Market Recap

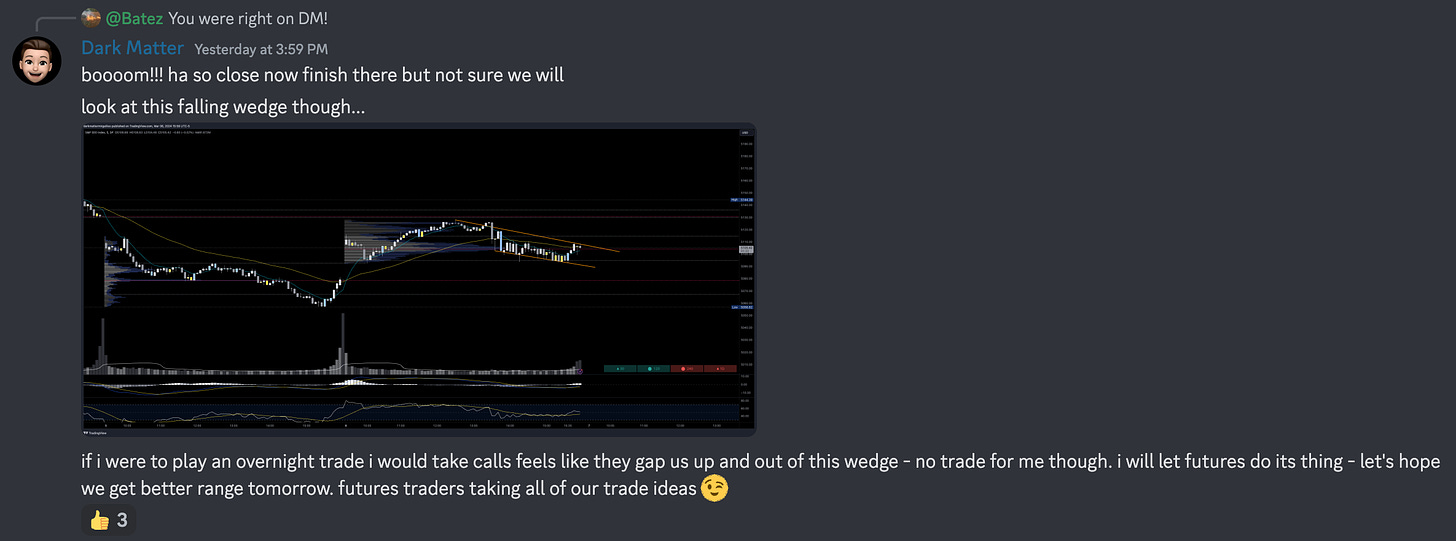

Hello team. What a nice gap up and I was thrilled to hear some of our traders took our analysis on the falling wedge and how price became supportive yesterday and low and behold the session opened with a 25pt gap up.

Boy did we nail that analysis and got the gap up we discussed in our Discord.

📈 Don't miss out on key levels, expert trade ideas, daily plans, and intraday updates for only $29.99/month.

💰 Click subscribe now and supercharge your trading game! 🚀

#TradeSmart #LimitedTimeOffer

SUBSCRIBE

For those of us who didn’t take a trade overnight the market opened at 5137 and went as high as 5143 before selling back towards 5130. Prior to that we sent the following to our group in the Discord that if price got to 5130-5125 to go long targeting 5150 and we got there by 10:40am and closed our first trade idea. Riding a nice 20pt trade on the SPX.

We also then provided a bonus trade idea if price retreated near 5140 to go long and that it would target 5160. Again this trade idea nailed and was completed by 2pm.

A very successful day for the group and now it is time to turn our attention to tomorrow’s trade plan.

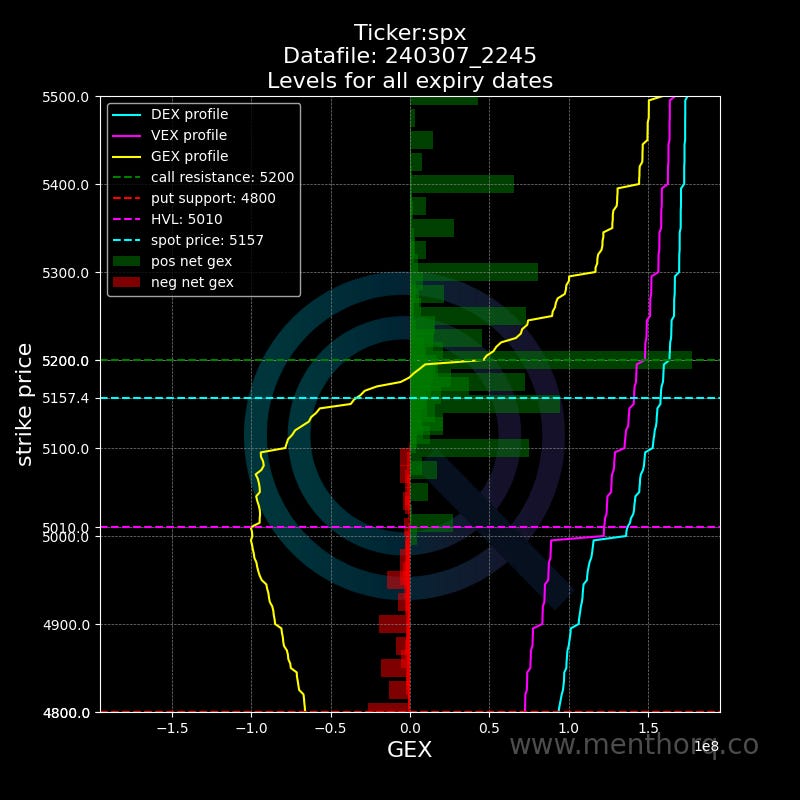

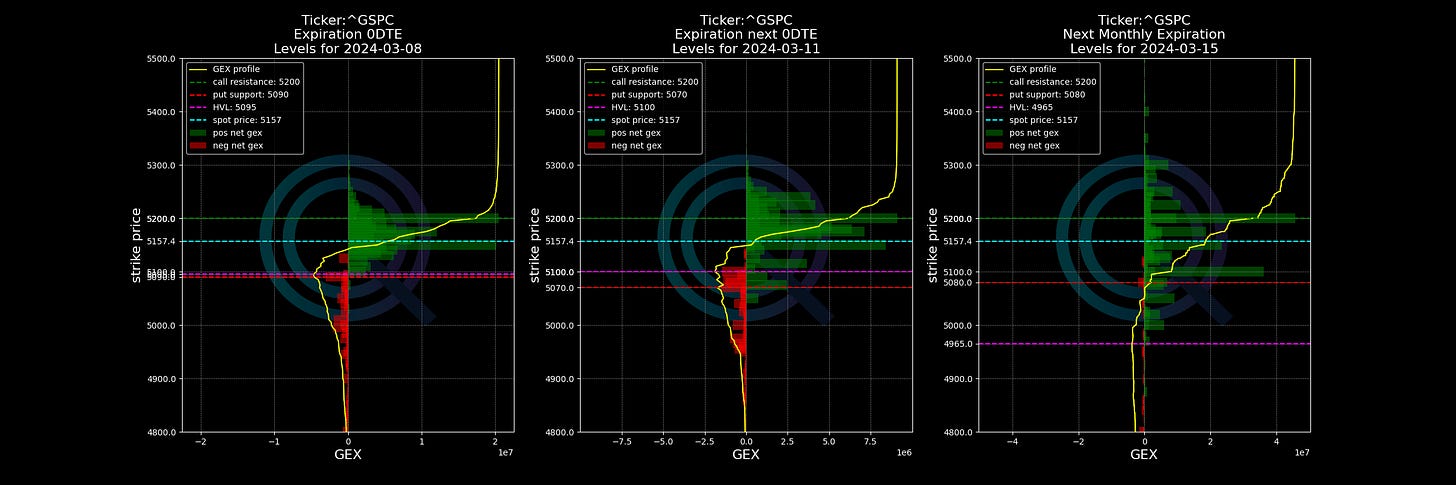

From a GEX standpoint the top levels are 5150 and 5200 suggesting the market may continue its ride up. 5010 is where the market shifts into a negative gamma environment.

Looking at 0DTE the range seems to agree with our thesis above, but the range on the day could be 5095 - support level - and 5200 where we face resistance. If we look at the positive gamma on 0DTE you can see between 5150-5200 is where the market will range - at least its view at this point.

With that let’s jump into our trade plan….

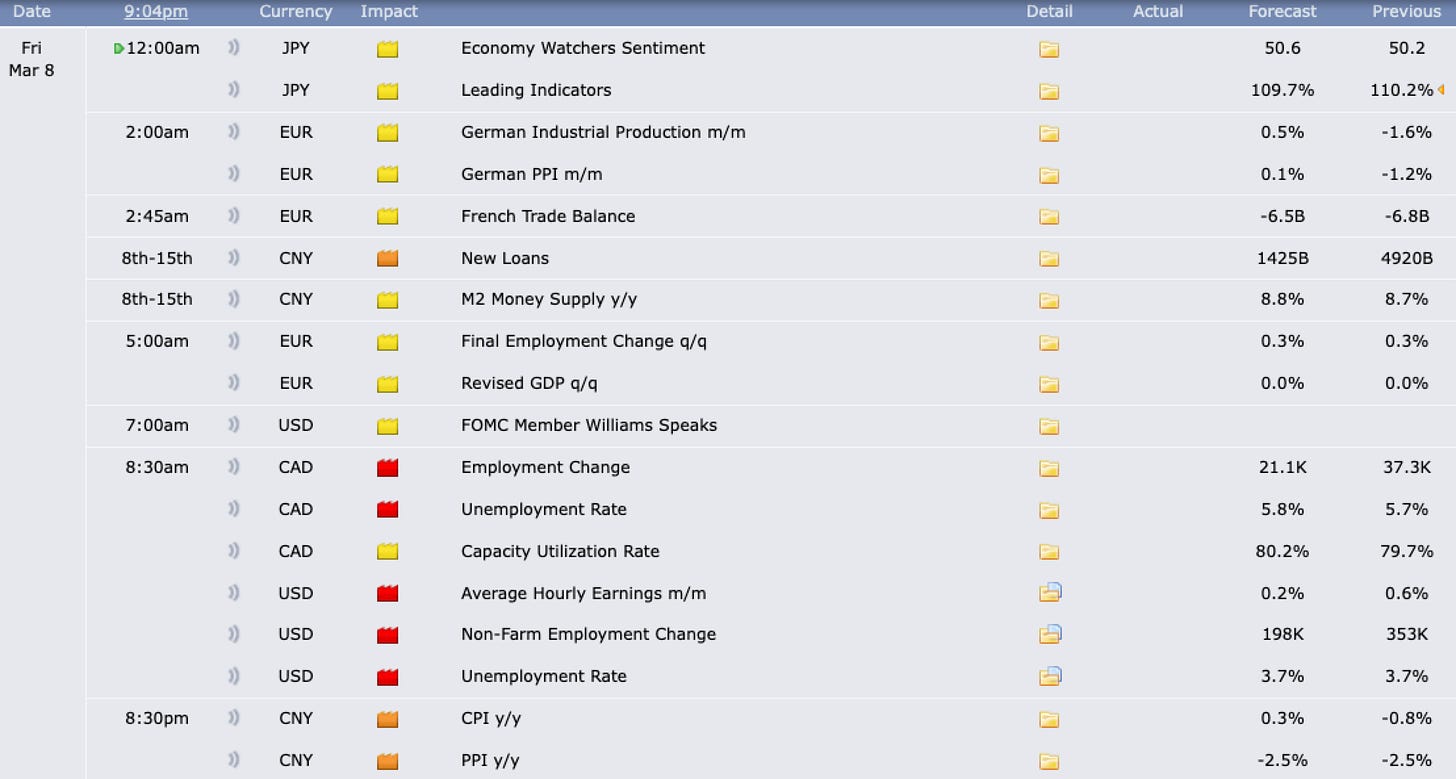

3/8 News Catalysts

Non-Farm Employment Change is the key catalyst on the day. The market is expecting 198k jobs - last month we crushed expectations with over 353k jobs. Don’t be surprised if most of tomorrow’s move occurs after the release of this data. We also have a FED speaker prior to market open.

For more information on news events, visit the Economic Calendar

Just a reminder for those not subscribed to the newsletter your access will end here for you.

You can still join us for the rest of the plan where we discuss key levels and entries to take and targets.

There is a 5 day free trial for access into our new Discord channel. SUBSCRIBE

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.