Market Recap

Hello traders. Between our analysis from yesterday’s trade plan and the updates shared in the chat room we called out the importance that 5030 was on the day and any bullish bias would be above this level to target 5050. Our high of the day came two points short at 5048, but of importance is the resistance that 5050 has become.

Is this an interim top? No clue. We could have a softer than expected CPI tomorrow premarket and see us rally right back towards this level. Would it break this time or are we finding some sellers interested in that level? Time will tell, but great analysis out of our trade plan and real time updates in the trading room today. Starting the week green with our trades and taking profits now gives us a bit of breathing room. We will need this as we are still in OPEX and could have more whipsaw action like today…

From the trade plan…

Above 5030 target 5040

If VIX continues going down then a breakout of 5040 targets 5050 then 5065

I think we are going to run into some resistance at 5050 and if we close a daily below it we could gap up the next day above it…

Danger thus lurks for the bulls as any signs of weakness below 4990-4980 could be the beginning of a larger selloff towards 4900. Tomorrow’s major catalyst is CPI and we should see a reduction in inflation bringing us towards 2.9%. Let’s jump into the trade plan…

For our free trial subscribers you have had a sneak peek into our daily trade plans and more importantly our intraday trading/chat room. Tomorrow the chat room will exclusively be back for paid subscribers only.

Don't miss out on these trade plans and intraday updates for as low as $15/month!

That is less than 30 cents a day! Don't miss out before prices go up!2/13 News Catalysts

2:00am est - UK Jobs Data and Hourly Earnings Index

8:30am est - USA CPI

For more information on news events, visit the Economic Calendar

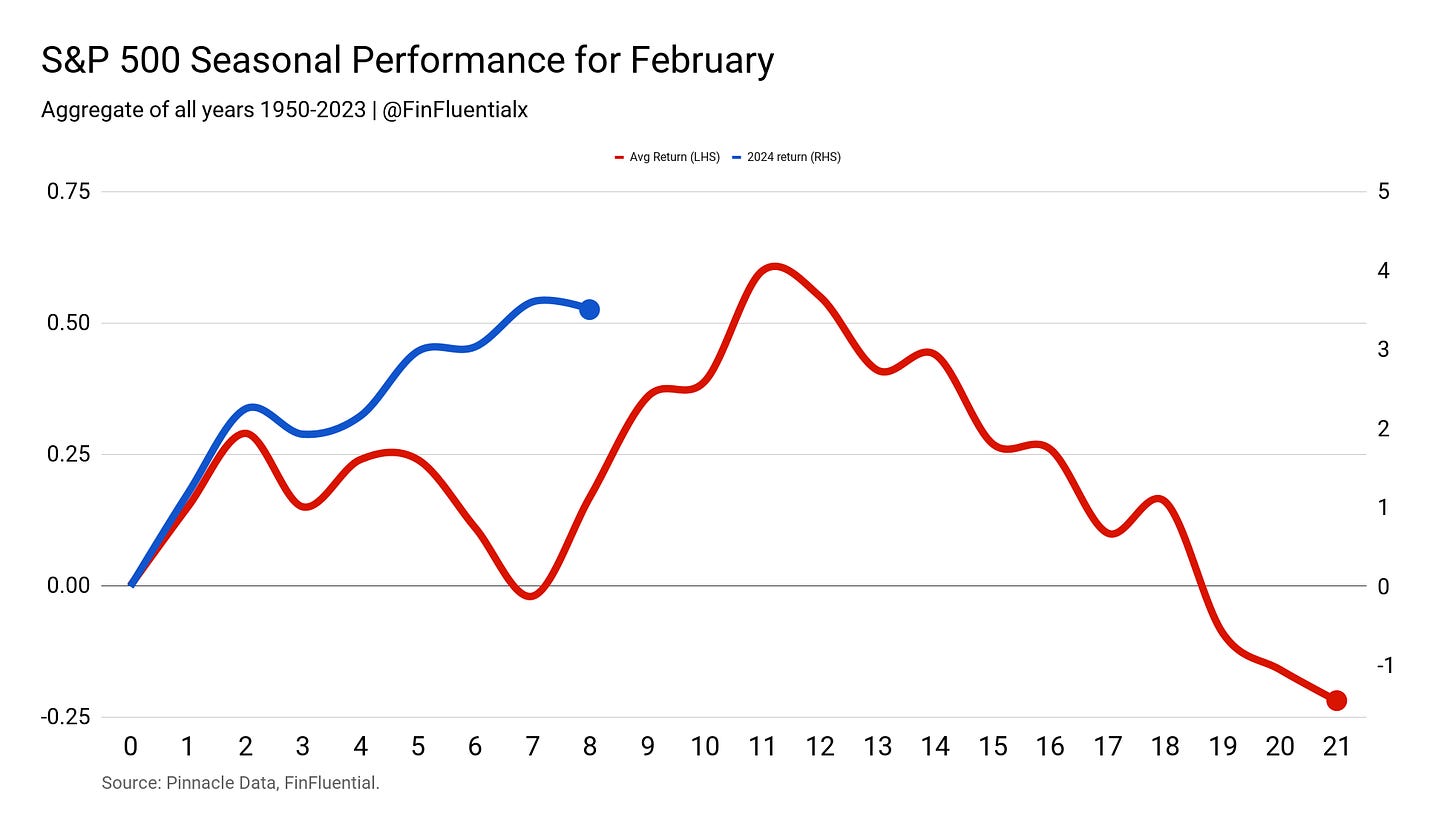

February’s trading session seasonality…

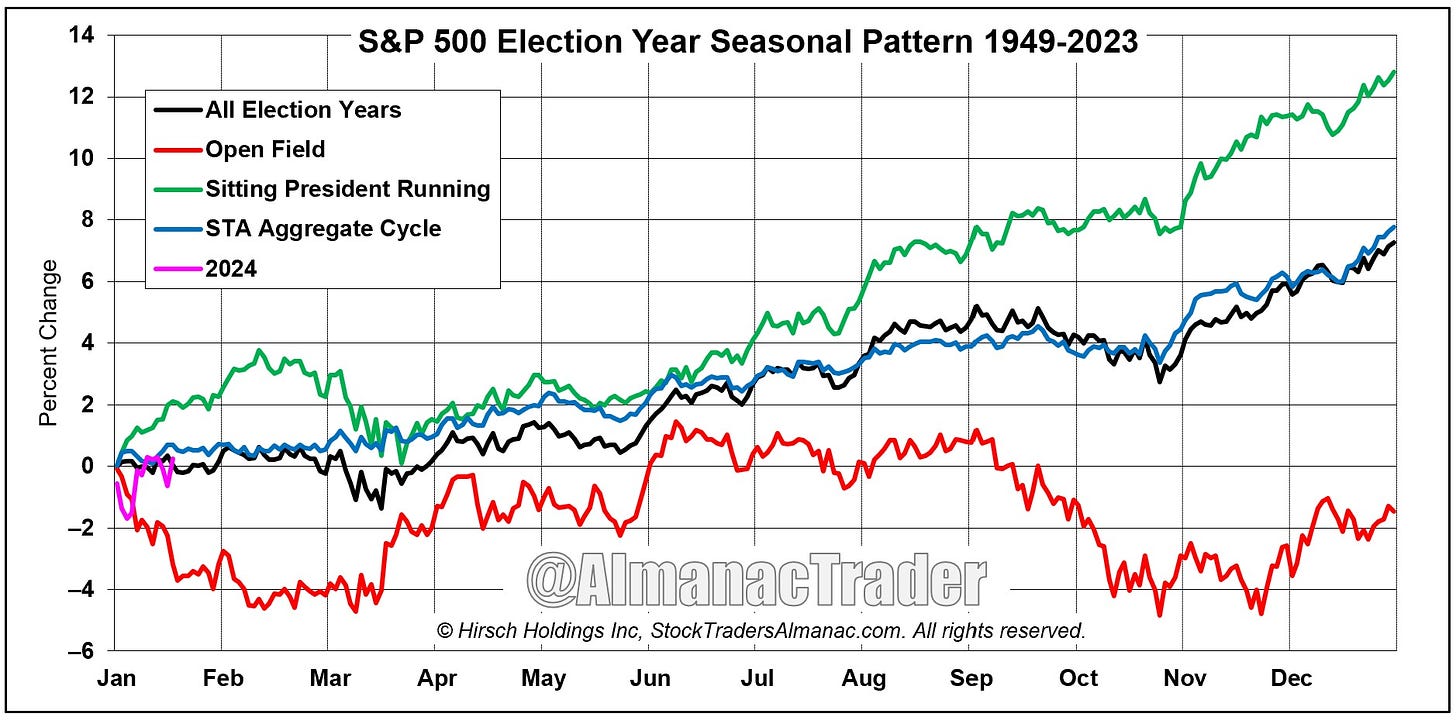

It tracks with the larger yearly season calendar during an election year.

Just a reminder for those not subscribed to our monthly or yearly paid subscription the newsletter will end here for you. You can still join us for the rest of the plan where we discuss key levels and entries to take and targets. Subscribe below. Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.