December 20, 2023 SPX, SPY, ES Trade Plan

Market Recap

Going to skip the recap for today, but going long at the open or after breaking 4755 was the key to success. My biggest callout here is I hope you all have avoided 0DTE’s. While they can return some insane returns during low volume/holiday weeks they tend to decay quite a bit if you rode out to the target at 4765. So be careful, try to stick to weeklies.

Alright let’s jump into the plan…

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

News Catalysts

10:00am est - CB Consumer Confidence

10:00am est - Existing Home Sales

12:00pm est - FOMC Member Goolsbee Speaks

For more information on news events, visit the Economic Calendar

12/20 - SPX/ES/SPY Trade Plan

Bullish bias:

If there is a failed break down of 4750 target 4775

Above 4780 target 4800

If VIX continues going down then a breakout of 4800 targets 4815

Bearish bias:

If there is a failed breakout of 4775 target 4765

Below 4765 target 4750

If VIX continues going up then a breakdown of 4750 targets 4725

As always keep an eye on Volland30 and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 52pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.01.

SPX - The Why Behind the Plan

Volume Profile & Trends

Let’s review our volume profiles…

From a quarterly volume profile on the weekly chart some key levels are seen.

4768 - Q4 VAH - still forming

4740 - 2021 VAH

4715 - Q4 2021 VAH

4687 - 2021 POC

4684 - Q4 2021 POC

4552 - Q4 POC - still forming

If we take a look at the daily chart and review the monthly volume profile we find the following levels…

4818 - January ‘22 VAH

4786 - January ‘22 POC - hasn’t been breached

4713 - December's VAH - still forming

4564 - December's POC - still forming

4546 - December’s VAL - still forming

Let’s now look at the 4hr chart and review what the weekly volume profile levels show.

4768 - Weekly High & 12/18 Weekly VAH (still forming)

4742 - 12/18 Weekly VAL - still forming

4719 - 12/11 Weekly POC - hasn’t been breached

4647 - 12/11 Weekly VAL

On the smaller timeframe and intraday let’s go to our 30min chart where we will put our session volume profile on. Our levels of importance are…

4768 - 12/19 VAH

4759 - 12/19 VAL

4740 - 12/18 POC - hasn’t been breached

4727 - 12/14 VAH

4724 - 12/15 VAH

4719 - 12/15 POC - hasn’t been breached

4716 - 12/15 VAL

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

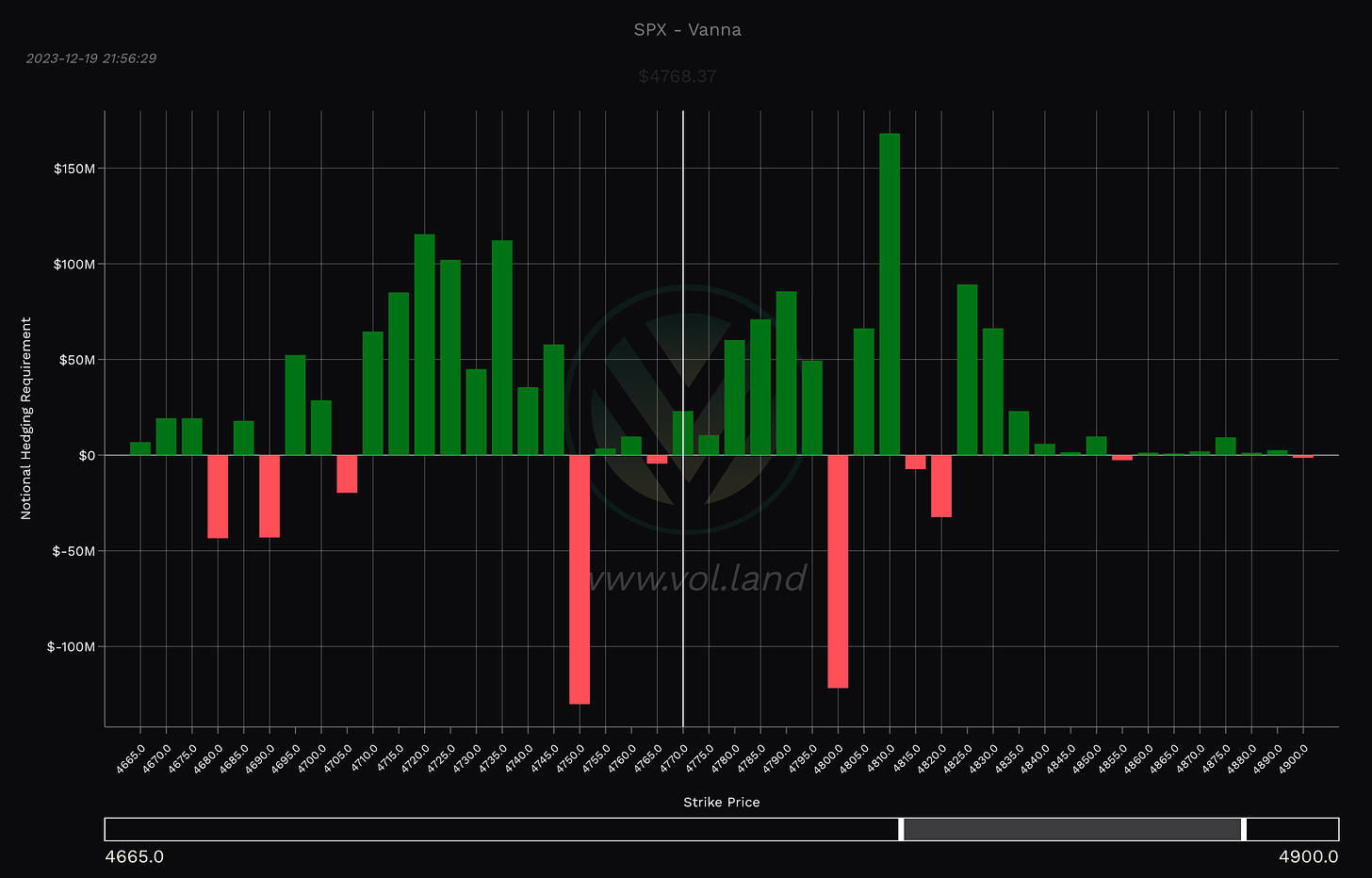

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4775-4780 - negative vanna

4800 - negative vanna

4815-4820 - negative vanna

4855 - negative vanna

4875 - negative vanna

Below Spot:

4765 - negative vanna

4750 - negative vanna

4735 - negative vanna

4720 - negative vanna

4705-4700 - negative vanna

4690 - negative vanna

Orderblocks (OB)

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4778-4797 - OB (1hr, 2hr chart)

4788 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4760-4756 - OB (30min chart)

4757 midline

4747-4740 - OB (30min, 1hr, 2hr chart)

4744 midline

4738-4731 - OB (30min chart)

4735 midline

4719-4704 - OB (1hr chart)

4712 midline

Key Levels

Above Spot:

4775-4780 - negative vanna

4786 - January ‘22 POC - hasn’t been breached

4778-4797 - OB (1hr, 2hr chart)

4788 midline

4800 - negative vanna

4815-4820 - negative vanna

4818 - January ‘22 VAH

4855 - negative vanna

Below Spot:

4765 - negative vanna

4760-4756 - OB (30min chart)

4757 midline

4759 - 12/19 VAL

4750 - negative vanna

4747-4740 - OB (30min, 1hr, 2hr chart)

4744 midline

4742 - 12/18 Weekly VAL - still forming

4740 - 12/18 POC - hasn’t been breached

4740 - 2021 VAH

4735 - negative vanna

4738-4731 - OB (30min chart)

4735 midline

4727 - 12/14 VAH

4724 - 12/15 VAH

4720 - negative vanna

4719-4704 - OB (1hr chart)

4712 midline

4719 - 12/11 Weekly POC - hasn’t been breached

4719 - 12/15 POC - hasn’t been breached

4716 - 12/15 VAL

4715 - Q4 2021 VAH

4713 - December's VAH - still forming

4705-4700 - negative vanna

Weekly Option Expected Move

SPX’s weekly option expected move is ~54.53 points. SPY’s expected move is ~5.61. That puts us at 4773.71 to the upside and 4664.65 to the downside. For SPY these levels are 474.98 and 463.76.

Remember over 68% of the time price will resolve it self in this range by weeks end.

TradingView Chart Access

For access to my chart laying out all of the above key levels please visit here.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.