January 18, 2024 SPX, ES, SPY Trade Plan

Market Recap

Hello fellow traders. Before we get to the recap…

As I have mentioned multiple times this week welcome to OPEX week. It’s brutal and most times than not the move occurs overnight and we chop the rest of the day. With that said I will stress again go lite, hell don’t trade this week, and preserve your capital. We are going to have some amazing opportunities coming up over the next few weeks. Earnings coming, we also have our swing trade idea #paytiently waiting for it.

The next two days are going to be a lot more volatile as dealers start to unwind the massive options expiring Friday. With that said lock those profits keep trades green when they are there and tight stop losses. As always we will do our best to guide our trades in the chat room.

Will keep the recap quick as all of our trade ideas triggered overnight in futures action. Lots of action caused by China, UK CPI coming in hotter, and retail sales while higher than expected the positive news is seen negative by the market because it complicates the FED’s decision on cutting interest. The probability of a rate cut now in March dropped from 63% to 56% just off that retail sales number…

The headline or theme so far of this market in 2024 will be interest rate cuts and how many of them. It will move the markets. I would suggest that you add the tickers - at least on TradingView - US02Y and US10Y. This is the 2 and 10 year interest rates. It goes up markets come down.

If you are a futures trader and you stuck to our plan bravo you nailed a 50pt move basically. At the market open we were able to secure 10-15 points depending on your entry when we called long to target 4745-4750.

For those wondering why I do not trade futures - plain and simple I like my sleep and options allow me to define my risk in every trade I enter - for me personally. Others may find it opposite and that is why our trade plans can be widely used to trade ES (futures), SPX, or even SPY.

🚀 Secure your spot before prices soar! For the cost of your daily options commission—just $0.30 a day—you can unlock our daily stock market newsletter.

📈 Don't miss out on key levels, expert trade ideas, and daily plans for only $15/month. Act fast before these prices increase.

💰 Click subscribe now and supercharge your trading game! 🚀

#TradeSmart #LimitedTimeOffer

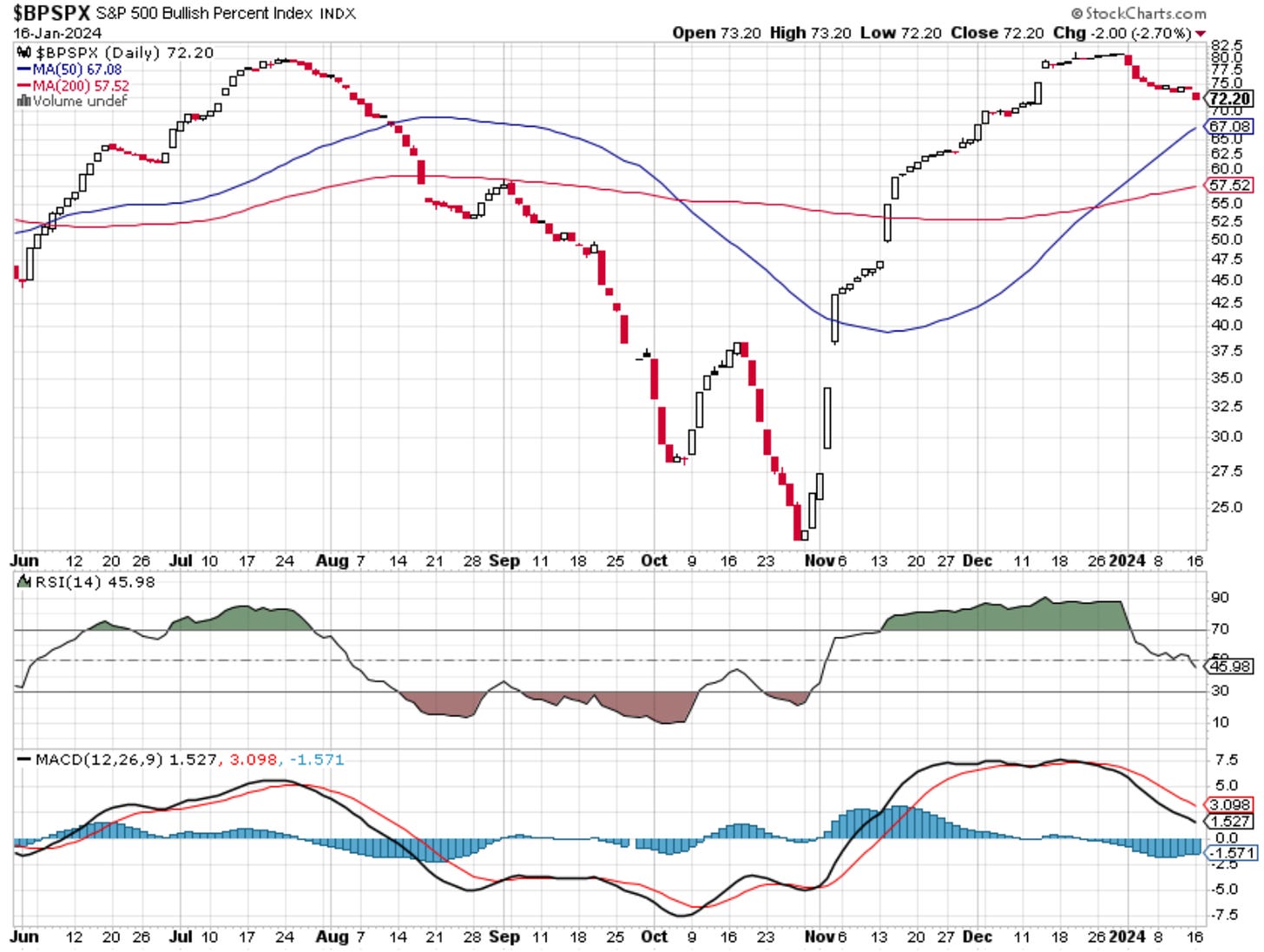

Nothing to see here but a new lower low on the weekly as more stocks selloff - in the future this is our queue as a leading indicator. Now that we have closely followed this as a group we will utilize it more often.

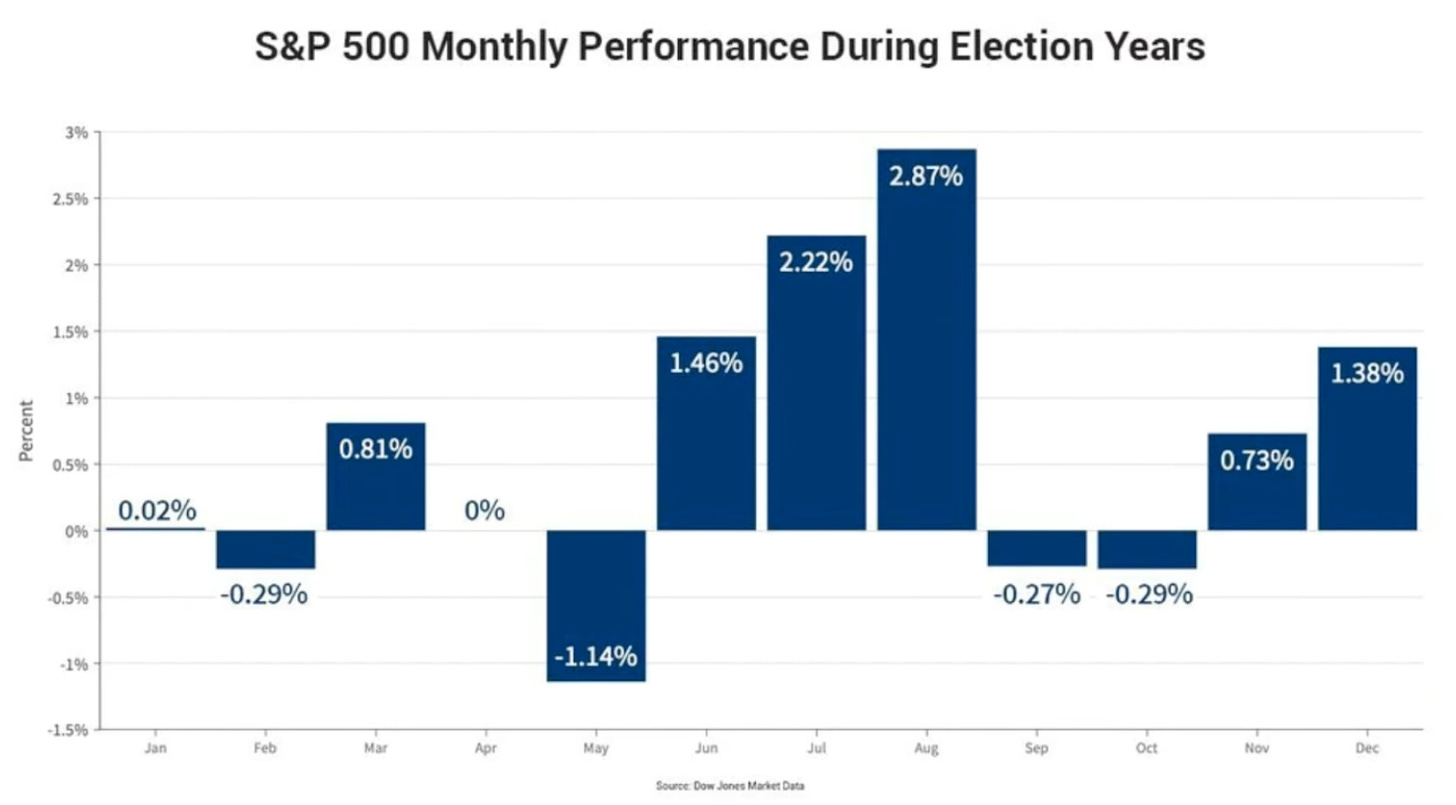

Here is a seasonality chart day-by-day of the trading sessions in January…

Let’s bookmark this image and come back to it each month…

Just a reminder for those not subscribed to our monthly paid service the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.