Good evening/day/morning traders. While our levels were dead on and we nailed the bottom I can’t repeat how often I suggest you avoid 0DTE, 1DTE type of trades. If you are not playing flys/spreads/etc and just going long/short calls or puts, buy yourself time. It gives you more time to see the trade, it decays less, and if you are wrong your losses are more minimal than a short expiry. I have shifted to taking weeklys at the beginning of the week and the 2nd half I will buy weeklies for the following week. Try it out and it might save you from a trade that ends up going your way, but you cut it too soon.

In our trade plan we said:

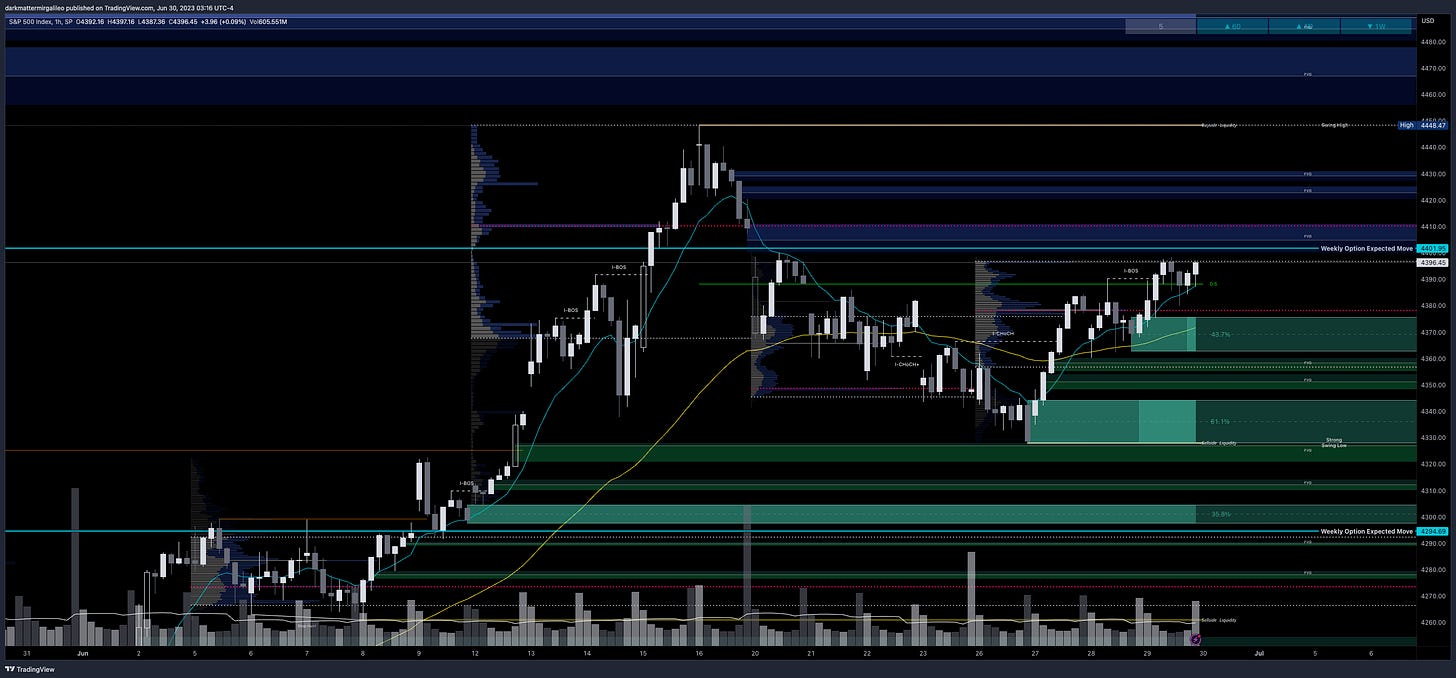

If there is a failed breakdown of 4370 target 4395

The trading session opened with price at 4371 and as I noted in the trade plan and tweeted as long as bulls kept price above 4370 there was no reason to short. Take a call at that point and leave your stop loss below 4365 where we said we would turn bearish targeting 4350. Again, emotions and discipline are key here. Don’t have a specific bias to one side. The market doesn’t go straight up or down…it’s like a roller coaster!

Tomorrow the bulls need to keep SPX above 4380 to target 4405 with potential overshot to 4410-4415 - will need more volume than we have had this week so keep an eye on Volland30 and VOLD for any levels above 4405.

For the bears they need to get below 4365 to target 4350. Again 4350 is a major support level so if we do get a selloff I don’t expect it to go past here. Unless you are scalping I wouldn’t take any shorts between 4370-4380 even if 4380 breaks down.

Here is a view of the stock market heat map from yesterday’s session. JP Morgan, Bank of America, Visa and Mastercard had some of the highest gains.

Let’s jump into the trade plan.

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

5:00am est - EU CPI Flash Estimate

8:30am est - Core PCE Price

9:45am est - Chicago PMI

10:00am est - Revised UoM Consumer Sentiment

10:00am est - Revised UoM Inflation Expectations

For more information on news events, visit the Economic Calendar

SPX/ES/SPY Trade Plan

Bullish bias:

Above 4395 target 4405

If there is a failed breakdown of 4380 target 4405

If there is a breakout of 4415 target 4430

Bearish bias:

Below 4365 target 4350

If there is a failed breakout of 4415 target 4400

If there is a breakdown of 4350 target 4325

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 41pts more than the SPX levels shared below. To get SPY levels simply take the SPX levels and divide by 10.01.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4405-4415 - negative vanna

4400-4409 - FVG (30min chart)

4396 - 439.22 - $3.32B

4430-4435 - negative vanna

4434-4440 - OB (15min chart)

4437 midline

4470 - negative vanna

4438-4470 - OB (4hr chart)

4455 midline

Below Spot:

4380 - negative vanna

4375-4362 - OB (1hr chart)

4369 midline

4376-4369 - 437.18-436.54 - $19.45B

4355-4350 - negative vanna

4344-4328 - OB (1hr chart)

4336 midline

4340-4336 - 433.65-433.19 - $9.39B

4325 - negative vanna

4333-4318 - FVG (2hr chart)

4325 premium level

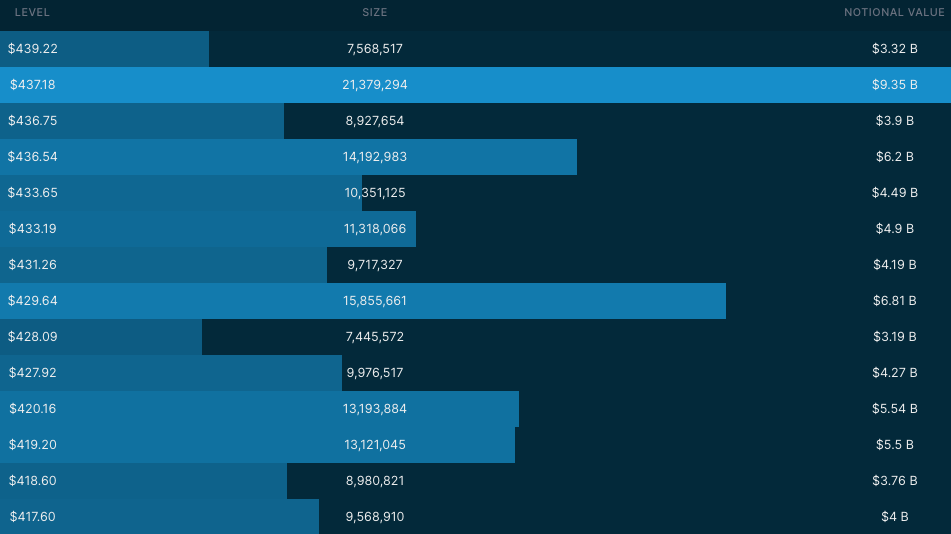

Dark Pool Levels

Similar to the Wednesday’s trading session we had minimal activity in dark pool activity. We continue to keep the 4376-4369 zone as a key pivot point.

4396 - 439.22 - $3.32B

4376-4369 - 437.18-436.54 - $19.45B

4340-4336 - 433.65-433.19 - $9.39B

4316 - 431.26 - $4.19B

4300 - 429.64 - $6.81B

4285-4283 - 428.09-427.92 - $7.46B

4205 - 420.16-420.03 - $8.05B

4196-80 - 419.20-417.60 - $16B

We need to pay attention to these dark pool levels. Mark them on your chart as key levels that we should pay attention to. Remember the levels where we see dark pool prints greater than $4B should peak our interest. I get my dark pool levels from Quant Data.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4400-4409 - FVG (30min chart)

4434-4440 - OB (15min chart)

4437 midline

4438-4470 - OB (4hr chart)

4455 midline

4475-4520 - OB (4hr chart)

4497 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4375-4362 - OB (1hr chart)

4369 midline

4344-4328 - OB (1hr chart)

4336 midline

4333-4318 - FVG (2hr chart)

4325 premium level

4304-4297 - OB (1hr chart)

4301 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~53.63 points. SPY’s expected move is ~5.58. That puts us at 4401.95 for the upside and 4294.69 to the downside. For SPY these levels are 438.79 and 427.63.

Remember over 68% of the time price will resolve it self in this range by weeks end.

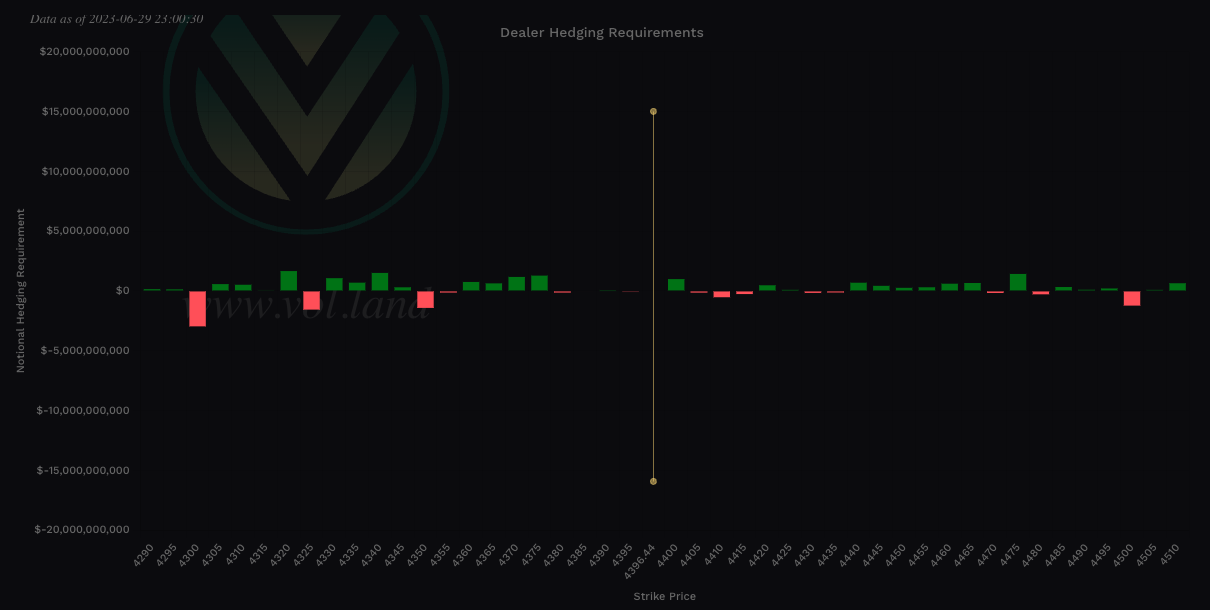

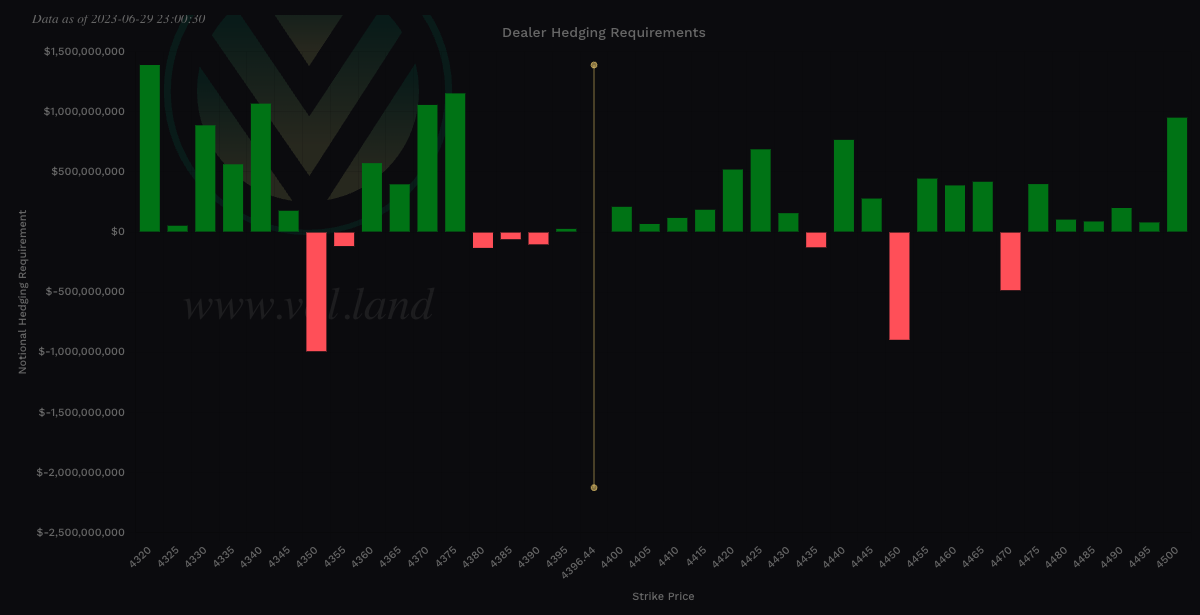

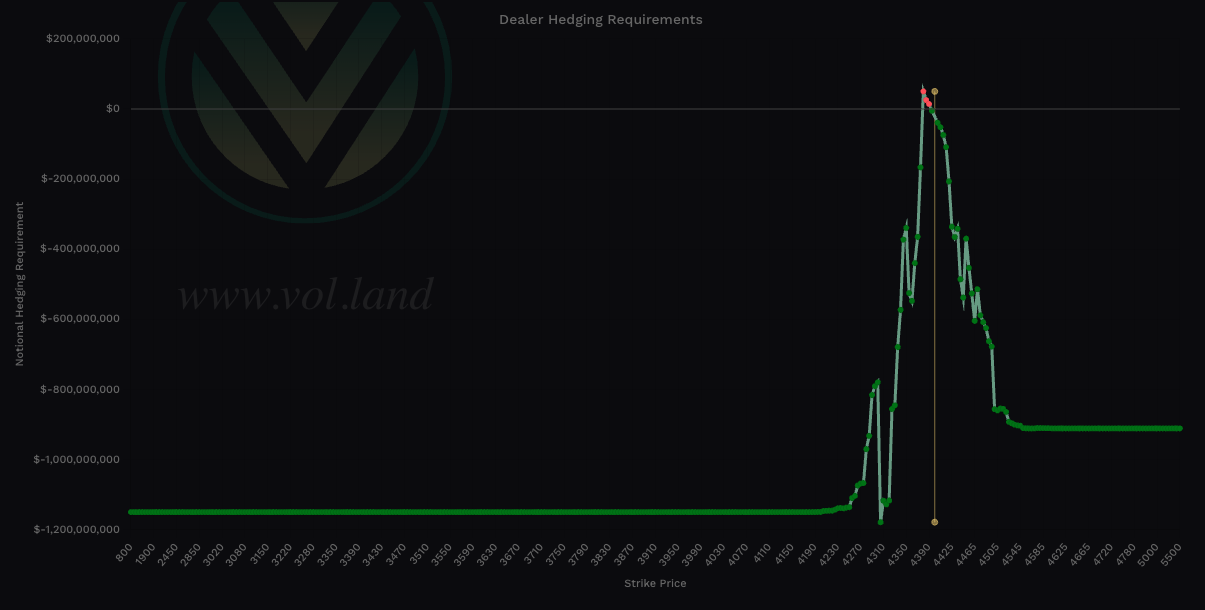

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4405-4415 - negative vanna

4430-4435 - negative vanna

4470 - negative vanna

4480 - negative vanna

Below Spot:

4380 - negative vanna

4355-4350 - negative vanna

4325 - negative vanna

4300 - negative vanna

Gamma and Delta-Adjusted Gamma (DAG)

Positive Gamma Above Spot - acts as resistance - meaning that dealers want to push against the move

Positive Gamma Below Spot - acts as support - meaning that dealers will want to support price at these levels

Negative Gamma - becomes permissive to price as it moves there - aka neither resistance nor support - simply just chillin and watching what’s happening…

Above Spot:

4400-4405 - positive gamma

4420-4425 - positive gamma

4440-4445 - positive gamma

Below Spot:

4390-4380 - positive gamma

4355-4350 - positive gamma

4325 - positive gamma

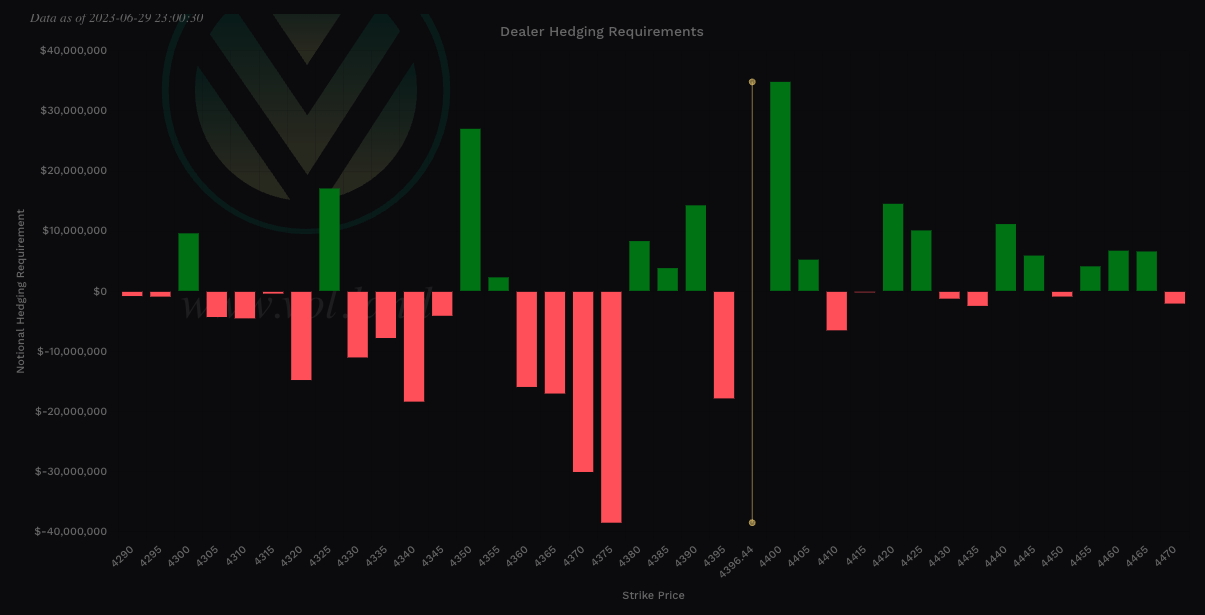

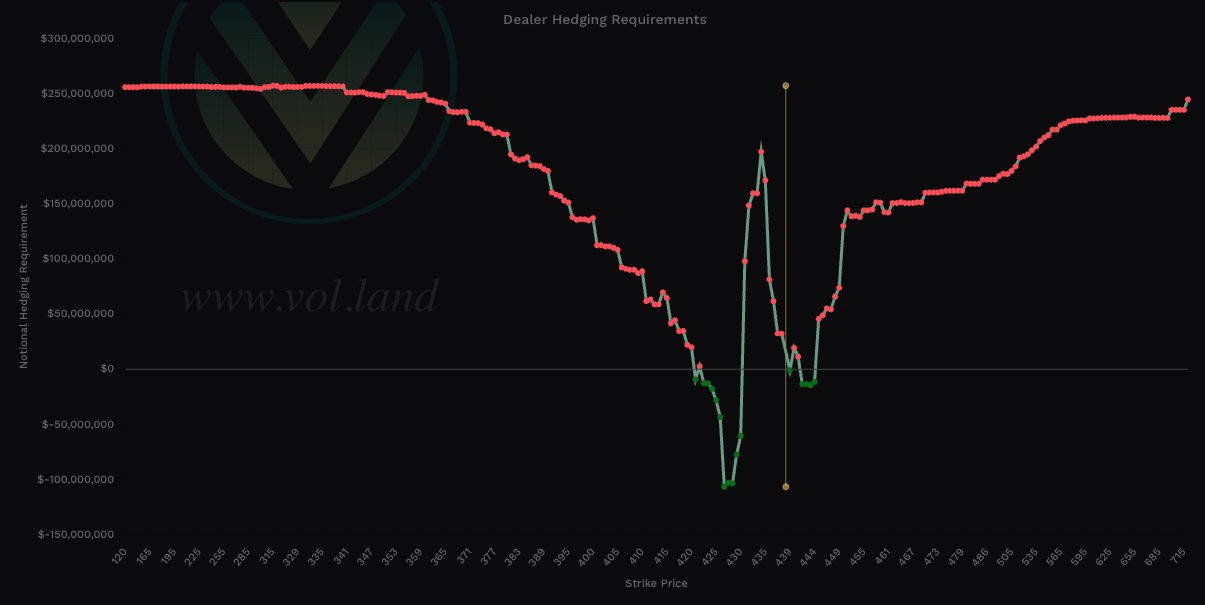

Charm

Remember if IV is not expanding charm will start to overtake Vanna especially 0DTE as it comes closer to expiration.

Charm total notional value is bullish - negative is bullish and positive bearish - take the total of the far left and far right values.

The 0DTE view on SPX Charm shows a bullish bias.

Note that the total notional value of SPX is 10x. Thus it’s charm will outweigh that of SPY’s. For the full charm effect to play out ideally we want to see SPX and SPY in sync.

So what does SPY’s charm tell us? It is leaning bearish at an aggregate view.

If we look at SPY for 0DTE we are seeing a bullish charm view.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.