March 4, 2024 SPX, ES, SPY Trade Plan

Weekly Market Overview

Hello team and before we get into this week’s overview and Monday’s trade plan I want to congratulate the entire community on our monster Friday.

We called for the low of 5095 to hold and if you wanted to be safe to wait to long 5105, but we rode that all the way to 5135-5140 where we called for profits to be taken all in real time in our Discord…

Here is a peak into the DM Discord for those who haven’t had a chance to subscribe yet or are on a free trial…

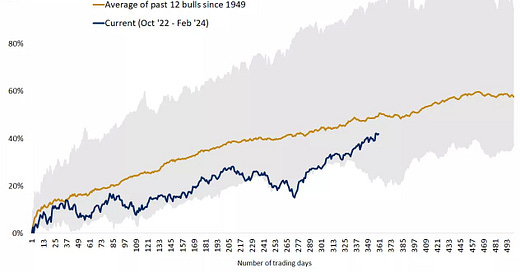

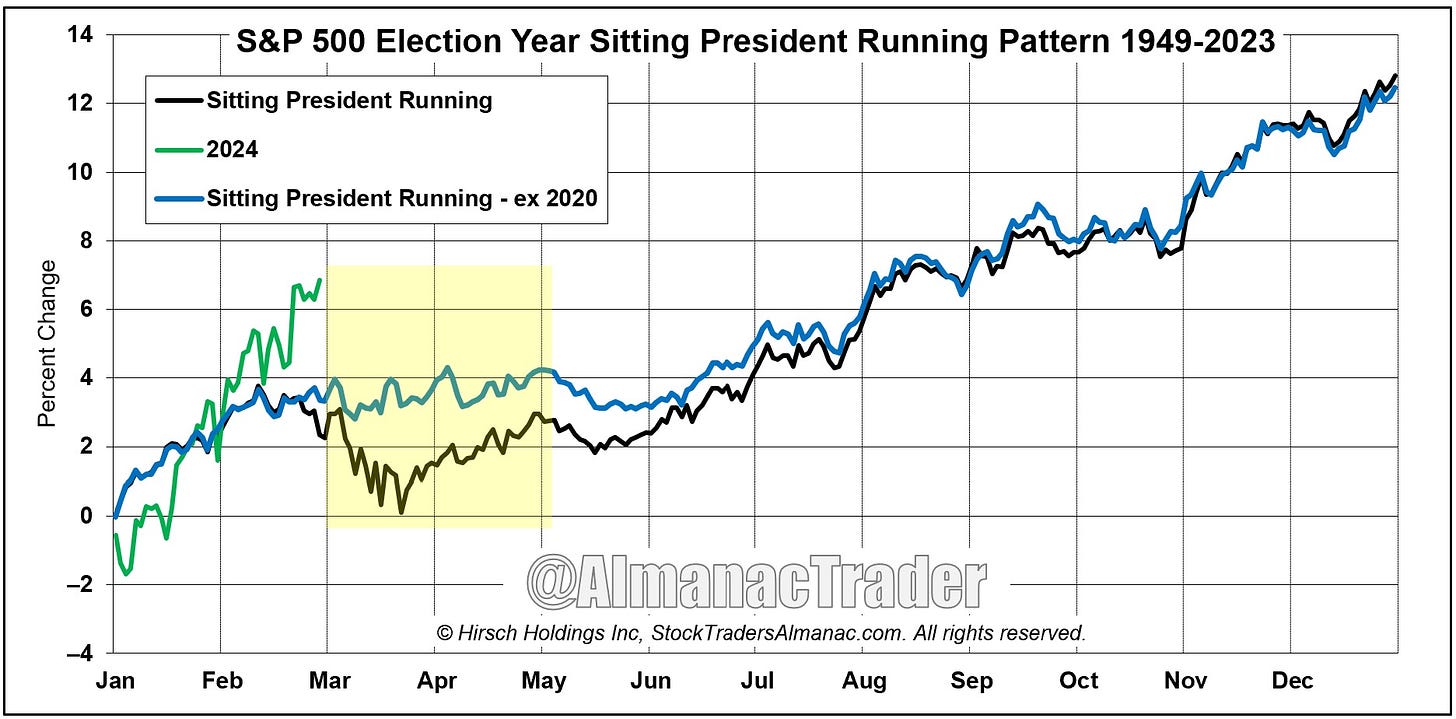

So looking ahead to this week’s action are we ready for a retracement? Is there going to be a selloff? Honestly, I stated this in the past couple of weeks this could be a 2021 like market where we had little selloffs besides one of the weaker periods in the markets between September-October. That chart above also aligns with my view that we are in a longer term bull market.

From a news catalyst standpoint FED Chair Powell testifies on Wednesday and Thursday of this week. The next big news catalyst comes on Friday with jobs data where the market is looking for a weakening in the jobs reports. We also have the ECB with their interest rate decisions.

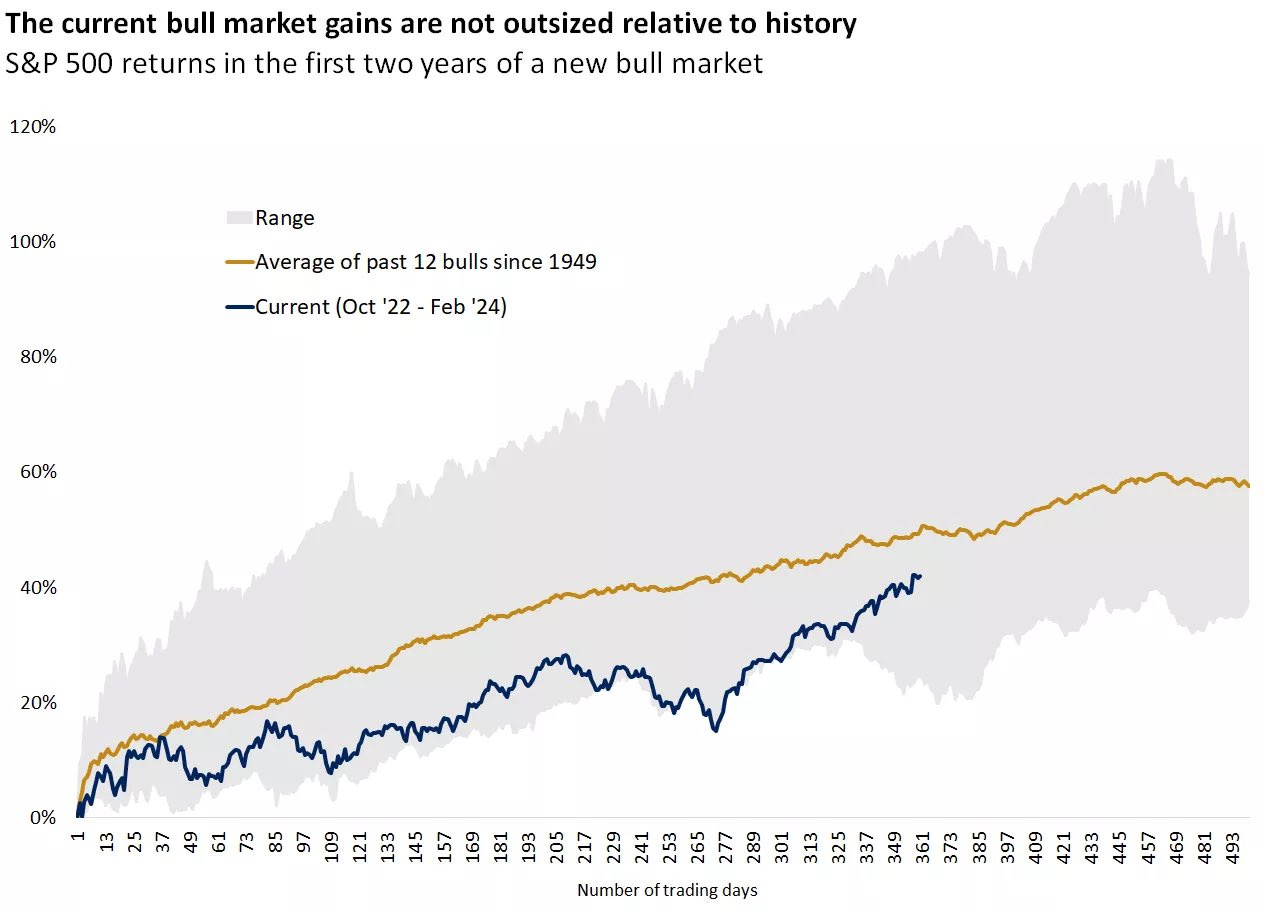

Let’s take a look at the Gamma levels. We are still in a positive gamma market - buy dips and sell rips - and we do not flip negative until we see a weekly close below 5000.

Lots of positive gamma was added on the tape last week including that 5200 level. So until this view or a key trend line breaks I see no reason why to short the market besides a quick intraday scalp. This CONTINUES to be a buy the dip kind of market…

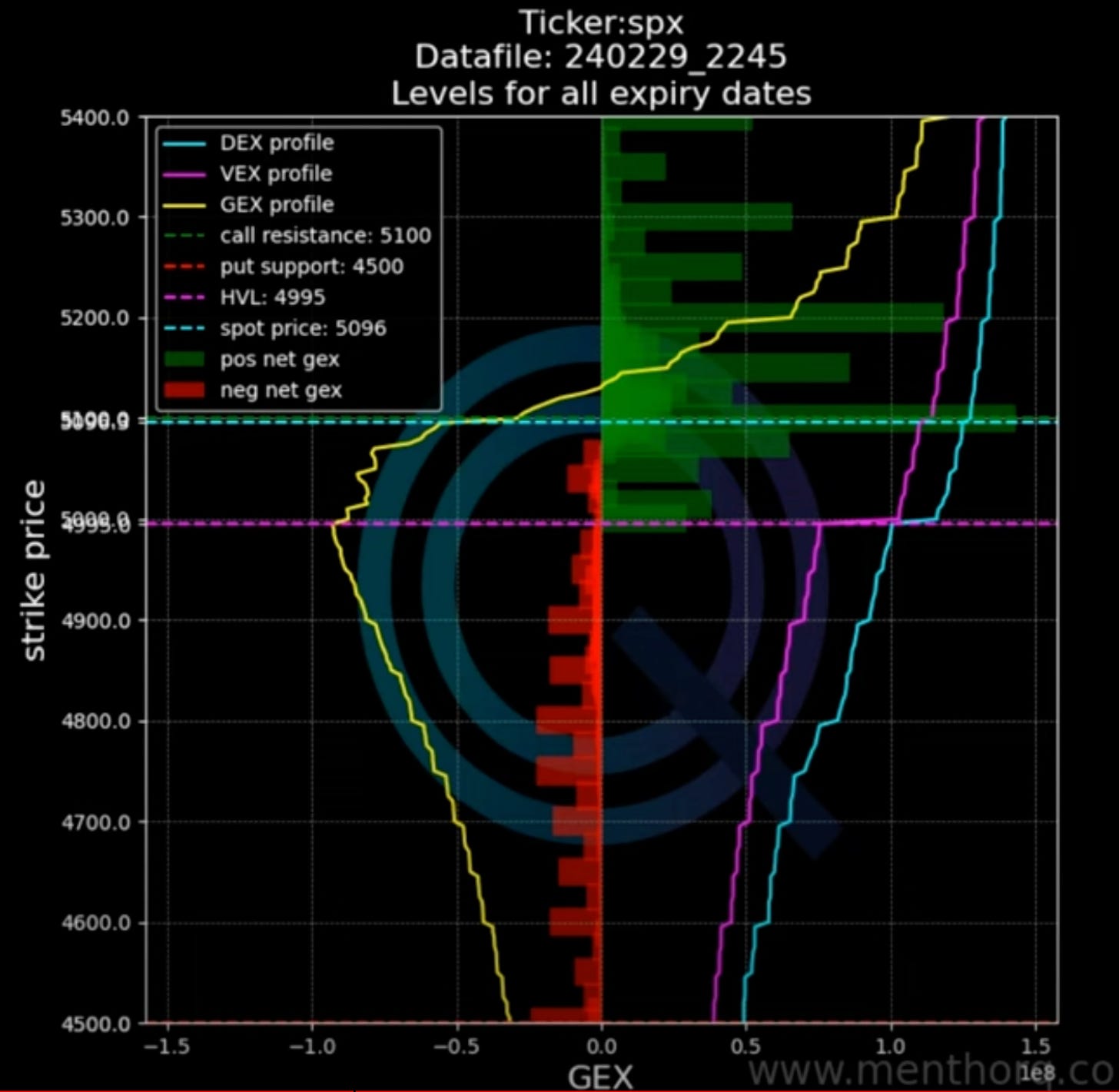

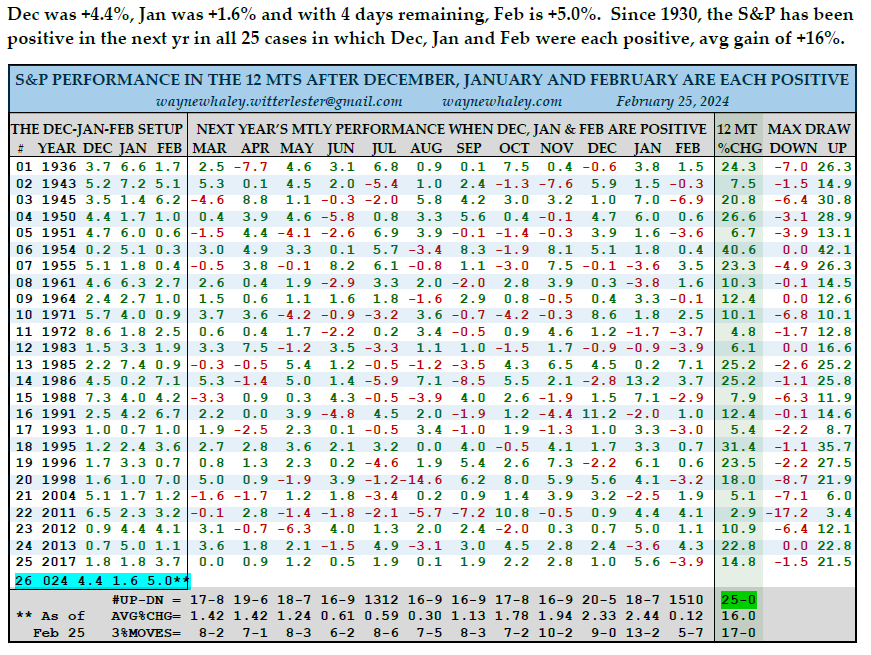

To add to the gamma outlook above Wayne Whaley has a great share here that when the trailing quarter - December thru February - is greater than 5% then March is up 21 times and down 9 times - that is over 2/3’s of the time that March will go up in this scenario. Along with that it tends to bring a 3% move with it 11 times out of 13.

Additionally, when Dec-Feb are each positive on the monthly candle close we have been up every single time one year later - 25 times has this occurred in the past with an avg gain of 16%. That puts us at a target of 5900 from February’s close.

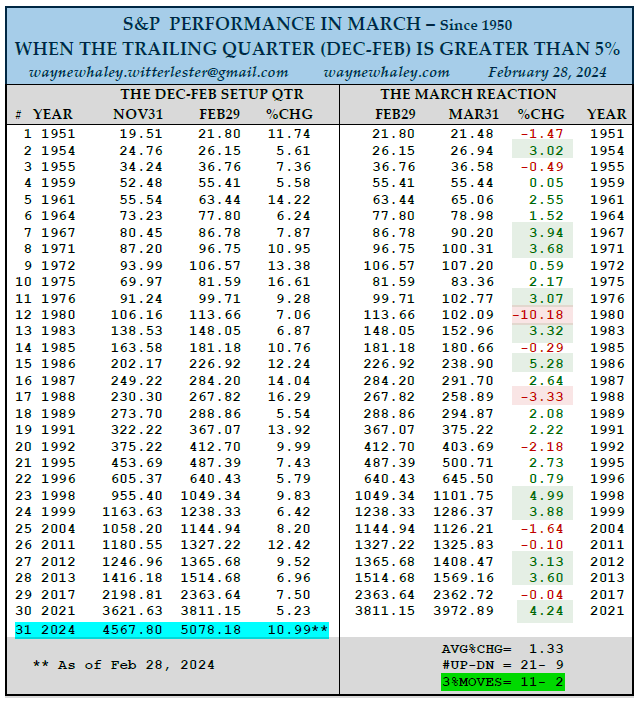

Let’s now take a look at the monthly chart on ES and we have two clear trend lines you can add to your chart.

The first one is the trend line starting from the lows of March 2009 connecting it to the lows of 2011, 2016, 2018 and 2020.

The other trend line connects the highs of 2000, 2021, and 2022.

You can clearly see we have more room up before we hit the top of that trend line which is currently around 5350 ES levels.

What’s interesting though is viewing the same trend lines on the SPX is that we have hit the top of this trend already.

So let’s see if the SPX chart holds or the ES chart will instead. I will update this as we go through this week.

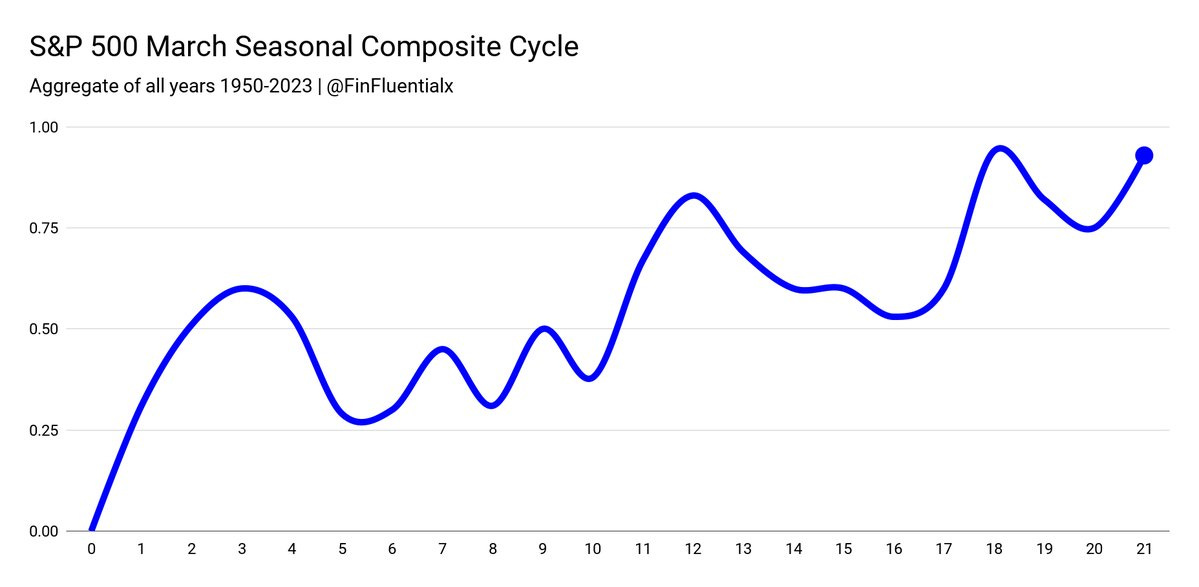

Last, but not least here is a seasonality view of March. The back half of February broke the typical seasonality of a bearish 2nd half of the month. This month continues that bullish uptrend where we push up, trade down and then sideways and then up. Kind of like a bull flag pattern.

Here is the month-by-month seasonality chart…Conflicts a bit with the typical March seasonality view so we will keep an close eye on the key levels for confirmation of which seasonality chart is more accurate.

In summary, this continues to be a buy the dip market. I am going to be seeking a more long term swing long call on SPX/SPY and looking for a dip to buy it and hold until January/February 2025 expiry.

5000 will be a great opportunity to long again IF we get there and so will 4900. Until then for this week I am curious to see how price reacts at 5100 and 5050 and then to the upside 5150, 5175, and 5200.

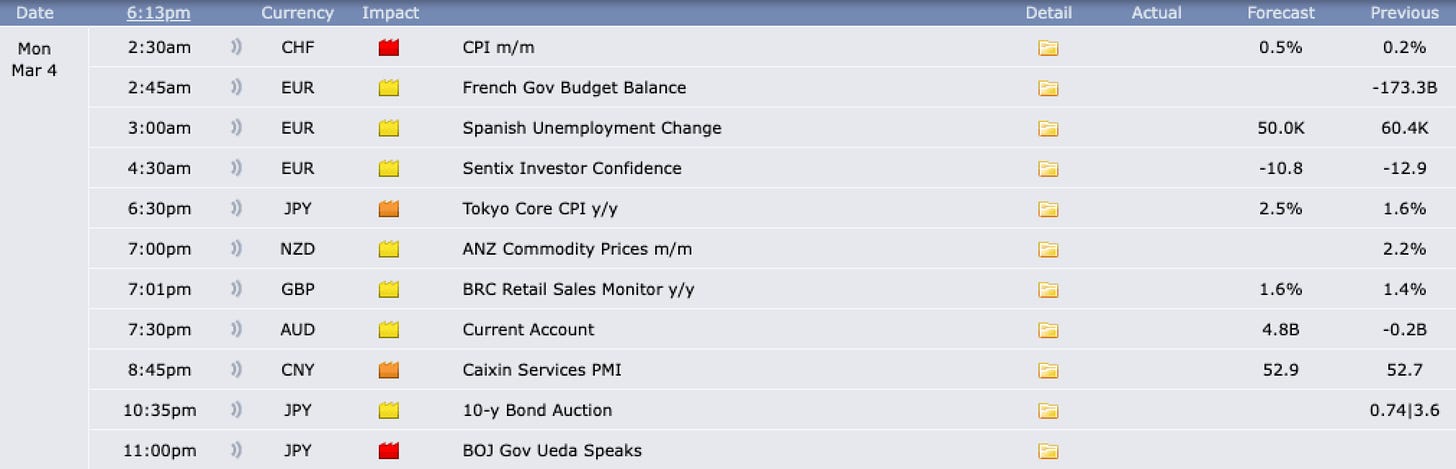

3/4 News Catalysts

No major news catalysts, but at noon est we have FED Member Harker speaking. Then Monday overnight keep an eye for Tokyo Core CPI and BOJ Gov Ueda speaks.

For more information on news events, visit the Economic Calendar

There are a few key earning reports that I would keep an eye out for.

Just a reminder for those not subscribed to the newsletter your access will end here for you.

You can still join us for the rest of the plan where we discuss key levels and entries to take and targets.

There is a 5 day free trial for access into our new Discord channel. SUBSCRIBE

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.