March 11, 2024 SPX, ES, SPY Trade Plan

Weekly Market Overview

Welcome team to another week of our intraday SPX plans. Before we kick into gear and look into tomorrow’s plan let’s dig in and review a few things that are important on the week.

First of all key levels, 5200 and 5010. Can’t state this enough but these two levels will dictate the trend the SPX may take in the interim. In between that is a bunch of noise and we need our intraday trade plans to help guide us until this zone has consolidated and we know the larger trend move.

Remember this week is monthly OPEX week. Lock in your profits avoid overtrading and go lite in size. Better trades will come post this week. NOTE: There is also quarterly OPEX this month which is Q1’s options expiry on 3/28.

Monday could be a frustrating day as an intraday trader. Why? Well for one we have CPI coming out premarket Tuesday. The market may want to stay in a tight range or wait until the EOD in anticipation of this major event.

Otherwise we have the 10 and 30 year bond auctions (Tue & Wed), PPI and Retail Sales Thursday, and Empire State Manufacturing Index and Consumer Sentiment Friday.

📈 Don't miss out on key levels, expert trade ideas, daily plans, and intraday updates for only $29.99/month.

💰 Click subscribe now and supercharge your trading game! 🚀

#TradeSmart #LimitedTimeOffer

SUBSCRIBE

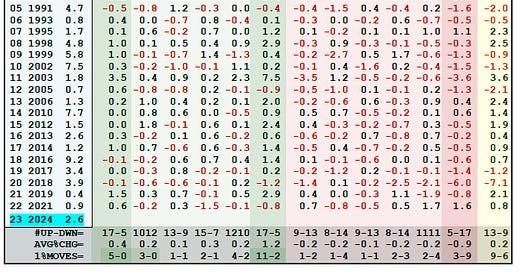

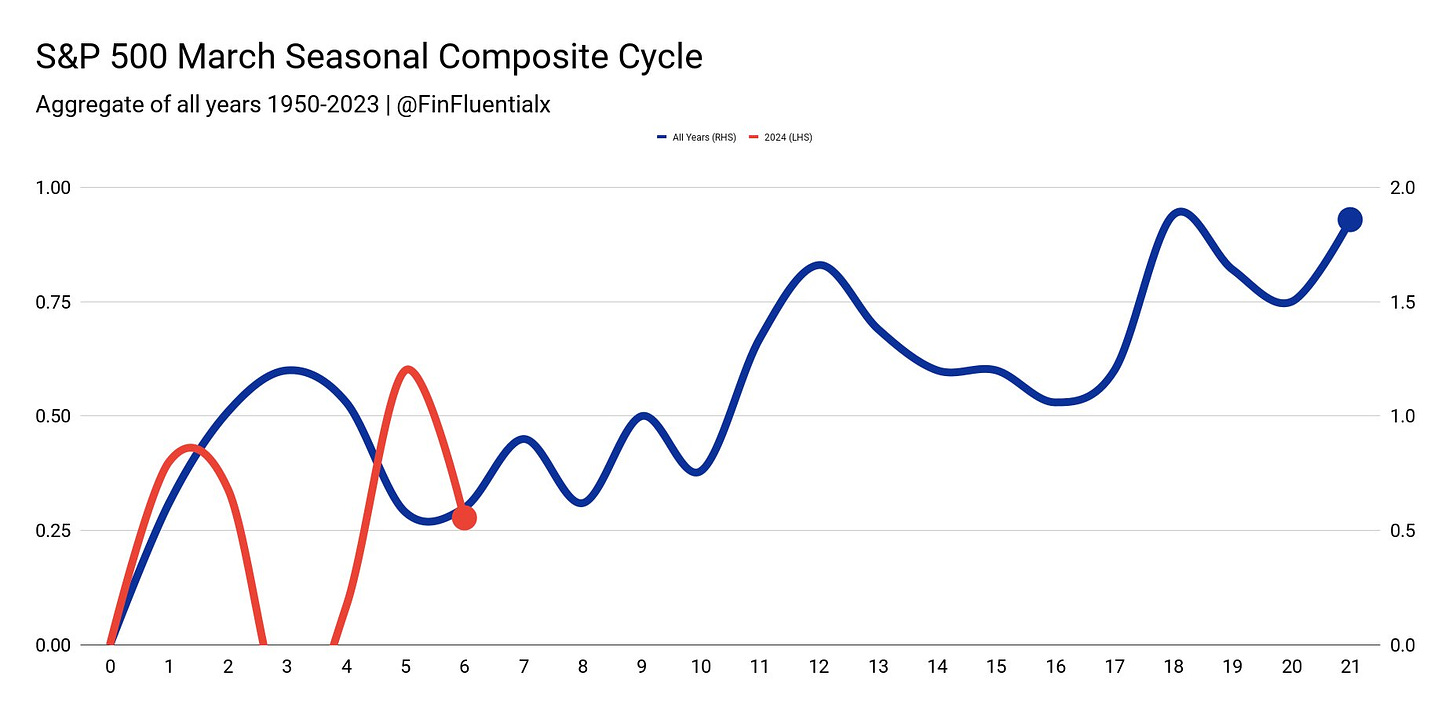

Here is a great study by Wayne Whaley where the week prior to quarterly OPEX we see the market trend up and then post that quarterly opex we start to see the market turn bearish. Let’s keep an eye on this one, it is an interesting future view into what may come in the market.

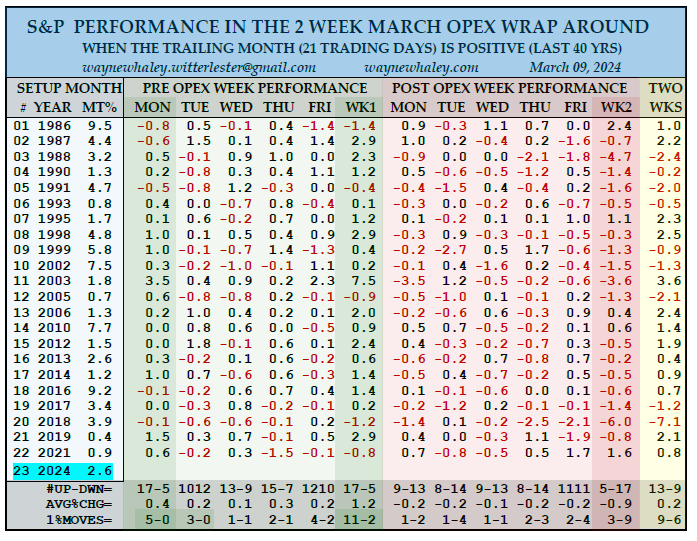

From a March seasonality standpoint from Almanac Trader this time in March is when we start to see a bearish period.

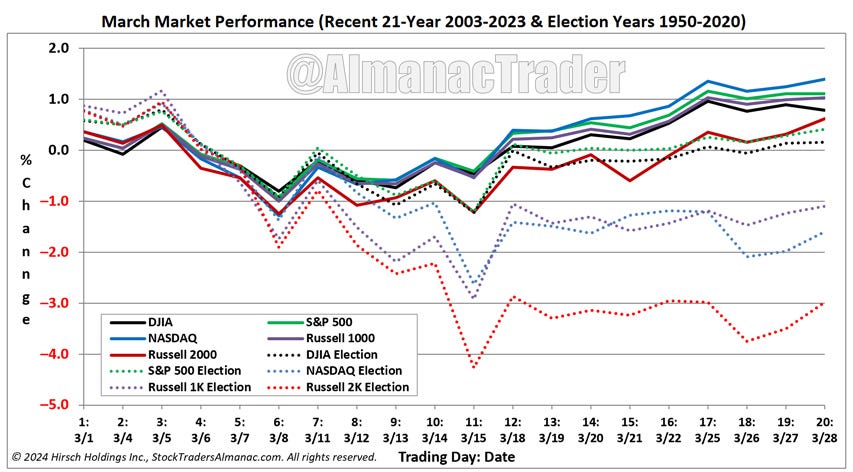

Here is another view on seasonality compared to how we have tracked in the month so far…

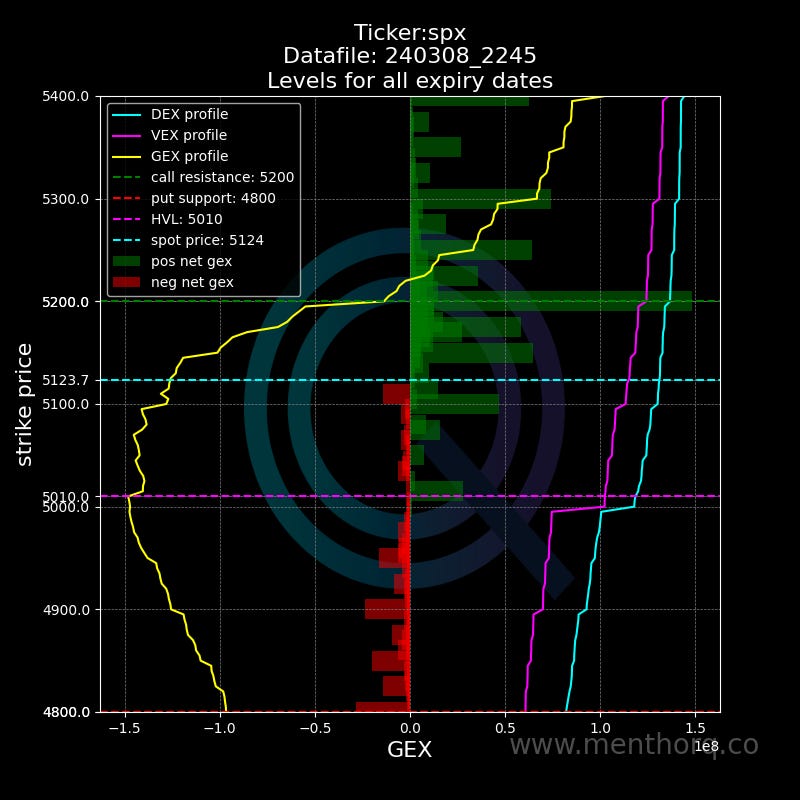

Ok so what does GEX look like? Remember, these are customer gamma levels and not similar to the Volland dealer data. Why I share this data is that it gives us a perspective of what the customers are thinking and how the dealers will/are going to hedge against those positions.

Here is an overview of the Gamma/GEX data we are seeing longer term…

Customers are treating this market as positive gamma - buy the dips

5100 is immediate support level and then 5050 and then 5010

5200 still has interest on it if revisited but will be major resistance

5000 will trigger the most volatility if it is visited followed by 5100 and 5200

Here is what it looks like intraday or 0DTE…

Intraday we are in negative gamma - sell rips

5135 is a pivot level intraday - above targets 5150 and below it 5100

With that let’s jump into our trade plan….

3/11 News Catalysts

No major news catalyst.

For more information on news events, visit the Economic Calendar

Just a reminder for those not subscribed to the newsletter your access will end here for you.

You can still join us for the rest of the plan where we discuss key levels and entries to take and targets.

There is a 5 day free trial for access into our new Discord channel. SUBSCRIBE

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.