Weekly Market Overview

Bravo to the market for finally getting us out of that treacherous consolidation zone of 4545-4570. Boy those two weeks where we consolidated was just brutal. Happy to see from

’s trade plan on Friday that if we broke and held 4570 we were on our way to target 4600 and that is exactly what we got.For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

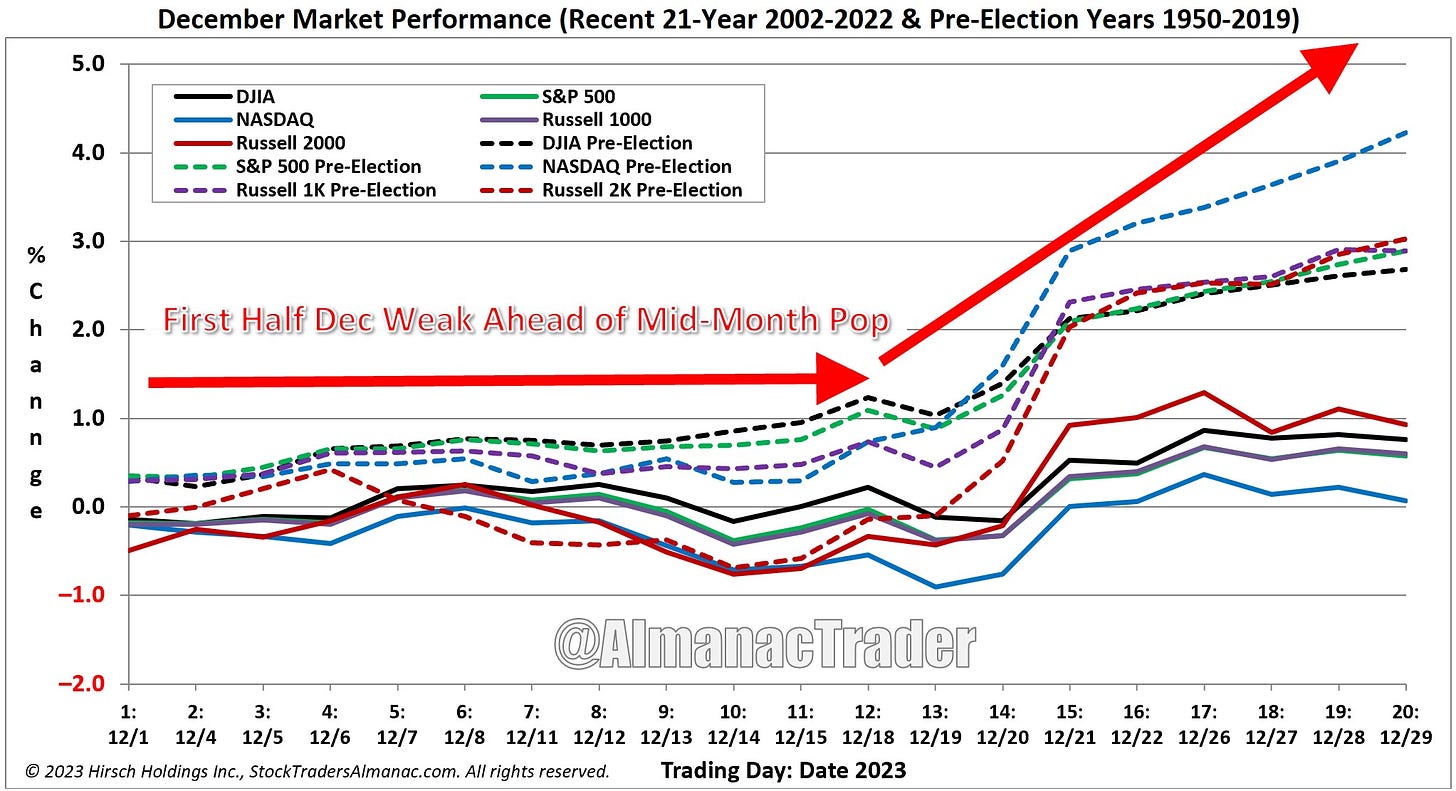

So where does that leave us now? From a seasonality standpoint there is typically a pullback going the next two weeks, where we then get some consolidation mid-month and then start our Santa rally into January - note end of December consolidation happens.

That selloff that happens between this week and early next week is very shallow - we are talking no greater than 1% and most times about 0.5% down.

As long time readers will know I have been bullish and even stated that we would test the 52 week highs back in late October and here we are. Will we see new all time highs? I am not here to predict, but should some key levels hold - which we outline below - over the next week to two weeks that means it could provide us with a great swing opportunity.

Not here to debate that so let’s jump into the trade plan and review our key levels.

News Catalysts

10:00am est - Factory Orders

For more information on news events, visit the Economic Calendar

12/4 SPX/SPY/ES Intraday Overview (TL;DR)

I think that the zone between 4600-4550 is chop. Not that we can’t find any great trades in this zone, but it will be critical that we only play breakouts or breakdowns or failed ones.

So first and foremost if you are a bull you want price to stay above…

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.