February 22, 2024 SPX, ES, SPY Trade Plan

Market Recap

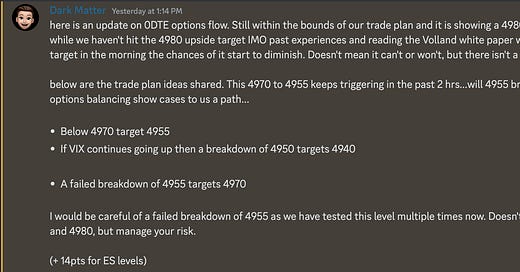

Hello team. What an intense ending to the market that I unfortunately missed as I was away the 2nd half of the trading day, but throughout the day we stated to play the edges of 4945 and 4980. Meaning long above 4945 when price came there and short 4980.

We had a nice tight range between 4980 and 4950 until the end of the day when they trapped bears - remember our trading rules after lunch hours breakdowns of key levels need to be proven on the 15 and/or 30 min chart. We didn’t have a single candle close below this level all day on the 15 or 30min chart.

I took puts twice on the day and with those opportunities and PnL locked I called it a day. We guided all of our traders and the new experience in the DM Discord is just amazing. Giving key levels and targets and suggesting when to take profits.

One thing is for sure a close above 4976 was going to be bullish and as we discussed in yesterday’s trade plan it came to fruition where we are now on a path to targeting 5040.

From the 2/20 session we rejected the POC from the 2/5 weekly profile sitting at 4994. We also sold down and closed the trading session below last week’s VAL at 4976.

This 4976 level and VAL is critical for the bulls to reclaim and push price back towards last week’s VAH sitting at 5039.

For our free trial subscribers you have had a sneak peek into our daily trade plans and more importantly our intraday trading/chat room.

Don't miss out on these trade plans and intraday updates for as low as $15/month! At the end of this month prices will increase to $29.99/month.

That is less than 30 cents a day! Don't miss out before prices go up!SUBSCRIBE

Amazing ER results from NVDA and bravo to that team and company. They continue to be the star in the market and carried a lot of additional stocks AH such as SMCI.

There is a lot of overnight data coming from the EU in PMI numbers. Into the morning we have unemployment claims and more importantly after the market open US PMI numbers at 9:45am est. Could be a choppy opening waiting for those PMI numbers to report.

There is an obvious gap up in futures and ultimately if we want to see continuation above 5025 we need to see NVDA push price above 750.

2/22 News Catalysts

For more information on news events, visit the Economic Calendar

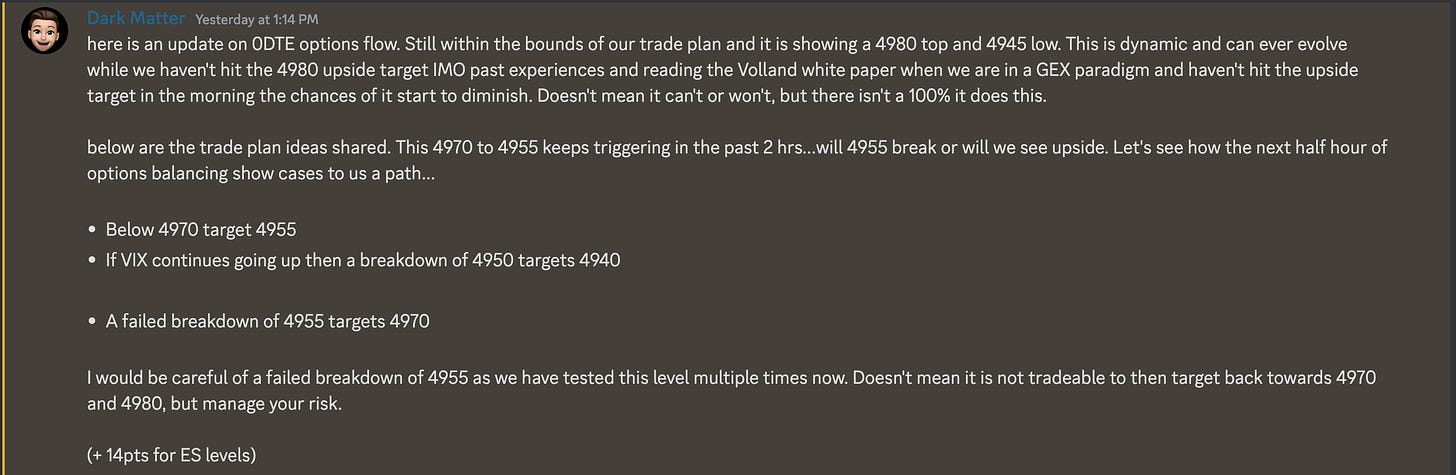

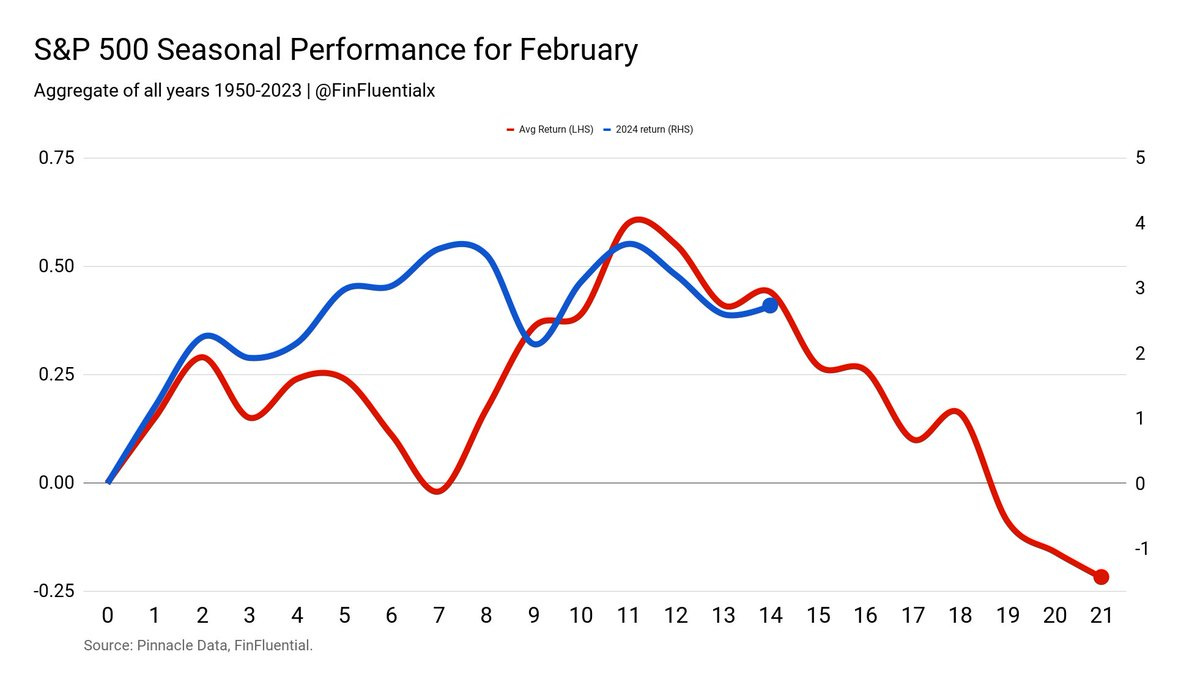

February’s trading session seasonality

It tracks with the larger yearly season calendar during an election year.

Just a reminder for those not subscribed to our monthly or yearly paid subscription the newsletter will end here for you. You can still join us for the rest of the plan where we discuss key levels and entries to take and targets. Subscribe below. SUBSCRIBE

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.