Good evening traders. I am back this week after a work trip that consumed much of my time. This week will allow me to resume our daily SPX trade plans. I will admit without doing my own trade plan, charting, etc it is hard to react each day and what levels are important to guide trades. So always, do your own work, understand why these levels are important, and more importantly stay #paytient and don’t predict, but react.

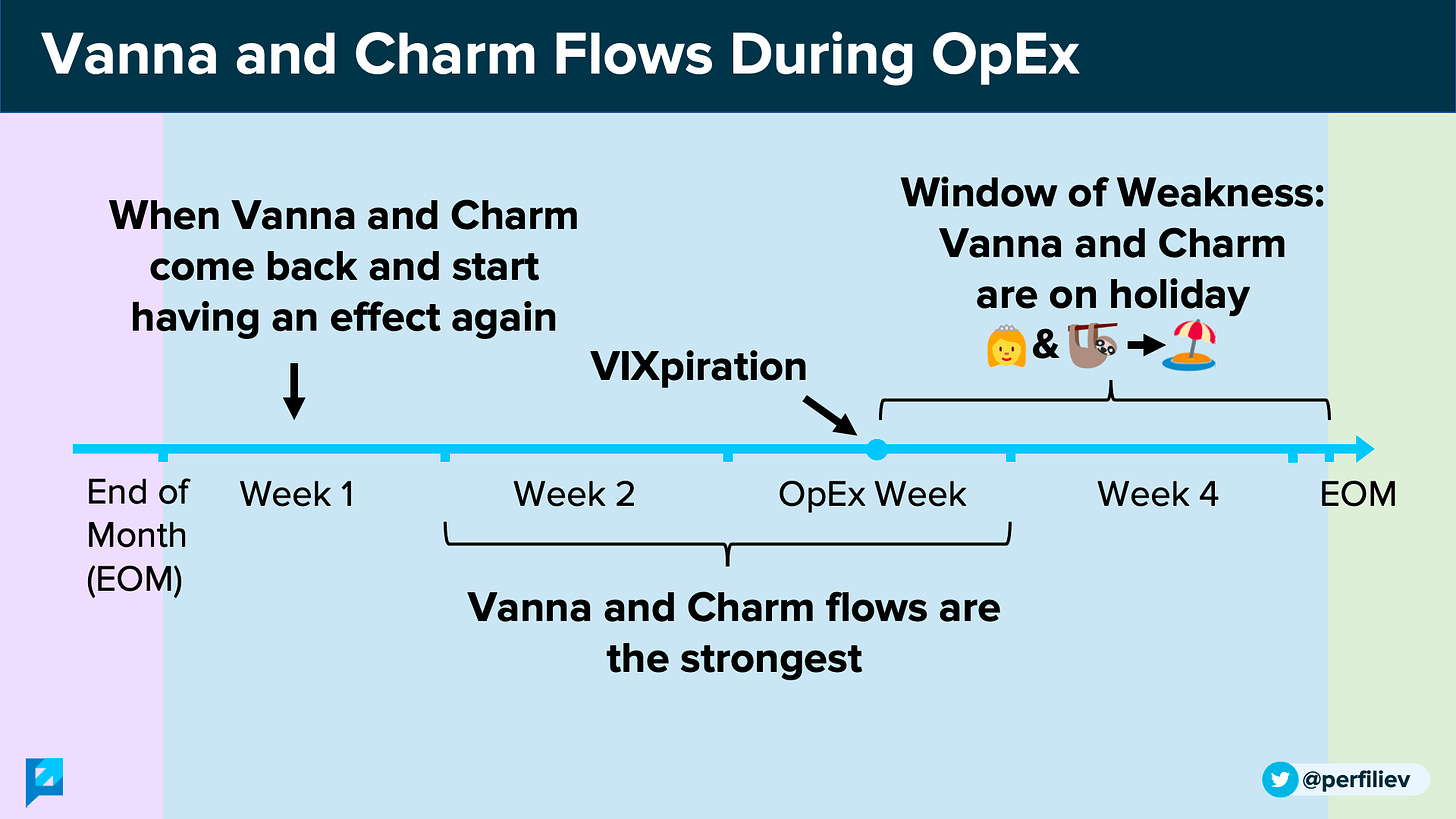

Reminder, this is an unusual trading month where we have an additional week of weakness in Vanna and Charm. So pay extra close attention to the Gamma levels and any key volume profile value area’s and points of control, along with bullish/bearish orderblocks, and dark pools. They will compliment our dealer data for this week.

Last session trading recap

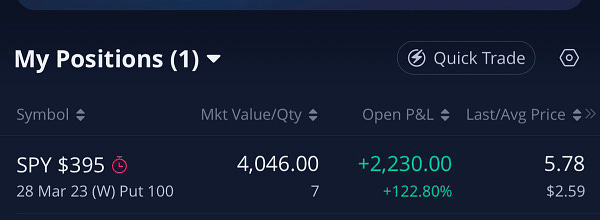

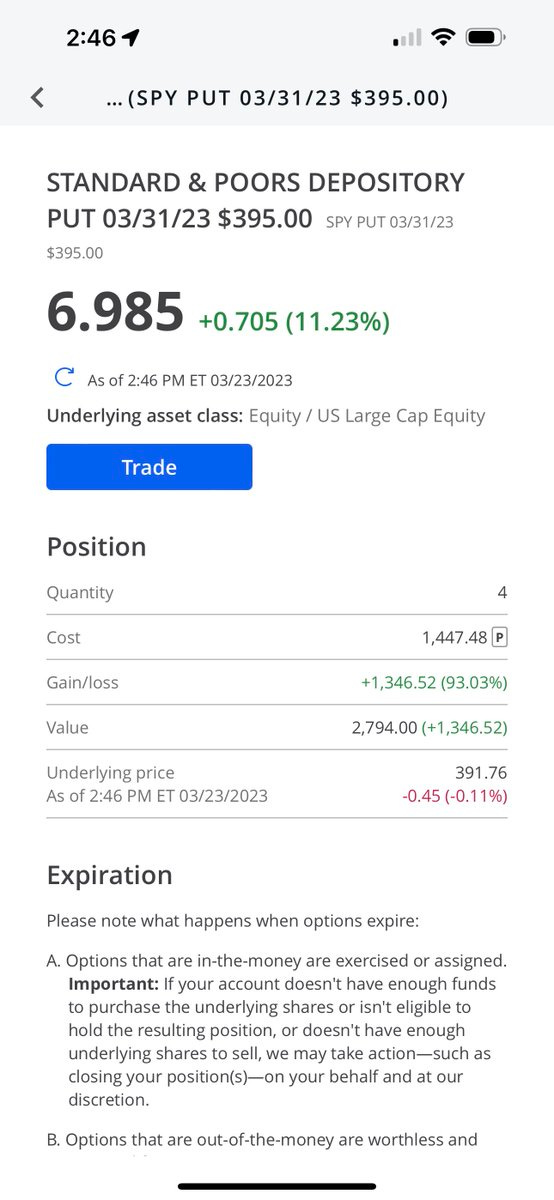

As I mentioned I didn’t do much trading last week and there is nothing wrong with that. If you are busy, haven’t done your homework, etc cash is always great to hold on. It was a directional less week and if you are not trading intraday, hard to swing anything with the decay in premium.

As always Captain Wick provided a nice analysis on SPY and I traded just one day this week netting over $3000 in profit. Why did this day peak my interest? After the FOMC I was able to get a sense of what the FEDs thoughts were and how the market ended Wednesday. We had weak bulls - ie volume near the highs were low and major wicks near the top - and both SPX and VIX were hitting key orderblocks. Couple that with dealer data and you have a nice recipe for success.

I enjoy interacting and learning from other traders so continue to share your trades, ideas, and how you use this trade plan by messaging me on Twitter @DarkMatterTrade.

News Catalyst

This week brings a lot of news catalysts that could swing the market up and down. It all starts Monday at 1pm est with the Bank of England Gov Bailey speaking, Consumer Confidence Tuesday, Pending Home Sales Wednesday, GDP and Treasury SEC Yellen Thursday, and probably the most important event of the week Friday with PCE.

1pm est - BOE Gov Bailey Speaks

For more information on news events, visit the Economic Calendar

SPX/ES/SPY Trade Plan

Remember you can use this SPX trade plan to trade ES or SPY.

Bullish bias:

Above 4005 target 4025

If there is a failed breakdown of 3950 target 3980

If there is a failed breakdown of 3925-30 target 3950

Bearish bias:

Below 3980 target 3950

If there is a breakdown of 3925 target 3895

If there is a failed breakout of 4000-05 target 3980

SPX - The Why Behind the Plan

Key Levels

Last week we mentioned a key level at…

3915 - (390.11) $3.7B was reported at this level

We are right at this level - will be curious to see if this pool ends up being a short or longing - based on previous Dark Pools you could argue this most likely will be a sell/short - let’s wait and see

This ended up being a huge level all week as the SPX held this key level - basing in this area for short amounts of time as these dips were bought. Continued increase in dark pool activity at this level helped support the market when this level was tested on Monday and Thursday.

For this week some key levels on my radar are:

Below Spot:

3901-3890 - FVG (30min chart)

3910-15 - key dark pool level

3930-3901 - OB (4HR chart)

3960-3954 - OB (15min chart)

Above Spot:

3976-3986 - FVG (1HR chart)

3996-4031 - bearish OB (1HR chart)

4000 - 2/27 weekly VAH

4028 - 2/21 weekly VAH

4054 - February’s VAL

Dark Pool Levels

We need to pay attention to some key levels that have Dark Pool buildup. Mark them on your chart as key levels that we should pay attention to.

3968 - (395.62) Over $3B was reported on Friday

3940-45 - (393.40) $1.81B was reported on Friday

3910-15 - (390.11) a key dark pool level that kept the market supportive to the upside

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break.

3976-3986 - FVG (1HR chart)

3996-4031 - OB (1HR chart)

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break.

3960-3954 - OB (15min chart)

3940-3932 - OB (15min chart)

3930-3901 - OB (4HR chart)

3901-3890 - FVG (30min chart)

3874-3843 - OB (1HR chart)

Volume Profile

Let’s review the volume profile and some key levels there. If you are unfamiliar with the Volume Profile I highly suggest reviewing some YouTube videos or reading this quick overview on it.

Some keywords to be aware of:

VAH = value area high

VAL = value area low

POC = point of control

Monthly Levels:

3901 - March’s VAL

Note this figure fluctuates as the month goes on so review it daily for any potential changes

3917 - January’s VAL

Bulls nicely defended this key VAL along with the dark pool buys at this level shows we have a strong support level building in the 3910-3920 zone

3948 - March’s POC

4013 - March’s VAH

Note this figure fluctuates as the month goes on so review it daily for any potential changes

January’s POC as well

4054 - this is February’s value area low

4085 - this is January’s value area high

Weekly Levels:

3922 - 3/20 weekly VAL

3951 - 3/20 weekly naked POC

Naked means it hasn’t been tested and will typically be a magnet for price to come back and either act as support or further consolidation to the downside

3986 - 3/6 weekly POC

4000 - 2/27 weekly VAH

4028 - 2/21 weekly VAH

An area that continues to face resistance since early March and will be a key level for continued upside trend

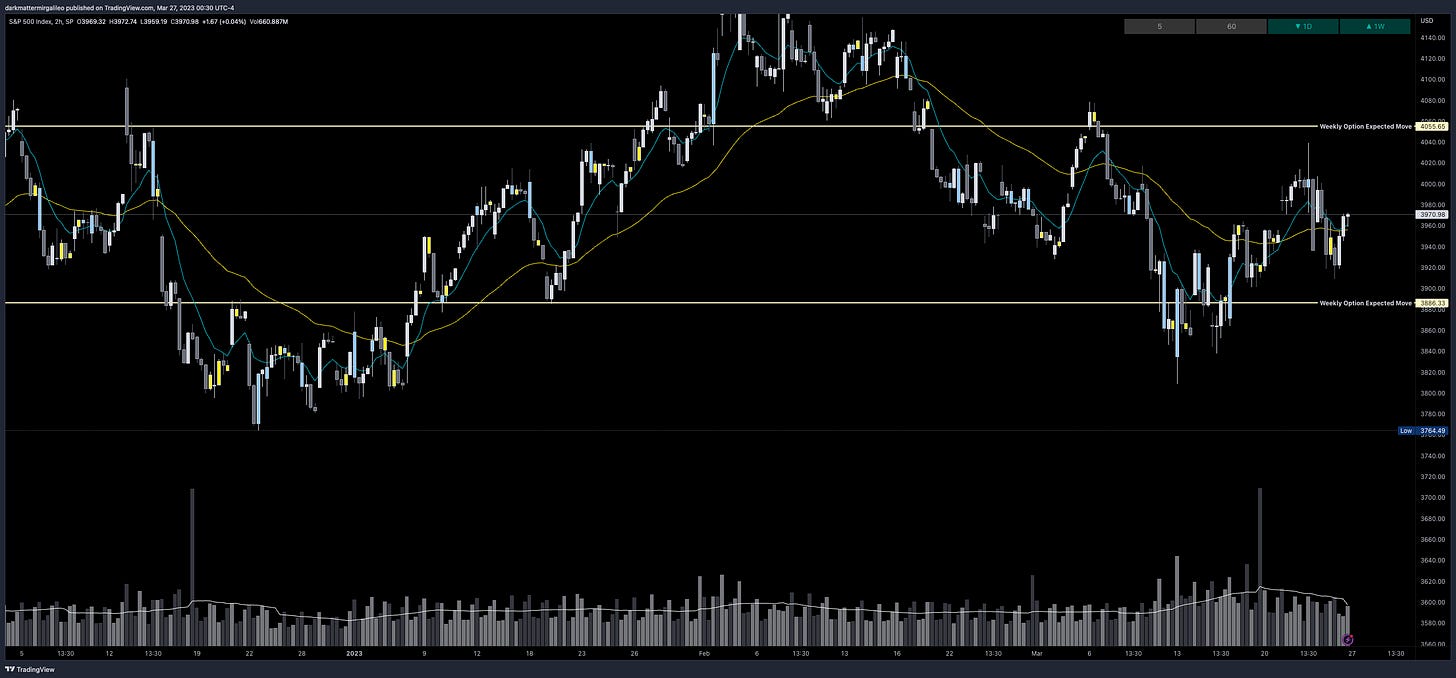

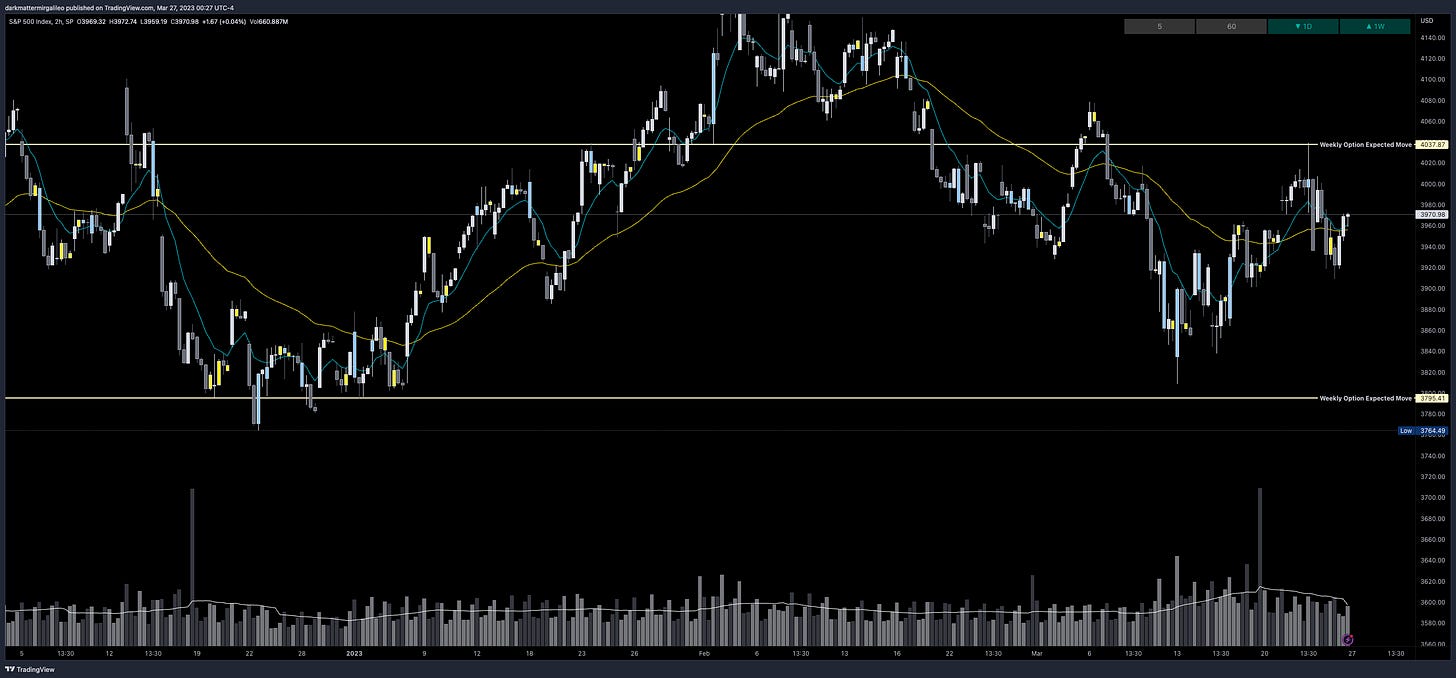

Weekly Option Expected Move

SPX’s weekly option expected move is ~84.66 points. SPY’s expected move is ~9.15. Remember over 68% of the time price will resolve it self in this range by weeks end.

Last week we tapped the high of the expected move and saw a selloff from there. Again no two weeks will be exactly the same, but this helps provide the range for the week and could help you escape a potential trap up or down…

VIX Update

Let’s review the VIX chart. VIX continued it’s selloff after hitting an OB on the 4hr chart. We are now trading near a key bullish OB.

Key levels are:

22.41-23.40

21.60-20.89

20.89-20.20

19.60-19.25

19.25-18.90

Remember, typically VIX going down correlates with a uptrend in the market and vice versa for a downtrend in the market.

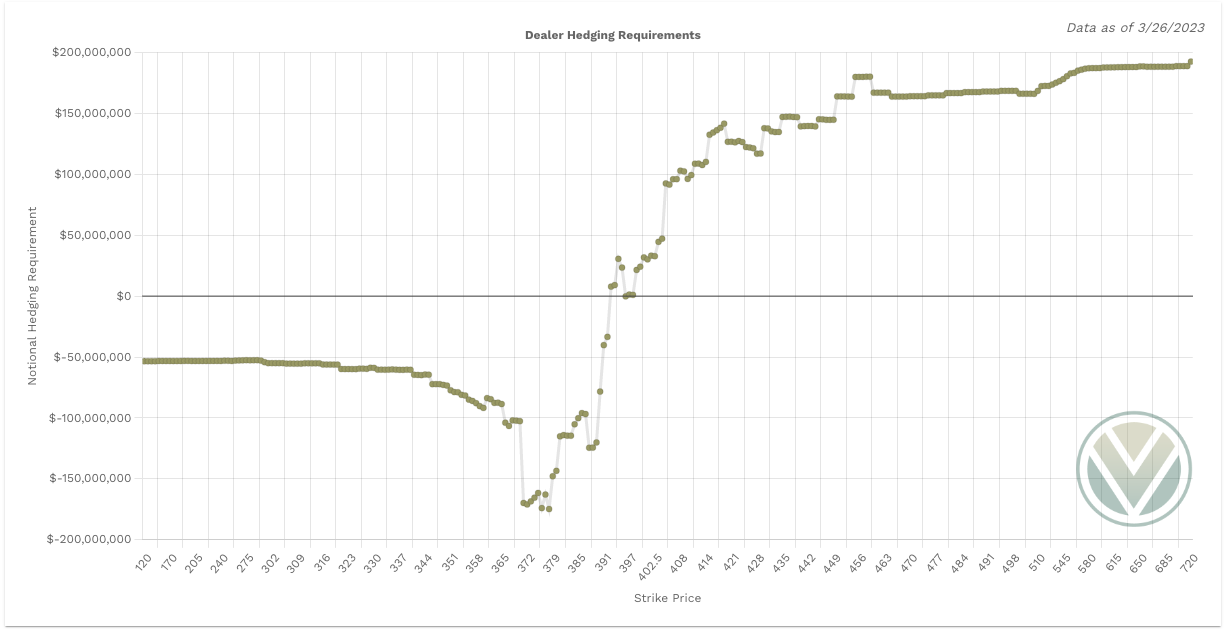

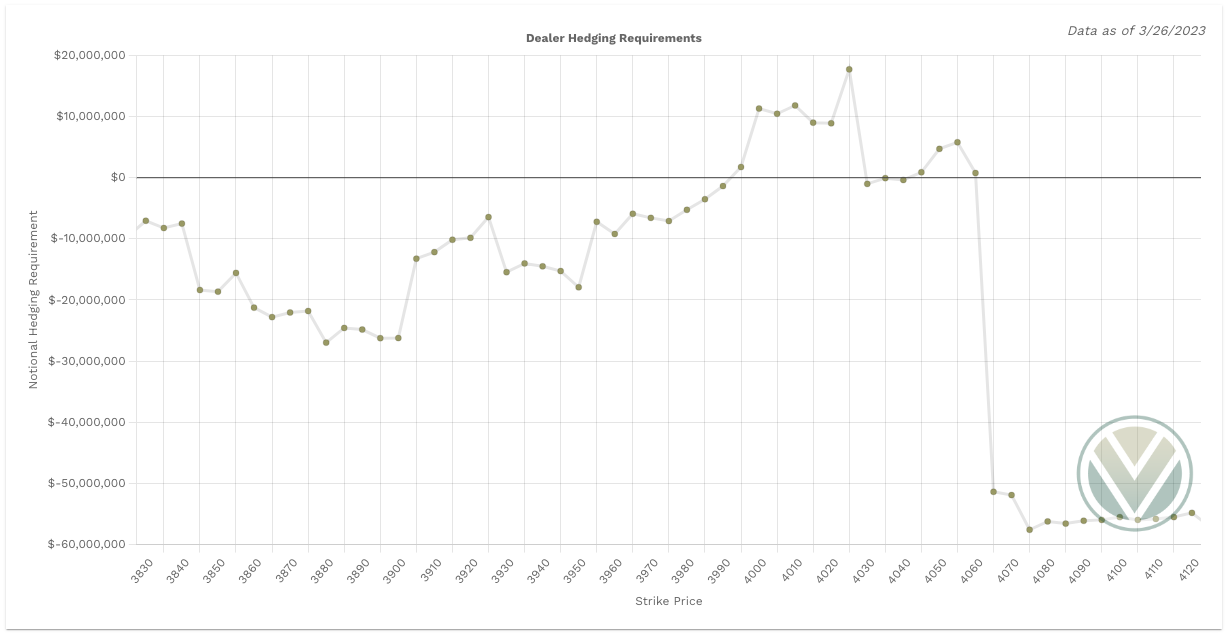

Vol.land Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

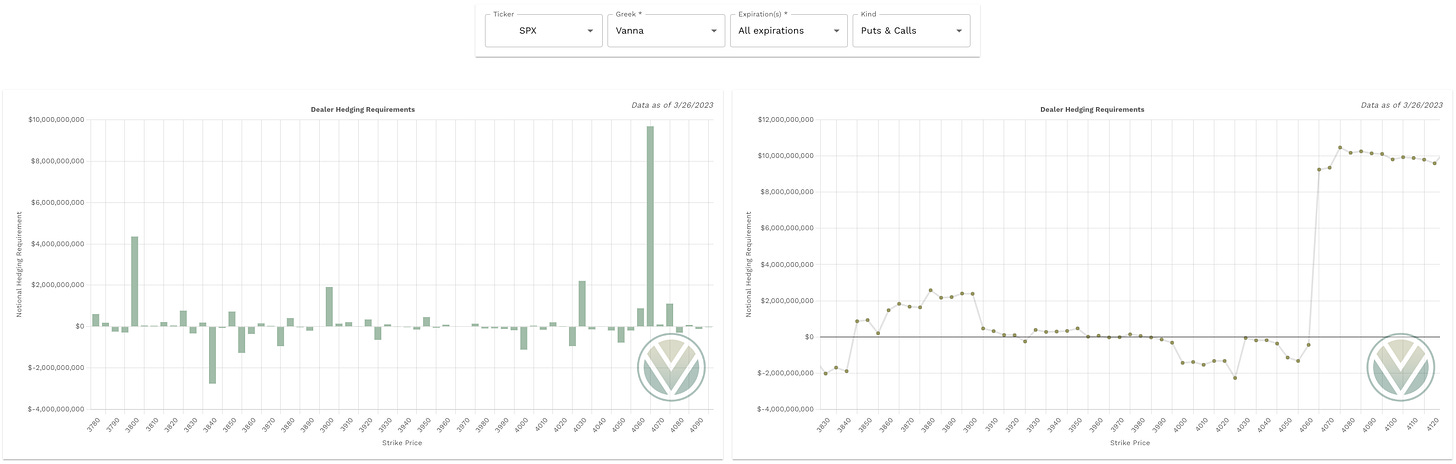

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

As we are in a window of weakness with Vanna we cannot solely rely on these levels. It is imperative that for the next two weeks we look at key Gamma levels, orderblocks, dark pools and the VIX.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

Above Spot:

3975 is positive vanna

3980-4000 is negative vanna

4005 is positive vanna

4010 is negative vanna

4025 is positive vanna

Continues to be a key magnet level should the bulls hold above 4000

4065 is positive vanna

This is the largest positive vanna above spot

Below Spot:

3970-65 is negative vanna

3960-50 is positive vanna

3945-35 is negative vanna

3925 is negative vanna

3920-3895 is positive vanna

3890-3885 is negative vanna

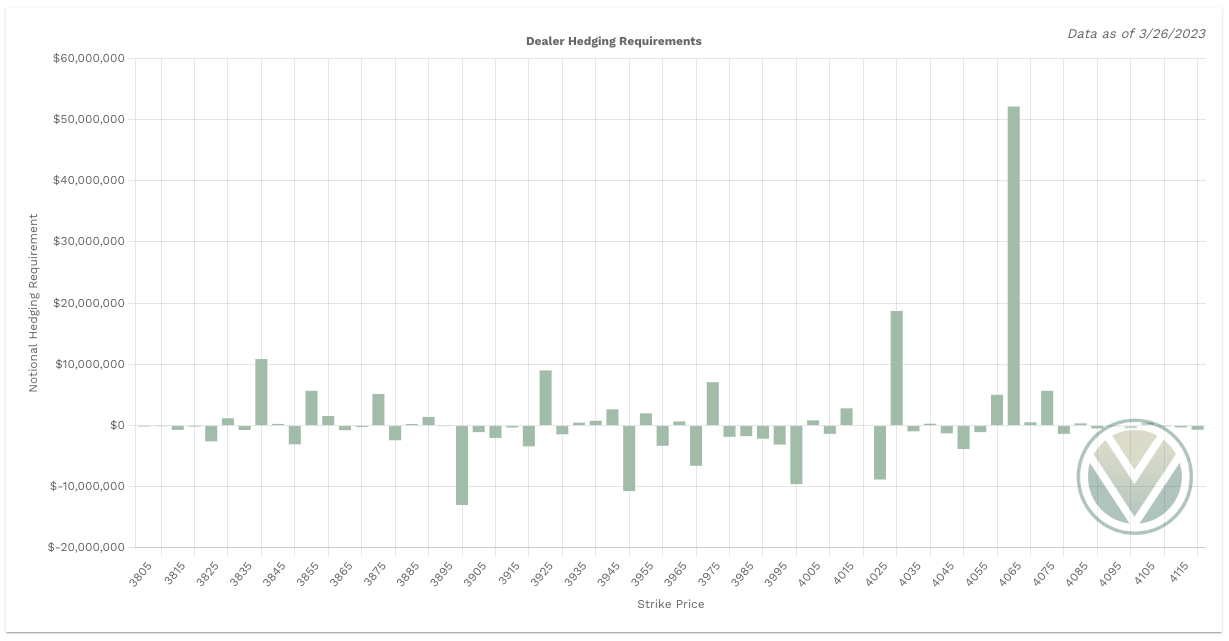

Gamma and Delta-Adjusted Gamma (DAG)

Positive Gamma Above Spot - acts as resistance

Positive Gamma Below Spot - acts as support

Above Spot:

3975 is positive Gamma

3980-4000 is negative Gamma

If price floats through this zone dealers will not impact price as they are neutral to these levels - no buying or selling

What we will want to be looking for are 0DTE Volland or Options Flow Data to guide us through these levels for further upside

4005 is positive Gamma

4015 is positive Gamma

4030 is positive Gamma

Dealers must buy above 3995

Below Spot:

3965 is positive Gamma

3955 is positive Gamma

3945-35 is positive Gamma

3925 is positive Gamma

3890 is positive Gamma

Dealers must sell below 3990

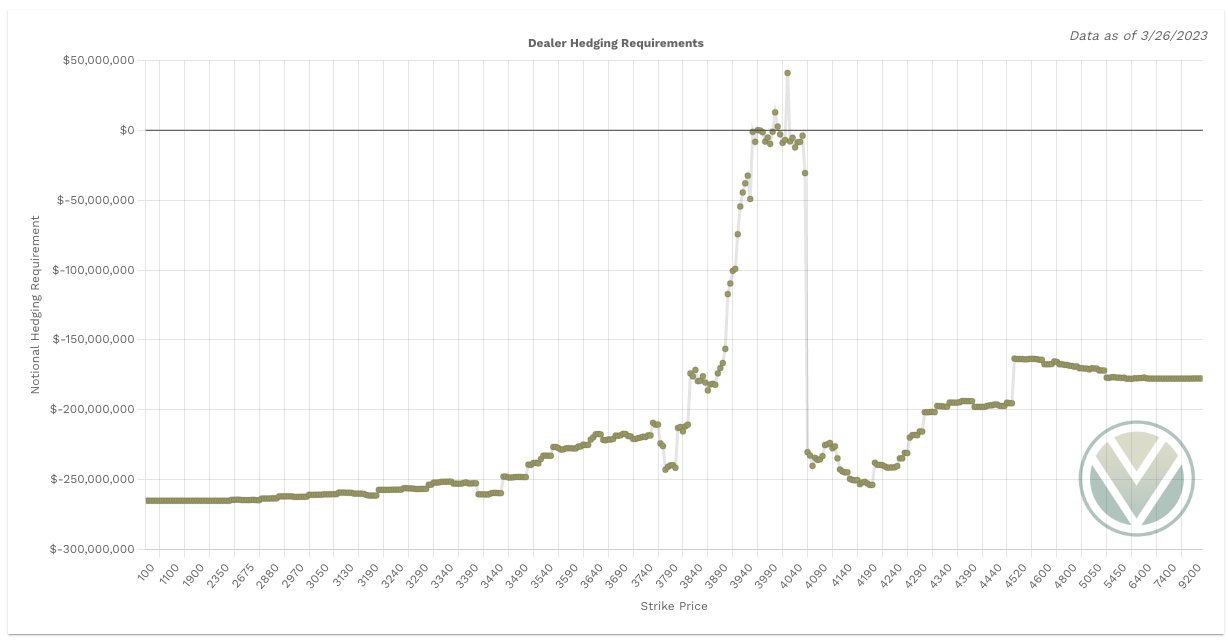

Charm

While Charm is on “vacation” I will continue to share the data just for observation purposes.

Charm is more negative on SPX. This suggests that Charm will have little a more bullish impact on SPX today.

When reviewing Charm we also need to account for SPY’s charm. It is leaning neutral. Between the totals of SPY and SPX, SPX charm will outweigh SPY. When they are in sync that further adds to the charm impact.

Keep in mind the total notional value of SPX should be multiplied by 10 for comparison to SPY.

Final Take

Based on futures the market is risk on, but let’s see if we break through some key supply levels to the upside. Vanna levels are also not promising showing a cluster of negative vanna’s above our existing levels in the futures market while the gamma levels are interesting showing potential upside to 4005, 4015, and 4030.

For those of you in the QE camp, I leave you with one last chart and suggest you visit our friends @fxevolution and this YouTube on the QE tapering already…

Stay #paytient and react to the key levels - no predictions! Good luck traders.

I am going to share my key rules to intraday trading in the end of the plan moving forward to build better habits and allowing you to grow as a better trader.

My Intraday Trading Rules

I do not trade within the first half hour UNLESS I am in a trade from the prior session and looking to close the trade or we have a major gap or a key level already broken

I let the initial balance do its thing - I am just a small fish in a large ocean of traders so let's let them fight it out

I then wait for key levels targeting one level to the next and taking profits at each one.

If there are key levels that are 10pts apart that is when I have scalping mindset and anything above 10pts I want to give it the room to hit the price target with a 5 pt buffer to take profits once we reach within 5 pts of a target - I also tighten my stop loss once at 10-20% profit with the goal of never allowing trades to go red when I have a nice profit)

I supply options greeks with OB (order blocks) and FVG (fair value gaps) otherwise known as Smart Money Concepts

When I am scalping - ie targeting 10pt trade levels I will take profits and never go more than 10% red. Simple as that, know your trade plan strategy and the risk. When you are wrong you are wrong and reset

For 20pt trade level targets I will increase my stop losses to 20% and allow more of the trade to play in the event I entered too early

I try - key word try ha - avoid trading lunch hours defined as 12pm to 2 pm est. Money for the most part unless you are scalping - is made in the first 2 hours of the trading day and the last 2 hours

I always stick to two EMA’s on my chart and that’s the 10/50 EMA’s

When the 10ema is above 50ema we are bullish

When the 10ema is below the 50ema we are bearish

Go put these on your charts and when you view them on timeframes less than the daily timeframe you will see the power they provide

For scalpers out there the smaller timeframes provide great opportunities to scalp 5-10pt moves

There are more we could discuss including volume profile, low volume nodes that I think are great strategies to compliment option greeks. Maybe in the future we can include more details.

Trading is not for the unprepared. It is critical you abide to a strategy and checklist and walk into every trade with a plan. Without a plan you are simply gambling and have a better chance at the slot machines. There are more nuances to my weekly and daily checklists, but I think this provides a good read for now and we will/can continue adding to it.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.