February 8, 2024 SPX, ES, SPY Trade Plan

Market Recap

The market gapped up and at the open I decided to lock in on some of profits on the 2/16 SPY calls I was accumulating since Monday. Still have runners in this trade and plan to continue to hold them into next week especially if we see a weekly close above 5000 + seasonality = potential shot at 5100-5115.

All week long in our key levels we have shared the following and they exactly played out this week…

4950 - from a gamma standpoint this starts an area of weakness and dealers will less likely support it so there will need to be a catalyst that pushes us up and more puts bought…

4975 - last stop before we trek our way towards 5000…

In each instance if you followed these key zones including the failed breakdown of 4930 you gained 70pts on the week with 25pts at each target! For those trading options these are the details in the trade plan to follow and when I have a key level it is backed with data and not just my personal opinion.

Around 10am est when the market balanced including 0DTE option flows we saw a surge in puts bought - customers - which meant that dealers would buy triggering 4970 to become supportive with targets at 4980 and then 4995. We had many traders in the chat room go long on this trade and including the afternoon post lunch session getting 10 pts from 4985 to 5000.

In Monday’s trade plan we also shared the Gamma levels and chart from Volland and suggested there are 3 options and price will migrate to one of these options. We got a little bit of option 1 here price found support at 4920 this week before we finally completed the journey up to 5000 once we were above 4950…

Before we continue we are looking at Discord as an opportunity to move our intraday trade plans & chat room. We belief this will provide better and faster content that doesn’t require Substack to navigate. Complete the poll below please…

2/8 News Catalysts

8:30am est - Unemployment Claims

8:30am est - FOMC Member Barkin Speaks

10:00am est - Final Wholesale Inventories m/m

12:05pm est - FOMC Member Barkin Speaks

1:01pm est - 30-y Bond Auction

For more information on news events, visit the Economic Calendar

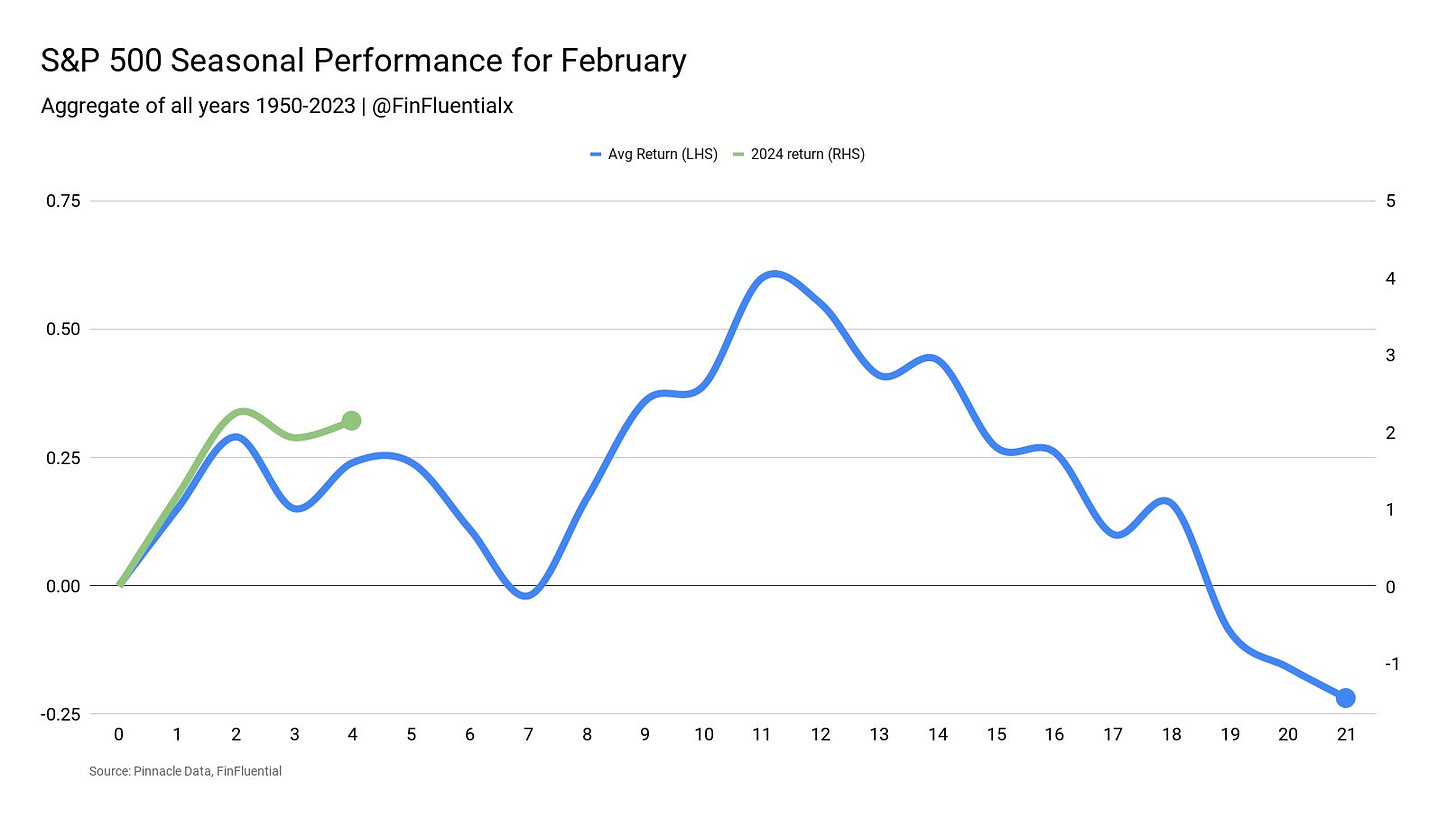

Seasonality favors a small pullback this week before rising again going into OPEX next week. The trend is key here not the amount so ignore the scales…

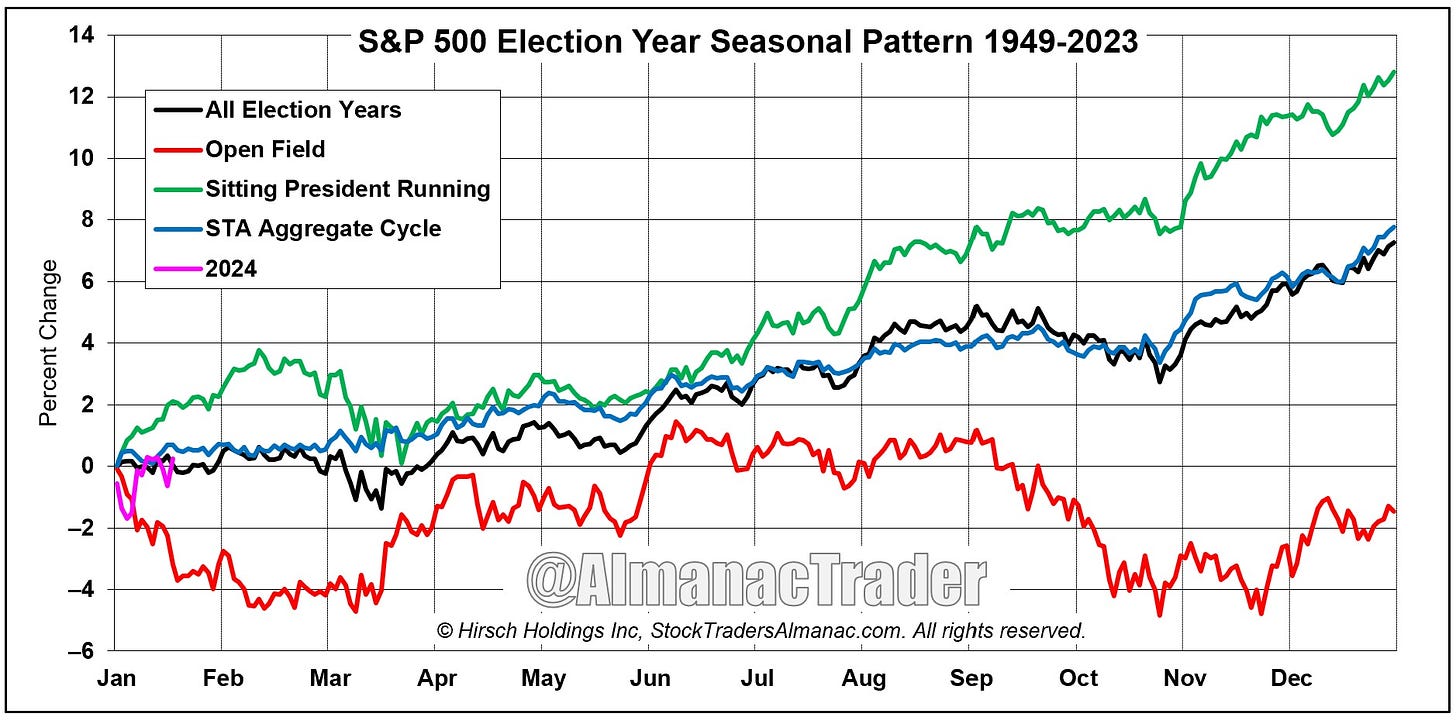

It tracks with the larger yearly season calendar during an election year.

Just a reminder for those not subscribed to our monthly or yearly paid subscription the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.