January 22, 2024 SPX, ES, SPY Trade Plan

Weekly Market Overview

We finally reached all time highs this week after calling for this weeks ago. Just a slow grind the past few weeks where finally we coiled and boom just like that we are at unseen levels at 4840. So what’s next?

Our free preview to our chat room expired on Friday. For those in the chat room we triggered longs on Friday and use our chat room for intraday updates and targets as 0DTE options come on.This week is full of data starting with the BOJ’s Policy Rate and Report Monday overnight, then we have Wednesday overnight with PMI numbers from EU countries and then at market open we have Manufacturing and Services PMI. Thursday comes GDP, Unemployment Claims, and Durable Goods Orders. We end the day friday with PCE and Pending Home Sales.

As if that was not enough this week kicks off another busy of earnings with tech starting with NFLX and TSLA reporting this week. Full list of ER’s below…

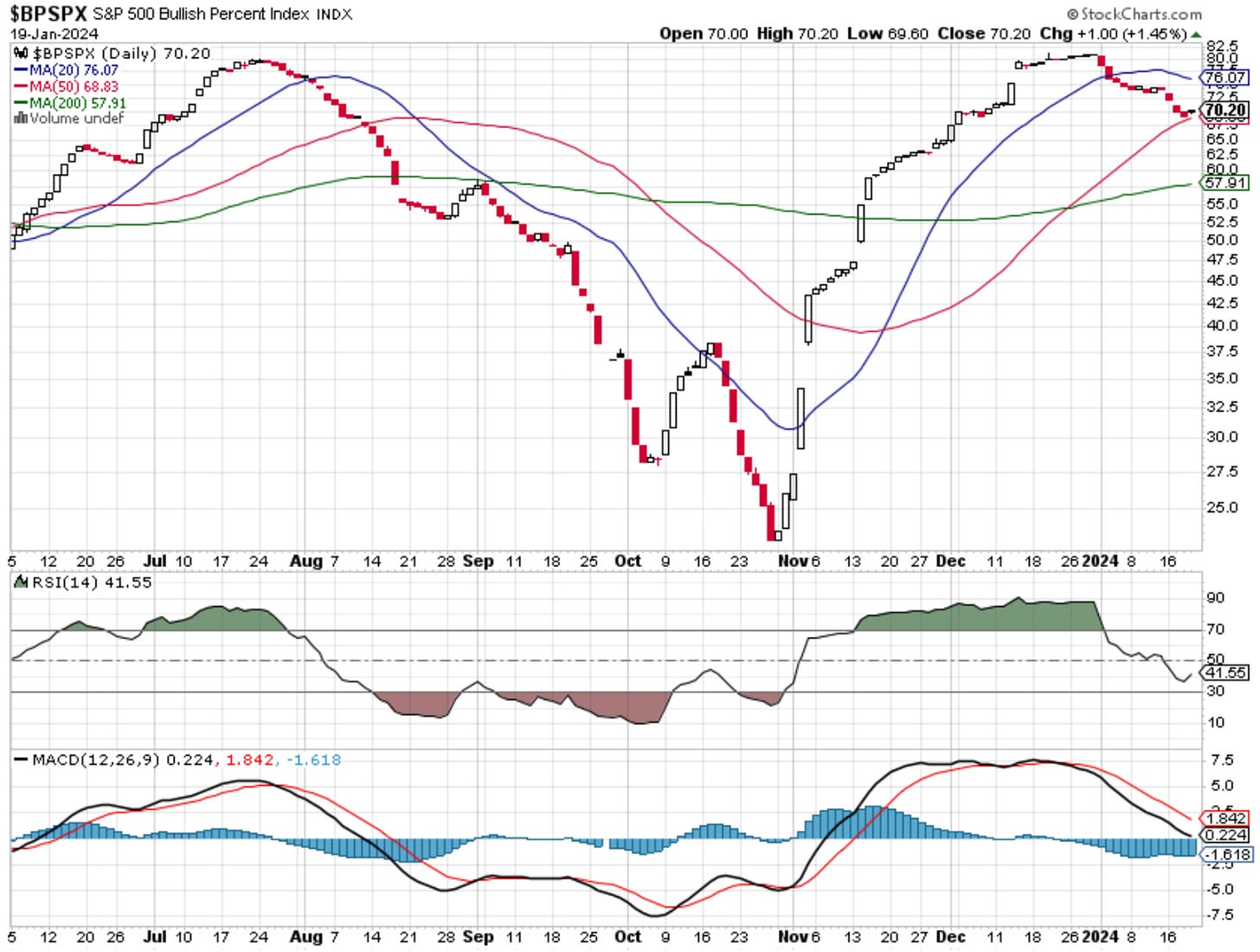

Good shoutout in Thursday’s trade plan where we stated to be on the lookout for some support to come in on the daily chart for BPSPX. This is why I have suggested waiting on any large short positions even though this chart has shown a bearish reversal. Ideally, next we want to see another day above the 50MA and ultimately then a break of it. This will help confirm a larger selloff below 4700 on the SPX IMO.

Here is a seasonality chart day-by-day of the trading sessions in January…

So far on the month the SPX is up 1.47%…

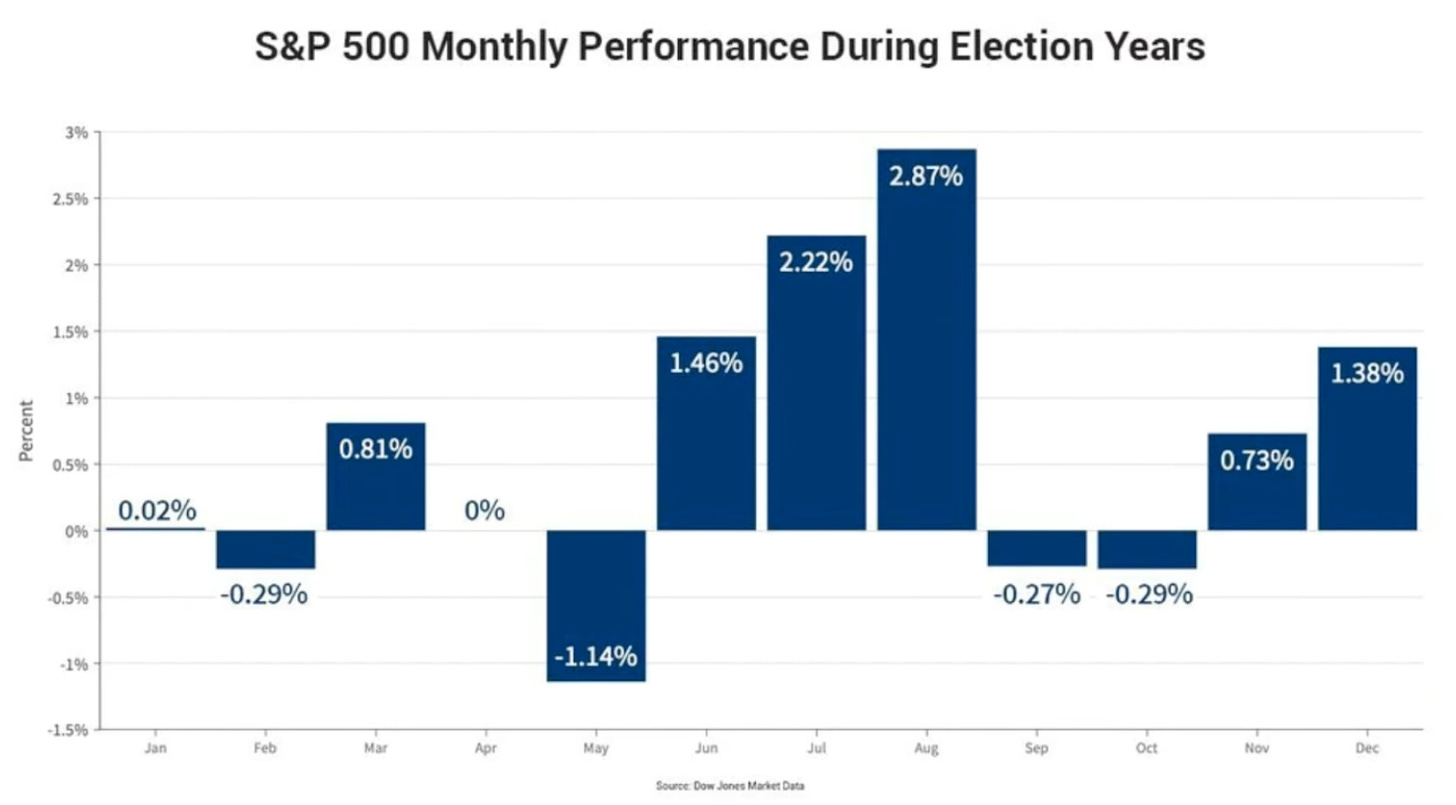

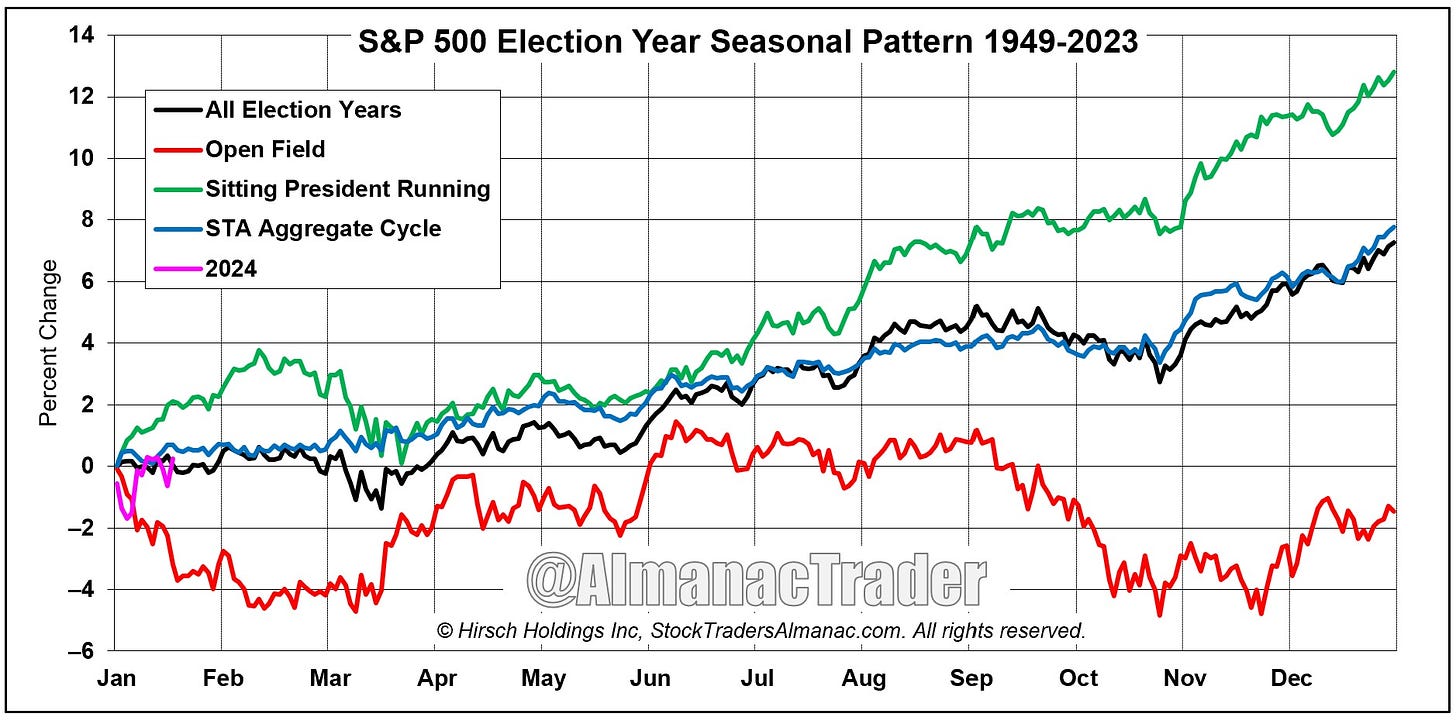

What we have to keep in mind with some of these seasonality charts is that we are in an election year. Seasonality instead looks like this which is another 2ish percent up from now until early/mid February before we then get a selloff going into March which negates the gains we make in January/February…

Just a reminder for those not subscribed to our monthly paid service the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.