January 24, 2024 SPX, ES, SPY Trade Plan

Market Recap

Congrats to the NFLX team and also the bulls. They finally closed that gap near 500 and pushed price well above it after a tremendous earnings report from the company. We briefly chatted about it in our chat room this sets up NFLX for some lofty expectations moving forward especially as it gets into live content with the signing of taking over all of WWE’s content.

This in turn has triggered one of our trade ideas…Futures trading is just begging me to start trading it. I know some of you in the group are trading futures or shares hope you got in this one or those who took SPX calls long overnight…

Above 4860 target 4875

From our trade plan the best trade was playing within this tight 10 pt range…

Above 4850 target 4860

As mentioned above our second trade idea kicked in late in the day and hit after hours post NFLX ER.

Our other trade idea in ADBE played out nicely where our trade plan hit the bearish bias at the open…

Below 600 target 590

We then called for a failed breakdown of 590 and adjusted our target on this position to 600 in the chat room.

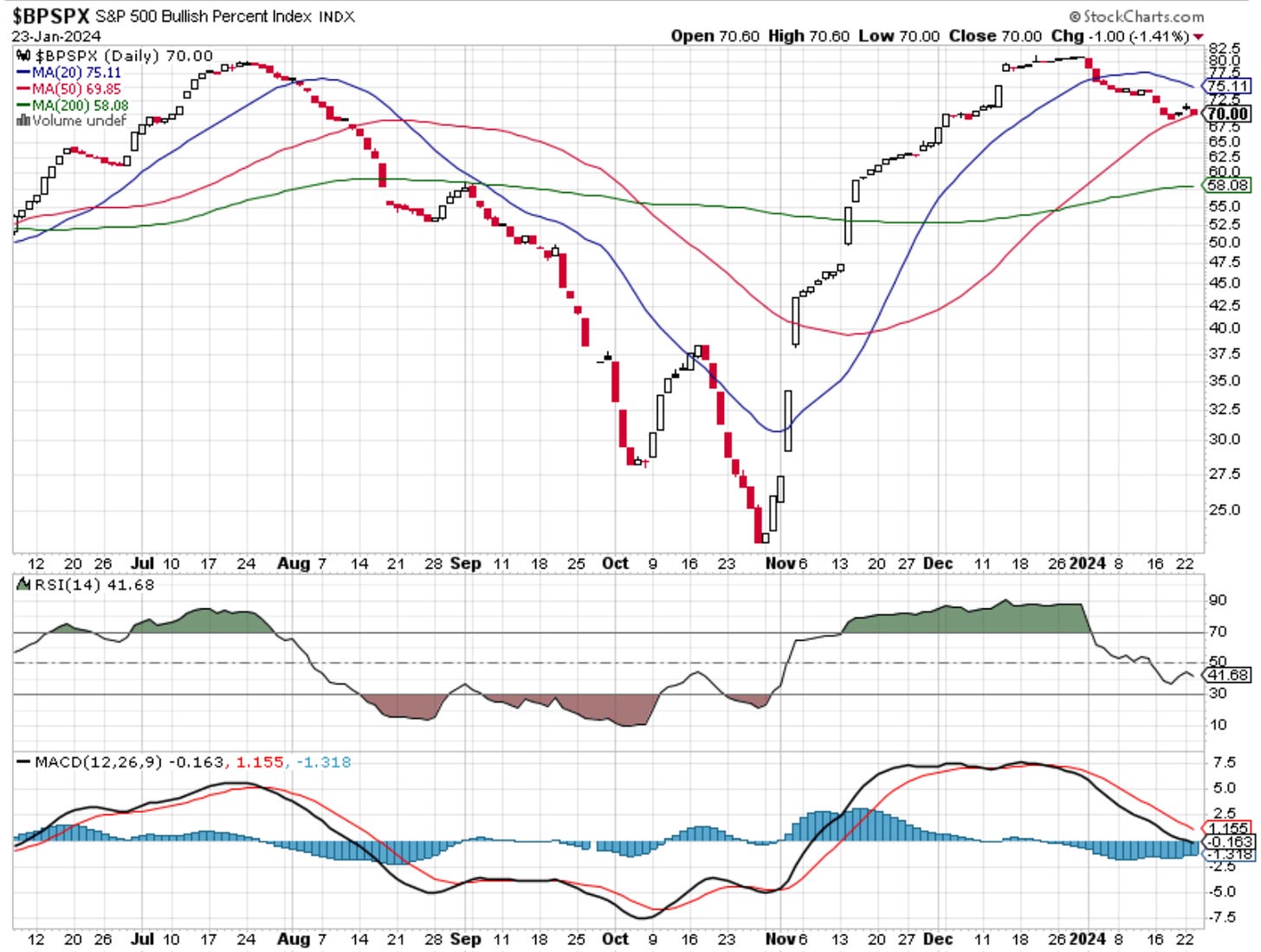

Our free preview to our chat room expired on Friday. For those in the chat room we triggered longs on Friday and use our chat room for intraday updates and targets as 0DTE options come on.The BPSPX put in a nice red daily candle and we sit right at that key critical 50MA. The RSI is curling back down and we have a MACD continuing to push lower…

Here is a seasonality chart day-by-day of the trading sessions in January…

So far on the month the SPX is up 1.99%…

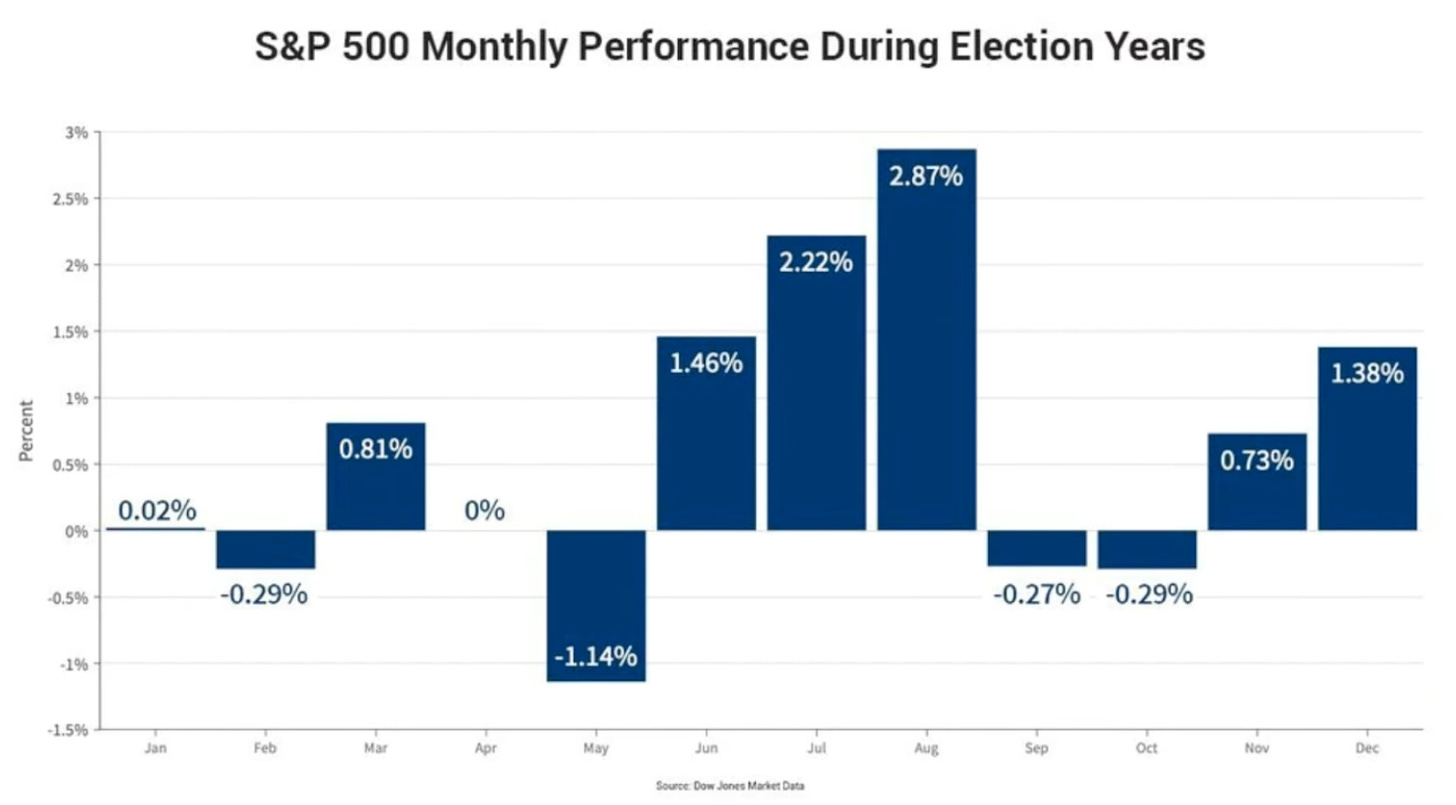

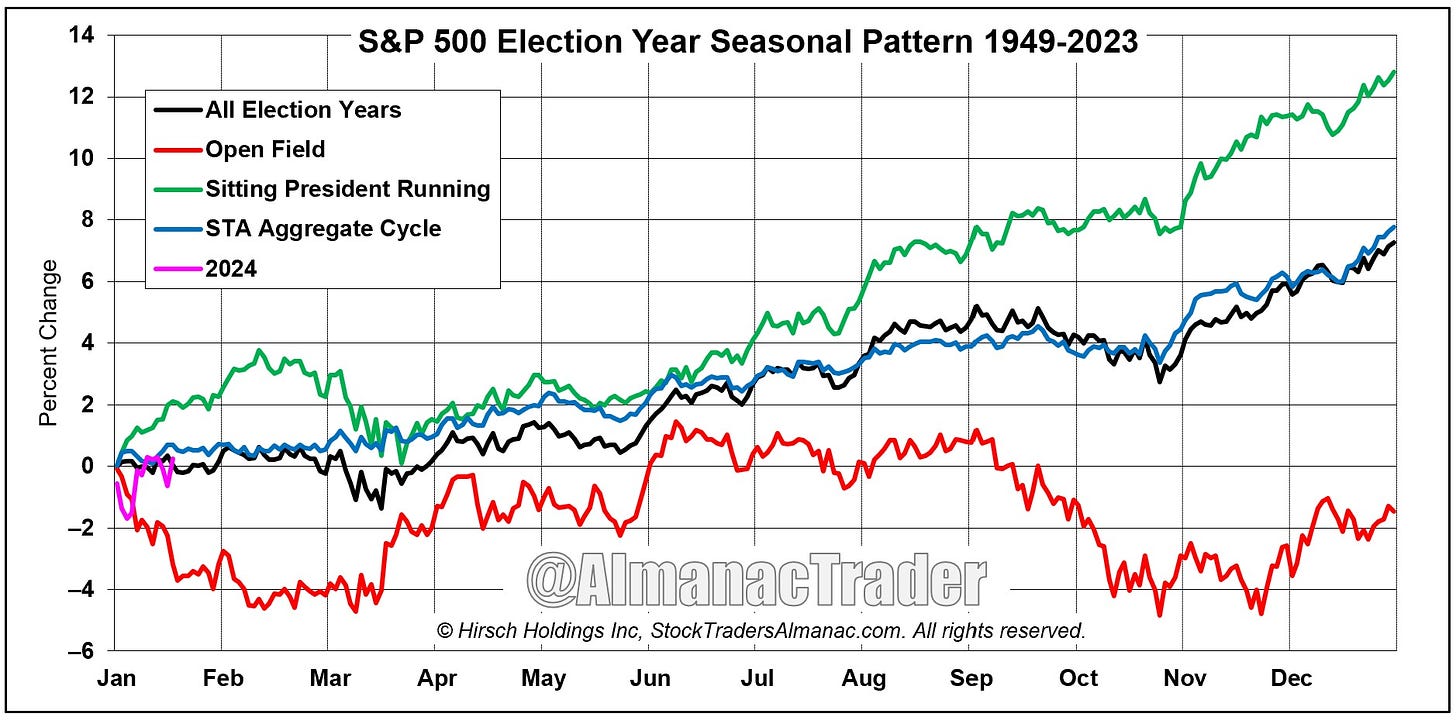

What we have to keep in mind with some of these seasonality charts is that we are in an election year. Seasonality instead looks like this which is another 2ish percent up from now until early/mid February before we then get a selloff going into March which negates the gains we make in January/February…

We will continue to monitor some of these seasonality views. There are a few of them out there and it will be important to see how the month ends to give us more insight into which seasonality chart it follows.

Just a reminder for those not subscribed to our monthly paid service the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.