Market Recap

Not much of a recap as the market brokeout on lower CPI news yesterday. These days where we have major market making moves premarket are always tough to trade. Especially when the majority of the move occurs in the futures session.

For those who haven’t subscribed this is the kind of work we do here. For as little as $15/month we provide daily trade plans for intraday traders while also providing great educational content to our subscribers.

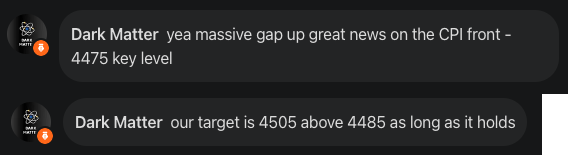

As our trade plan targets all hit in futures action we provided updates in our trading room - aka the Substack chat room - where we called 4475, 4495 and finally 4505 as targets on the day.

While the beat on the CPI helped fuel our trend day the number of shorts and the short squeeze that occurred really help fuel this fire. Lots of bears out there and maybe they will be right in a few months/year timeframe, but remember check your one sided bias at the door when it comes to trading especially if you are trading on a daily basis.

Now let’s jump into the trade plan…

11/15 SPX/SPY/ES Intraday Overview (TL;DR)

Today’s news catalysts are PPI, Retail Sales, and the Empire State Manufacturing Index. Should be another fun one prior to market open. Additionally, overnight China released retail sales numbers and it was a beat giving us a gap up in futures.

The zone in and around 4480-4495 is complete chop and most likely a zone for accumulation if we were to see it again. Bulls are in full control and it is going to take a bit for the bears to make a dent into this run.

Thus, if I am a bull today I want price to stay above 4505. That is the LIS. Above it we target 4520 - almost there in futures - and above it we target…

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.