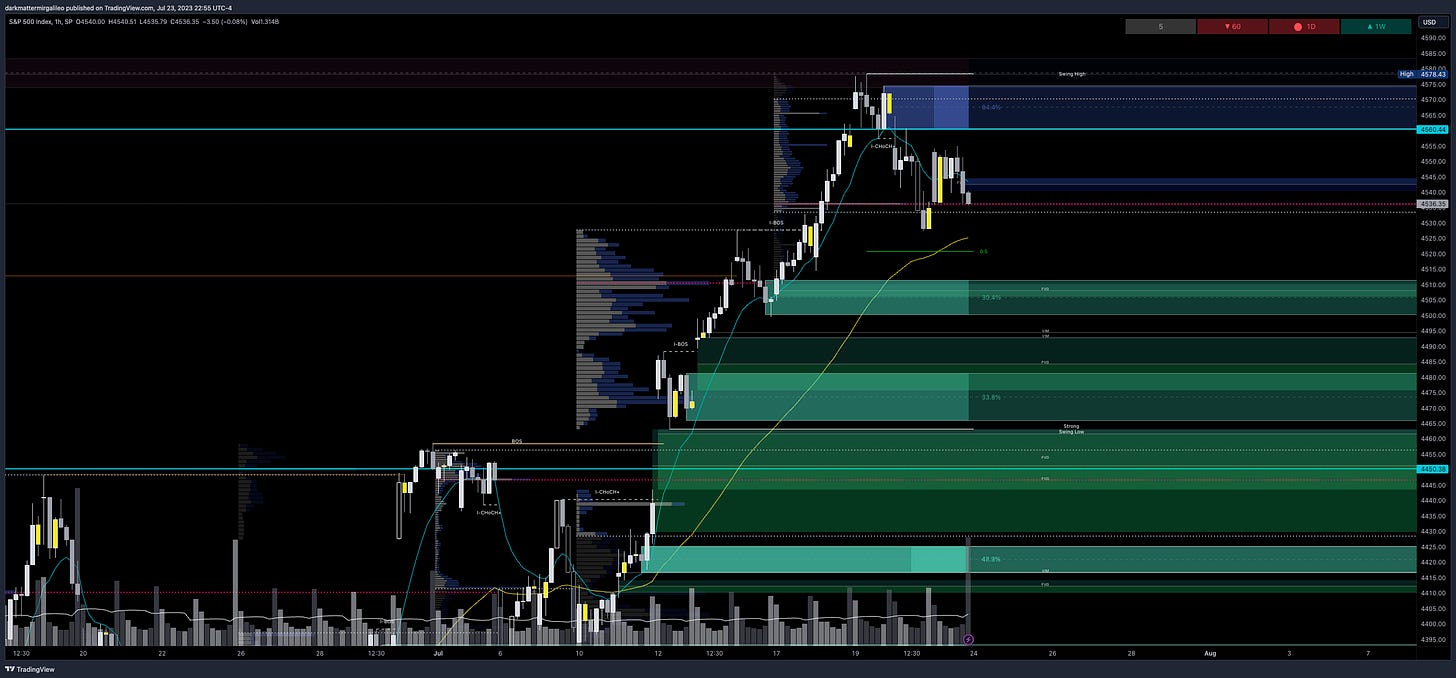

Friday’s action was was quite interesting where we gaped up, but immediately sold off towards the lows of the day at 4535. Basically price ping ponged between 4555 and 4535 the entire day. Friday was also OPEX, which if you go back to each monthly OPEX or quarterly OPEX I mention it is one of the more difficult and frustrating days especially if you are waiting for levels to break or for continuation. It often traps traders to the up or down side with no follow through. I use these days as opportunities to start positions and I did this with ADBE - by starting another short position on it after taking profits shorting it Thursday.

For those of you trading other tickers outside of SPX, I want to reiterate the below notes I shared in last Friday’s plan. The levels will bounce around a few pts and thus you should not immediately enter a trade if a key level breaks or we are in the middle of a move unless you have defined your risk. ADBE and MSFT were price examples of this from Friday’s session. Opening up higher only to sell off.

From Friday’s trade plan:

Before we get into the SPX trade plan let’s do an update on a few tickers. One thing I want to call out for those in Volland already, unlike SPX where it respects many Greek levels, individual tickers will typically overshoot a bit and then reverse course. Thus it is critical that you swing 2 weeks out on options and that you wait for key levels using 30 min or larger timeframes. Candles must close above/below your levels and trade accordingly. ADBE is a prime example of this from today’s action. Additionally, you must wait for these levels to take a trade - if price has broken the levels you cannot go chasing. I have seen many times we gap above or break through quickly only for price to retrace back down through a breakout level. MSFT is that example today.

ADBE

This ticker gaped up from its 515 lows the prior today hitting a high of 529 where it immediately faced selling pressure. In the first hour we never saw enough buying pressure for what I thought was a sustained push above 525 to hold and test. This is where I entered my new puts at 525 after closing prior positions the session prior swinging a minimum of 1 and 2 weeks out on two new positions. What am I looking for?

As a bear I don’t want price above 535 - if it revisits there I would consider adding to short positions a minimum of 2 weeks out. If we face more selling pressure in Monday’s trading session we want to see how price reacts at 517.5 and ultimately push price down towards 515 and then 510.

This is where we have an inflection point and where price may accumulate and trade between 510 and 530 waiting for direction. These two levels are key levels for the next leg up or down.

Above 520 target 530

If there is a failed breakdown of 510 target 520

If there is a failed breakout of 530-535 target 520

Below 510 target 500

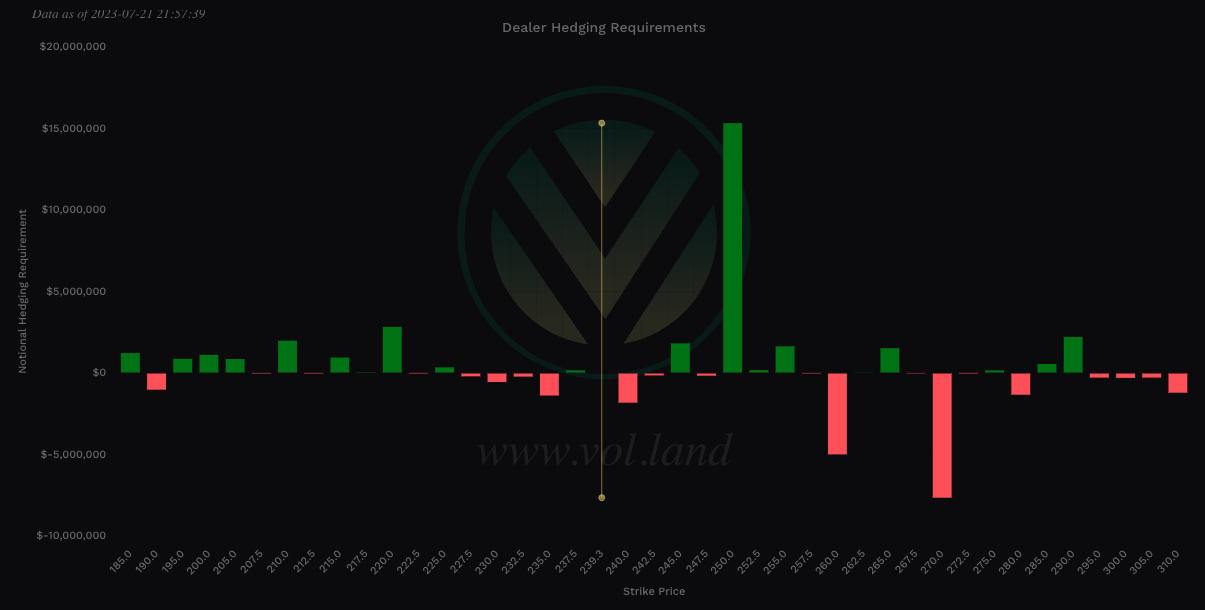

V

This is an interesting play with ER Tuesday after the market. The key levels on this ticker is 235 and 230 to the down side and 240 and 247.5 to the upside. For this week my expectation is that price could bounce between 232.5 and 242.5. I will wait to see how price reacts at this level and use the latest data in Volland to determine a potential trade prior to its earnings.

If there is a failed breakdown of 235 target 240

Above 240 target 247.5 - with a speed bump at 242.5

If there is a failed breakout of 240 or 242.5 target 235

Below 235 target 230 - with a speed bump at 232.5

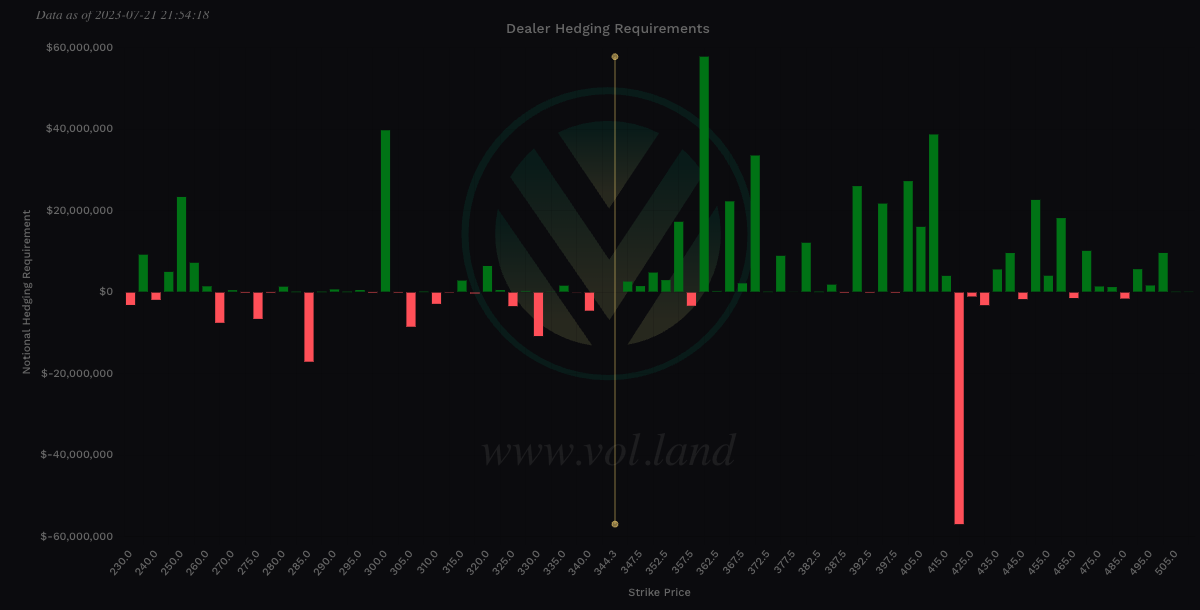

MSFT

Again as you can see in these tickers they go towards the opposite direction and then quickly fade. MSFT opened at 349 and hit a high of 350 before falling. Now I wouldn’t have taken this trade as we were in the middle of our move and I would want to wait and see what price would do if it came back to 345. Price came back to it, couldn’t hold it and we hit our bearish trade idea of below 345 target 340.

As ER comes into play Wednesday after the bell let’s review some of the key levels. Bears want to push price below 340 to target 330 with a speed bump at 337.5. If bulls can hold 340 then price could target 357.5 still.

Above 345 target 357.5

Below 340 target 330

SPX/SPY/ES Overview (TL;DR)

For tomorrow’s session 4535 is our key level. This will mark whether the bulls can push up to 4550. If the bears can break this price and hold it below we target 4520.

If we gap up or price hits 4545 in the first half hour and we can’t hold it, I would go short target 4520.

If the bears can maintain pressure on 4520 then we target 4500.

This 4520 to 4500 is a key support level for the bulls and I will be on the lookout for any accumulation where the next trend could be determined. Watch watch the dark pool does in this level.

Let’s jump into the trade plan.

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

We have a packed week of key news catalysts starting Monday with the big event vol coming Wednesday with FOMC. Along with that we have earnings reports.

9:45am est - Flash Manufacturing PMI

9:45am est - Flash Services PMI

For more information on news events, visit the Economic Calendar

SPX/ES/SPY Trade Plan

Bullish bias:

Above 4550 target 4560

If there is a failed breakdown of 4535 target 4550

Bearish bias:

Below 4535 target 4520

If there is a failed breakout of 4545 target 4535

If there is a breakdown of 4520 target 4500

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 28pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4545 - negative vanna

4540 - positive gamma

4550-4555 - OB (30min chart)

4553 midline

4560-4574 - OB (1hr chart)

4567 midline

4565-4554 - 455.22-454.10 - $9.17B

4574-4583 - OB (2hr chart)

4578 midline

4595-4600 - negative vanna

Below Spot:

4535 - negative vanna

4520 - negative vanna

4529-4520 - OB (30min chart)

4525 midline

4522-4509 - 450.89-449.62 - $14.81B

4500 - positive gamma

4511-4500 - OB (1hr chart)

4506 midline

4498-4493 - OB (15min chart)

4495 midline

4475 - negative vanna

4475 - positive gamma

4481-4466 - OB (1hr & 2hr chart)

4473 midline

4471 - 445.84 - $3.17B

4455- negative vanna

4455 - positive gamma

4453-4438 - 444.02-442.48 - $20.06B

Dark Pool Levels

Another +$2B of dark pool came in at the 4536 level where I will be watching to see if we have more accumulation at this level.

4565-4554 - 455.22-454.10 - $9.17B

4522-4509 - 450.89-449.62 - $14.81B

4471 - 445.84 - $3.17B

4453-4438 - 444.02-442.48 - $20.06B

4421-4393 - 440.85-438.06 - $25.11B

4384-4375 - 437.18-436.20 - $24.71B

4349-4344 - 433.65-433.19 - $12.14B

4325-4292 - 431.26-427.92 - $18.46B

We need to pay attention to these dark pool levels. Remember the levels where we see dark pool prints greater than $4B should peak our interest. I get my dark pool levels from Quant Data.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4550-4555 - OB (30min chart)

4553 midline

4560-4574 - OB (1hr chart)

4567 midline

4574-4583 - OB (2hr chart)

4578 midline

4589-4597 - OB (30min chart)

4593 midline

4652-4665 - OB (1hr, 2hr chart)

4658 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4529-4520 - OB (30min chart)

4525 midline

4511-4500 - OB (1hr chart)

4506 midline

4498-4493 - OB (15min chart)

4495 midline

4481-4466 - OB (1hr & 2hr chart)

4473 midline

4408-4399 - OB (2hr chart)

4404 midline

4393-4380 - OB (1hr chart)

4386 midline

4375-4362 - OB (1hr chart)

4369 midline

4344-4328 - OB (1hr & 2hr chart)

4336 midline

4304-4297 - OB (1hr chart)

4301 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~60.84 points. SPY’s expected move is ~6.22. That puts us at 4560.44 to the upside and 4450.38 to the downside. For SPY these levels are 458.40 and 445.96.

Remember over 68% of the time price will resolve it self in this range by weeks end.

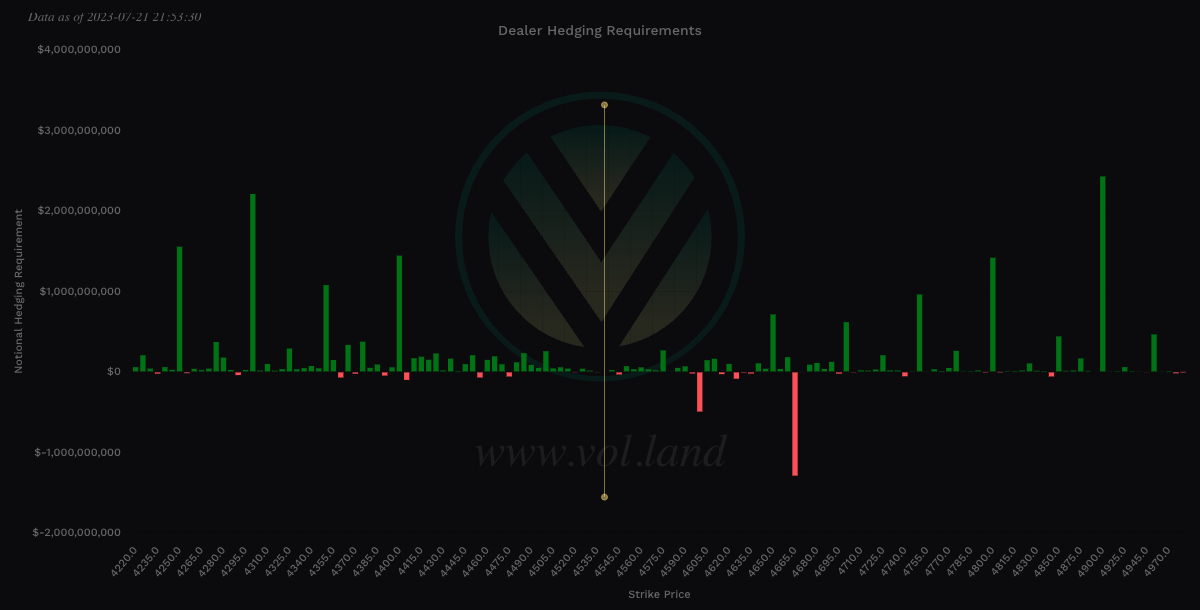

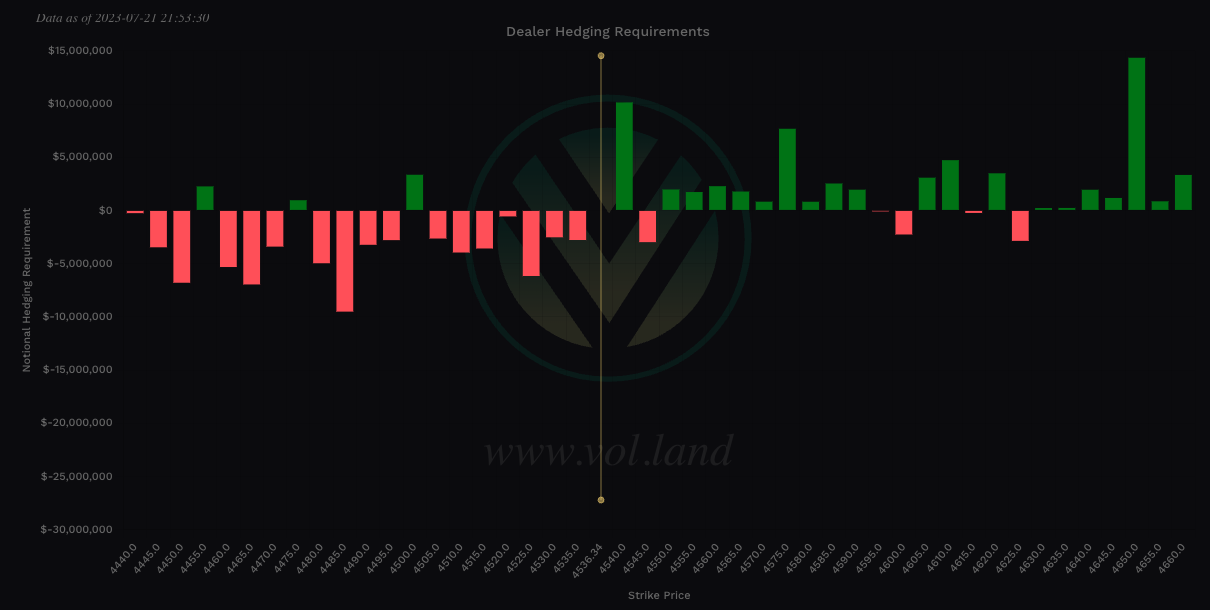

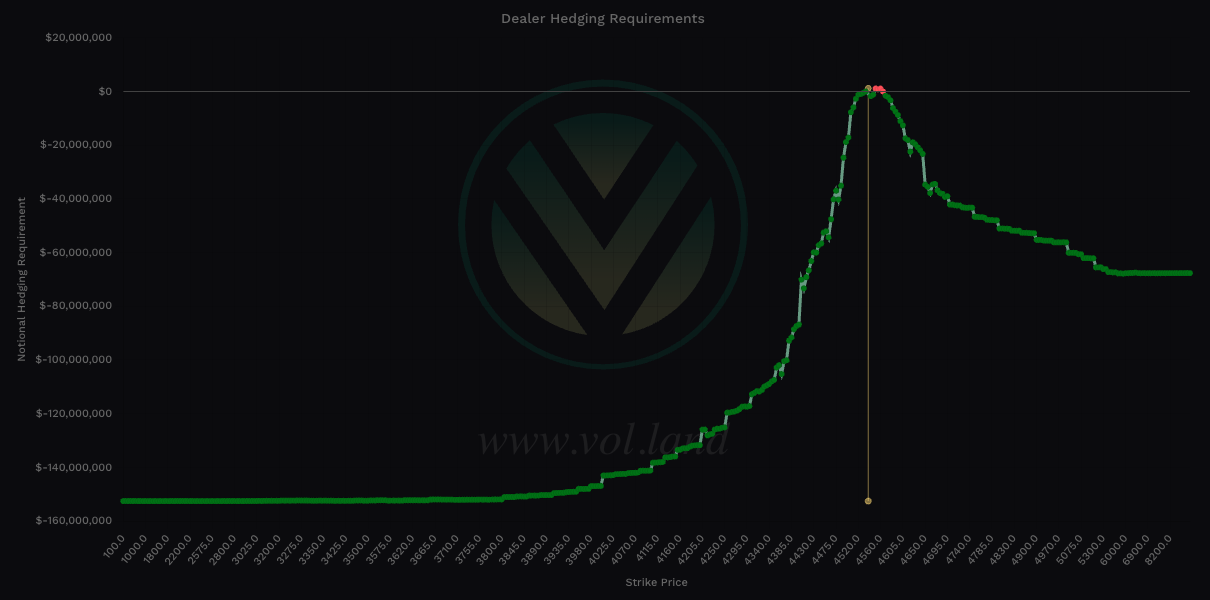

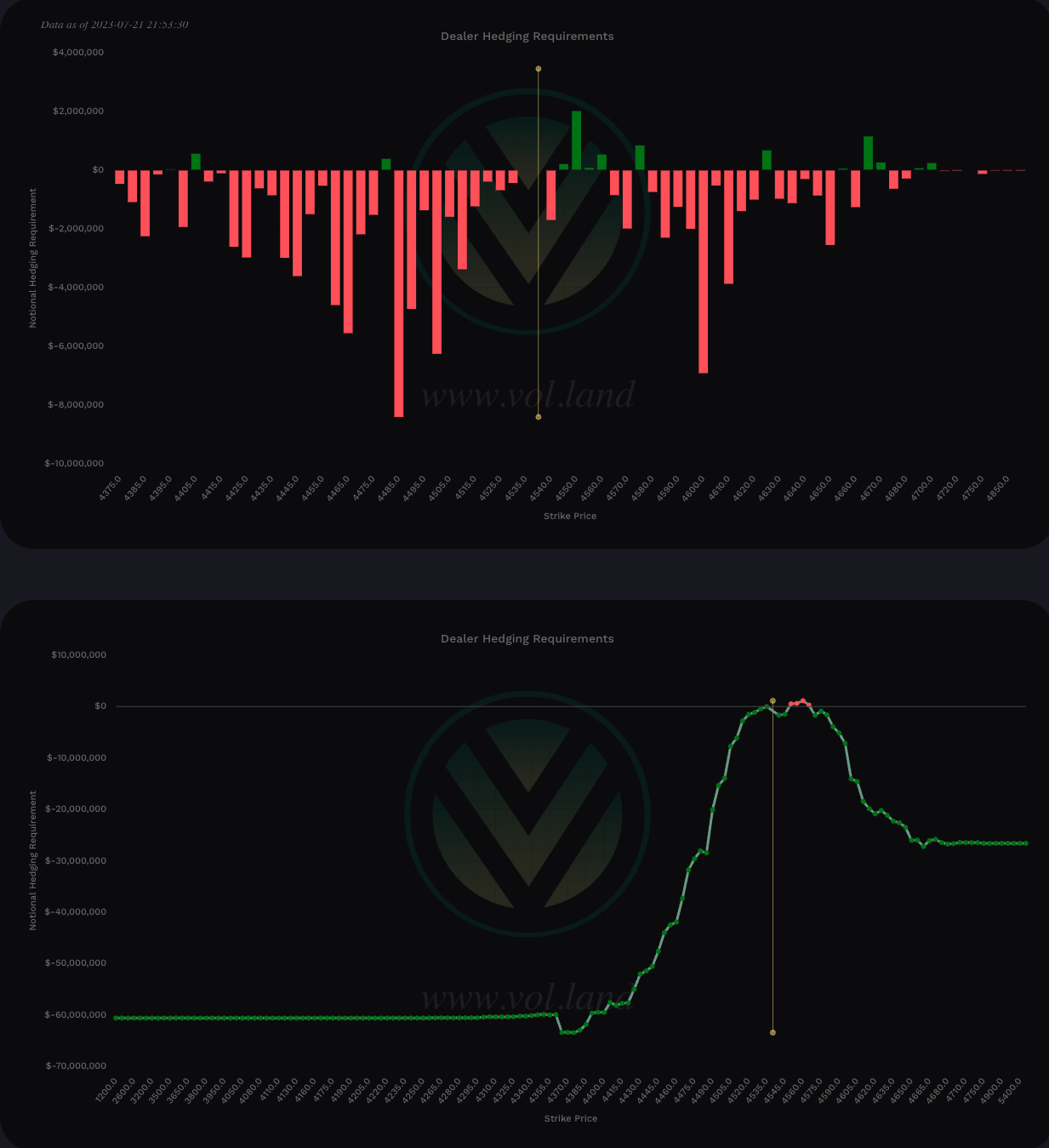

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4545 - negative vanna

4595-4600 - negative vanna

4615 - negative vanna

Below Spot:

4535 - negative vanna

4520 - negative vanna

4475 - negative vanna

4455- negative vanna

Gamma

Positive Gamma Above Spot - acts as resistance - meaning that dealers want to push against the move

Positive Gamma Below Spot - acts as support - meaning that dealers will want to support price at these levels

Negative Gamma - becomes permissive to price as it moves there - aka neither resistance nor support - simply just chillin and watching what’s happening…

Above Spot:

4540 - positive gamma

4550-4590 - positive gamma

Below Spot:

4500 - positive gamma

4475 - positive gamma

4455 - positive gamma

Charm

Remember if IV is not expanding charm will start to overtake Vanna especially 0DTE as it comes closer to expiration.

For all expiry’s, Charm total notional value is bullish - negative is bullish and positive bearish - take the total of the far left and far right values. This is a longer term view of the market and suggests we find key dips to buy to long.

The 0DTE view on SPX Charm shows a bullish trend. We will want to wait and see what the 10am est Volland30 update provides us what paradigm the SPX will have and potential trend on targets for the day.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.