March 22, 2024 SPX, ES, SPY Trade Plan

Market Recap

Today was a sloppy and choppy day after the massive run up we had in the prior trading session on the heels of Powell speaking and then overnight futures action.

While we saw a 20pt selloff from the highs of the day we closed above 5240 and more importantly ES continues to show support at 5300.

That’s what it ultimately comes down to is how these levels react when tested and whether we continue up more or come falling back down.

Let’s jump into the trade plan…

Just a reminder - Transition to Discord…

One more week - end of March - and we will be discontinuing our Substack in favor of our transition to Discord. Haven’t made the transition yet? Below are details…

All of these updates were provided in real time in our Discord server. If you are an existing subscriber and haven’t received an email on how to transition to Discord please email me at darkmattertrade@gmail.com. For the subject line please add “Access to Discord.”

📈 Don't miss out on key levels, expert trade ideas, daily plans, and intraday updates for only $29.99/month.

💰 Click subscribe now and supercharge your trading game! 🚀

#TradeSmart #LimitedTimeOffer

SUBSCRIBE

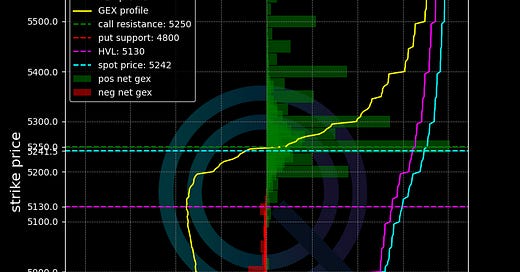

Gamma Levels - GEX

Here is an overview of the Gamma/GEX data we are seeing longer term…

Customers are treating this market as positive gamma - buy the dips

5250, 5275, 5245 are your top net GEX levels

5250 is showing a lot of interest from customers…

There will be a squeeze if we break and hold 5250…

5130 is a key pivot - below will trigger a larger selloff and push us back into negative gamma

4800 is a key level of support

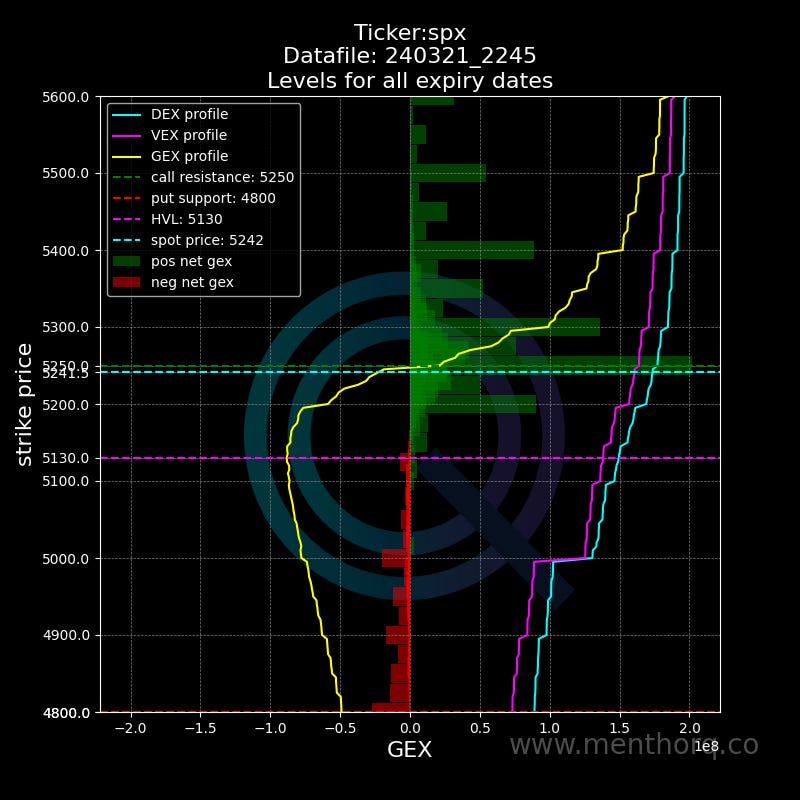

Here is what it looks like intraday or 0DTE…

5200 is an area of support

Put support at 5140 - could be where the low of the day could get to

5145 is where the market starts to get negative gamma - aka sell the rips

5250 is a key upside target and resistance

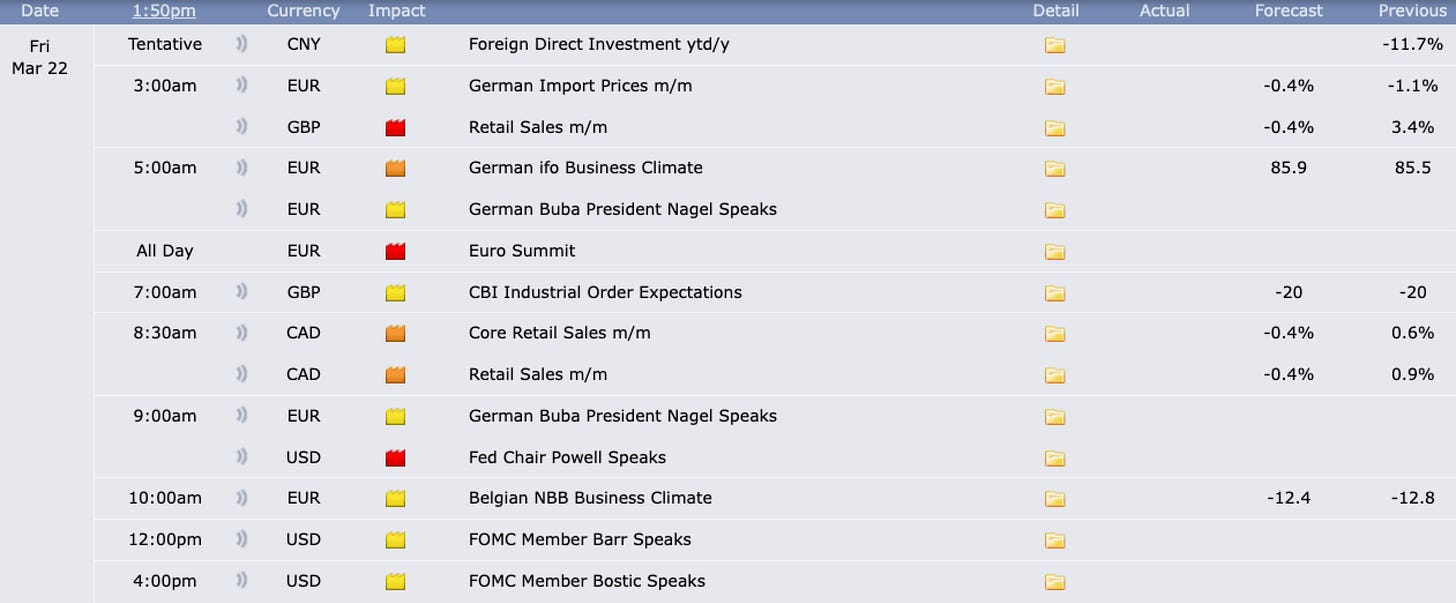

3/22 News Catalysts

UK retail sales are overnight, CA retails sales premarket, and last but not least FED Chair Powell Speaks at 9am est premarket.

For more information on news events, visit the Economic Calendar

Just a reminder for those not subscribed to the newsletter your access will end here for you.

You can still join us for the rest of the plan where we discuss key levels and entries to take and targets.

There is a 5 day free trial for access into our new Discord channel. SUBSCRIBE

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.