Market Recap

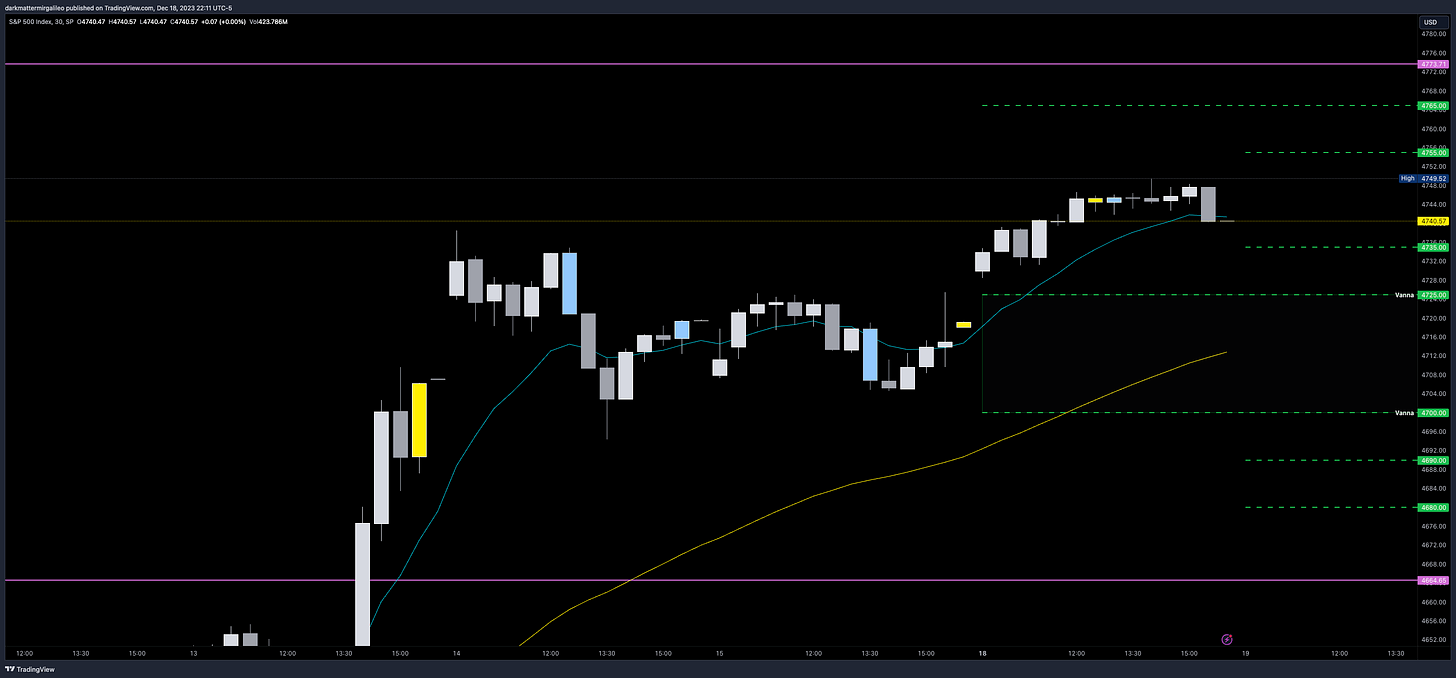

The market moved relatively fast overnight breaking our bullish pennant with a gap up at the open on the SPX - where price opened at 4730, finding a low of 4728, and then hitting our updated target we provided in our chat room this afternoon at 4750.

Our trade plan provided two trade ideas today…

Above 4730 target 4740

If there is a failed break down of 4740-4735 target 4760

Now trade idea 1 hit immediately as mentioned at the open. I didn’t take the trade at the open and instead let it play out, but what clicked immediately if it hasn’t for you is that if price comes back in this area then I want to be ready to pounce on it and define my risk to go long if I do enter a trade.

At around 10:45am est price started to trend back towards this area of support and after finding 3 candles on the 5min chart close above 4730 I missed this trade… Yes full honesty here I got busy missed this amazing trade and instead I waited for the next trade to go long at 4740 where we were facing some back and forth around this level.

After what felt like forever - we finally hit 4749 - and all my trades were closed. I also called for longs in ADBE near the lows within the chat room as well which I have closed as well.

Alright, enough of that recap. Let’s jump into the plan…

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

News Catalysts

10:00pm est - BoJ Interest Rate Decision

8:30am est - Canada CPI

8:30am est - Building Permits

8:30am est - Housing Starts

9:30am est - Richmond Fed President Thomas Barkin speaks

12:30pm est - Atlanta Fed President Raphael Bostic speaks

For more information on news events, visit the Economic Calendar

12/19 SPX/SPY/ES Intraday Overview (TL;DR)

4735-4745 - Ping pong zone - potentially where we start the session. Wouldn’t just jump in a trade in the middle of this zone. Wait to see how price reacts on the edges here. Could turn into a scalp like trade or buy with time in options to reduce exposure either way it goes.

Ok so what’s below 4735? Honestly, not a lot. You could scalp a quick 10 pts here to target 4725-4720, but anything else is just risky and adverse to chop or reversals. In other words buyer beware or shorter beware.

So what’s above? What is the bullish bias?

4755 - This is our first target - scalp 10 pts. I would not be surprised if we hit this level and sold back down to test 4735. It could be that kind of day where we are rangebound.

4765 - If we break and hold 4755 - I want some consolidation near 4755 so this means we could hit 4757 back down to 4750 as it consolidates.

Ideally, I want to see one of these opportunities occur:

A failed breakdown of 4735 - opportunity to go long

A failed breakdown of 4725 - opportunity to go long

A breakout of 4745 - opportunity to go long

A failed breakout of 4745 - opportunity to go short

Only in the first hour of trading otherwise see Volland data for updated dealer options flow

A breakout of 4755 - opportunity to go long

12/19 - SPX/ES/SPY Trade Plan

Bullish bias:

If there is a failed break down of 4735 target 4745

If there is a failed break down of 4725 target 4745

I am only looking at this trade in the first hour - otherwise see updated Volland dealer options flow

Above 4745 target 4755

If VIX continues going down then a breakout of 4755 targets 4765

Bearish bias:

If there is a failed breakout of 4745 target 4735

Below 4735 target 4725

High risk be careful for reversals and manage trade

As always keep an eye on Volland30 and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 53pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.01.

SPX - The Why Behind the Plan

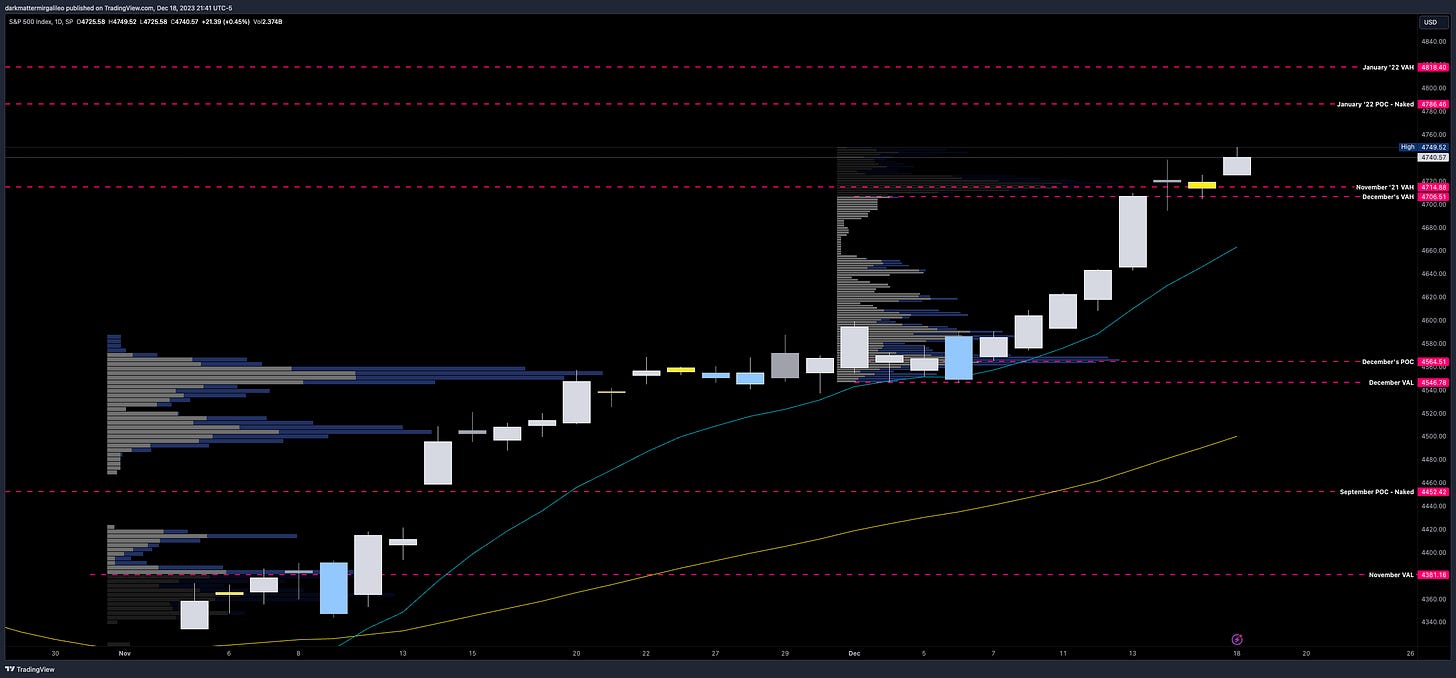

Volume Profile & Trends

Our pennant from yesterday’s trade plan came to fruition - with a gap up at the open we pushed price well above the pennant.

In one piece of good news for the bears is that we have a rising wedge pattern forming. This pattern typically indicates a bearish trend reversal. This indicates that momentum is starting to slow down. Does this mean full port into shorts? No. Does this mean a huge correction is coming? No. Is there a potential retracement coming? Quite possibly.

Let’s review our volume profiles…

From a quarterly volume profile on the weekly chart some key levels are seen.

4749 - Q4 VAH - still forming

4740 - 2021 VAH

4715 - Q4 2021 VAH

4687 - 2021 POC

4684 - Q4 2021 POC

4552 - Q4 POC - still forming

4450 - Q3 POC

If we take a look at the daily chart and review the monthly volume profile we find the following levels…

4818 - January ‘22 VAH

4786 - January ‘22 POC - hasn’t been breached

4714 - November '21 VAH

4706 - December's VAH - still forming

4564 - December's POC - still forming

4546 - December’s VAL - still forming

Let’s now look at the 4hr chart and review what the weekly volume profile levels show.

4749 - Weekly High

4748 - 12/18 Weekly VAH - still forming

4739 - 12/18 Weekly VAL - still forming

4719 - 12/11 Weekly POC

4647 - 12/11 Weekly VAL

4593 - Weekly Low

On the smaller timeframe and intraday let’s go to our 30min chart where we will put our session volume profile on. Our levels of importance are…

4747 - 12/18 VAH

4739 - 12/18 VAL

4727 - 12/14 VAH

4724 - 12/15 VAH

4716 - 12/15 VAL

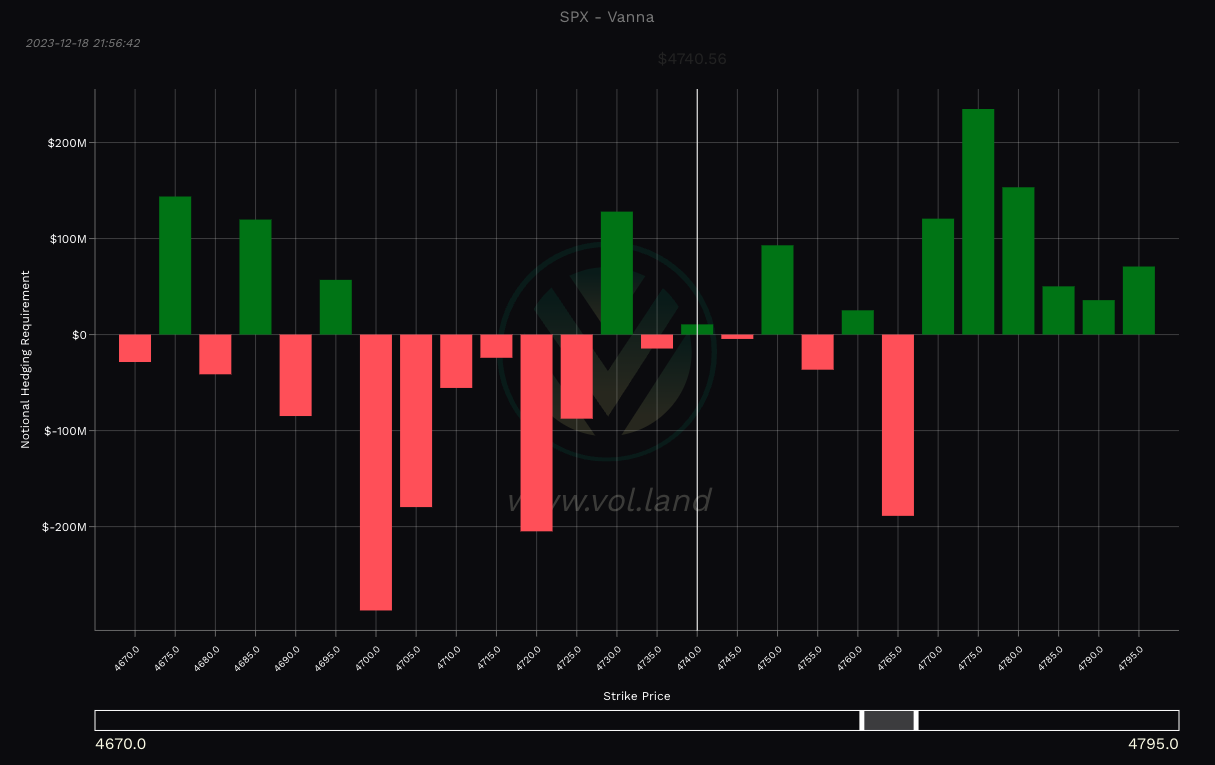

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4745 - negative vanna

4755 - negative vanna

4765 - negative vanna

4785-4790 - negative vanna

Below Spot:

4735 - negative vanna

4725-4700 - negative vanna

4690 - negative vanna

4680 - negative vanna

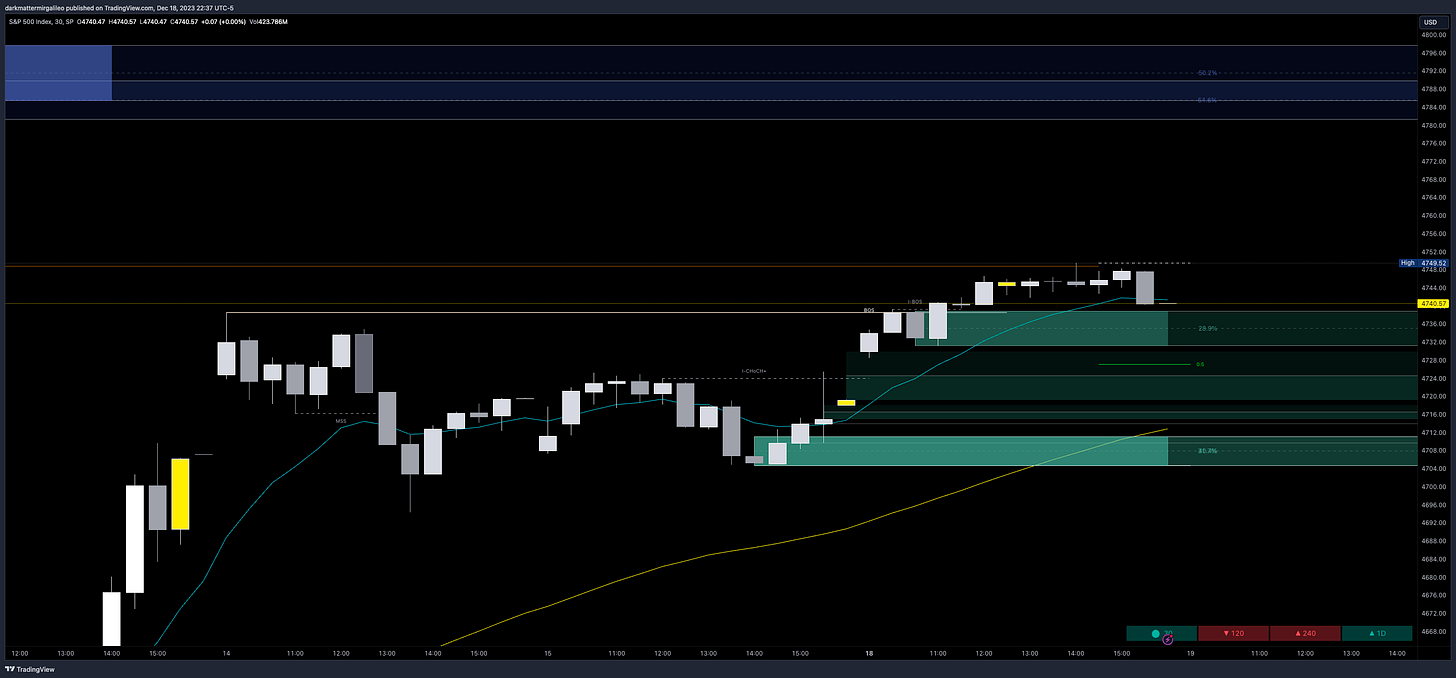

Orderblocks (OB)

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4745-4748 - OB (10min chart)

4747 midline

4778-4797 - OB (1hr, 2hr chart)

4788 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4738-4731 - OB (30min chart)

4735 midline

4719-4704 - OB (1hr chart)

4712 midline

4652-4643 - OB (2hr chart)

4648 midline

4631-4627 - OB (15min chart)

4629 midline

4591-4580 - OB (30min chart)

4586 midline

Key Levels

Above Spot:

4745 - negative vanna

4745-4748 - OB (10min chart)

4747 midline

4747 - 12/18 VAH

4748 - 12/18 Weekly VAH - still forming

4749 - Q4 VAH - still forming

4749 - Weekly High

4755 - negative vanna

4765 - negative vanna

4785-4790 - negative vanna

4786 - January ‘22 POC - hasn’t been breached

4778-4797 - OB (1hr, 2hr chart)

4788 midline

Below Spot:

4735 - negative vanna

4738-4731 - OB (30min chart)

4735 midline

4725-4700 - negative vanna

4727 - 12/14 VAH

4724 - 12/15 VAH

4719 - 12/11 Weekly POC

4719-4704 - OB (1hr chart)

4712 midline

4715 - Q4 2021 VAH

4716 - 12/15 VAL

4714 - November '21 VAH

4706 - December's VAH - still forming

4690 - negative vanna

4687 - 2021 POC

Weekly Option Expected Move

SPX’s weekly option expected move is ~54.53 points. SPY’s expected move is ~5.61. That puts us at 4773.71 to the upside and 4664.65 to the downside. For SPY these levels are 474.98 and 463.76.

Remember over 68% of the time price will resolve it self in this range by weeks end.

TradingView Chart Access

For access to my chart laying out all of the above key levels please visit here.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.