Market Recap

What a way to start 2024 right? No Santa rally today and we got a nice selloff that started overnight and continued throughout the day as traders kept selling rips intraday.

What caused that selloff? News based selloff I will attribute this to due to the Red Sea conflict. Iran bringing in a warship really escalates things and then you add the new news coming out of Lebanon and what we should expect is volatility! I won’t get into the geopolitics this is not the place for that, but it could have an impact on trading beyond yesterday’s session.

From our trade plan we had the following 3 trade plans hit…

If there is a failed breakout of 4775 target 4765

Below 4765 target 4750

If VIX continues going up then a breakdown of 4745 targets 4730

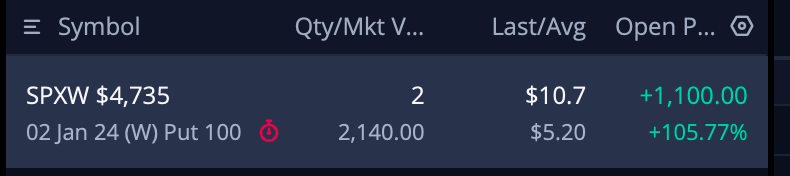

The market opened right at 4745 and when it retested near this level I entered in 0DTE puts on SPX? But why 0DTE? With the strength in the selloff, news from overnight, and data showing us going lower I had all the conviction I needed to start with a 0DTE for 2024 - again manage your own risk and not something I typically do.

This trade went for over 100% in PnL and like that my day was done all within the first hour of the trading day.

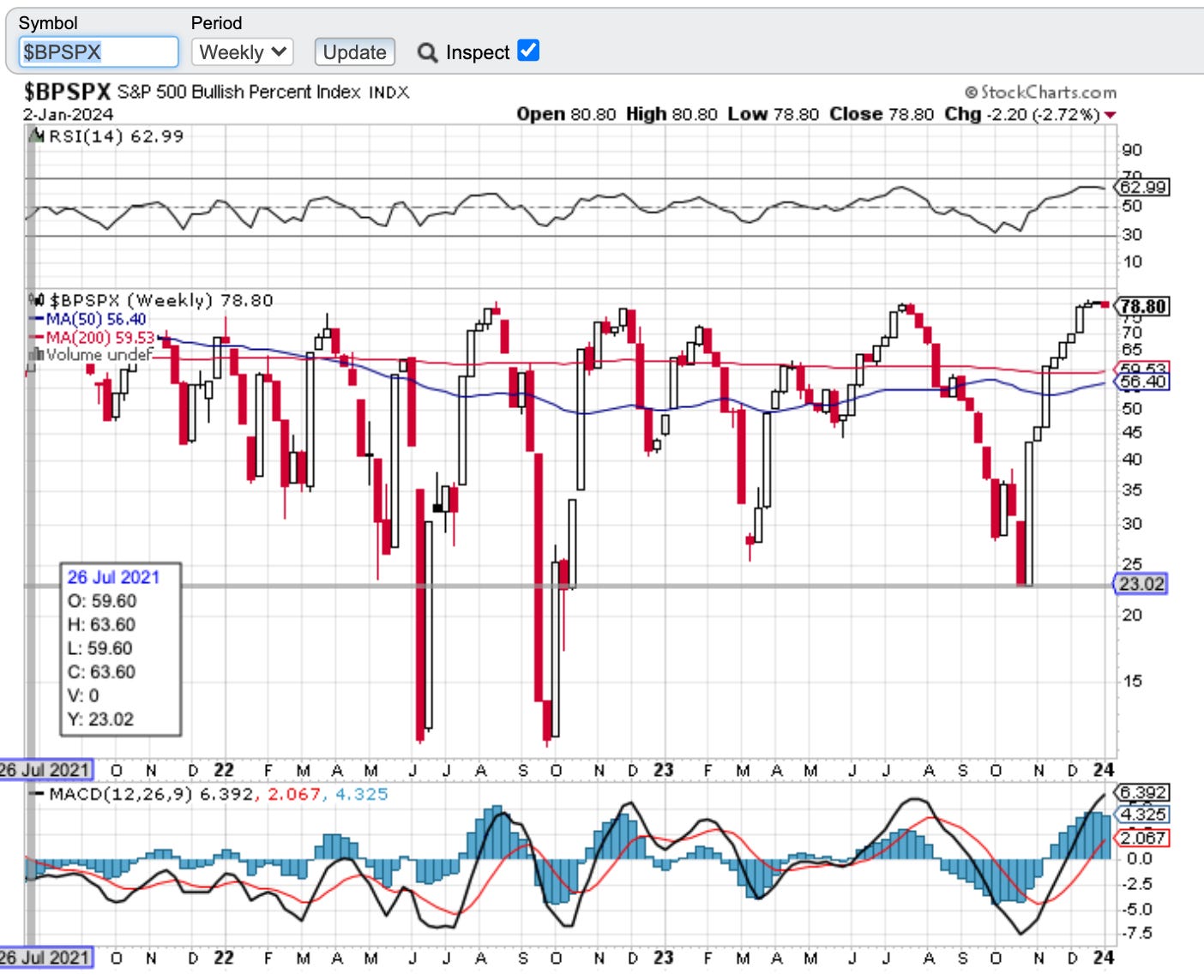

Before we get into the trade plan let’s check-in on the BPSPX. I discussed the BPSPX in a previous posting, but it is starting to show its first signs of a crack and what has been a tremendous bullish run up over the past 2 months. I want to really see how this closes on the weekly. Near its current levels and highs we typically see it start to selloff and find some balance between 50-60%. This is also where the 50MA sits on this chart. In one day of trading this week we are already below the past 2 weeks lows on the weekly chart…

Let’s jump into the trade plan and let’s review what we can expect tomorrow with the SPX/SPY/ES.

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

News Catalysts

8:30am est - FOMC Member Barkin Speaks

10:00am est - ISM Manufacturing PMI

10:00am est - JOLTS Job Openings

2:00pm est - FOMC Meeting Minutes

For more information on news events, visit the Economic Calendar

1/3 - SPX/ES/SPY Trade Plan

Bullish bias:

If there is a failed breakdown of 4740 target 4755

Above 4755 target 4765

If VIX continues going down then a breakout of 4765 targets 4775-4780

If we have volume and a catalyst a breakout of 4780 targets 4795 then 4805

Be careful of reversals between 4789-4795 where price has faced resistance of late

If there is a failed breakdown of 4725 target 4755

Bearish bias:

If there is a failed breakout of 4755 target 4740

Below 4740 target 4725

If VIX continues going up then a breakdown of 4720 targets 4698

If we get a catalyst for further selloff then a breakdown of 4695 targets 4680

Any updates to the plan or levels will be provided in our chat room. Keep an eye on Volland30 and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 45pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

1/3 SPX/SPY/ES Intraday Overview (TL;DR)

Today’s trade plan is going to have an expanded view of the levels. With data coming out after the market open and FOMC minutes we could see range and with it volatility so buckle up!

If you are bullish you want to see 4755 get taken out. This begins our trek towards 4765 then 4780. Bit of a road bump around 4770…Above 4780 will continue to push against the big wall that is 4800. Above 4780 targets 4795, but for more continuation we need to see 4795 to break and then hold on any retracement. We target 4805 then and IF we have a catalyst and volume above 4805 we target 4820 to get to new all time highs.

For the bears you want to keep price below 4755 - if you do then you target 4740 followed by 4725. A breakdown of 4720 - below last sessions low - will target 4698. IF we have a catalyst, volume and with VIX continuing to go up below 4698 we target 4680.

Any updates to the plan or levels will be provided in our chat room.

SPX - The Why Behind the Plan

Volume Profile & Trends

Now that we have the year complete, let’s review our yearly profiles on the monthly chart…

1/2 - No change here obviously as the year goes I will update this view…

4687 - 2021 POC

4433 - 2023 VAH

4128 - 2023 POC

3883 - 2023 VAL

From a quarterly volume profile on the weekly chart some key levels are seen.

1/2 - No change here obviously as the quarter goes I will update this view…

4792 - Q4 VAH

4555 - Q4 POC

4345 - Q4 VAL’

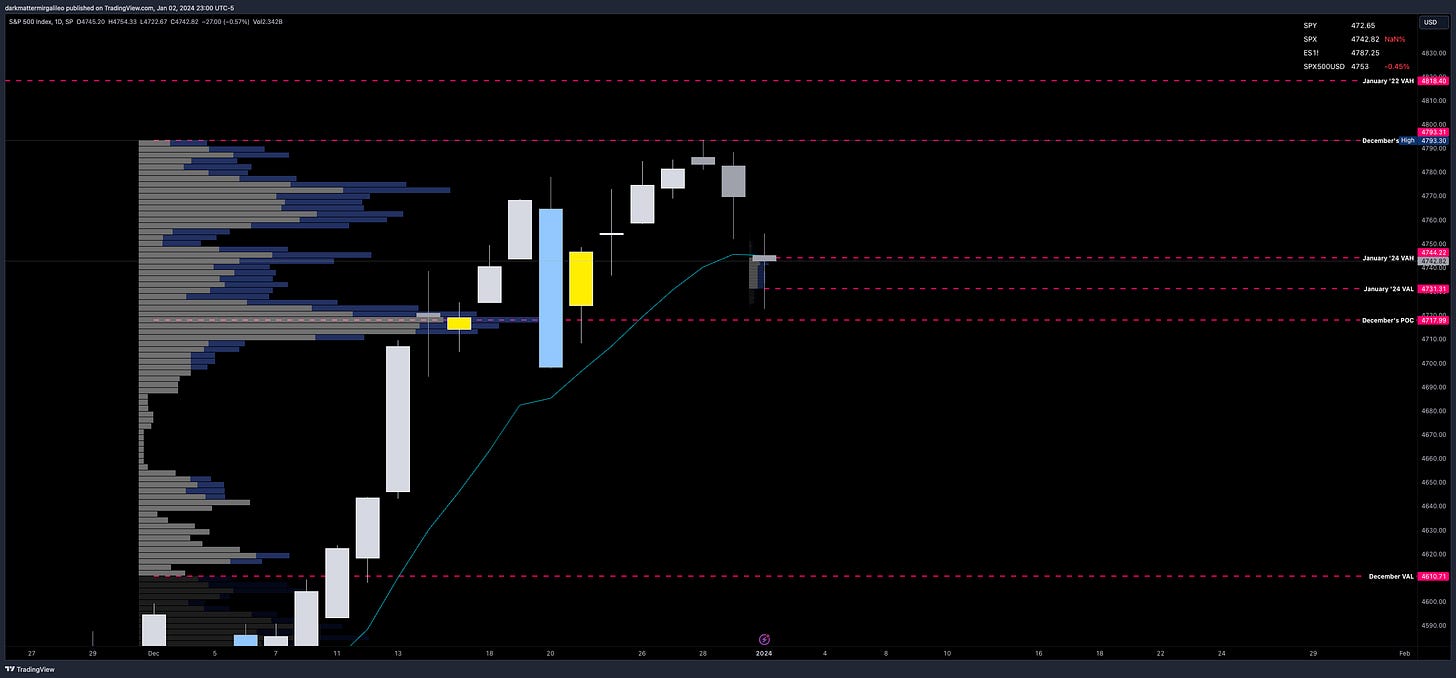

If we take a look at the daily chart and review the monthly volume profile we find the following levels…

4818 - January ‘22 VAH

4793 - December ‘23 VAH

4742 - January ‘24 VAH - still forming

4731 - January ‘24 VAL - still forming

4717 - December ‘23 POC

4610 - December ‘23 VAL

Let’s now look at the 4hr chart and review what the weekly volume profile levels show.

4818 - All Time Highs

4793 - Previous Weekly High

4783 - 12/26 Weekly VAH

4774 - 12/26 Weekly POC

4766 - 12/26 Weekly VAL

4754 - Weekly High

4744 - 1/2 Weekly VAH - still forming

4732 - 1/2 Weekly VAL - still forming

4722 - 12/18 Weekly VAL

4722 - Weekly Low

4647 - 12/11 Weekly VAL

On the smaller timeframe and intraday let’s go to our 30min chart where we will put our session volume profile on. Our levels of importance are…

4789 - 12/28 VAH

4775 - 12/29 VAH

4770 - 12/29 POC - Hasn’t been breached

4761 - 12/29 VAL

4754 - Previous Session High of Day

4744 - 1/2 VAH

4732 - 1/2 VAL

4722 - Previous Session Low of Day

4698 - 12/20 VAL & POC - Hasn’t been breached

4651 - 12/13 VAL

Volland Data

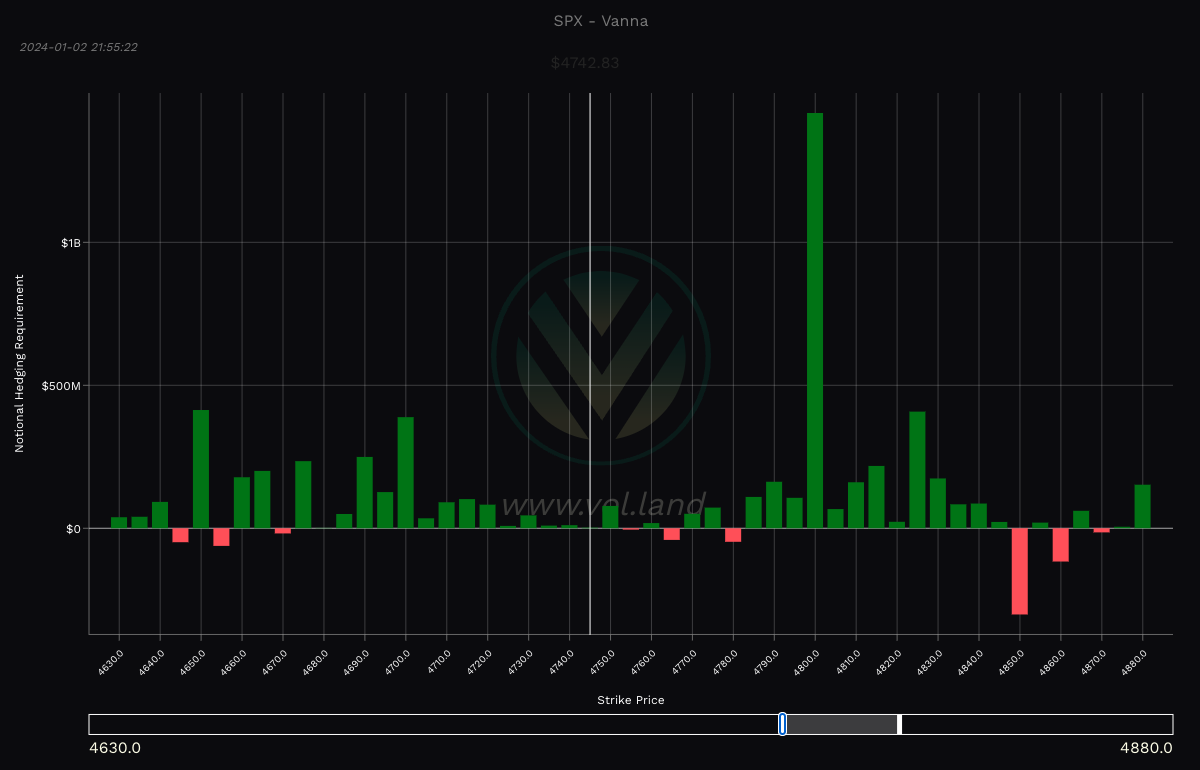

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4755 - negative vanna

4765 - negative vanna

4780 - negative vanna

4805 - negative vanna

4820 - negative vanna

4850 - negative vanna

4860 - negative vanna

Below Spot:

4740 - negative vanna

4725 - negative vanna

4680 - negative vanna

4670 - negative vanna

4655 - negative vanna

4645 - negative vanna

4610 - negative vanna

4600-4595 - negative vanna

Orderblocks (OB)

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4740-4747 - OB (30min chart)

4744 midline

4763-4776 - OB (2hr chart)

4770 midline

4778-4797 - OB (2hr chart)

4788 midline

4782-4787 - OB (30min chart)

4784 midline

4774-4807 - OB (4hr chart)

4790 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4735-4708 - OB (2hr chart)

4722 midline

4729-4721 - OB (30min chart)

4725 midline

4720-4697 - OB (2hr chart)

4708 midline

4652-4643 - OB (2hr chart)

4648 midline

4591-4580 - OB (30min chart)

4586 midline

4568-4546 - OB (4hr chart)

4557 midline

4766-4736 - OB (4hr chart)

4751 midline

Overlay of Key Levels

Above Spot:

4740-4747 - OB (30min chart)

4744 midline

4742 - January ‘24 VAH - still forming

4744 - 1/2 VAH

4744 - 1/2 Weekly VAH - still forming

4755 - negative vanna

4754 - Previous Session High of Day

4754 - Weekly High

4761 - 12/29 VAL

4765 - negative vanna

4763-4776 - OB (2hr chart)

4770 midline

4766 - 12/26 Weekly VAL

4770 - 12/29 POC - Hasn’t been breached

4774 - 12/26 Weekly POC

4775 - 12/29 VAH

4780 - negative vanna

4778-4797 - OB (2hr chart)

4788 midline

4783 - 12/26 Weekly VAH

4789 - 12/28 VAH

4792 - Q4 VAH

4793 - Previous Weekly High

4793 - December ‘23 VAH

4805 - negative vanna

4774-4807 - OB (4hr chart)

4790 midline

4820 - negative vanna

4818 - All Time Highs

4818 - January ‘22 VAH

4850 - negative vanna

Below Spot:

4740 - negative vanna

4732 - 1/2 VAL

4732 - 1/2 Weekly VAL - still forming

4731 - January ‘24 VAL - still forming

4725 - negative vanna

4729-4721 - OB (30min chart)

4725 midline

4722 - Previous Session Low of Day

4722 - 12/18 Weekly VAL

4722 - Weekly Low

4717 - December ‘23 POC

4720-4697 - OB (2hr chart)

4708 midline

4698 - 12/20 VAL & POC - Hasn’t been breached

4687 - 2021 POC

4680 - negative vanna

4670 - negative vanna

4655 - negative vanna

4651 - 12/13 VAL

4652-4643 - OB (2hr chart)

4648 midline

4645 - negative vanna

4647 - 12/11 Weekly VAL

4610 - negative vanna

Weekly Option Expected Move

SPX’s weekly option expected move is ~51.69 points. SPY’s expected move is ~5.33. That puts us at 4821.51 to the upside and 4718.13 to the downside. For SPY these levels are 480.68 and 470.02.

Remember over 68% of the time price will resolve it self in this range by weeks end.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.