Market Recap

The new year starts with more red and more selling. For those not aware this selloff is not just random or profit taking, it aligns with the themes we discussed in Tuesday’s trade plan - rate cuts…

Prior to this week, the market was expecting 6 rate cuts and today - as you know someone always knows and is doing something well in advance - is that the FOMC minutes showed that while the FED expects rate cuts this year what the market was not expecting was the FED expects only 3 rate cuts.

The market was also expecting the first rate cut to come from the March FOMC meeting. So as you can see this entire year until we get those 6 interest rate cuts the market might continue to sell or go sideways until it knows this is happening or not. Welcome to the biggest storyline and theme for the market this year in 2024.

From our trade plan we had the following ideas - I don’t want to brag but how many people are giving you levels and targets like this? I get it last week or so of December was tough, but those are low volume weeks no momentum. Now, that we have some volume coming back and our levels are nailing those liquidity zones we are getting the movement that we wish for. Here are the three trade ideas that hit…

If there is a failed breakout of 4755 target 4740

Below 4740 target 4725

If VIX continues going up then a breakdown of 4720 targets 4698

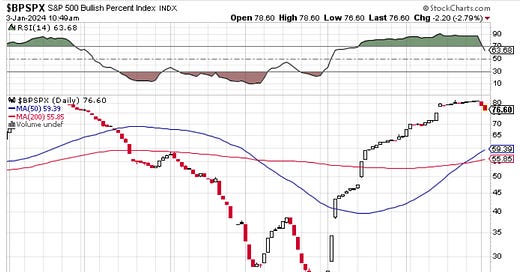

Sharing an updated view of BPSPX…

Let’s jump into the trade plan and let’s review what we can expect tomorrow with the SPX/SPY/ES.

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

News Catalysts

Overnight - Germany CPI

8:15am est - ADP Non-Farm Employment Change

8:30am est - Unemployment Claims

For more information on news events, visit the Economic Calendar

1/4 - SPX/ES/SPY Trade Plan

Bullish bias:

If there is a failed breakdown of 4700 target 4715

Above 4715 target 4725

Be wary of reversals and fake breakouts

Bearish bias:

If there is a failed breakout of 4715 or 4725 target 4700

Below 4700 target 4685

If VIX continues going up then a breakdown of 4680 targets 4670

If we get a catalyst for further selloff then a breakdown of 4670 targets 4650-4645

Any updates to the plan or levels will be provided in our chat room. Keep an eye on Volland30 and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 42pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

1/4 SPX/SPY/ES Intraday Overview (TL;DR)

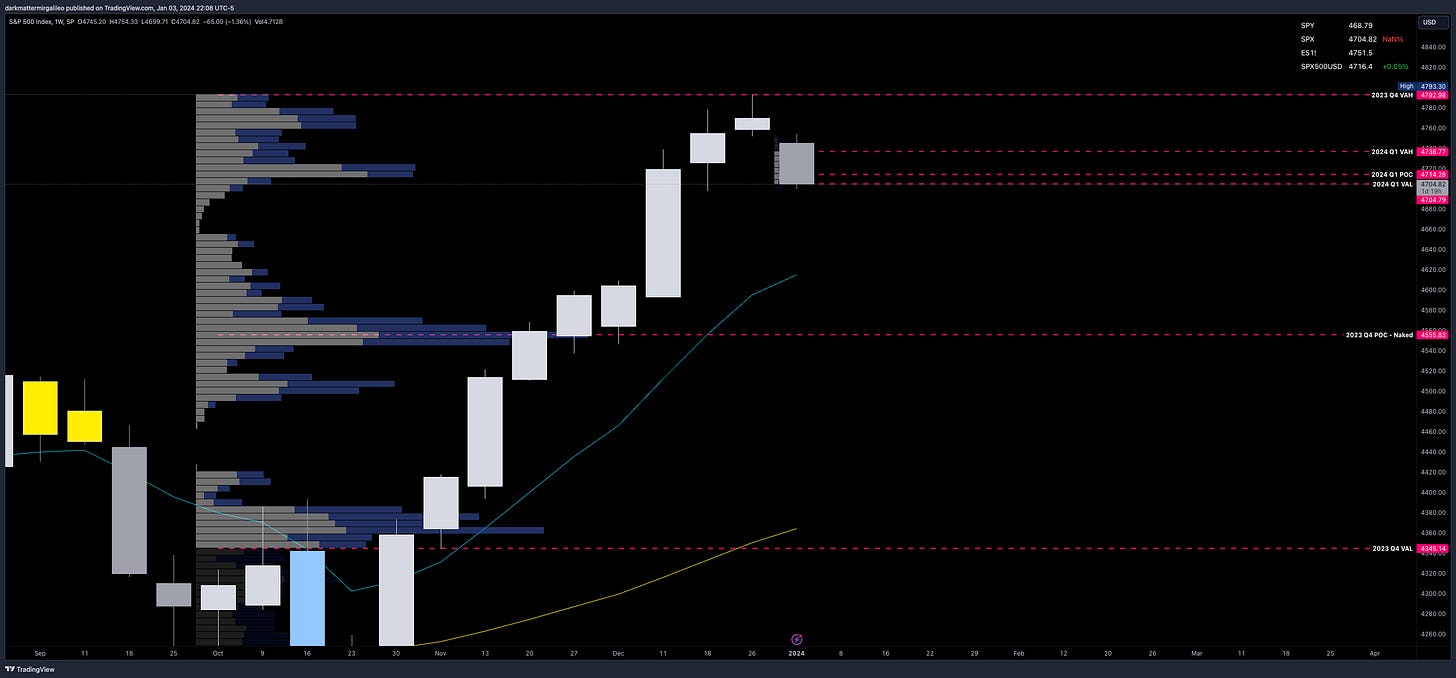

First and foremost there is a lot of resistance above spot. The bears have made some damage this week - could it change? Yes of course, but I would be wary of any longs unless they are failed breakdowns.

Thus, if you are a bear you want to defend 4715-4725 zone. If defended then we can push price back towards 4700 and then a breakdown of it will target 4685-4680. If we continue to selloff below 4680 targets 4670. If we have more volume or catalyst then a breakdown of 4670 will target 4650-4645.

For the bulls you want to play failed breakdowns. The first area is 4700 - this level is weaker but if we hold it and if there is a retest of it I would consider a long to target 4715. Above 4715 will target 4725. If we see any additional bullish trades we will communicate it via chat.

Any updates to the plan or levels will be provided in our chat room.

SPX - The Why Behind the Plan

Volume Profile & Trends

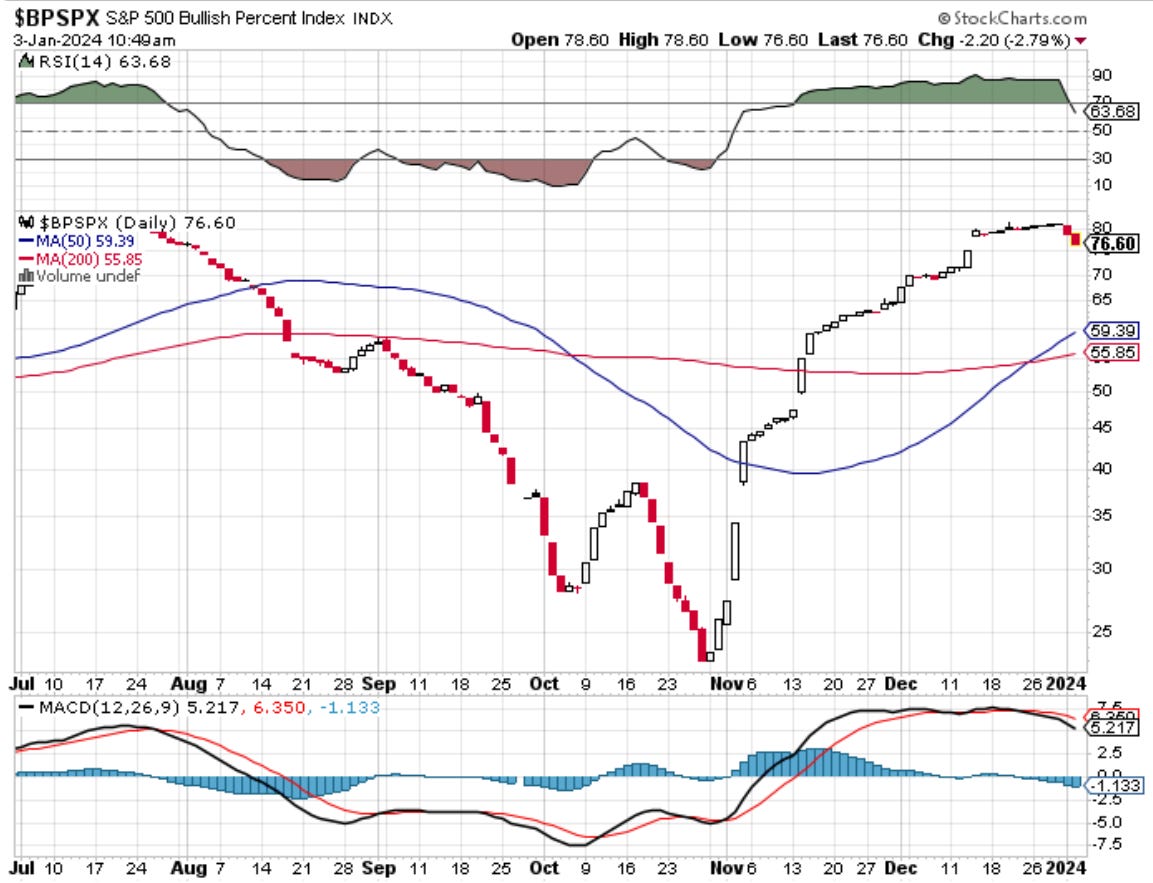

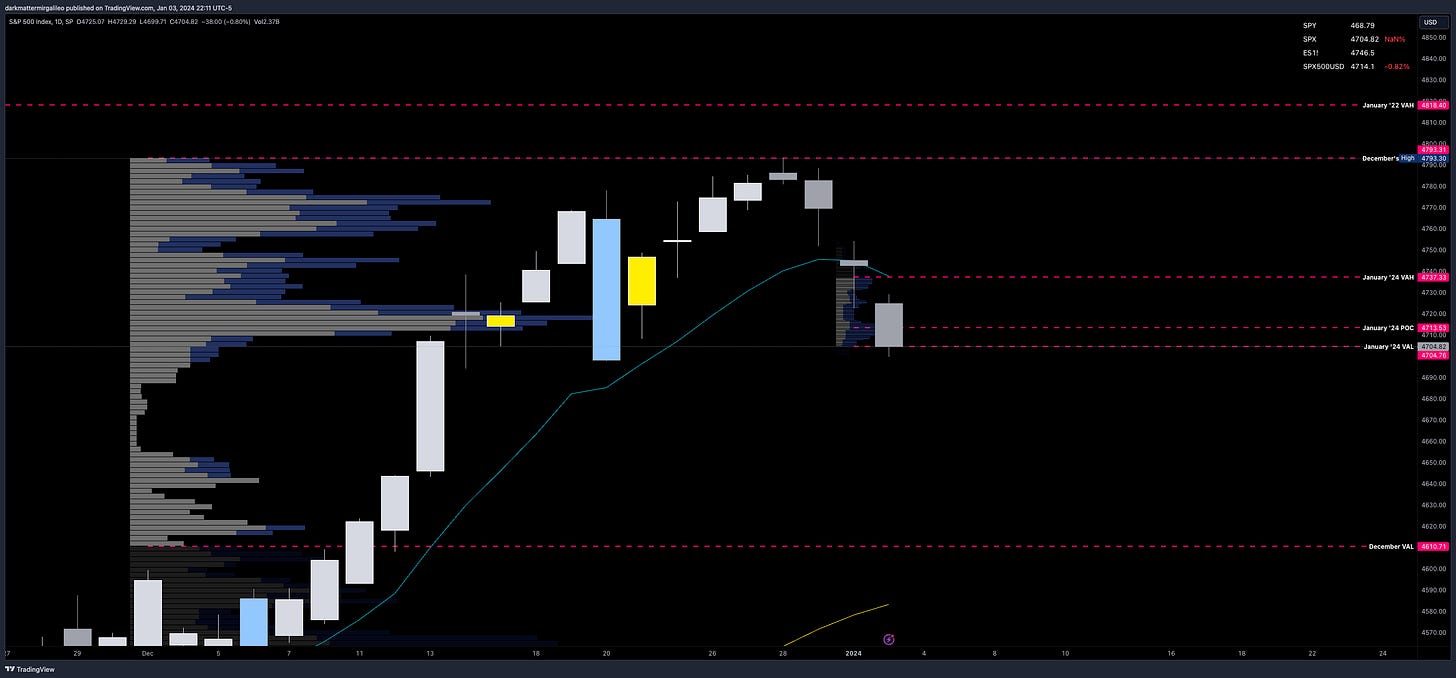

Now that we have the year complete, let’s review our yearly profiles on the monthly chart…

4736 - 2024 VAH - still forming

4713 - 2024 POC - still forming

4704 - 2024 VAL - still forming

4687 - 2021 POC

4433 - 2023 VAH

4128 - 2023 POC

3883 - 2023 VAL

From a quarterly volume profile on the weekly chart some key levels are seen.

4792 - Q4 VAH

4736 - 2024 Q1 VAH

4714 - 2024 Q1 POC

4704 - 2024 Q1 VAL

4555 - Q4 POC

4345 - Q4 VAL

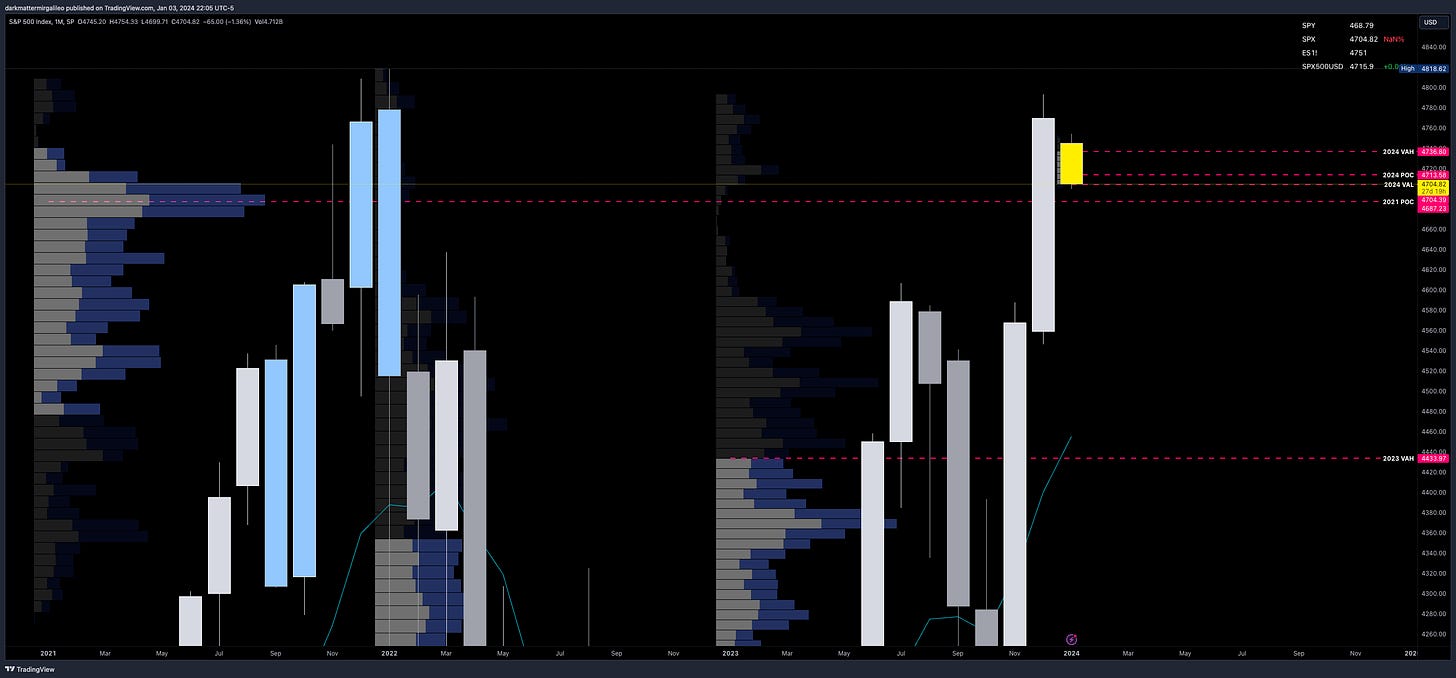

If we take a look at the daily chart and review the monthly volume profile we find the following levels…

4818 - January ‘22 VAH

4793 - December ‘23 VAH

4737 - January ‘24 VAH - still forming

4717 - December ‘23 POC

4713 - January ‘24 POC - still forming

4704 - January ‘24 VAL - still forming

4610 - December ‘23 VAL

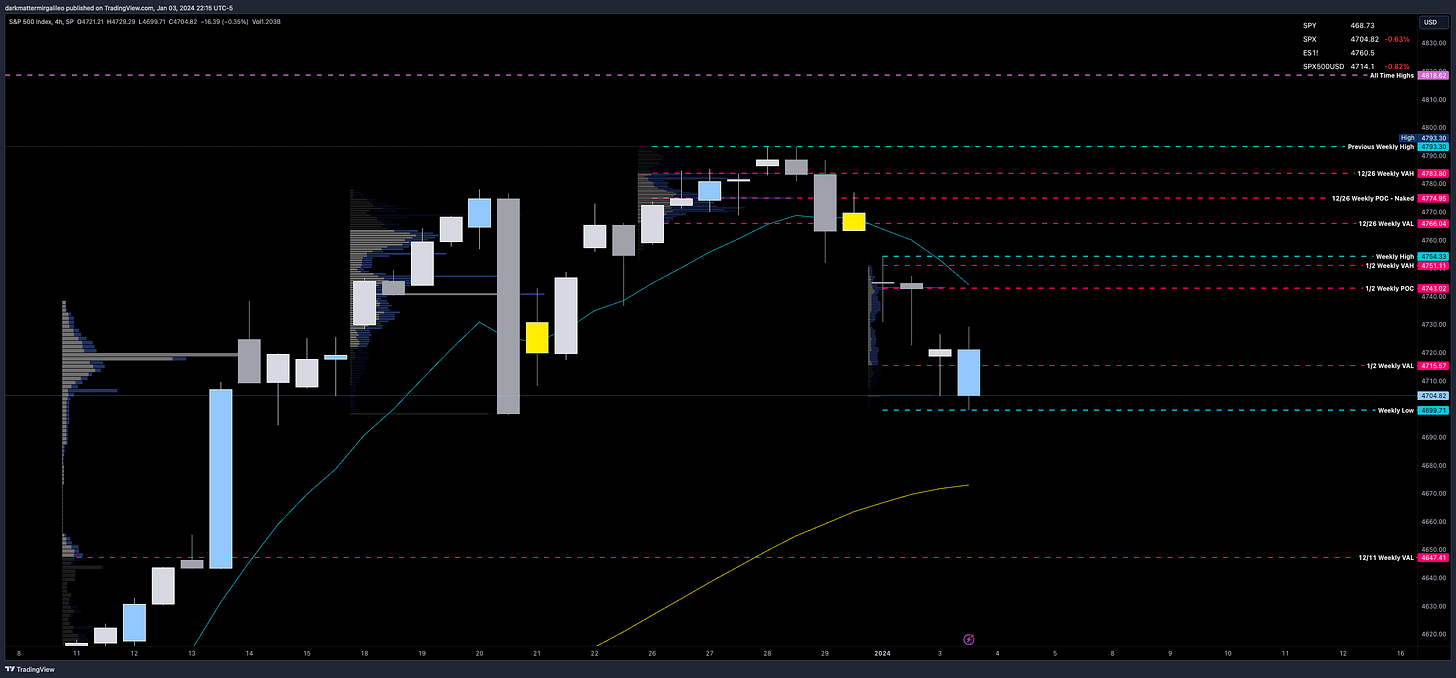

Let’s now look at the 4hr chart and review what the weekly volume profile levels show.

4818 - All Time Highs

4793 - Previous Weekly High

4783 - 12/26 Weekly VAH

4774 - 12/26 Weekly POC

4766 - 12/26 Weekly VAL

4754 - Weekly High

4751 - 1/2 Weekly VAH - still forming

4743 - 1/2 Weekly POC - still forming

4715 - 1/2 Weekly VAL - still forming

4699 - Weekly Low

4647 - 12/11 Weekly VAL

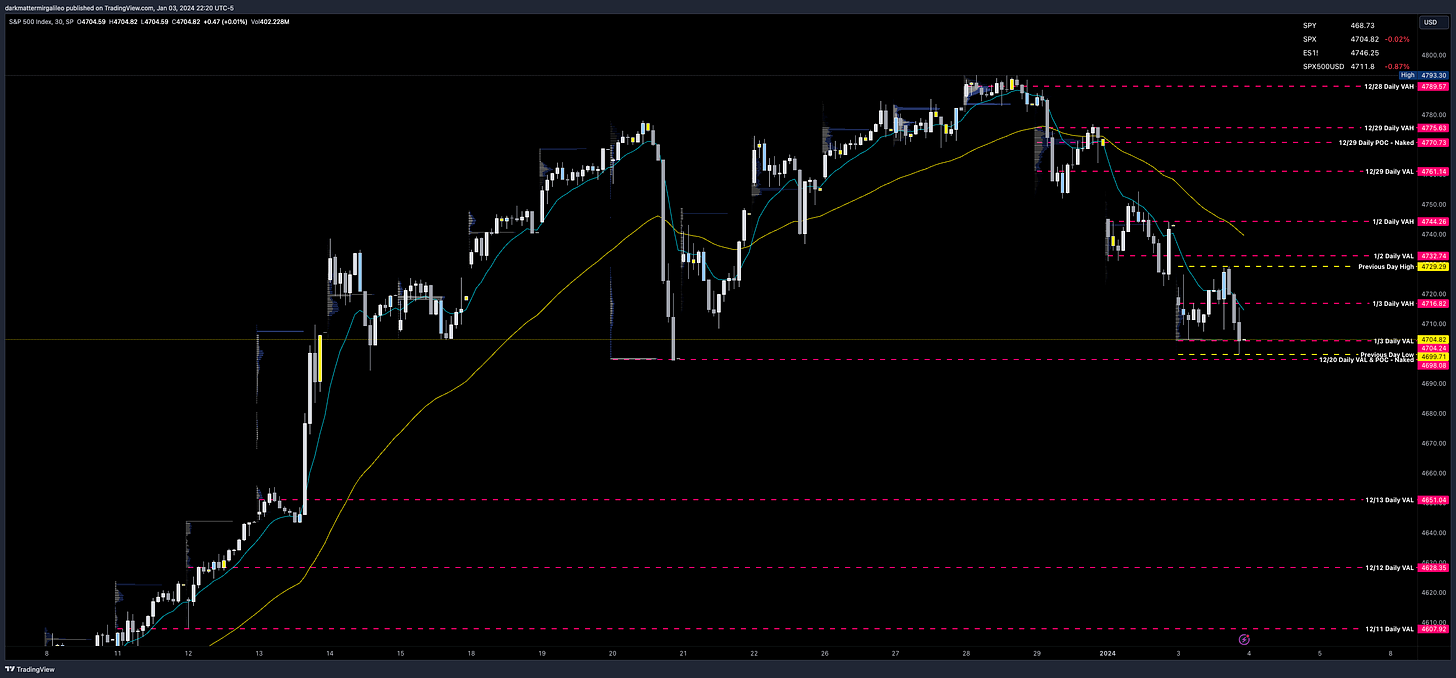

On the smaller timeframe and intraday let’s go to our 30min chart where we will put our session volume profile on. Our levels of importance are…

4789 - 12/28 VAH

4775 - 12/29 VAH

4770 - 12/29 POC - Hasn’t been breached

4761 - 12/29 VAL

4744 - 1/2 VAH

4732 - 1/2 VAL

4729 - Previous Session High of Day

4716 - 1/3 VAH

4704 - 1/3 VAL

4699 - Previous Session Low of Day

4698 - 12/20 VAL & POC - Hasn’t been breached

4651 - 12/13 VAL

4628 - 12/12 Daily VAL

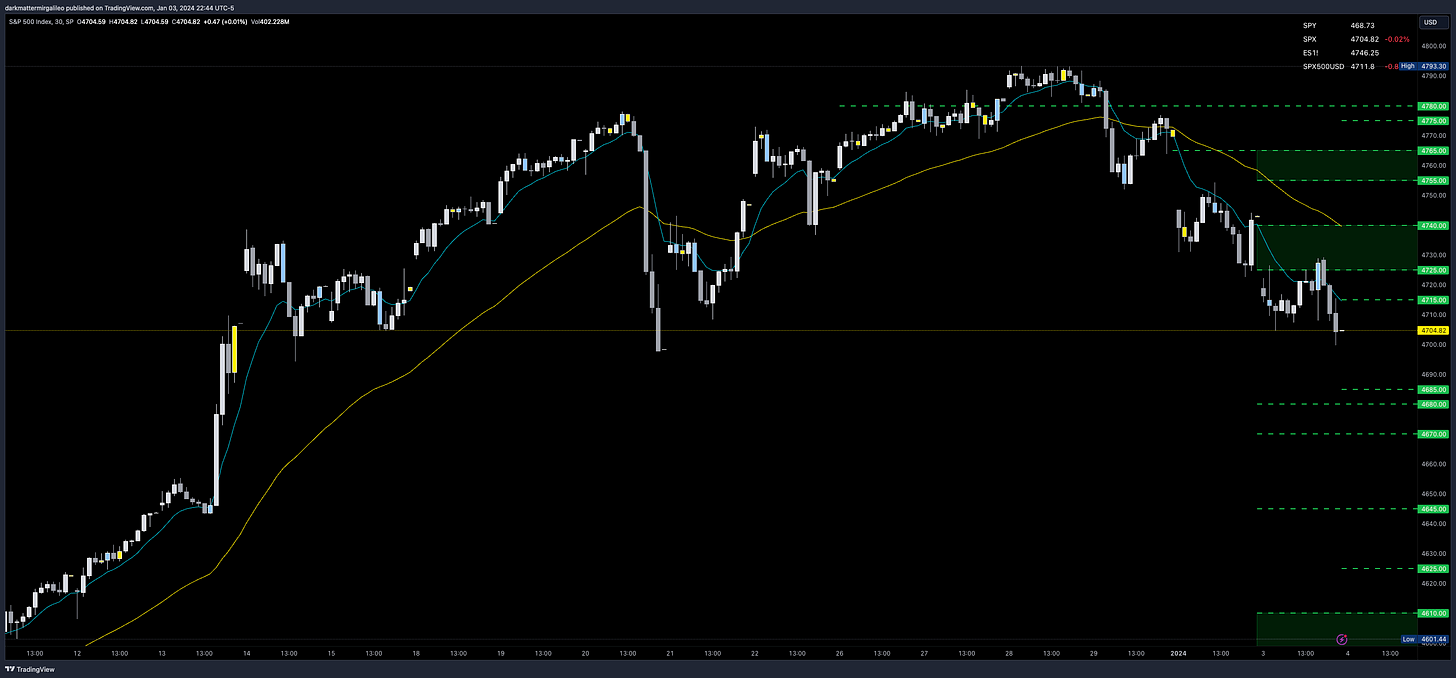

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4715 - negative vanna

4725-4740 - negative vanna

4755-4765 - negative vanna

4775-4780 - negative vanna

4820 - negative vanna

Below Spot:

4685-4680 - negative vanna

4670 - negative vanna

4645 - negative vanna

4625 - negative vanna

4610-4595 - negative vanna

Orderblocks (OB)

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4708-4728 - OB (30min chart)

4718 midline

4724-4744 - OB (1hr chart)

4734 midline

4740-4747 - OB (30min chart)

4744 midline

4763-4776 - OB (2hr chart)

4770 midline

4778-4797 - OB (2hr chart)

4788 midline

4782-4787 - OB (30min chart)

4784 midline

4774-4807 - OB (4hr chart)

4790 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4720-4697 - OB (2hr chart)

4708 midline

4652-4643 - OB (2hr chart)

4648 midline

4618-4608 - OB (30min chart)

4813 midline

4591-4580 - OB (30min chart)

4586 midline

4568-4546 - OB (4hr chart)

4557 midline

4766-4736 - OB (4hr chart)

4751 midline

Overlay of Key Levels

Above Spot:

4715 - negative vanna

4708-4728 - OB (30min chart)

4718 midline

4713 - 2024 POC - still forming

4713 - January ‘24 POC - still forming

4714 - 2024 Q1 POC

4715 - 1/2 Weekly VAL - still forming

4716 - 1/3 VAH

4717 - December ‘23 POC

4725-4740 - negative vanna

4724-4744 - OB (1hr chart)

4734 midline

4729 - Previous Session High of Day

4732 - 1/2 VAL

4736 - 2024 VAH - still forming

4736 - 2024 Q1 VAH

4737 - January ‘24 VAH - still forming

4743 - 1/2 Weekly POC - still forming

4744 - 1/2 VAH

4755-4765 - negative vanna

4763-4776 - OB (2hr chart)

4770 midline

4751 - 1/2 Weekly VAH - still forming

4754 - Weekly High

4761 - 12/29 VAL

4766 - 12/26 Weekly VAL

4770 - 12/29 POC - Hasn’t been breached

4775-4780 - negative vanna

4778-4797 - OB (2hr chart)

4788 midline

4774 - 12/26 Weekly POC

4775 - 12/29 VAH

4783 - 12/26 Weekly VAH

Below Spot:

4720-4697 - OB (2hr chart)

4708 midline

4699 - Previous Session Low of Day

4699 - Weekly Low

4698 - 12/20 VAL & POC - Hasn’t been breached

4685-4680 - negative vanna

4687 - 2021 POC

4670 - negative vanna

4645 - negative vanna

4651 - 12/13 VAL

4647 - 12/11 Weekly VAL

4652-4643 - OB (2hr chart)

4648 midline

4625 - negative vanna

4628 - 12/12 Daily VAL

4610-4595 - negative vanna

4618-4608 - OB (30min chart)

4813 midline

4610 - December ‘23 VAL

Weekly Option Expected Move

SPX’s weekly option expected move is ~51.69 points. SPY’s expected move is ~5.33. That puts us at 4821.51 to the upside and 4718.13 to the downside. For SPY these levels are 480.68 and 470.02.

Remember over 68% of the time price will resolve it self in this range by weeks end.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.