February 7, 2024 SPX, ES, SPY Trade Plan

Market Recap

Hello traders and welcome back as we saw a choppy day where more and more consolidation is occurring reading for a big move. We shared this in our chat room tonight, but you can clearly see from these charts of ES that we are consolidating for what feels like another leg up. Higher highs, higher lows. Smaller to larger timeframes key levels are holding as support.

This 4900-4931 zone continues to show it’s support in the market and if you are trading any shorts intraday lock in your profits as we are finding further areas of support on our way towards 5000.

IMO if we get to 5000 before the end of this week there is a good chance that this continues to go up towards 5100 into next week…

Before we continue we are looking at Discord as an opportunity to move our intraday trade plans & chat room. We belief this will provide better and faster content that doesn’t require Substack to navigate. Complete the poll below please…

ADBE shared in our trade plan broke that key critical level of 620 and with it a multitude of key value areas. Shared again in our chat room a breakdown of this trade idea shared Sunday.

We lost January's Value Area High at 623.18 and from there targeted all the way down to what was previously past December's VAH and ended up landing at the 1/22 weekly VAL. Perfect execution of price chasing an area of liqudity with volume profile.

Tomorrow’s big catalyst and really the entire week comes down to the 10-year bond auction at 1 pm and then Thursday we have the 30-year bond auction at the same time.

2/7 News Catalysts

11:00am est - FOMC Member Kugler Speaks

12:30pm est - FOMC Member Barkin Speaks

1:01pm est - 10-y Bond Auction

2:00pm est - FOMC Member Bowman Speaks

3:00pm est - Consumer Credit m/m

For more information on news events, visit the Economic Calendar

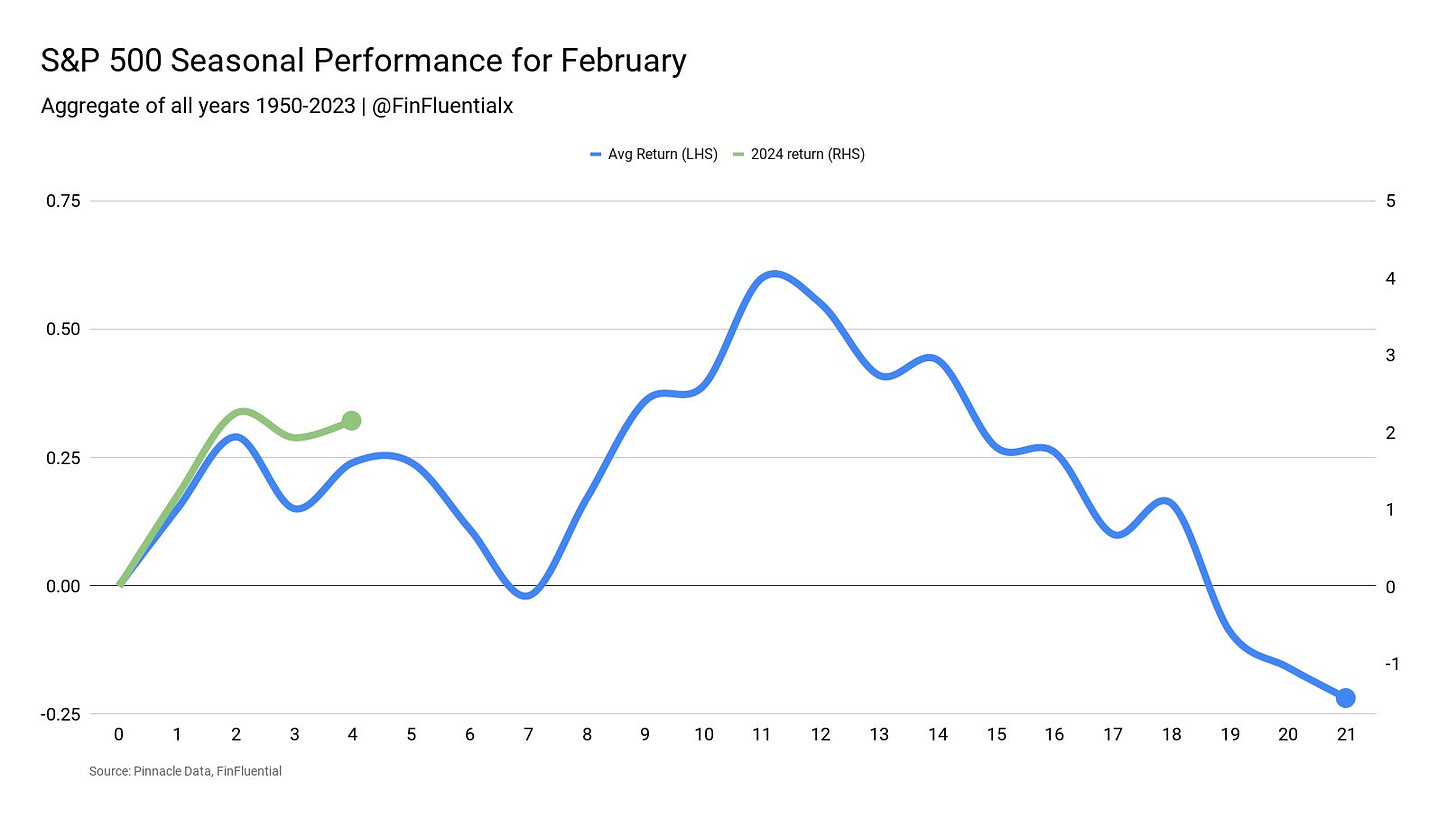

Seasonality favors a small pullback this week before rising again going into OPEX next week. The trend is key here not the amount so ignore the scales…

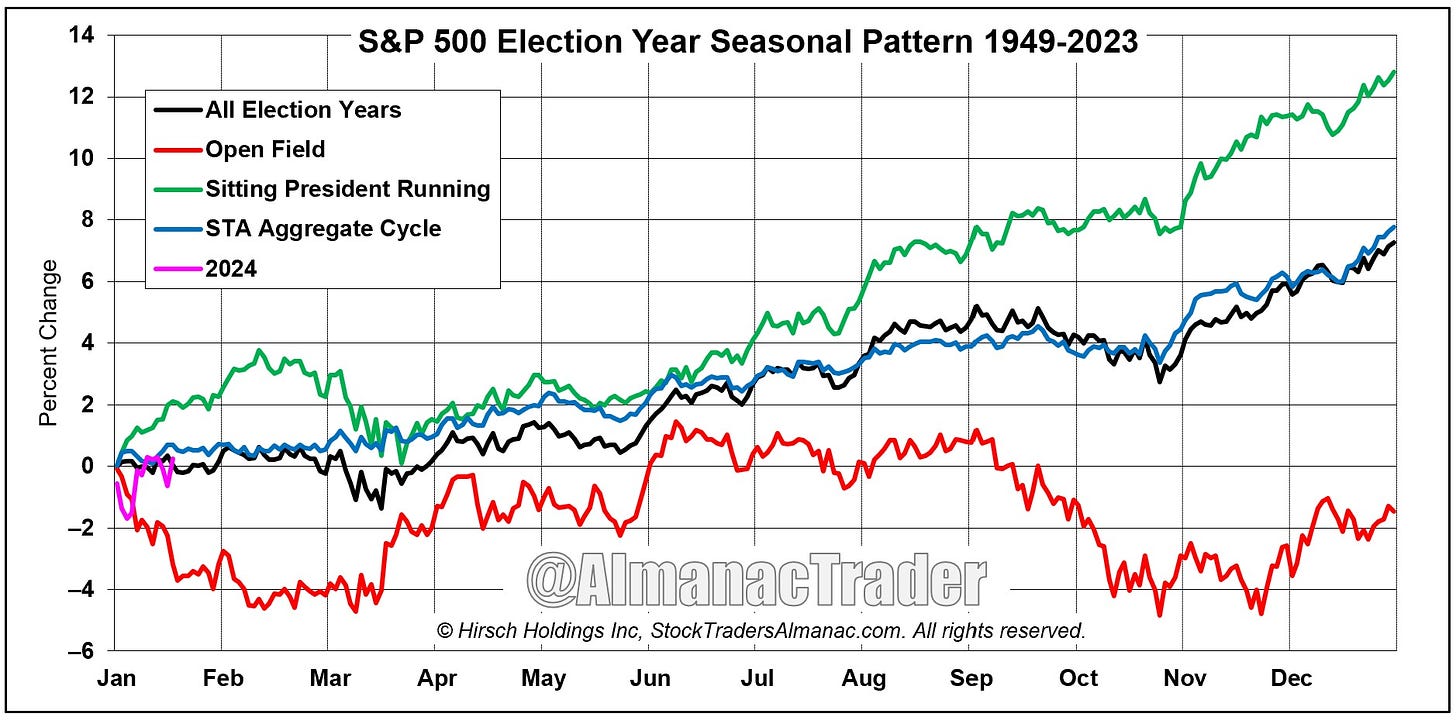

It tracks with the larger yearly season calendar during an election year.

Just a reminder for those not subscribed to our monthly or yearly paid subscription the newsletter will end here for you. You can still join us for the rest of the plan by subscribing below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.