November 28, 2023 SPX, SPY, ES Trade Plan

Market Recap

I hate to tell you it, but we called this chopfest - mentioned the following…

As we discussed above and below in the trade plan this week is going to be choppy. Play key levels on break downs or breakouts or failed ones.

Thus 4550-4560 is complete noise and you can see in futures action so far we have just bounced in between these levels.

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

Surely enough we played an agonizing game of ping pong between these levels. As a pure technical trader or scalper this was your kind of session. Just going long and short at these levels until proven otherwise. We did have a few pokes below 4550, but what is interesting we didn’t see that above 4560…

Something to keep in mind and a level if you haven’t charted how critical it is.

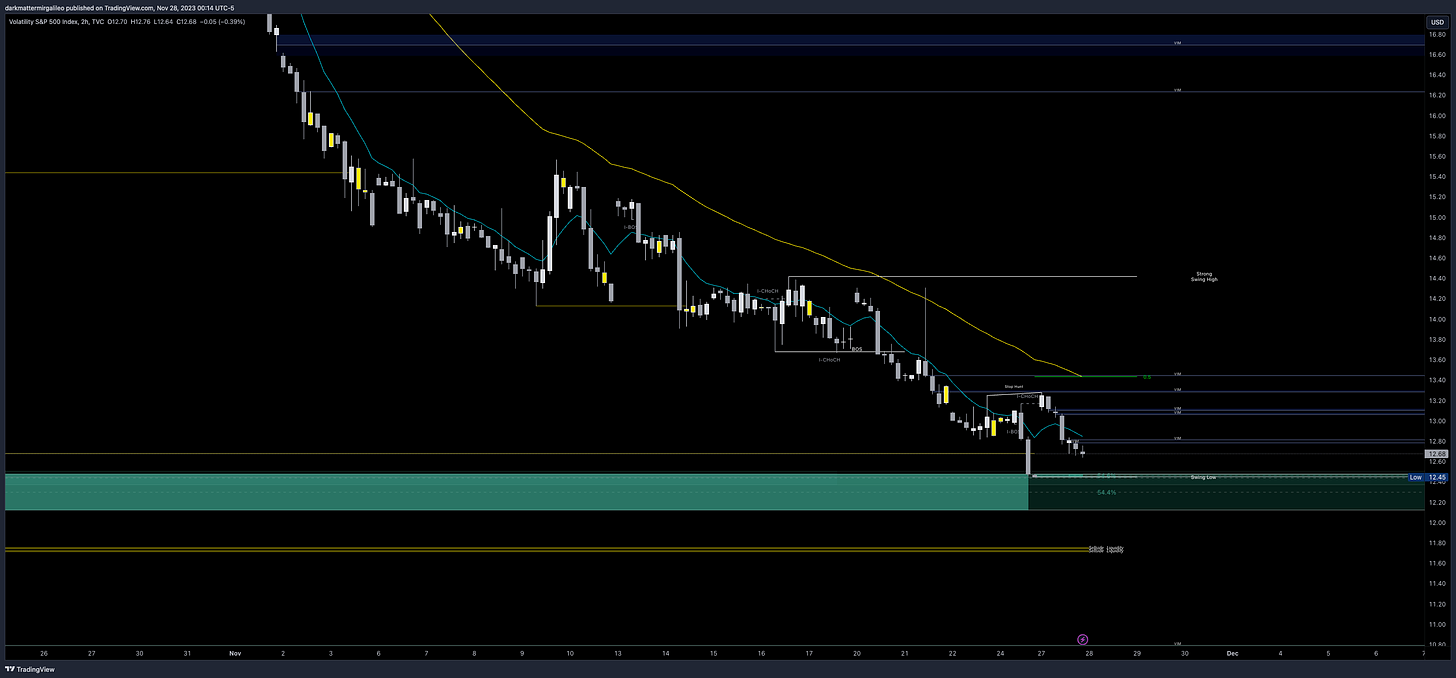

An update on the VIX…We gapped up and then continued to “sell off” the rest of the trading session. Volatility is being suppressed…Would like to see the VIX increase to see further range and trend - until then more chop and tight ranges…

Now let’s jump into the daily trade plan…

News Catalysts

Overnight - UK 30-y Bond Action

9:00am est - Change in selling price of homes - S&P/CS Composite-20 HPI y/y

10:00am est - CB Consumer Confidence

10:00am est - Richmond Manufacturing Index

10:00am est - FOMC Member Goolsbee Speaks

10:05am est - FOMC Member Waller Speaks

10:45am est - FOMC Member Bowman Speaks

1:05pm est - FOMC Member Barr Speaks

3:30pm est - FOMC Member Barr Speaks

For more information on news events, visit the Economic Calendar

11/28 SPX/SPY/ES Intraday Overview (TL;DR)

Again don’t be shocked with chop - we might have a wider range than yesterday’s session, but it will chop and you won’t get that second burst or third burst of continuation.

With that said you would think volatility would be at its highs with the amount of news we have tomorrow and FED speakers. VIX maybe one of the most important charts I watch tomorrow as I decide my trades.

Today’s big level is 4550 and our intraday LIS. Below it we target 4535. Separately, I will just add that 4560-4535 is our chop zone. Reversals, randomness, expect it here…

The bears will want to keep price suppressed below…

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.