March 7, 2024 SPX, ES, SPY Trade Plan

Market Recap

Alright team we are going to jump right into the trade plan for Thursday’s session.

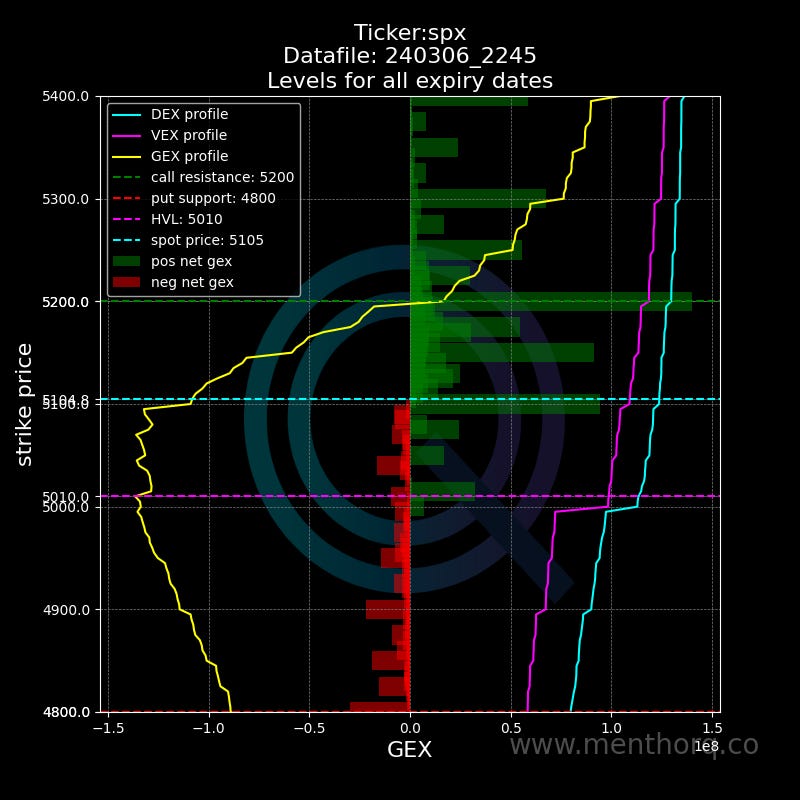

From a gamma standpoint no major changes to the markets condition. Still in a positive gamma condition - market sells will be faced with buyers buying the dip. This came to fruition today as the market gapped up.

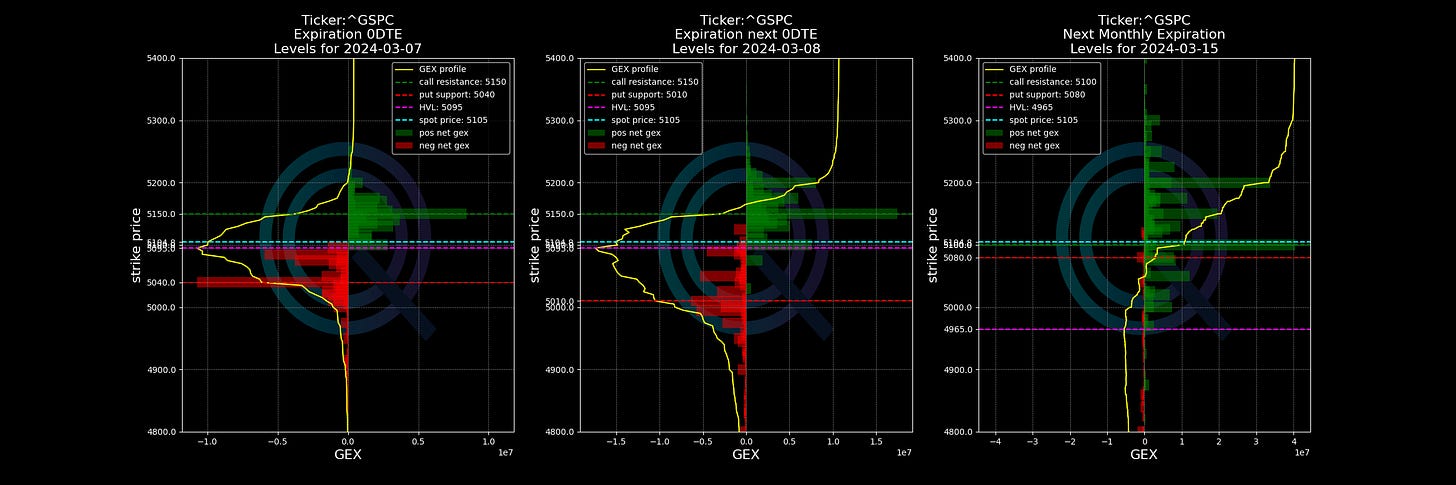

On the 0DTE front we are seeing that tomorrow’s range looks to be between 5150 and 5040 with 5095 as the key line in the sand or pivot. Stay above it and we venture our way towards 5150 and below it towards 5040…

The parallel channel on the QQQ/SPY combo held the bottom of the channel again. This is a big channel on my charts and the minute it breaks and hold could spell larger trouble for the bulls and some of the recent strength in the market may start to deflate after an amazing 5 month run.

With that recap let’s jump into our trade plan….

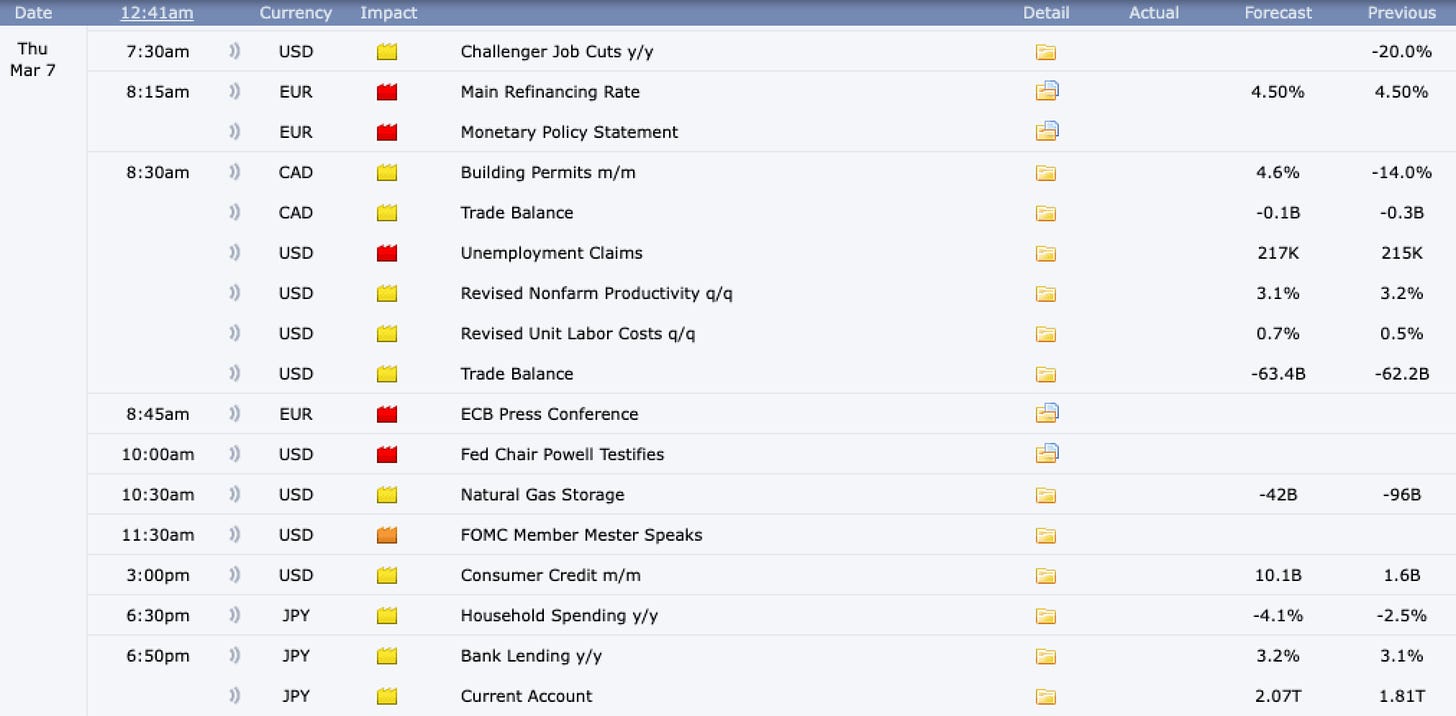

3/7 News Catalysts

Big EU Monetary Policy Statement coming out premarket, followed by Unemployment Claims, the ECB Press Conference. Then the session opens and we have FED Chair Powell testifying again and another FED Speaker at 11:30am.

For more information on news events, visit the Economic Calendar

Just a reminder for those not subscribed to the newsletter your access will end here for you.

You can still join us for the rest of the plan where we discuss key levels and entries to take and targets.

There is a 5 day free trial for access into our new Discord channel. SUBSCRIBE

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.