March 13, 2024 SPX, ES, SPY Trade Plan

Market Recap

Good morning/evening wherever you are in the world. Before we kick into today’s trade plan let’s review yesterday’s CPI print. If you just saw the print today you would have assumed the market would have sold off and while it did briefly it found footing and then we rallied today gaining 57pts on the SPX. Reversing a couple days of red/bearish activity.

So why did we rally? When you breakdown the inflation numbers actually were cooler than what the print showcased. The MoM figures for CPI came in at 0.4% but in reality it was 0.36% as they round up which leads to the 3.2% YoY print we had and the initial - oh my we have a hot CPI print… So what was the discrepancy?

Higher gas prices - this is a very volatile item in the inflation report and it added 15bps which could be erased in the next print - in other words its a very volatile number that can swing often

Transportation services and auto insurance added 13bps

Of that 13bps in transportation services - 5bps came from used cars and trucks

So if you eliminate the 3 items the MoM (month over month) figured would have been 0.29% and the YoY (year over year) figure would have been 2.9%.

What is something we should keep our eye out for is the increase still in food and shelter costs. These two are the largest expenses to the typical household in any country, let alone the USA, but if these figures don’t see some level of correction here it continue to push up inflation which will cause a risk off/sell off market environment. So if someone is telling you the CPI print doesn’t matter for the foreseeable future doesn’t have common sense…

This is why it is important to dig into the details and not just react to a headline number put out by the lamestream media…

Just a reminder…

All of these updates were provided in real time in our Discord server. If you are an existing subscriber and haven’t received an email on how to transition to Discord please email me at darkmattertrade@gmail.com. For the subject line please add “Access to Discord.”

📈 Don't miss out on key levels, expert trade ideas, daily plans, and intraday updates for only $29.99/month.

💰 Click subscribe now and supercharge your trading game! 🚀

#TradeSmart #LimitedTimeOffer

SUBSCRIBE

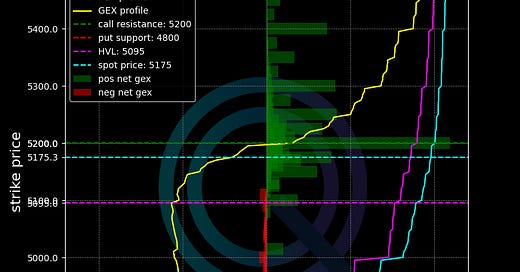

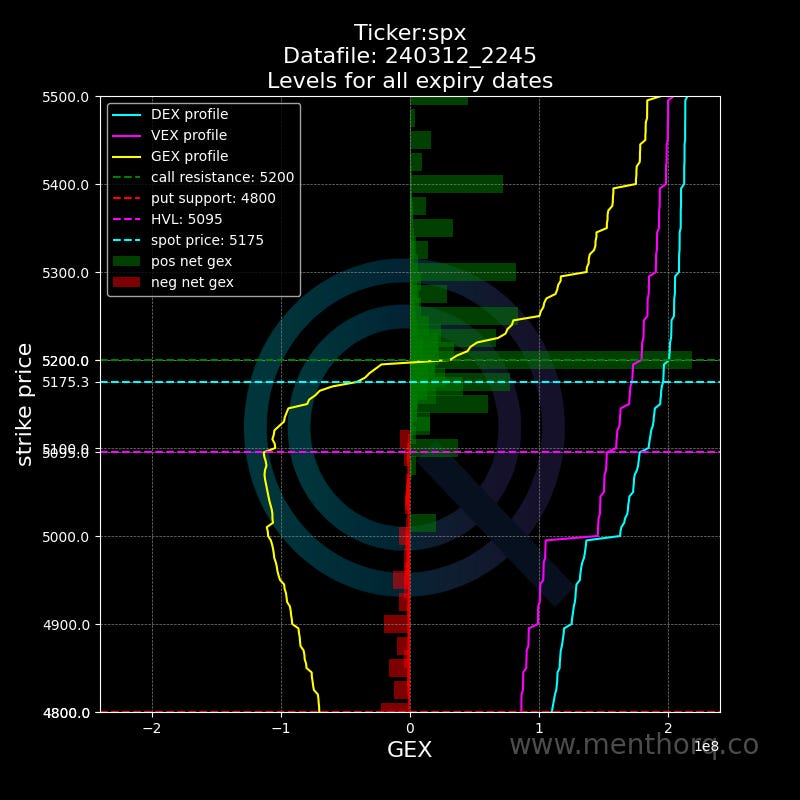

Here is an overview of the Gamma/GEX data we are seeing longer term…

Customers are treating this market as positive gamma - buy the dips

5150, 5200, 5175 are your top net GEX levels

5200 still has interest on it if revisited but will be major resistance

There will be a squeeze if we break and hold this level…

5095 is a key level which will trigger the market to shift into a negative gamma condition - sell the rips

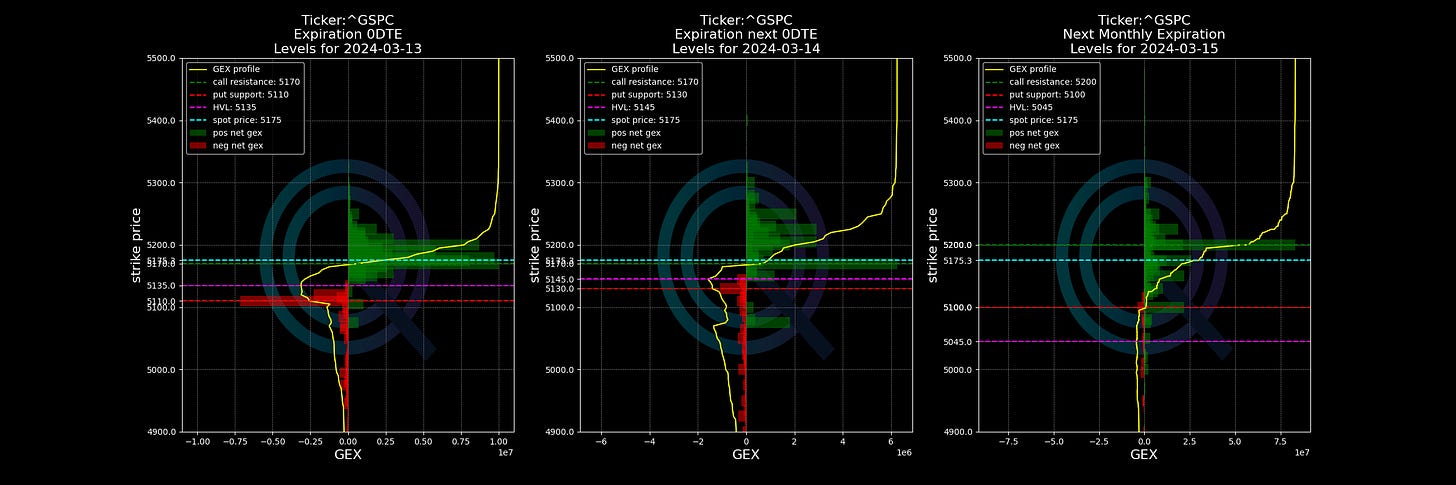

Here is what it looks like intraday or 0DTE…

Intraday we are in positive gamma - buy the dips

5170 is a pivot level intraday - below targets 5135 and below it 5100

With that let’s jump into our trade plan….

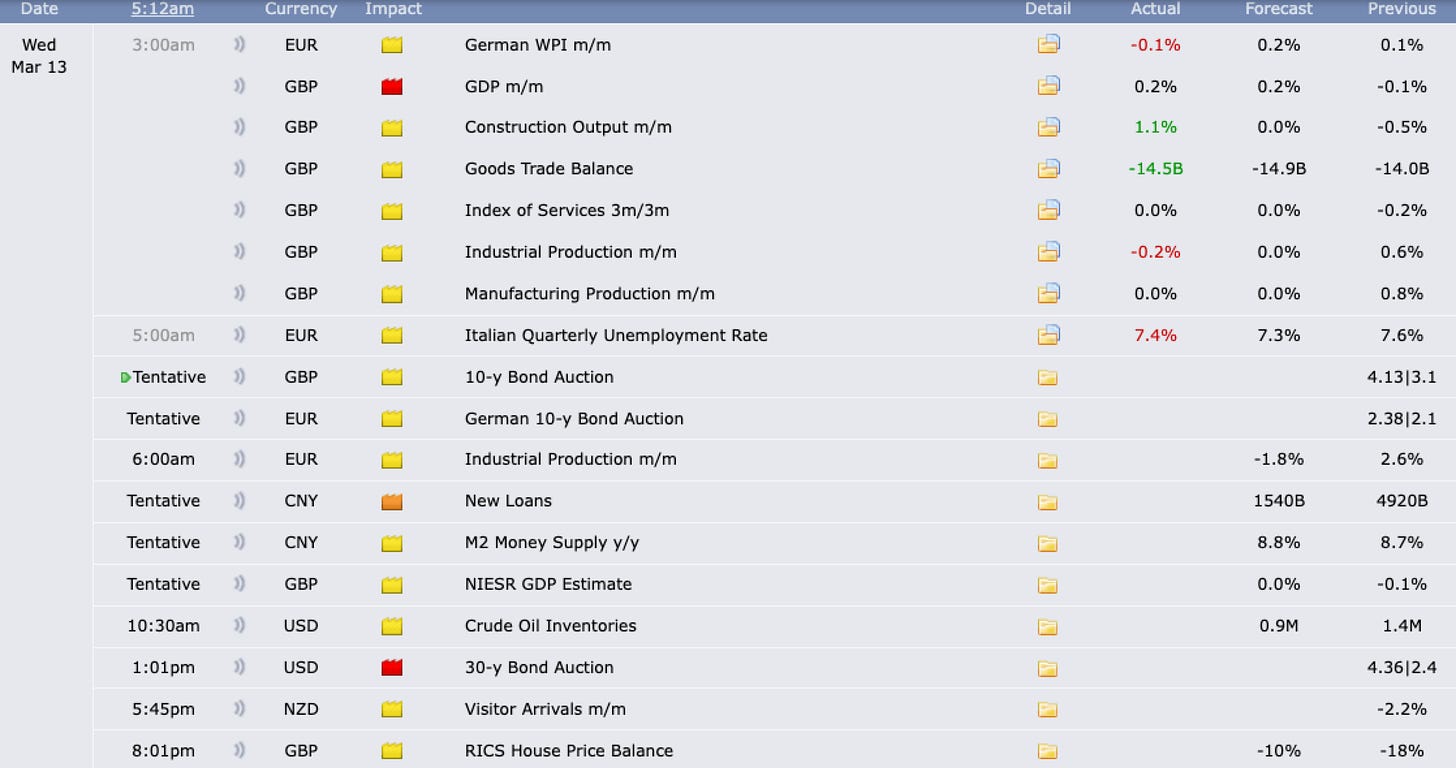

3/13 News Catalysts

Today’s main highlight is the 30-year bond auction at 1pm est.

For more information on news events, visit the Economic Calendar

Just a reminder for those not subscribed to the newsletter your access will end here for you.

You can still join us for the rest of the plan where we discuss key levels and entries to take and targets.

There is a 5 day free trial for access into our new Discord channel. SUBSCRIBE

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.