Good evening/day/morning traders. I can’t tell you how excited I am along with CaptainWick that if you stick to learning and push to find ways to be a knowledgeable trader it will come with time.

This is why we started this substack and trade plans. It wasn’t to become a signal service, but to show if you have a plan, understand the key levels, and how to react to them that you will learn and become a better trader. I thank all of you with your feedback, commentary, the Volland community for the new items I have learned and how to use it in my trading arsenal.

In yesterday’s session we continued to leverage what we have been doing here for months with the SPX/SPY trade plans, but with new tickers. For those keeping tabs the past two days you can see the amazing success we have had on our Twitter pages. We had trade ideas nicely pan out with ADBE, ENPH, NFLX continued today, SPX held and rallied to our target levels and then some.

Overview (TL;DR)

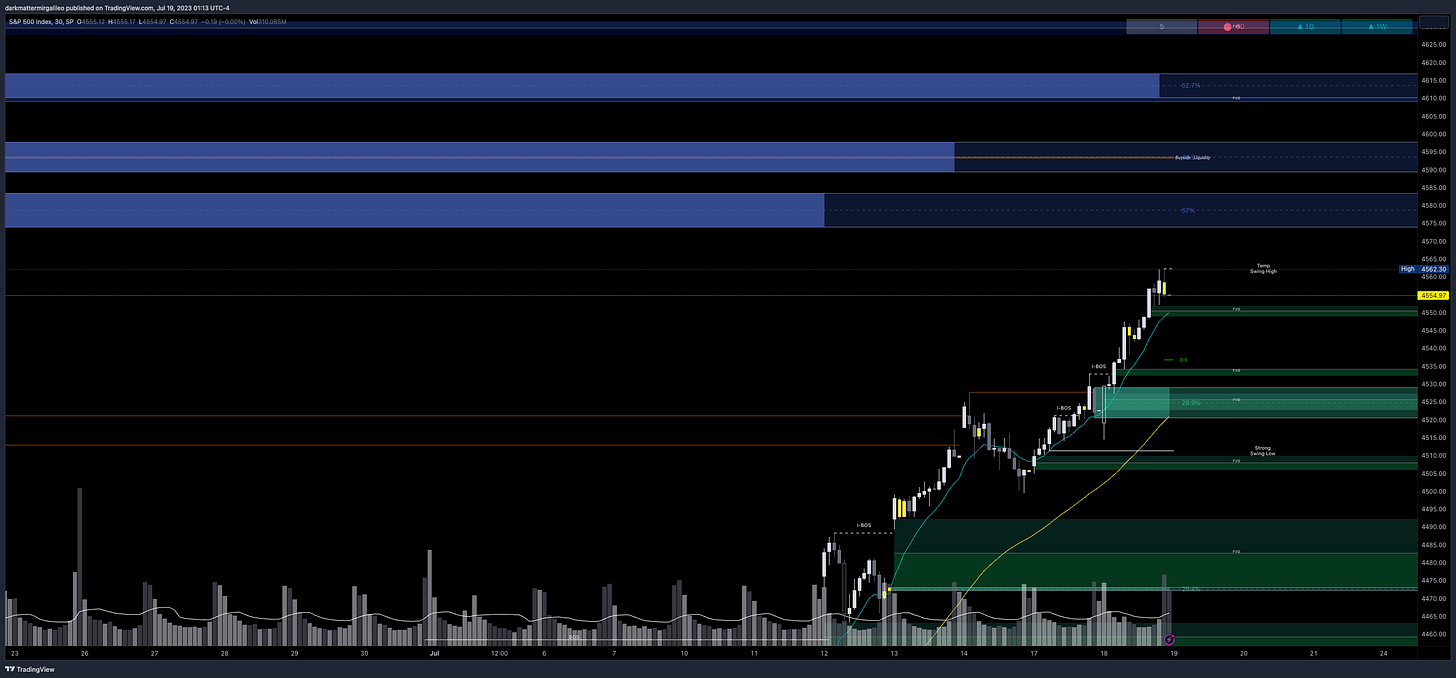

The 4550-4535 zone is chop city. Expect traps/reversals to occur in this range and I would stay out of any trades if price were to come here.

For bulls it comes down to defending 4540 for a push up towards 4575. Take it out and target 4590.

For the bears it comes down to breaking 4535 to target 4525. Take it out and target 4500.

Let’s jump into the trade plan.

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

8:30am est - Housing Starts

8:30am est - Building Permits

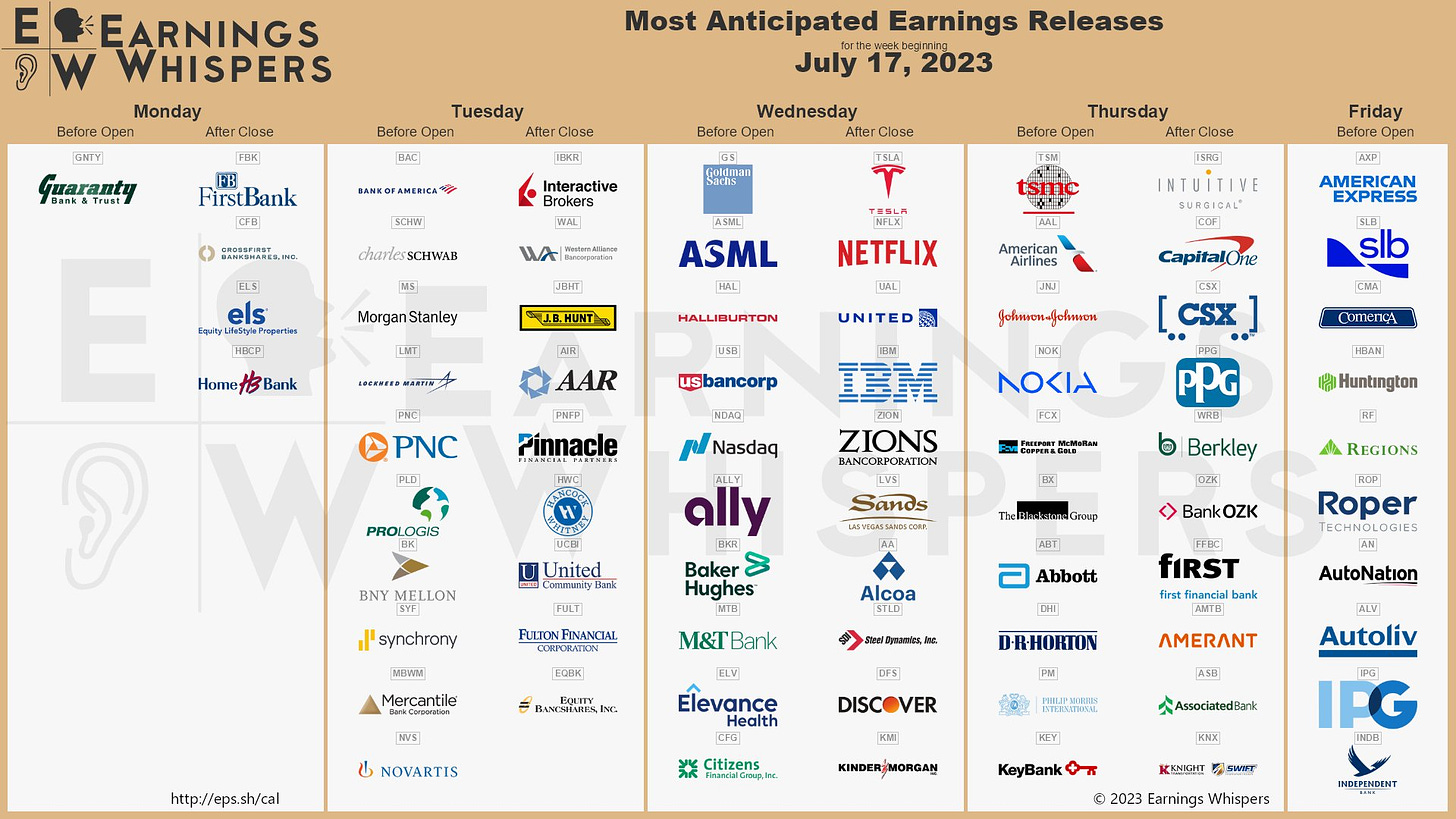

Earnings season officially has begin. Here are the key earnings to keep an eye for.

For more information on news events, visit the Economic Calendar

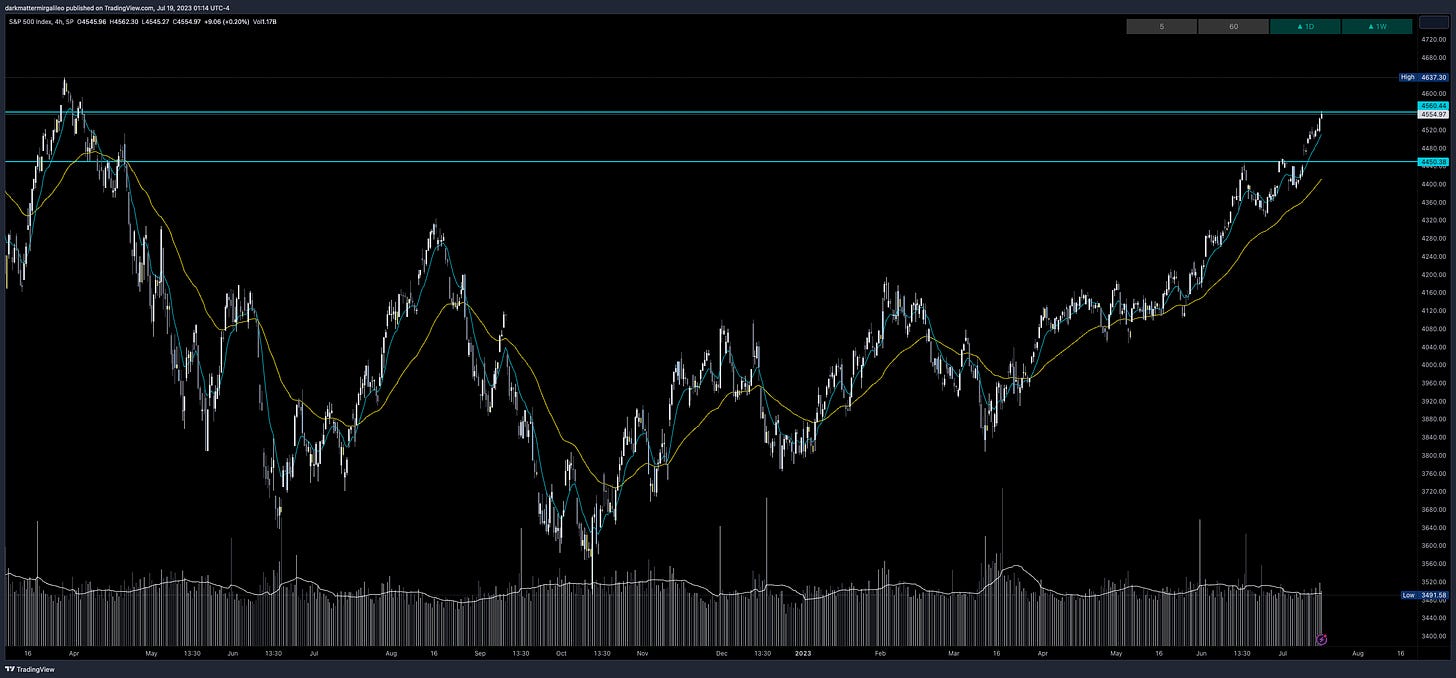

SPX/ES/SPY Trade Plan

Bullish bias:

Above 4560 target 4575

If there is a failed breakdown of 4540 target 4575

If there is a breakout of 4575 target 4590

Bearish bias:

Below 4535 target 4525

If there is a breakdown of 4525 target 4500

If there is a breakdown of 4490 target 4470

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 33pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4575 - negative vanna - 0DTE

4566-4583 - OB (4hr chart)

4575 midline

4556-4570 - OB (15min chart)

4563 midline

4590-4595 - negative vanna

4589-4597 - OB (30min chart)

4593 midline

4615 - negative vanna

4610-4617 - OB (30min chart)

4613 midline

4625 - negative vanna

Below Spot:

4550-4535 - negative vanna

4554 - 454.10 - $5.07B

4525 - negative vanna

4529-4520 - OB (30min chart)

4525 midline

4522-4509 - 450.89-449.62 - $14.81B

4500 - negative vanna

4498-4493 - OB (15min chart)

4495 midline

4490 - negative vanna - 0DTE

4470 - negative vanna

4481-4466 - OB (1hr & 2hr chart)

4473 midline

4471 - 445.84 - $3.17B

4453-4438 - 444.02-442.48 - $20.06B

Dark Pool Levels

Another +$2B of dark pool came in at the 4522 level while we saw accumulation begin at 4554 with dark pool printing over $5B.

4554 - 454.10 - $5.07B

4522-4509 - 450.89-449.62 - $14.81B

4471 - 445.84 - $3.17B

4453-4438 - 444.02-442.48 - $20.06B

4421-4393 - 440.85-438.06 - $25.11B

4384-4375 - 437.18-436.20 - $24.71B

4349-4344 - 433.65-433.19 - $12.14B

4325-4292 - 431.26-427.92 - $18.46B

We need to pay attention to these dark pool levels. Remember the levels where we see dark pool prints greater than $4B should peak our interest. I get my dark pool levels from Quant Data.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4556-4570 - OB (15min chart)

4563 midline

4566-4583 - OB (4hr chart)

4575 midline

4589-4597 - OB (30min chart)

4593 midline

4610-4617 - OB (30min chart)

4613 midline

4652-4665 - OB (1hr and 2hr chart)

4658 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4529-4520 - OB (30min chart)

4525 midline

4498-4493 - OB (15min chart)

4495 midline

4481-4466 - OB (1hr & 2hr chart)

4473 midline

4408-4399 - OB (2hr chart)

4404 midline

4393-4380 - OB (1hr chart)

4386 midline

4375-4362 - OB (1hr chart)

4369 midline

4344-4328 - OB (1hr & 2hr chart)

4336 midline

4304-4297 - OB (1hr chart)

4301 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~55.03 points. SPY’s expected move is ~5.69. That puts us at 4560.44 to the upside and 4450.38 to the downside. For SPY these levels are 454.97 and 443.59.

Remember over 68% of the time price will resolve it self in this range by weeks end.

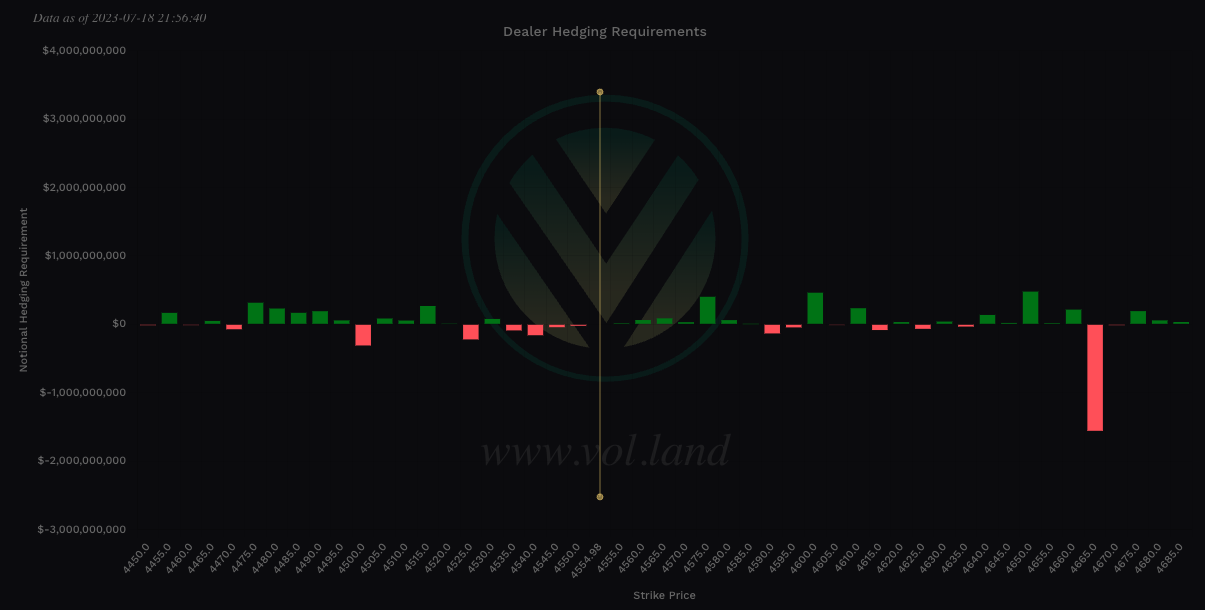

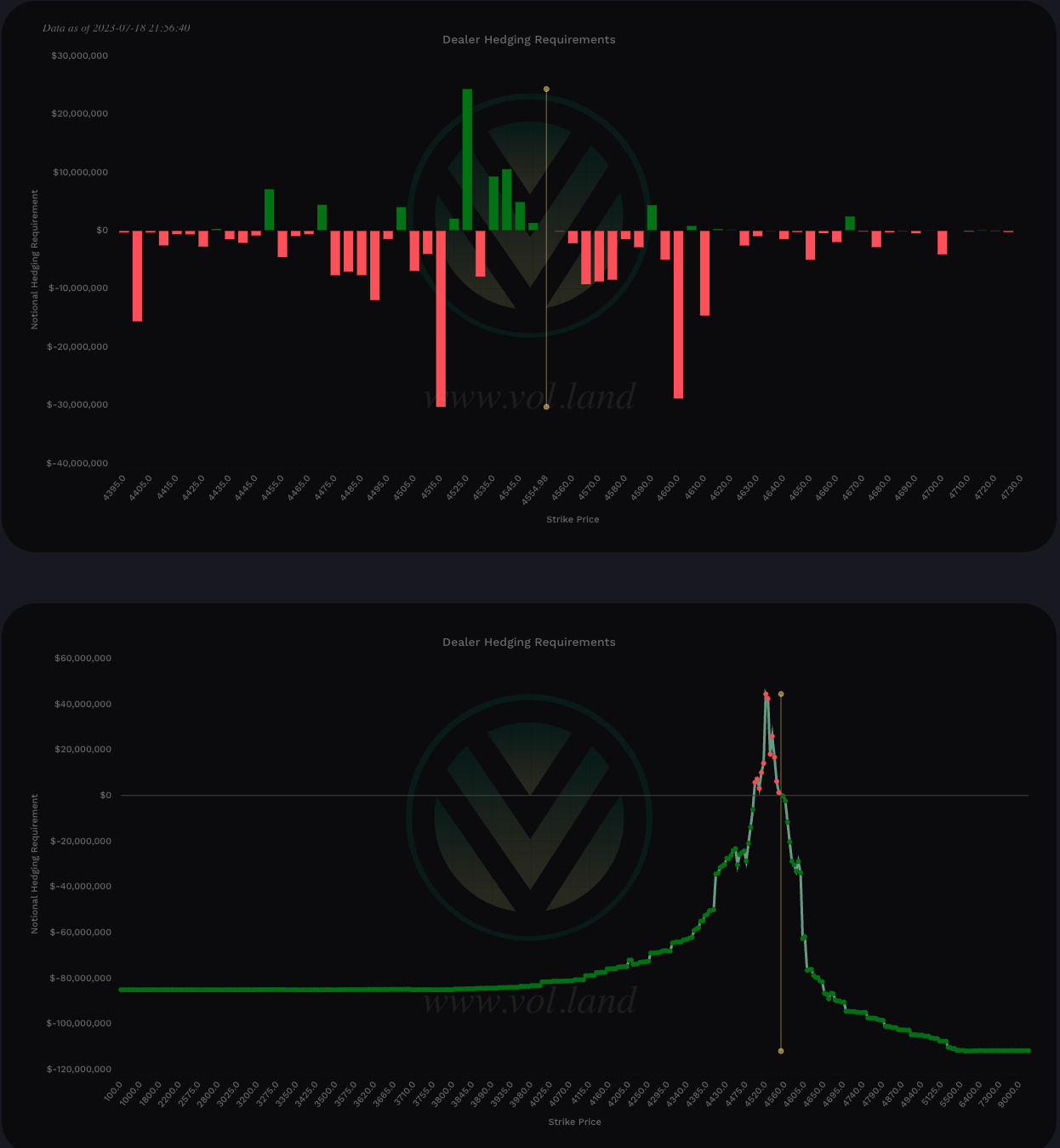

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4575 - negative vanna - 0DTE

4590-4595 - negative vanna

4605 - negative vanna

4615 - negative vanna

4625 - negative vanna

4635 - negative vanna

4665 - negative vanna

Below Spot:

4550-4535 - negative vanna

4525 - negative vanna

4500 - negative vanna

4490 - negative vanna - 0DTE

4470 - negative vanna

Charm

Remember if IV is not expanding charm will start to overtake Vanna especially 0DTE as it comes closer to expiration.

For all expiry’s, Charm total notional value is bullish - negative is bullish and positive bearish - take the total of the far left and far right values. It shows a target of 4590 or 4600 should we continue to trend bullish.

The 0DTE view on SPX Charm shows a bullish bias. I would expect any dips to be bought into 4530 or 4515 with a target of 4570 followed by 4600.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.