November 11 - ES Weekly Market Insights: Dealer Positions & Volume Profile Analysis!

Welcome to another weekly overview where we provide you with key levels to enter and target

Hello fellow traders. Welcome to another weekly overview of the ES/SPX/SPY market.

As a reminder we have officially partnered with Volland - available at https://vol.land - providing our weekly and daily ES/SPX analysis to subscribers there.

Get our weekly and daily plans while also learning how to use dealer positions to have better trading success.

Remember use promo code DARKMATTER10 to get 10% off your first month at Volland.

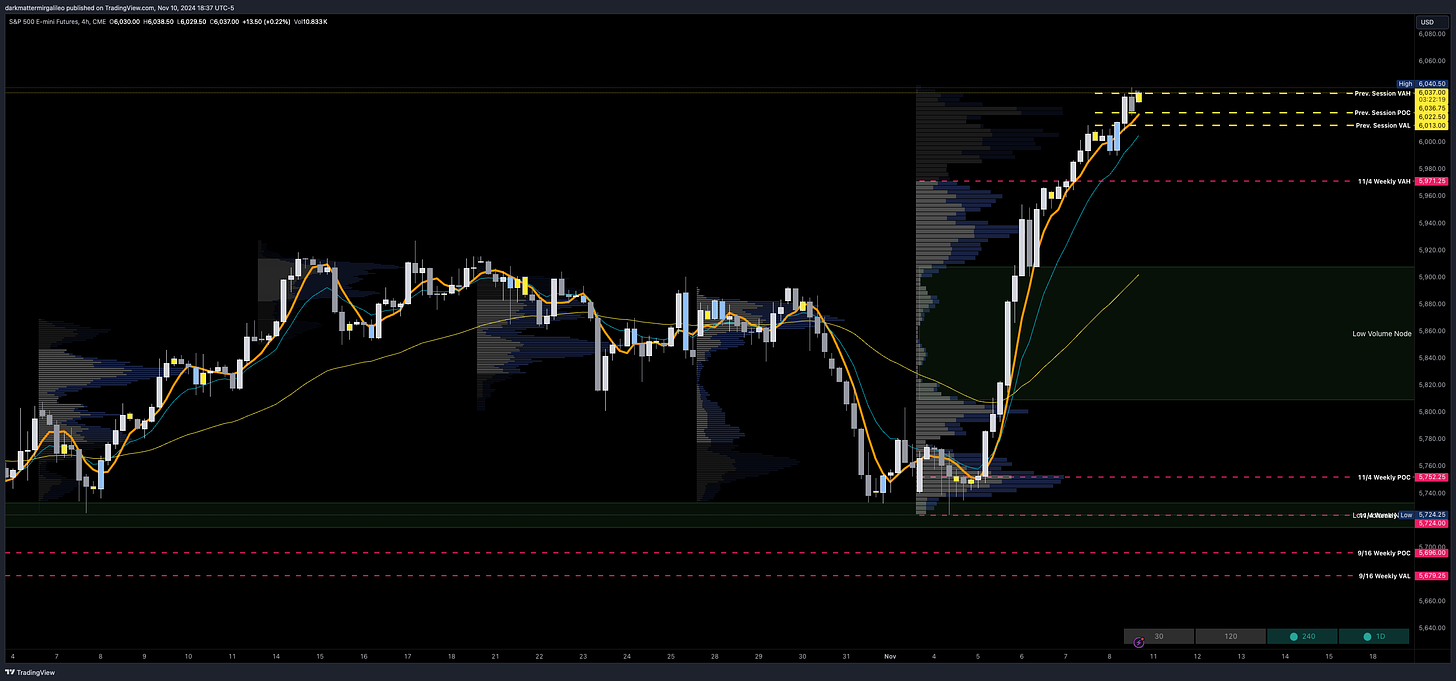

What a week - as Wiz and myself called out in our weekly Monday show - except excursions back near 5900spx as long as we are above 5700. We held that level Monday overnight and into Monday's session and never looked back from there. 300pts later and SPX continued to set new ATH's last week with President Trump being elected to his second term. With that win volatility quickly suppressed and off we went up.

11/4 - Weekly Recap:

Our bullish bias played out extremely nice here. Hope you got in at some point - staying above 5700 was the key and we got to 5721 in SPX but in overnight action on ES we did get to 5700spx or 5724es on Monday at midnight est and once more in regular trading hours. This goes to show you why you need to be looking at both ES, SPX when trading the index. The action starts in ES and continues into the opening session. Congrats to those who were able to take this trade idea this week.

Now what? Ultimately, I wouldn't get too bearish - we are in a very bullish period of the market seasonality wise - and until we crack 5850spx IMO you should be looking at dips to buy. We may see some initial selling early in the week to target 5975 OR 5936spx - this second level is where we have a gap from Wednesday into Thursday's session last week.

Let's jump into the trade plan as there is a lot to dissect here now that we are in a post elections view.

Market Moves with Volland

Don't forget to join Wiz and myself in our weekly installment of the "Market Moves with Volland." You can set a notification and join us live at 8:30am est on YouTube -

Biggest News Catalysts on the Week

Mon - Veteran's Day (Thank you to our service members for your service)

Wed - CPI

Thur - PPI, Unemployment Claims, Powell Speaks

Fri - Retail Sales

Earnings

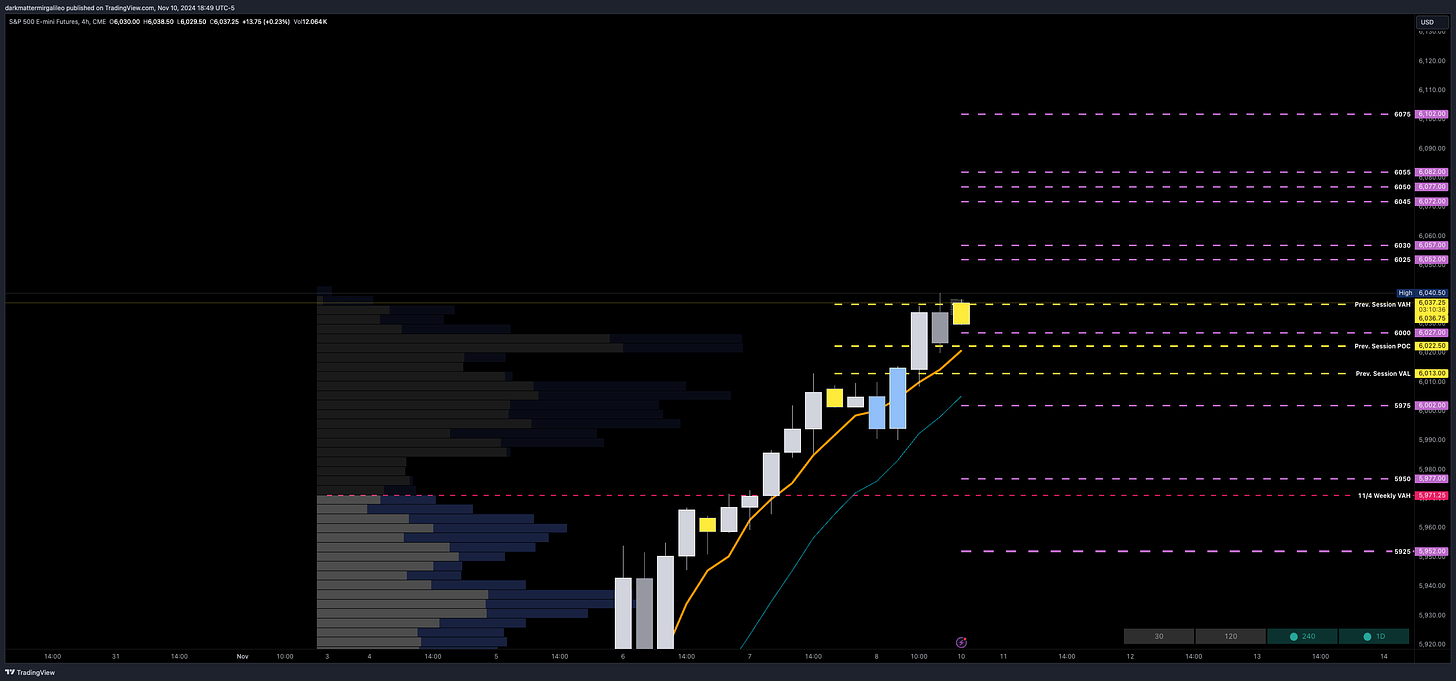

Weekly Options Expected Move

SPX’s weekly option expected move is ~79.85 points. That puts us at 6075.38 to the upside and 5915.68 to the downside.

Remember over 68% of the time price will resolve it self in this range by weeks end.

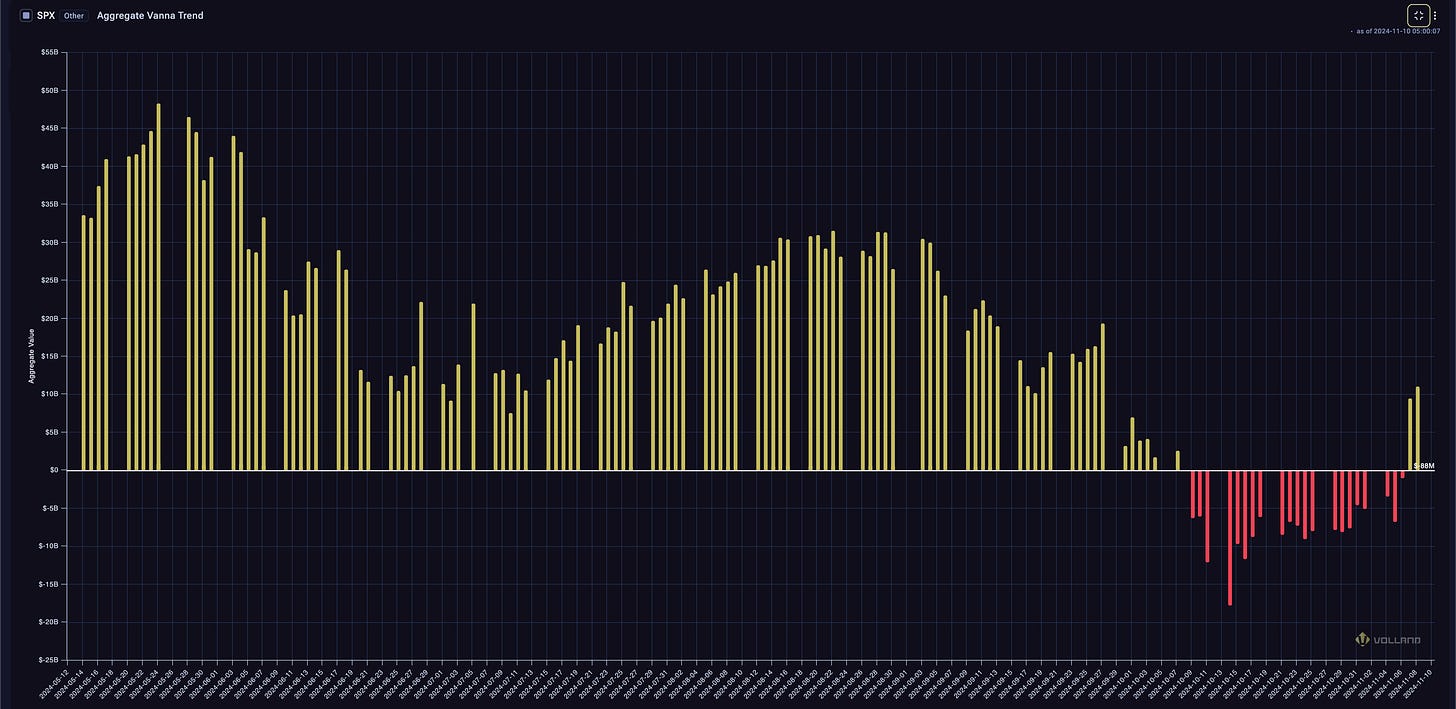

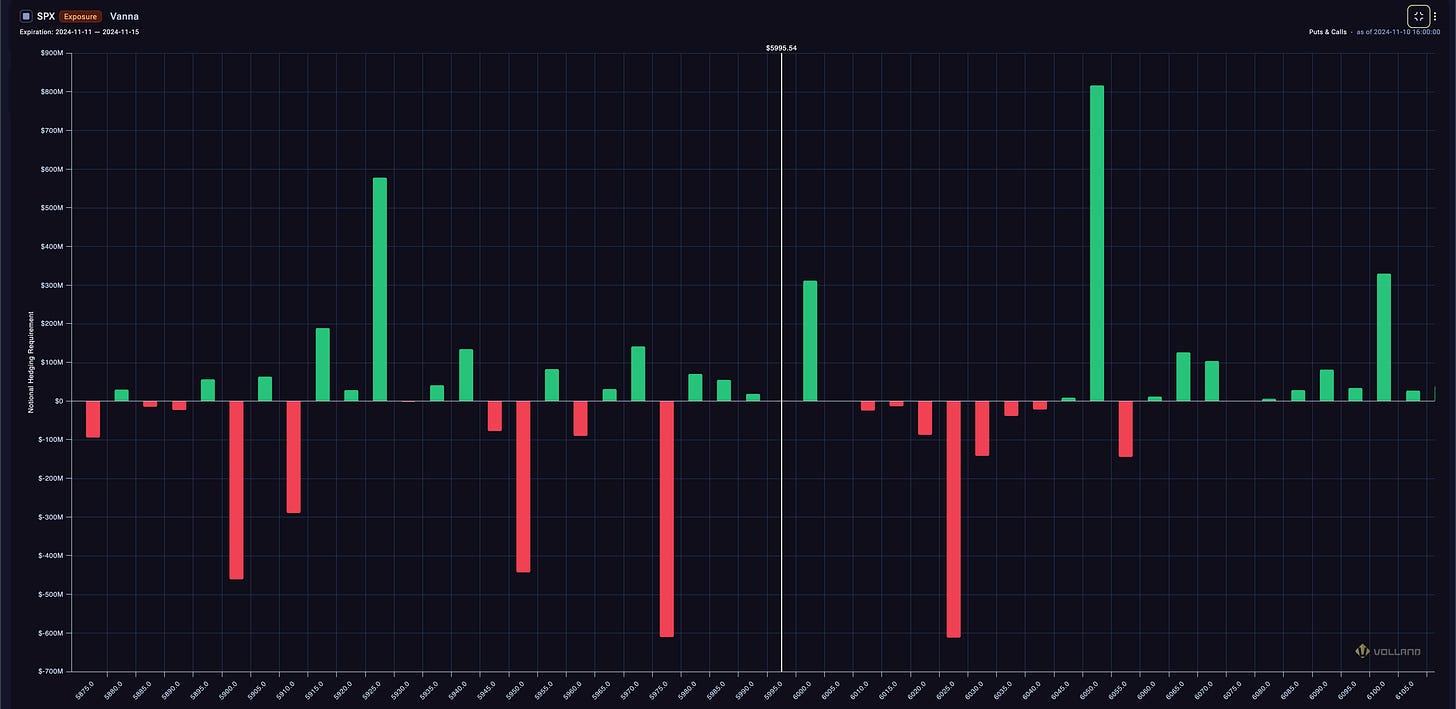

Vanna Overview

While we are entering positive vanna most of this is due to expire with this weeks monthly expiration. So before we get giddy and another 200-300 pt rally forms let's see how we react at a few key levels and how supportive of vanna we have. Again, due to the low amounts of vanna especially after OPEX if we have any reason to sell we will and it won't be as supportive.

Let's kick into reviewing cumulative vanna exposure.

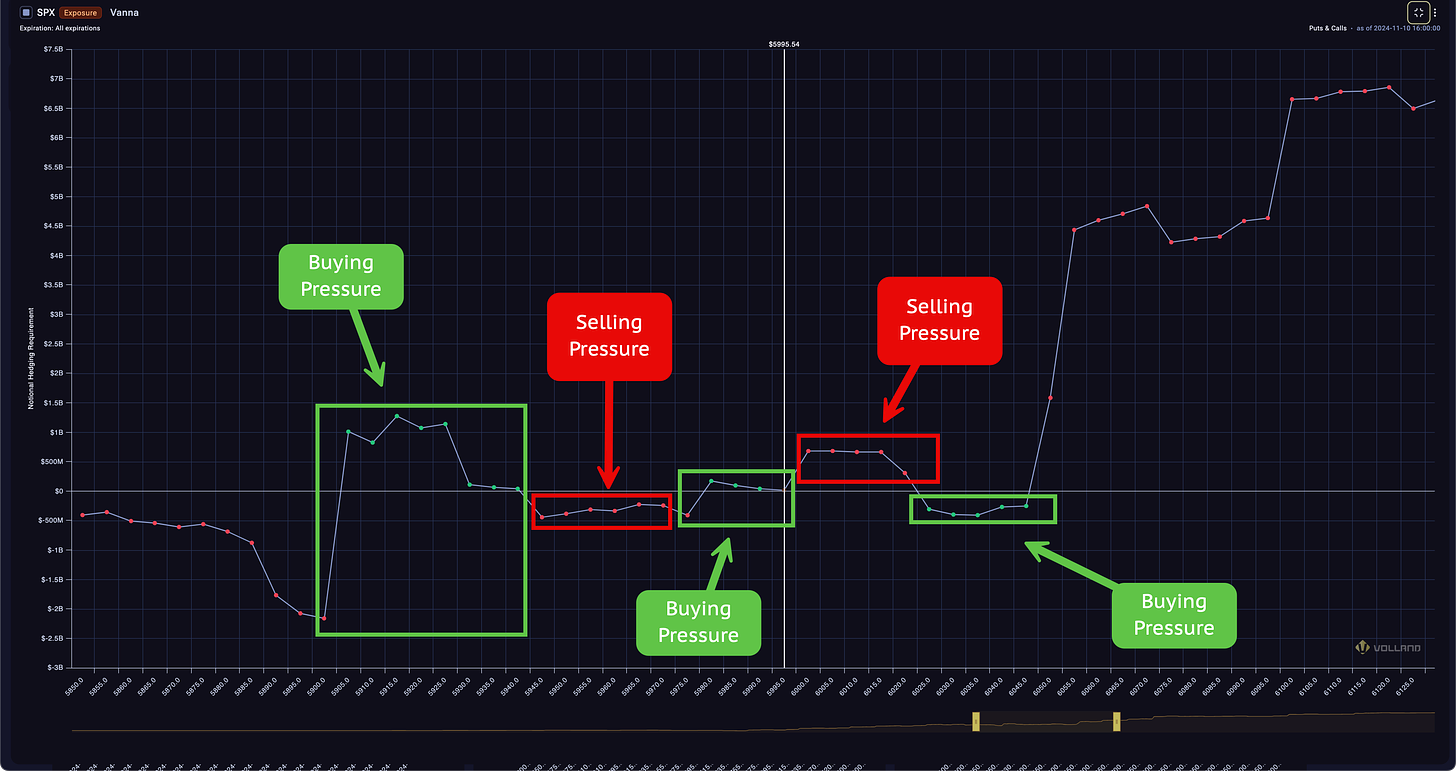

Looking at this from all expirations view...

5975 is supportive so IF price sells down there it should be supportive

5950 is supportive IF we sell below 5975

6000 is resistance up until 6020 so VIX/IV needs to suppress in order for us to pass through this zone

6025 until 6045 is full of buyer liquidity

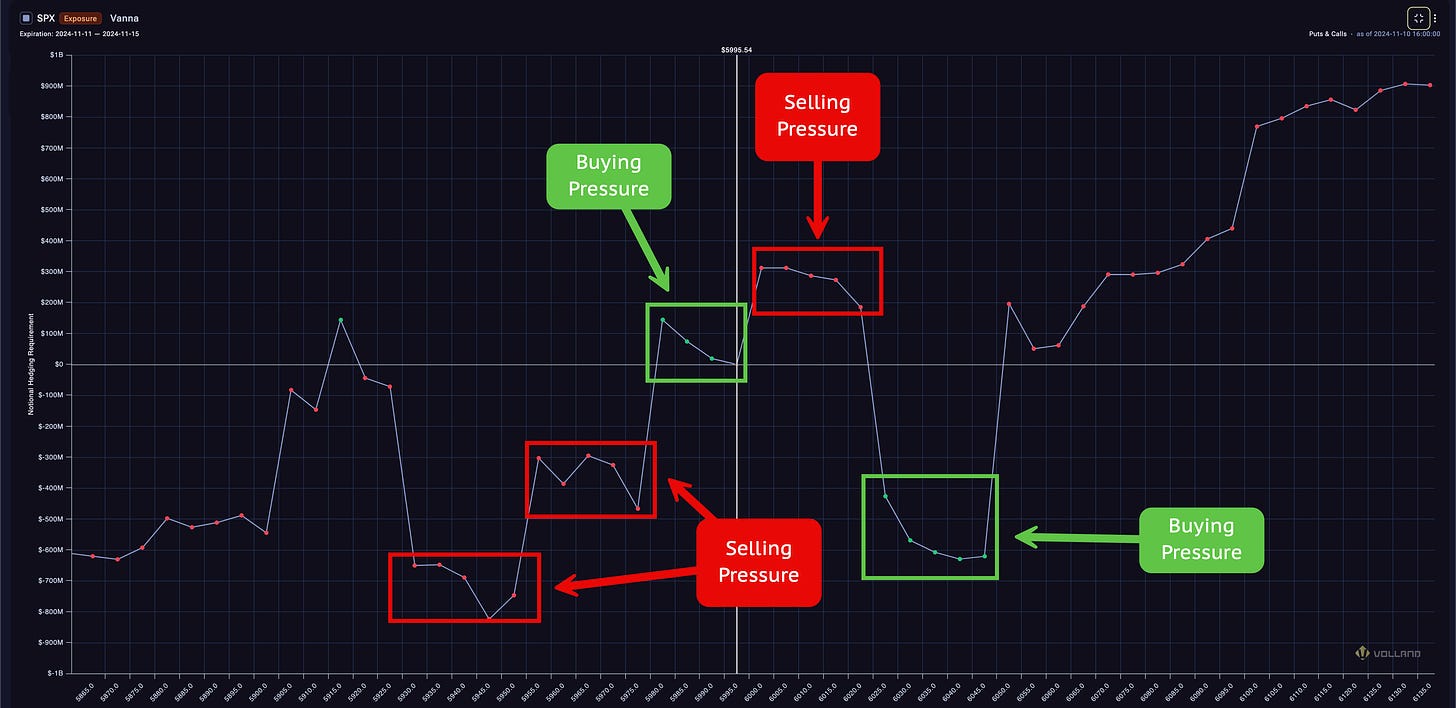

Let's now take a look at this from a weekly view...

6000 and above it we are bearish to 6020 - so in order to get through these levels we need to see the VIX/IV further suppress

6025 is where we get bullish and a rally towards 6050

5975 is the first crack on the weekly view for more selling to occur - otherwise it is supportive

5950 and 5930 is where we find support below 5975

If we take a look at the weekly vanna strikes and chart we can zoom in on the specific strikes that are important...

Resistance:

6000 - major resistance - weekly vanna magnet - gamma resistance - we really need to see VIX/IV decrease to get past this level

6010 - minor resistance

6025 - major resistance - weekly negative vanna

6050 - major resistance - weekly vanna magnet - we really need to see VIX/IV decrease to get past this level

Support:

5975 - major support - weekly negative vanna

5960 - minor support - weekly negative vanna

5950 - medium support - weekly negative vanna

5925 - magnet - medium support - weekly positive vanna

5910-5900 - major support - weekly negative vanna

Looking at the all expiration vanna strike chart we find the following key levels...

Resistance:

6000 - positive vanna/magnet/pivot

6020-6030 - negative vanna/resistance

6050-6055 - positive vanna/magnet/pivot

6075 - negative vanna

Support:

5975 - negative vanna - VIX/IV MUST increase to get past this critical level

5960 - negative vanna

5950-5945 - negative vanna - medium

5940 - positive vanna/magnet/pivot

5925 - positive vanna/magnet/pivot

5920 - negative vanna - minor

5910 - negative vanna - minor

5900 - negative vanna - major

Vanna Summary

If we now rap this up by reviewing the all expirations vanna strike chart we can see the following key levels across all timeframes are:

Above Spot:

6000 - resistance and if we want to get bullish it will occur above this level

6025-6030 - resistance - negative vanna

6045-6050 - above 6025-6030 we should guide our way to this level

6055 - negative resistance

Below Spot:

5975 - the most important level on the week for the bulls - you don't want to lose this level

5960 - watch for minor support to come here

5950 - medium support this is where we should find ourselves below 5975

5925 - positive vanna on all expiration and we need to see VIX/IV increase to take this level out

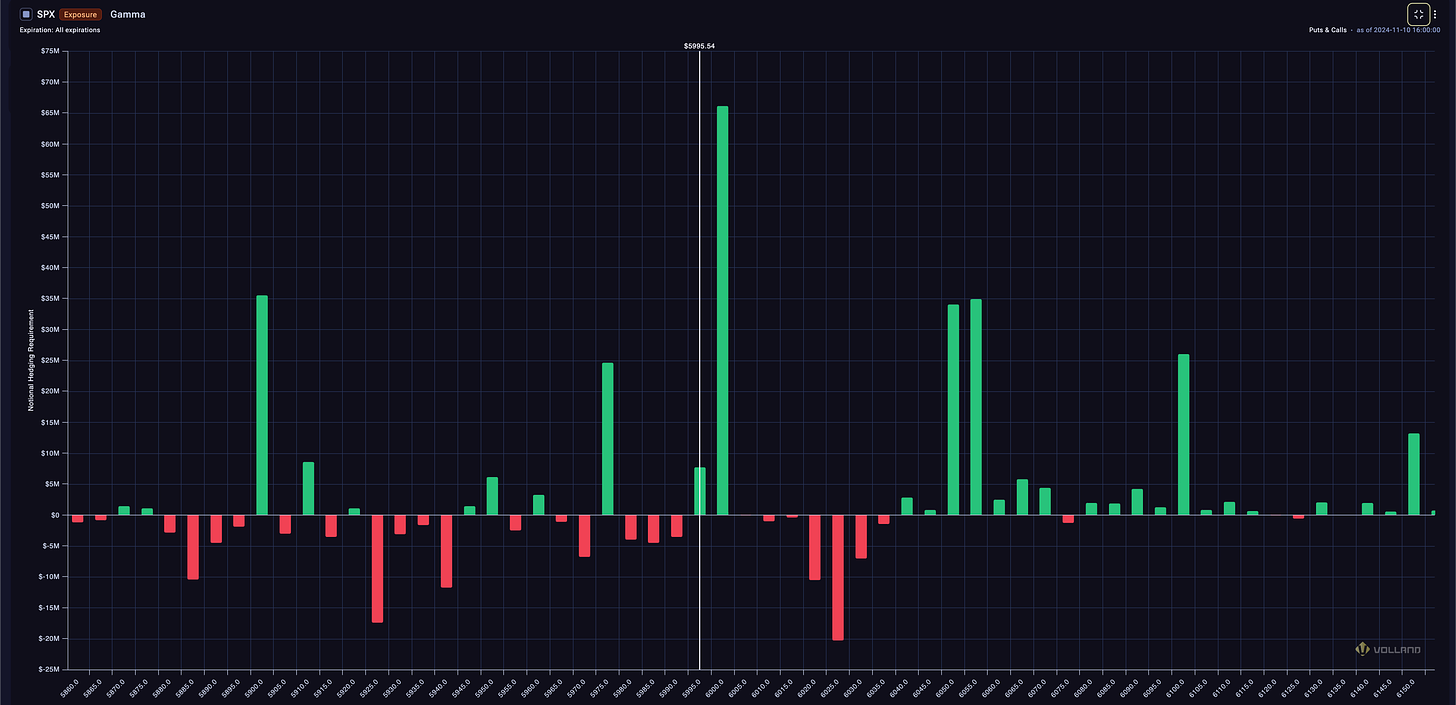

Gamma Overview

Key Levels on the week are...

6000 - massive tower

5975

5950

5910

5900

ES Volume Profile Overview

These are ES levels and NOT SPX - subtract 27-30pts to get SPX levels

TLDR

* 6013 - if we get below this expect more selling towards 5971es

Key Levels

5800-5907 - low volume node - this is where our buyers came in with strength last week...

5971 - weekly value area high

5752 - weekly point of control

5724 - weekly value area low

11/4 ES Weekly Trade Plan

Key Levels for the Week

6000 - if you are bull and want more upside this is the pivot/key level on the week to over take AND hold

5975 - critical area of support based on weekly vanna - stay above this and we most likely take out 6000 and hold above it then

5950-5925 - gap fill exists here at 5936.14 and a key support zone for the week

You can't really get super bearish unless we start breaking below 5850 - otherwise noise and scalps with puts

Bullish Bias:

If there is a failed breakdown of 5975 go long to target 6000, 6010, 6025-6030, 6050-6055, 6075

Basically, get above 6000 and hold it we are headed towards 6025 and then 6050

Bearish Bias:

If there is a failed breakout of 6000 target 5975, 5950, 5930, 5915

There might be a better entry above 6000 such as a failed breakout of 6020-6030 zone - but let's keep an eye on Volland for an entry - at this point I wouldn't be looking to call the top, but instead waiting for a key level to break. Markets aren’t made to be short so keep that in mind as you are looking for that “entry” to determine the top. It is not easy…

Any updates to the plan or levels will be provided in the Volland Discord Room. Keep an eye on Volland and the VIX for trend continuation or reversals.

ES December contract value is approx. 30pts more than the SPX levels shared - so take ES minus 41pts to get SPX levels. To get SPY levels simply take the SPX levels and divide by 10.03.

As a reminder we have officially partnered with Volland - available at https://vol.land - providing our weekly and daily ES/SPX analysis to subscribers there.

Get our weekly and daily plans while also learning how to use dealer positions to have better trading success.

Remember use promo code DARKMATTER10 to get 10% off your first month at Volland.

My Trading Rules -

X Profile - https://x.com/DarkMatterTrade

YouTube Channel - https://www.youtube.com/channel/UC_6nM50Ebtg7iaylWZVFoLw

Disclaimer:

The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.