February 14, 2024 SPX, ES, SPY Trade Plan

Market Recap

Hello traders. The bond market always sees ahead and going into the CPI print this morning we had a very hawkish bond market on this print. It played out with a hotter than expected print reducing the chances of a rate cut in May. Rates across the board went up and the DXY rallied as well.

While our trade plan was to stay flat going into the CPI print we did seize on the opening with a counter rally that had a failed breakdown of 4950 to target 4965. We called it a day after that. These levels and targets all provided live/real time in our trade/chat room.

If there is anything the past two days and in general with OPEX has thought us is you take your profits and do not let trades go red. Don’t get greedy lock those profits and keep your stop losses tight. We will have better trend days after OPEX so protecting your capital is just as important as hitting a green trade…

We have now found support at the 4920 SPX level and rallied so quickly out of this zone 2 times in a week now. Take a look at the daily chart on SPX to last Monday. Until we crack this level and close a daily candle below it we are most likely in a sideways market.

How do we get out of a sideways market? Well break below 4920 as mentioned or close a daily candle and weekly back above 5000. I am not ready to call the next leg in the market until one of these key levels break and hold.

Let’s see how we rebalance after OPEX…

For our free trial subscribers you have had a sneak peek into our daily trade plans and more importantly our intraday trading/chat room. Tomorrow the chat room will exclusively be back for paid subscribers only.

Don't miss out on these trade plans and intraday updates for as low as $15/month!

That is less than 30 cents a day! Don't miss out before prices go up!2/14 News Catalysts

2:00am est - UK CPI

9:30am est - Chicago Fed President Austan Goolsbee speaks

4:00pm est - Fed Vice Chair for Supervision Michael Barr speaks

For more information on news events, visit the Economic Calendar

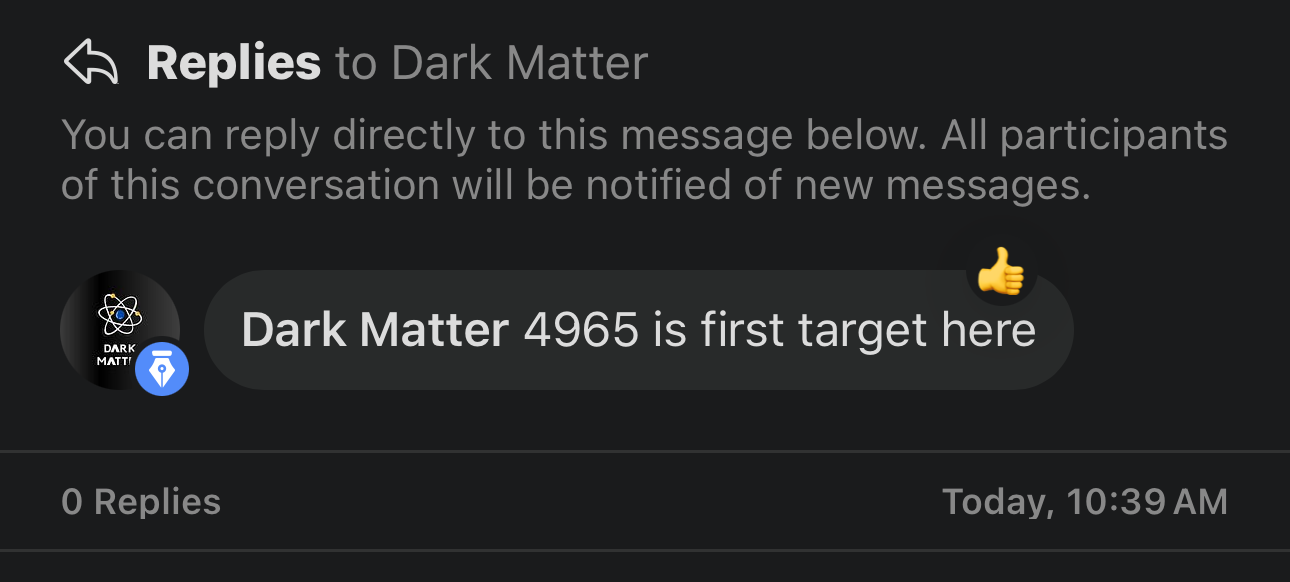

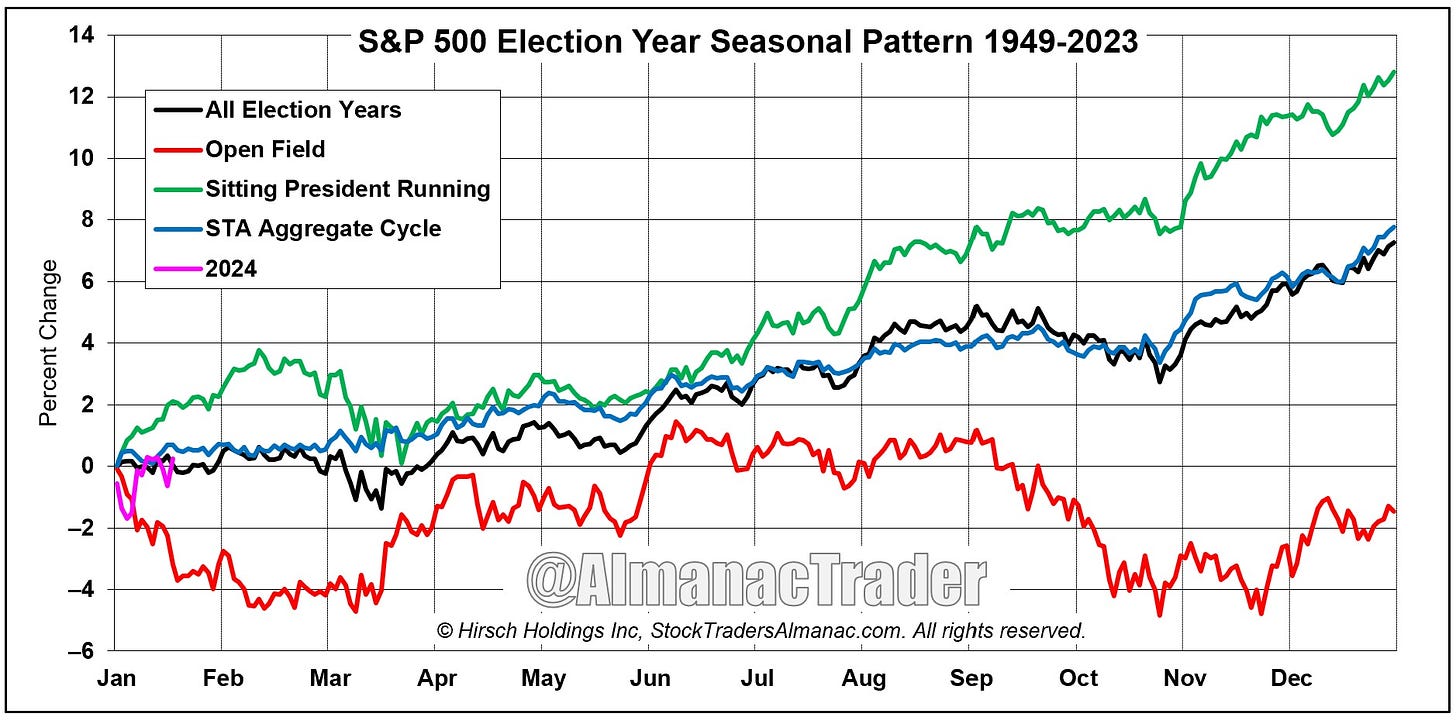

February’s trading session seasonality…

It tracks with the larger yearly season calendar during an election year.

Just a reminder for those not subscribed to our monthly or yearly paid subscription the newsletter will end here for you. You can still join us for the rest of the plan where we discuss key levels and entries to take and targets. Subscribe below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.