Market Recap

Today wasn’t easy especially with some last minute updates to the Volland platform that played with my mindset a bit - which is never good in trading.

To the plan - it held well where we discussed the following trade ideas…

If there is a failed breakout of 4730-4740 target 4715

If VIX continues going up then a breakdown of 4715 targets 4705

The best trade of the day was the first one - waiting for price to get back into the 4730-4740 zone and then shorting it. Twice did this trade play out and on the second time we had a deeper selloff into 4695 where SPX then found support and bounced from it.

We have a news heavy day so let’s jump into the trade plan.

For those who haven’t subscribed this is a great opportunity to subscribe.

For as little as $15/month we provide daily trade plans for intraday traders and also provide great educational content.

News Catalysts

Overnight - EUR Manufacturing PMI and Services PMI - France, Germany, UK

8:30am est - Empire State Manufacturing Index

9:15am est - Industrial Production m/m

9:45am est - Flash Manufacturing PMI

9:45am est - Flash Services PMI

12:25pm est - BOC Gov Macklem Speaks

For more information on news events, visit the Economic Calendar

12/15 SPX/SPY/ES Intraday Overview (TL;DR)

We have OPEX expiration - while I think we will have some great opportunities to trade I think price is going to be contained between a couple of key levels. I am also looking to see if we get a breakout of our pennant or whether it gets invalidated and we trigger a short play.

4725-4730 is no mans land. If price comes into this zone I would wait to play a failed breakout of this level or wait for a breakout of it and it must hold to continue further up. This was the level where price had a difficult time getting through in Thursday’s session.

So if I am bullish what’s above that zone?

4740-4745 - this is the next level/zone that the bulls will target. This area does have resistance so if we do see price get here I would take all profits and reassess from there as the better trade comes…

4765 - if we can break past 4745 with volume and with VIX continuing downward we will then target this level. There is a chance we overshoot to…

4775-4780 - in order to hit this level we would really need a catalyst to get us here and volume to push us up.

What if I am bearish?

You can’t let price get above 4730. Must protect 4725-4730 zone and if you do so the bears will be rewarded with a move back to 4715 where we do have some support. Now if we break this level we will then target 4705 and after that 4690.

12/15 - SPX/ES/SPY Trade Plan

Bullish bias:

If there is a failed break down of 4705 target 4715

Above 4730 target 4740

If VIX continues going down then a breakout of 4745 targets 4765

A breakout of 4765 targets 4775-4780

Bearish bias:

If there is a failed breakout of 4725-4730 target 4715

Below 4715 target 4705

If VIX continues going up then a breakdown of 4705 targets 4690

As always keep an eye on Volland30 and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 55pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.01.

SPX - The Why Behind the Plan

Volume Profile & Trends

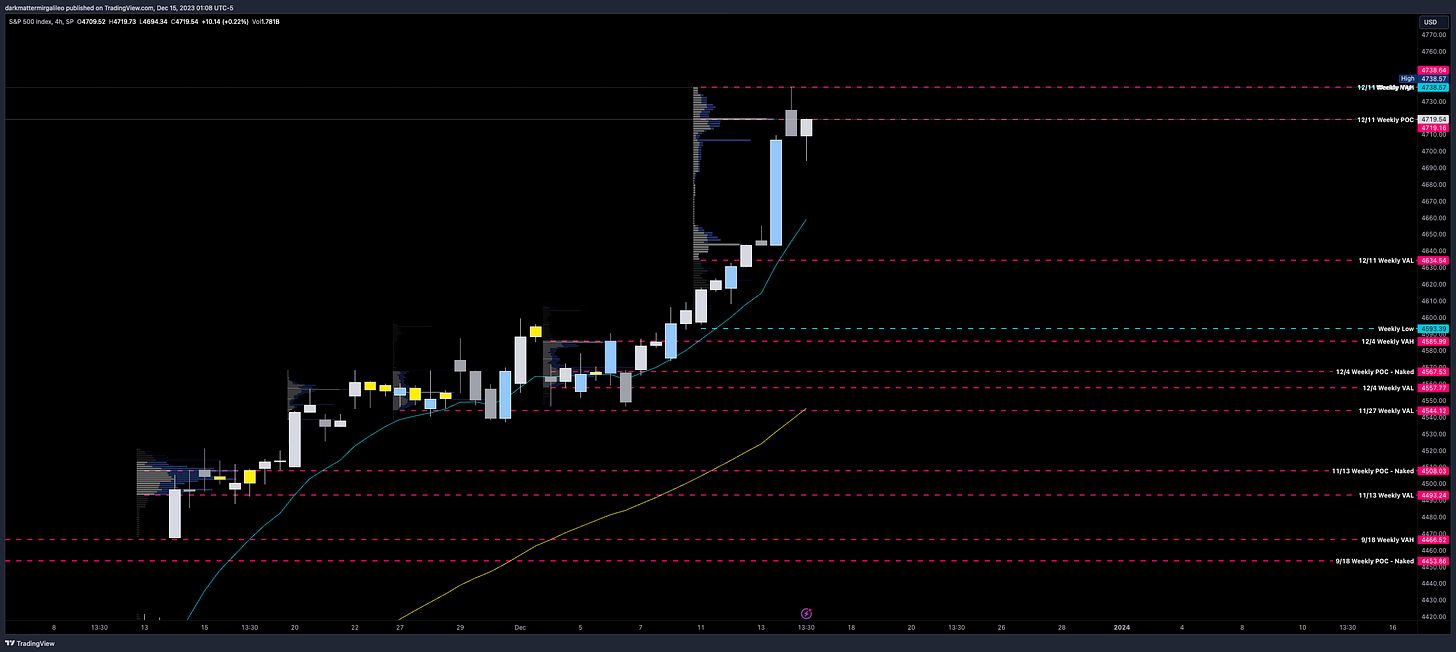

All eyes on this bullish triangle - coud call it a bullish pennant even - but will it play out or be invalidated? You know what to do if we break and hold either way though…

Let’s review our volume profiles…

From a quarterly volume profile on the weekly chart some key levels are seen.

4738 - Q4 VAH - still forming

4715 - Q4 2021 VAH

4684 - Q4 2021 POC

4551 - Q4 POC - still forming

4545 - Q3 VAH

4450 - Q3 POC

If we take a look at the daily chart and review the monthly volume profile we find the following levels…

4818 - January ‘22 VAH

4786 - January ‘22 POC - hasn’t been breached

4714 - November '21 VAH

4627 - December's VAH - still forming

4564 - December's POC - still forming

4546 - December’s VAL - still forming

4452 - September’s POC - hasn’t been breached

Let’s now look at the 4hr chart and review what the weekly volume profile levels show.

4738 - Weekly High & 12/11 Weekly VAH

4719 - 12/11 Weekly POC

4634 - 12/11 Weekly VAL - still forming

4593 - Weekly Low

On the smaller timeframe and intraday let’s go to our 30min chart where we will put our session volume profile on. Our levels of importance are…

4727 - 12/14 VAH

4712 - 12/14 VAL

4651 - 12/13 VAL

4628 - 12/12 VAL

4607 - 12/11 VAL

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4725-4730 - negative vanna

4740-4745 - negative vanna

4765 - negative vanna

4775-4780 - negative vanna

Below Spot:

4715 - negative vanna

4705 - negative vanna

4690 - negative vanna

4680-4670 - negative vanna

4650-4635 - negative vanna

4625-4620 - negative vanna

4600 - negative vanna

Orderblocks (OB)

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4726-4733 - OB (30min chart)

4730 midline

4737-4748 - OB (15min chart)

4743 midline

4778-4797 - OB (1hr, 2hr chart)

4788 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4652-4643 - OB (2hr chart)

4648 midline

4631-4627 - OB (15min chart)

4629 midline

4591-4580 - OB (30min chart)

4586 midline

4571-4565 - OB (15min chart)

4568 midline

4568-4546 - OB (1D chart)

4557 midline

4554-4525 - OB (4hr chart)

4536 midline

4554-4541 - OB (30m chart)

4548 midline

Key Levels

Above Spot:

4725-4730 - negative vanna

4726-4733 - OB (30min chart)

4730 midline

4727 - 12/14 VAH

4740-4745 - negative vanna

4738 - Weekly High & 12/11 Weekly VAH

4738 - Q4 VAH - still forming

4737-4748 - OB (15min chart)

4743 midline

4765 - negative vanna

4775-4780 - negative vanna

4786 - January ‘22 POC - hasn’t been breached

4778-4797 - OB (1hr, 2hr chart)

4788 midline

Below Spot:

4715 - negative vanna

4715 - Q4 2021 VAH

4714 - November '21 VAH

4712 - 12/14 VAL

4705 - negative vanna

4690 - negative vanna

4680-4670 - negative vanna

4684 - Q4 2021 POC

4650-4635 - negative vanna

4652-4643 - OB (2hr chart)

4648 midline

4651 - 12/13 VAL

4634 - 12/11 Weekly VAL - still forming

4625-4620 - negative vanna

4631-4627 - OB (15min chart)

4629 midline

4628 - 12/12 VAL

4627 - December's VAH - still forming

4600 - negative vanna

4593 - Weekly Low

Weekly Option Expected Move

SPX’s weekly option expected move is ~64.33 points. SPY’s expected move is ~6.99. That puts us at 4668.69 to the upside and 4540.03 to the downside. For SPY these levels are 467.19 and 453.21.

Remember over 68% of the time price will resolve it self in this range by weeks end.

TradingView Chart Access

For access to my chart laying out all of the above key levels please visit here.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.