or haven’t subscribed yet here is what we said…

Let’s review the day to learn from it. Futures kept most of the day as a magnet near that 4310 level. We also tested our trendline in the overnight action - that same trendline of the October ‘22 and March ‘23 lows. We have hammered home this trendline in multiple trade plans for weeks now and its importance came back today.

Additionally, we had a parallel channel, which we tested and ripped right through it near the 4320 level where we then rallied another 15 pts.

Speaking of which, if you haven’t subscribed already come and join us. For as little as $15/month where we provide these daily trade plans for intraday traders while also providing great educational content to our subscribers.

Dark Matter Trade - Chat Room on Substack

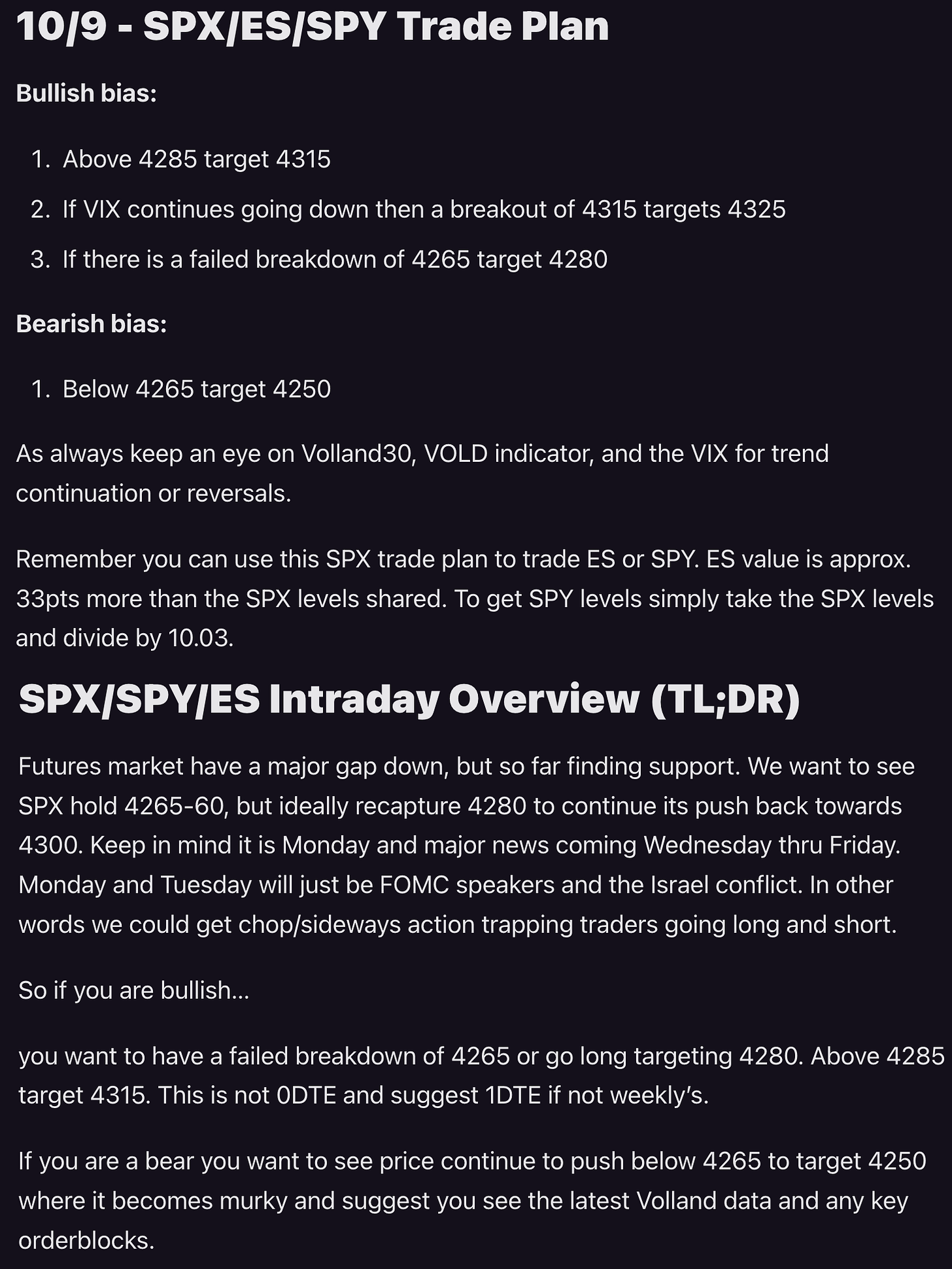

SPX/SPY/ES Intraday Overview (TL;DR)

Looking at futures data The big levels that we need to break to the upside is 4380 - approx. 4347 SPX. To the downside it is 4368-70 - approx 4335.

Thus, for the bulls you want to keep price above 4322 to target…

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.