Weekly Market Overview

Welcome to another week of trading fellow traders and teammates. We are going to discuss a potential swing opportunity arising in the SPX/ES/SPY. Before I get into that let’s discuss this weeks catalysts.

First and foremost we are in OPEX week. Expect the unexpected, chop up and down, trend quickly reversing and so forth. So go lite with your trades this week especially intraday trades. This is the week you want to preserve capital for that swing opportunity. Profits at 10-20% should be targets and not taken for granted. I am calling this out now and don’t want you surprised as the week unfolds.

Besides that we have one fewer trading day and our big news catalysts start on Wednesday with Retail Sales. This should give us an inside peek to ER coming up, but more importantly the health of the consumer and market.

To end the week we have UoM Consumer Sentiment and Existing Home Sales.

Our existing prices will not stay. Get in before prices raise. For as much as the cost of your options commissions you can enjoy this newsletter on a daily basis.

🚀 Elevate your trades for under $0.30 a day! 🚀

Gain access to key levels, expert trade ideas, and daily intraday plans for just $15/month. Time's ticking—seize the opportunity! Act fast - these prices won't stick around!

Click subscribe now and accelerate your journey to trading success. 📈💰 #TradeSmart #LimitedTimeOffer"

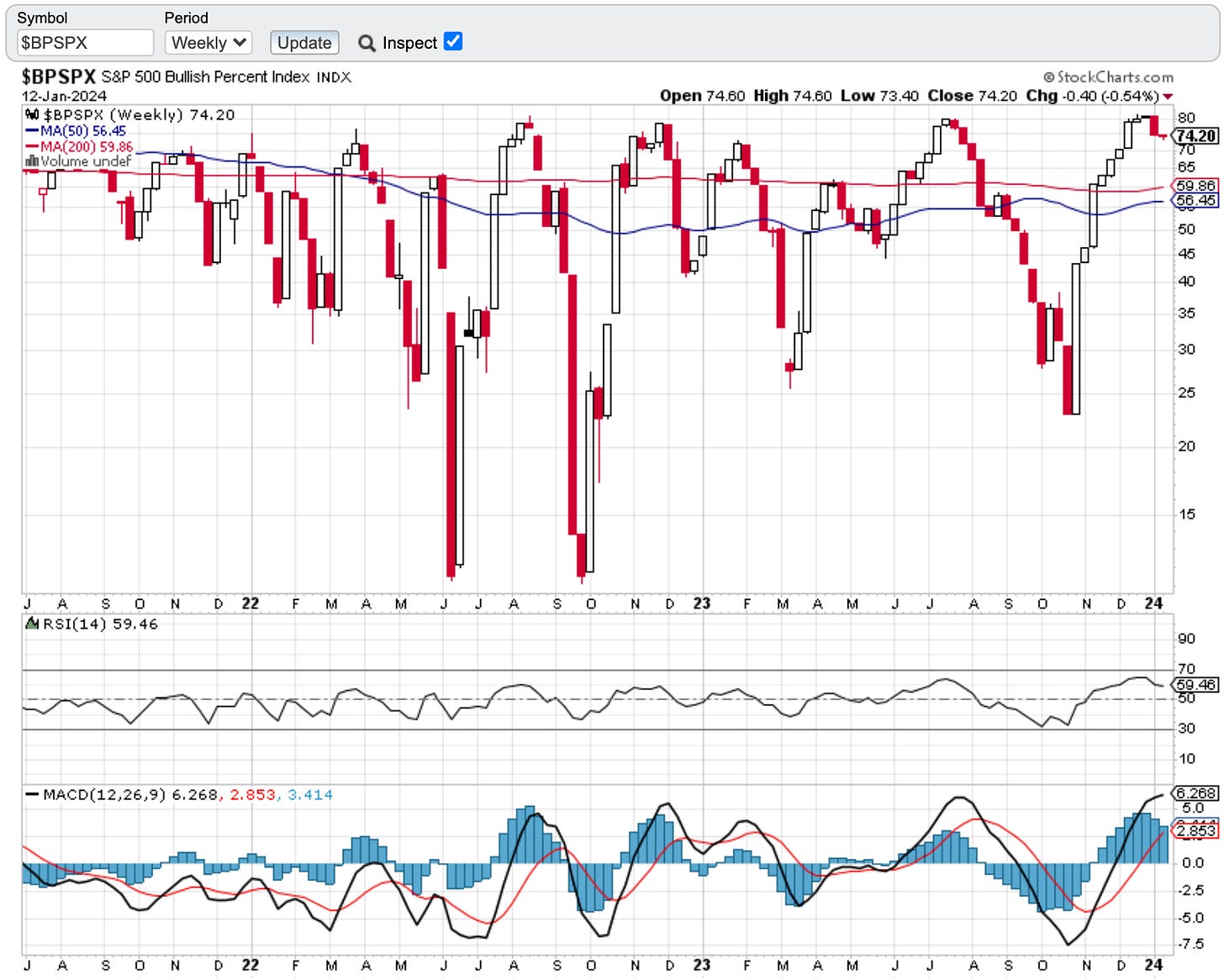

Let’s do a check in on the BPSPX. It is exactly doing what I wanted to see out of it. It fought further “selloff” in it, but we did make a lower low close on the weekly. What does this mean? We will discuss this in our swing trade idea below.

Let’s bookmark this image and come back to it each month…

Just a reminder for those not subscribed to our monthly paid service the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.