Market Recap

A great start to our week today where we had

nail an amazing fast trade on QQQ puts and then at 10:00am I signaled for us to go long at 4760 with a target at 4780.Here is a transcript from our chat room…

We also provided you with clear guidance on the whipsaw action to expect this week…

With OPEX in full swing I only want to trade breakouts and breakdowns or failed ones. On top of that I am going to be wary of any continuation in trend as I expect the market to whipsaw us up and down this week

So what made me flip long and not take the trade of the breakdown of 4760?

It was a level of interest in the options market a key vanna level

Last week’s value area low (VAL) sat at 4754 so I was leery to just jump into a trade without clear confirmations

While we had two 5min candles close below 4760 as we had printed a 15min candle looking at that timeframe I was not sold on it being a clean breakdown

When I don’t have confirmation the next trigger I wait for is a retest of that key level - in this case when 4760 was tested again we simply ripped right through it and the next two 5min candles closed above it and held it as support. On top of that the next 15min candle had formed and if you look at the chart that is one bullish looking candle

Charm 0DTE options flow started to show no rollovers of puts to lower strikes and instead shifted into a bullish paradigm

Add those up and that’s how I got to going long and making sure you were on the right side of that trade. Lots of traders/fintwit I seen today had folks in puts and boy did that reverse on them.

What is important to learn here is paytience and not going through your “checklist” for confirmation. We all do this as traders especially as we are learning, but continue to hammer these best practices and signals into your trade plans for better success.

Now we did end up selling back down once we hit 4780, but my day was done trading by then. I hit my daily PnL target and to avoid giving any of it back I simply closed up shop. That is how you preserve your profits and don’t overtrade. Pay yourself - pay more towards your mortgage, bills, take a trip. Walk away, be happy and move on. My day ended at 10:30 or if I waited to short 4780 after the initial trading hours that are most opportune - 9:30am - 11:30am - I would have had to sit and manage my trade for at least another 2hours to get to our target back at 4760…

🚀 Our existing prices will not stay. Get in before prices raise. For as much as the cost of your options commissions you can enjoy this newsletter on a daily basis. That’s about $0.30 a day! 🚀

Gain access to key levels, expert trade ideas, and daily intraday plans for just $15/month. Time's ticking—seize the opportunity! Act fast - these prices won't stick around!

Click subscribe now 💰

Additionally, our trade plan on ADBE was a nice hit with some contracts up well over 50%. Heck you could have played this ticker multiple times today using that 590 support as an entry…Trade is still open on this and let’s see what tomorrow sets up for us.

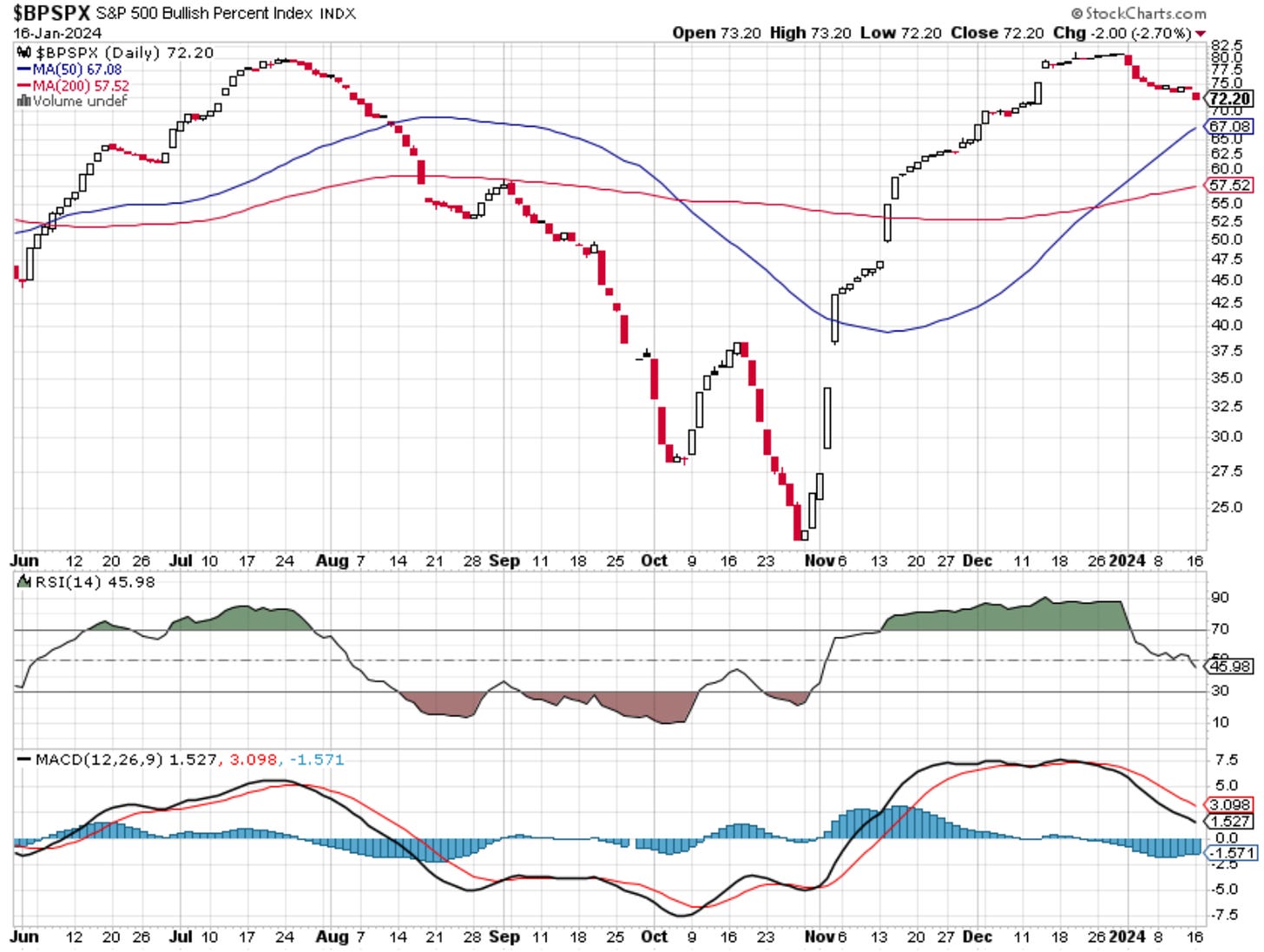

Another down day in the BPSPX…

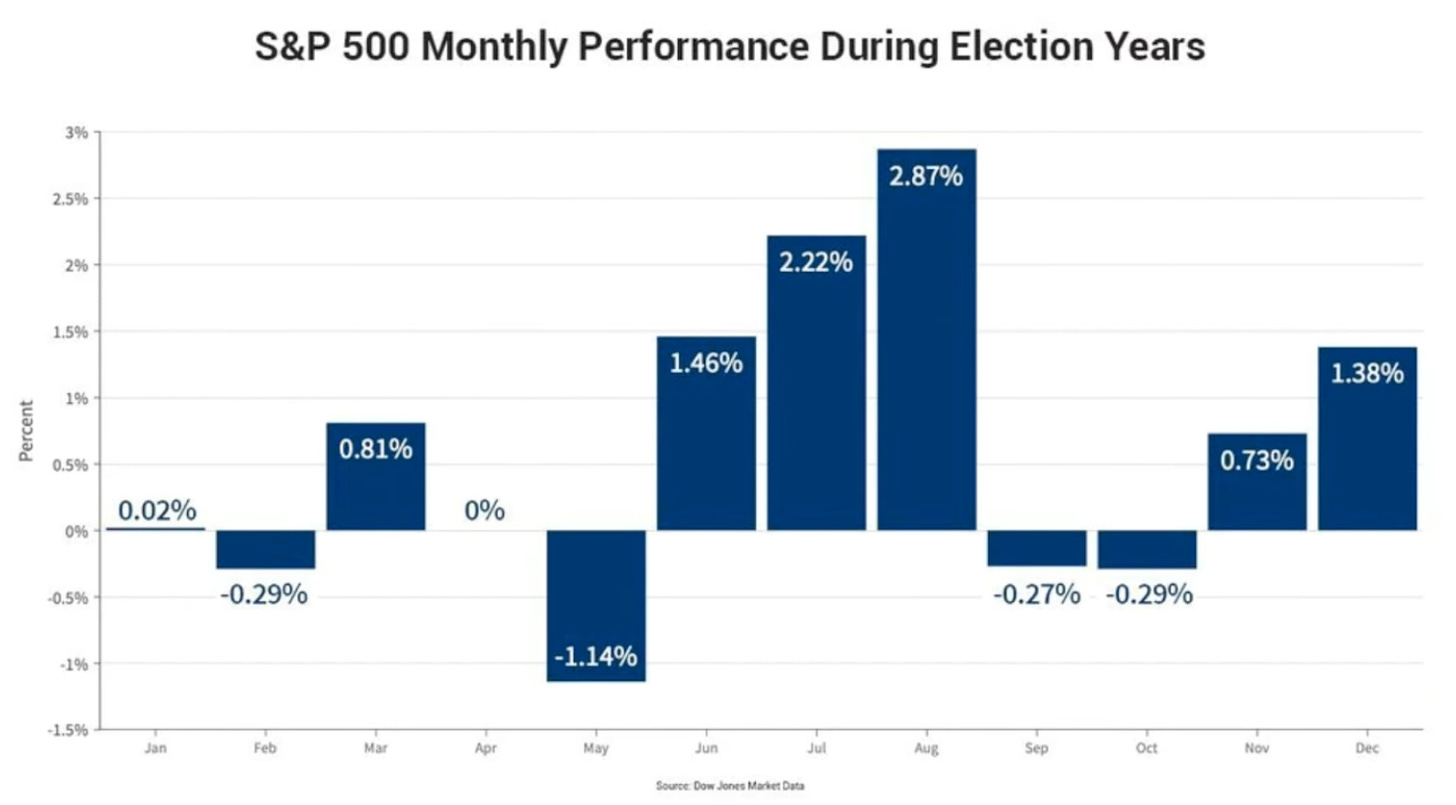

Let’s bookmark this image and come back to it each month…

Just a reminder for those not subscribed to our monthly paid service the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.