ES, SPX, SPY Weekly Market Insights: February 10th Edition

Welcome to another weekly overview where we provide you with key levels to enter and target

Hello fellow traders. Welcome to another weekly overview of the ES/SPX/SPY market.

As a reminder we have officially partnered with Volland - available at https://vol.land - providing our weekly and daily ES/SPX analysis to subscribers there.

Get our weekly and daily plans while also learning how to use dealer positions to have better trading success.

Remember use promo code DARKMATTER10 to get 10% off your first month of Volland.

2/10 ES Weekly Plan

Another week where we had a major selloff overnight Sunday into Monday's opening only for price to find a bottom and rally. Rally did it do going from 5923 to 6100spx and then doing what it has done for 3 weeks where on Friday it faced resistance at key levels and sold off with news midday from the Trump admin on tariffs pushing price down.

As we have discussed on multiple times - hanging on to trades without taking profits at key levels is risky and without much dealer put support below us price can go and go fast. For example, here is what we said on Friday where we called 6100spx to trade, but warned on a failed breakout and the importance of NOT losing 6075 - I bet you we see the 6000 part of that statement come true still. That prior sentence I had written prior to futures opening but we bottomed out at 5992spx or 6014es and had a failed breakdown of 6000 that triggered a trade all the way to our resistance at 6050spx...Wild start to the week and if you are a futures trader you are loving the action of the past 3 Sundays...

From Friday's Trade Plan...

6040-6045 is still supportive going into tomorrow. Now if you remove tomorrow's expiry and look at just next week if we pop above 6075 and then come back to lose it and then 6050-6040-6045 we could be in for a larger sell off that could target all the way down to 6000.

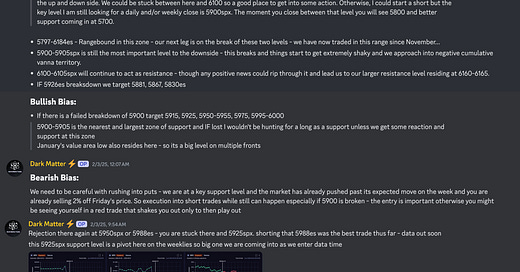

2/3 - Weekly Recap:

Before we kick into next week's trade plan let's review what we discussed last week.

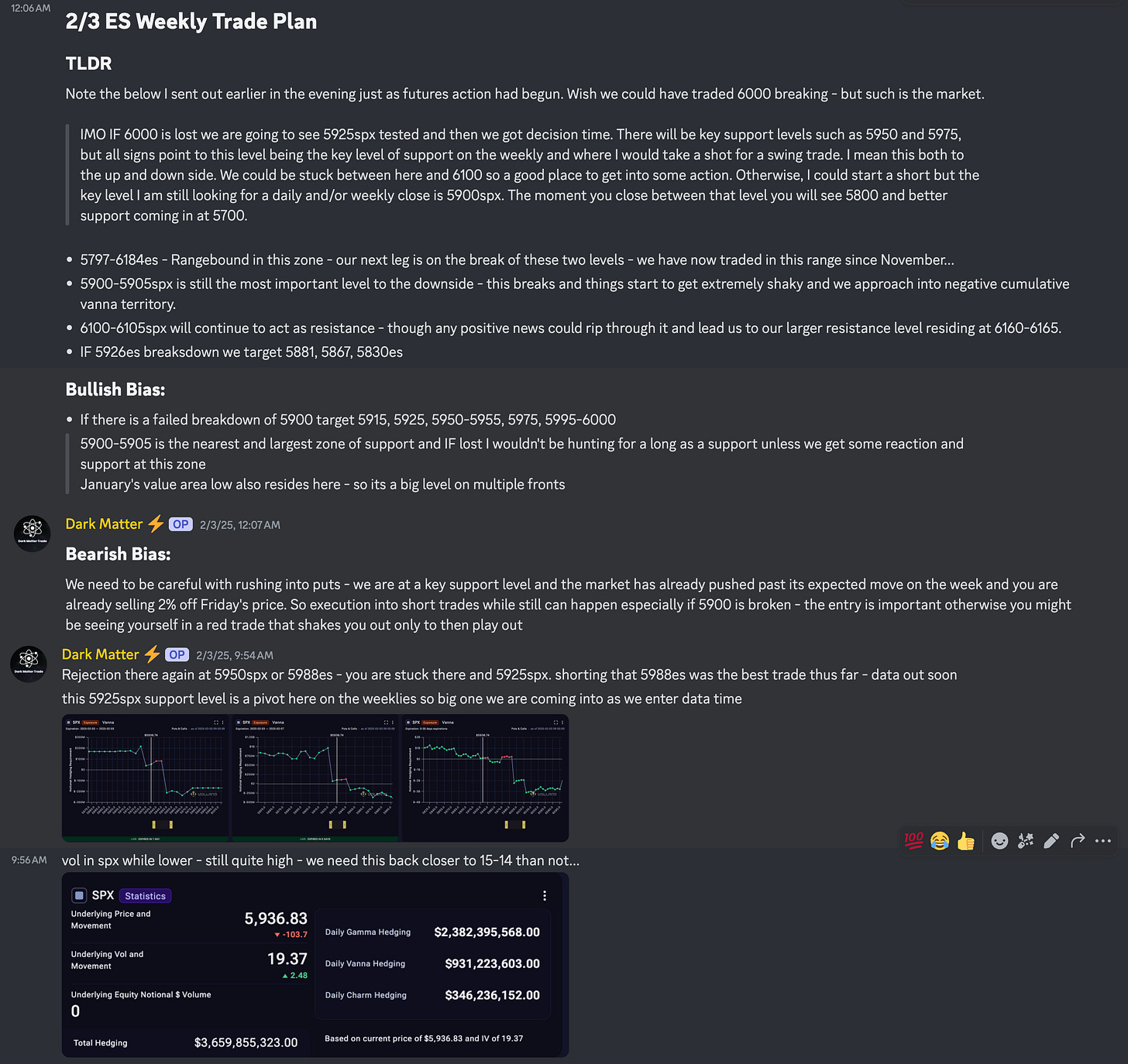

As we neared the market open and during our Market Moves show last Monday we said wait #paytiently and let the trade and data come. The opening of Monday was exactly that a bit wild and the market had to rebalance as we hit a low of 5910spx in futures action. As that rebalancing was occurring we opened near 5923spx on Monday and pushed up to 5960spx only to reject where we didn't called out prior to data coming out how important 5925spx was and that was an ideal entry point.

We held support at 5925spx and while the data wasn't the only saving grace we got news on deal making with the tariffs from Mexico and boy did we rise from 5925spx and push till we got to 6100spx where we said sellers would be present and did that show on Friday.

All-in-all another great week and analysis provided to you here in real time.

Market Moves with Volland

Don't forget to join Wiz and myself in our weekly installment of the "Market Moves with Volland." You can set a notification and join us live at 8:30am est on YouTube.

We will go through this upcoming week’s dealer positions, key levels, and how we plan to trade the week.

Biggest News Catalysts on the Week

The headlines this week are going to be OPEX, FED Chair Powell's testimony to the Senate Banking Committee and the House Financial Services Committee. We also have CPI, PPI, and retail sales data this week. It won't be a "vol-less" week that's for sure.

Mon - EU CPI, US Manufacturing PMI & Prices, FED Speakers

Tue - US Jolts Job Openings, FED Speakers

Wed - US ADP Non-Farm Employment Change, US Services PMI, FED Speakers

Thur - UK Monetary Policy, US Unemployment Claims, FED Speakers

Fri - US Non-Farm Employment Change, US Employment Rate, US Avg Hourly Earnings m/m, Consumer Sentiment & Inflation Expectations, FED Speaker

Source:

Earnings

While NVDA awaits there are some earnings this week to be on the lookout for such as HOOD, SMCI and COIN.

Weekly Options Expected Move

SPX’s weekly option expected move is ~97.70 points. That puts us at 6123.69 to the upside and 5928.29 to the downside.

Remember over 68% of the time price will resolve it self in this range by weeks end.

2/10 ES Weekly Trade Plan

TLDR:

We have already tested the lower ranges of the weekly support level - 6000 - and we have also tested a key resistance - 60..

To see the rest of this week’s ES Trade Plan and our daily plans - be sure to subscribe to Volland - available at https://vol.land - where we provide weekly and daily ES/SPX analysis and trade plans.

Get our weekly and daily plans while also learning how to use dealer positions to have better trading success.

Remember use promo code DARKMATTER10 to get 10% off first month of Volland.

My Trading Rules -

X Profile - https://x.com/DarkMatterTrade

YouTube Channel - https://www.youtube.com/channel/UC_6nM50Ebtg7iaylWZVFoLw

Disclaimer:

The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.