Market Recap

The market continues to tread higher and higher but is grinding along as we saw on Wednesday. What looked like a day where we would get some trend continuation we opened in our first trade idea breaking above 4551 and we quickly made a fast track towards 4567 which was a POC from 7/24 listed on our Volume Profile levels. I had a feeling this was where we would have a speed bump and should have left it as our target as we then faded from this level at 4545 which is another volume profile level at 4545. This is Q3’s value area high (VAH).

We bounced twice from this level in the session the first time trading back near 4565 and then the second time finding balance at 4555.

Going to make this plan a bit shorter than usually to get back to Thanksgiving festivities. Hope you all had a great Thanksgiving if you celebrated.

Note the market is open Friday but with a shorter session. So don’t trade 0DTE’s in general, but if you are expect faster decay in them.

Now let’s jump into the daily trade plan…

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

News Catalysts

9:45am est - Flash Manufacturing PMI

9:45am est - Flash Services PMI

For more information on news events, visit the Economic Calendar

11/24 SPX/SPY/ES Intraday Overview (TL;DR)

We have news after market open which could guide the trend on the day so be aware and the market will be closing earlier than normal around 1 pm est.

The zone between 4545 and 4577 is pure chop. We only want to trade on failed breakouts or breakdowns in this area - don’t go chasing anything.

If you are bullish you want to defend that 4555-4545 zone. If you defend this you continue towards 4575. Above 4577 target 4595 and if we get further continuation target 4610. Let’s say we sell back towards 4545 I would then wait till 4560 to break to long pushing us towards 4575 and then see the reaction at this level for any continuation.

For the bears you can’t let price get above 4575 - defend that and you can get price towards 4555 then 4545. The safer short comes on the break down of 4545 to target 4525. I might even wait to go short at 4540 to play it safer. Below 4525 target 4510 then 4500.

In summary we could have choppy conditions especially on low volume so don’t let green trades go red…

11/24 - SPX/ES/SPY Trade Plan

Bullish bias:

Above 4577 target 4595

If VIX continues going down then a breakout of 4596 targets 4610

If there is a failed break down of 4555 target 4575

Bearish bias:

If there is a failed break out of 4565 target 4555

Below 4545 target 4525

If VIX continues going up then a breakdown of 4525 targets 4510

If we break down 4510 target 4500

As always keep an eye on Volland30 and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 11pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4565-4575 - negative vanna

4560 - 11/22 VAH

4562 - Channel Break

4568 - November’s VAH - still forming

4573-4594 - OB (1D chart)

4583 midline

4577 - 7/31 Weekly POC - hasn’t been breached

4596 - July’s VAH

4610 - negative vanna

4620 - negative vanna

Below Spot:

4555-4545 - negative vanna

4545 - Q3 VAH

4539 - 11/21 VAH

4538 - 11/21 POC - hasn’t been breached

4537 - 11/20 Weekly VAL - still forming

4534 - 11/21 VAL

4525 - negative vanna

4510 - negative vanna

4513 - 11/13 Weekly VAH

4511-4489 - OB (2hr chart)

4501 midline

4508 - 11/13 Weekly POC - hasn’t been breached

4507 - 11/17 VAL

4505 - November’s POC - still forming

4500 - negative vanna

4498 - 11/16 VAL

4493 - 11/13 Weekly VAL

4487 - 2D Low

4466 - 9/18 Weekly VAH

4460-4440 - negative vanna

4450 - Q3 POC

Volume Profile & Trends

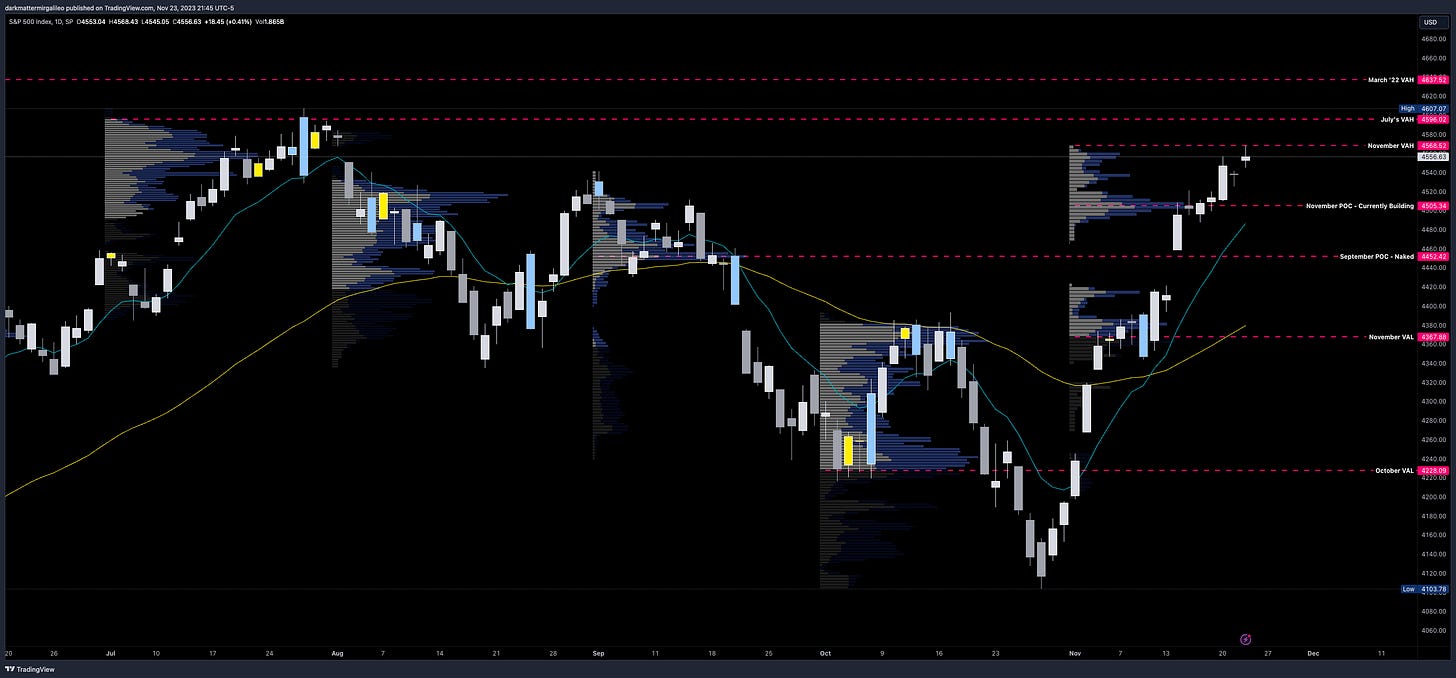

All eyes are on price targeting this down trend line connecting the all-time highs and the highs from July 2023. We breached it in Wednesday’s trading session, but were immediately rejected and sucked back in.

Additionally, I am looking at this channel - in red - where we have been trading in between since the beginning of the week. We also have a up trend line that has been respected starting from 11/16.

Let’s review our volume profiles…

From a quarterly volume profile on the weekly chart some key levels are seen.

4715 - Q4 2021 VAH

4684 - Q4 2021 POC

4545 - Q3 VAH

4450 - Q3 POC

4391 - Q4 VAH - still forming

4364 - Q4 POC - still forming

If we take a look at the daily chart and review the monthly volume profile we find the following levels…

4637 - March ‘22 VAH

4596 - July’s VAH

4568 - November’s VAH - still forming

4505 - November’s POC - still forming

4452 - September’s POC - hasn’t been breached

Let’s now look at the 4hr chart and review what the weekly volume profile levels show.

4594 - 7/31 Weekly VAH

4577 - 7/31 Weekly POC - hasn’t been breached

4568 - 11/20 Weekly VAH - still forming

4537 - 11/20 Weekly VAL - still forming

4513 - 11/13 Weekly VAH

4508 - 11/13 Weekly POC - hasn’t been breached

4493 - 11/13 Weekly VAL

4466 - 9/18 Weekly VAH

4453 - 9/18 Weekly POC - hasn’t been breached

On the smaller timeframe and intraday let’s go to our 30min chart where we will put our session volume profile on. Our levels of importance are…

4560 - 11/22 VAH

4554 - 11/22 VAL

4539 - 11/21 VAH

4538 - 11/21 POC - hasn’t been breached

4534 - 11/21 VAL

4507 - 11/17 VAL

4498 - 11/16 VAL

4487 - 2D Low

4458 - 2D Low

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break. I use Sonarlab’s indicator on Tradingview to plot these.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4573-4594 - OB (1D chart)

4583 midline

4652-4665 - OB (2hr chart)

4658 midline

4414-4541 - OB (1W chart)

4476 midline

4507-4637 - OB (1W chart)

4572 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4511-4489 - OB (2hr chart)

4501 midline

4416-4410 - OB (30min chart)

4413 midline

4393-4343 - OB (1D chart)

4369 midline

4375-4343 - OB (4hr chart)

4359 midline

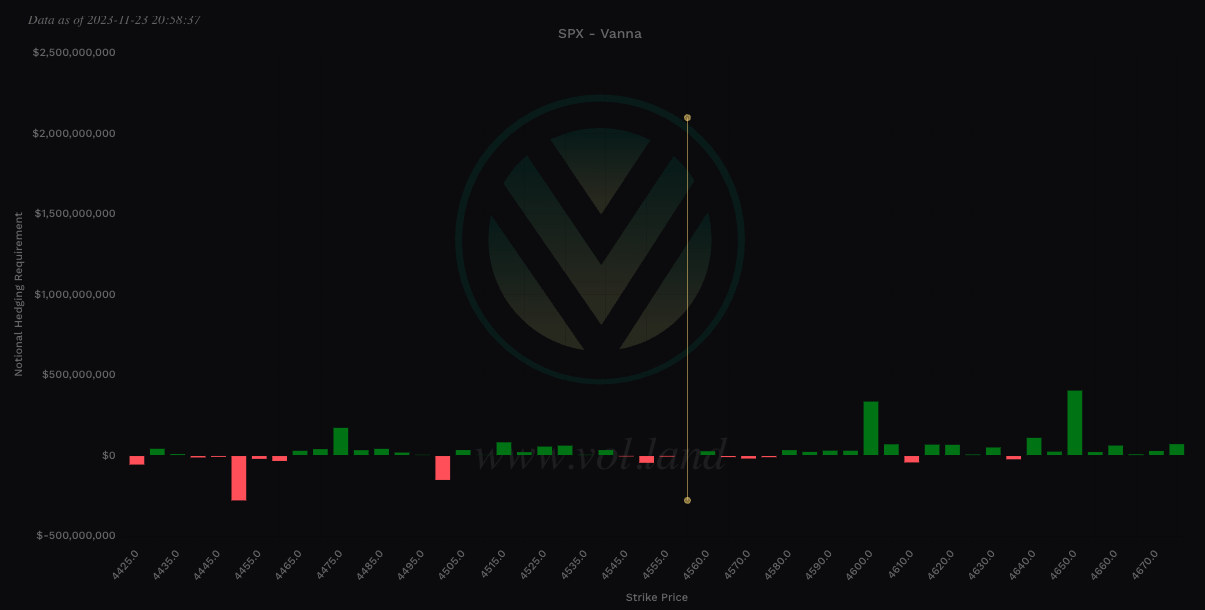

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4565-4575 - negative vanna

4610 - negative vanna

4620 - negative vanna

4635 - negative vanna

Below Spot:

4555-4545 - negative vanna

4525 - negative vanna

4510 - negative vanna

4500 - negative vanna

4460-4440 - negative vanna

Weekly Option Expected Move

SPX’s weekly option expected move is ~48.89 points. SPY’s expected move is ~4.99. That puts us at 4562.92 to the upside and 4465.14 to the downside. For SPY these levels are 455.78 and 445.80.

Remember over 68% of the time price will resolve it self in this range by weeks end.

TradingView Chart Access

For access to my chart laying out all of the above key levels please visit here.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.