8/7 Trading Session Review

What a difference of activity as overnight the market pushed up to provide a gap up on the SPX. The market opened at 4497, pushing up towards 4507 before selling back off near the low of the day at 4491. This is where SPX found support taking it as high as 4510 and then selling off.

Overall on a day like today I am avoiding trades on SPX. My criteria and thinking is as follows:

Are we opening in the middle of a move if we didn’t trade the overnight session?

Yes we did open today’s session in the middle of a move and I mentioned to be careful in this range or with a bullish outlook. Additionally, I wanted to see updated data via Volland or if any orderblocks were mitigated or built as we made the move up

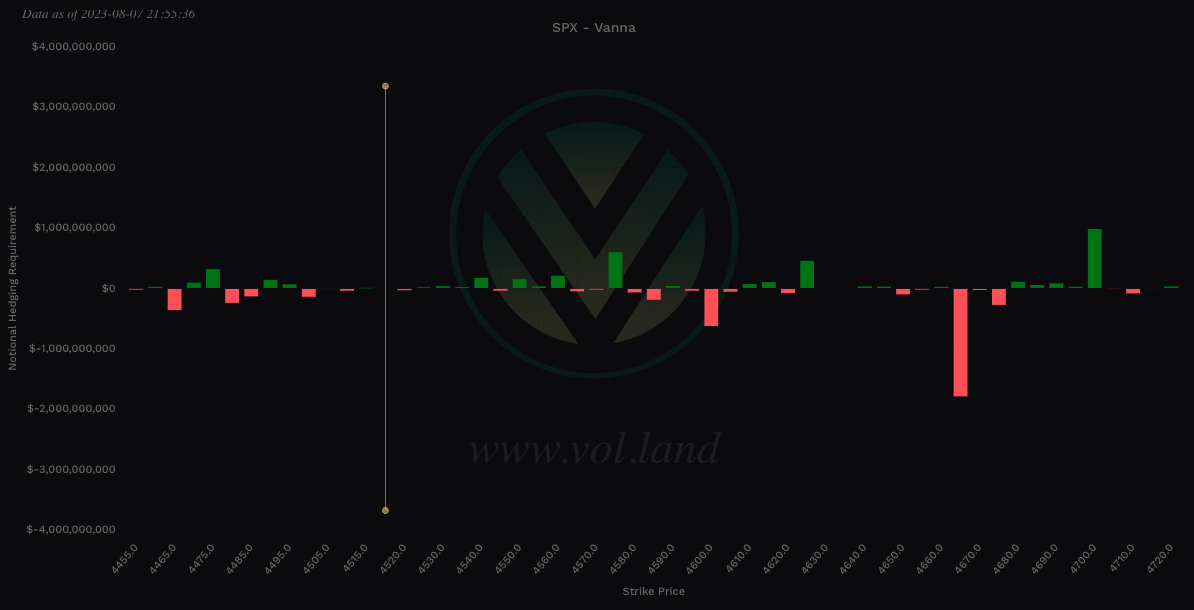

Vanna data looked choppy above 4490 and thus even if we had a bullish day we knew this area would be choppy and have traps. That’s exactly that we got and it wasn’t until later in the afternoon that we finally broke 4510 targeting 4518

Updated data in Volland shifted from a bearish view to a more bullish view on the intraday Greeks

It didn’t show much upside and looking at other mega cap tickers going in the opposite direction didn’t feel the trade was safe

Low volume again. Another day with minimal volume will typically mean we have smaller trends and ranges

Looking at just 2/3 above these are conditions with no great R/R and opportunity. Sure you could scalp, but that is not my trading style. By scalping we mean a few ticks here and there. While I know I can’t take every trade for 30pts I at least want the conditions around the trade I do take to be as clear of a path as one can get. Had you traded even weekly options today you had decay to deal with and if you had taken 0DTE’s yikes.

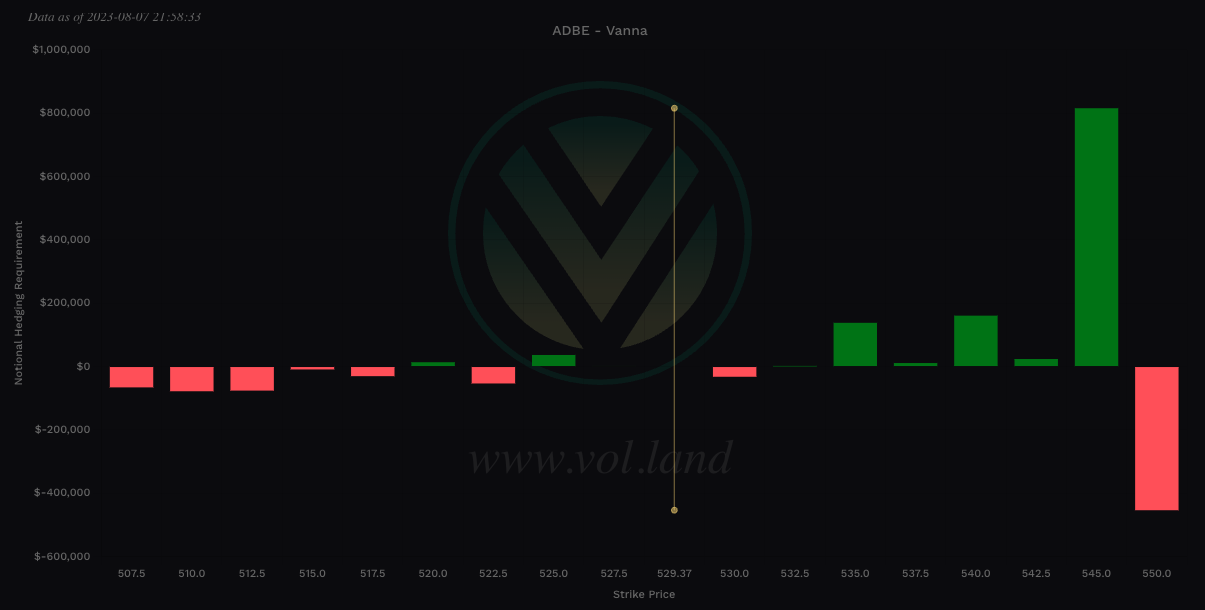

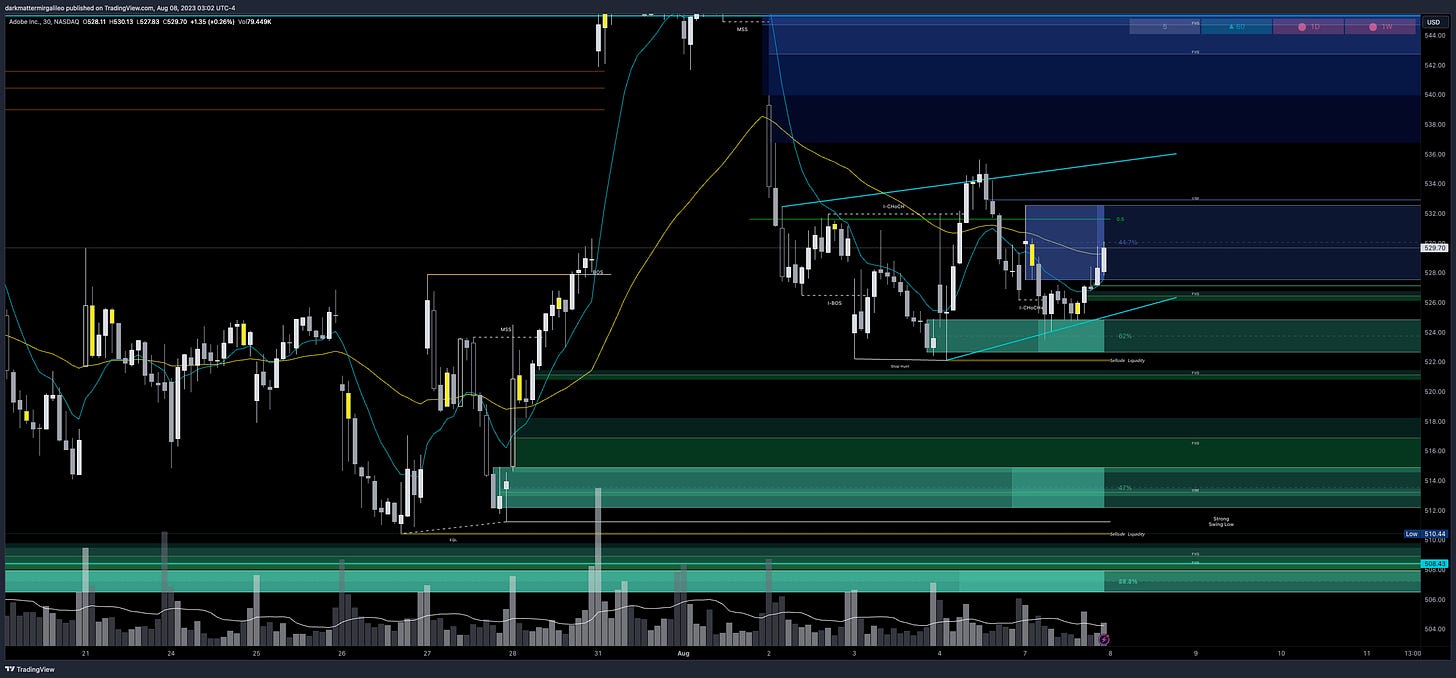

In good news we had two trade ideas on ADBE nail, a failed breakout of 530 to target 525 and a failed breakdown of 525 to target 530. Nice technical ping pong action on this ticker.

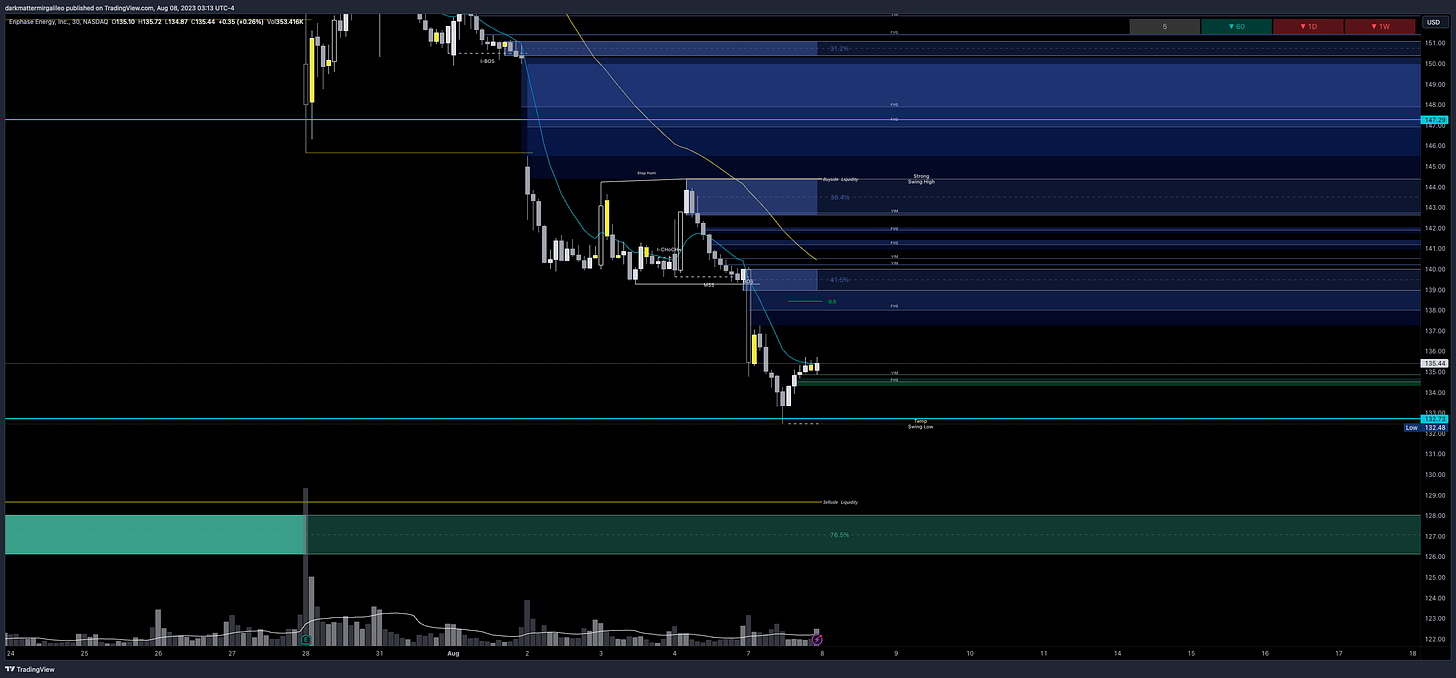

ENPH was another good trade where we said below 140 target 135 and we got a low of 132 on the day. This one moved fast and congrats if you took it.

On days where we have mixed signals on SPX I look to other tickers for trade ideas.

With that let’s jump into the trade plan.

SPX/SPY/ES Overview (TL;DR)

The key level for tomorrow is 4500. If the bears can break this level target 4480. Below it 4465.

For the bulls they need to hold 4500 to push back towards 4520. If they break that then 4545.

As we do have a large gap down in ES - as of writing 4521 - we want to find key levels for breakdowns or breakouts or failures of them.

ADBE

530 is the big level. If we gap down I want to target 522.5. Should this break down than 517.5 trades. Above 530 comes 535 then 540.

Below 530 target 523

Above 530 target 535

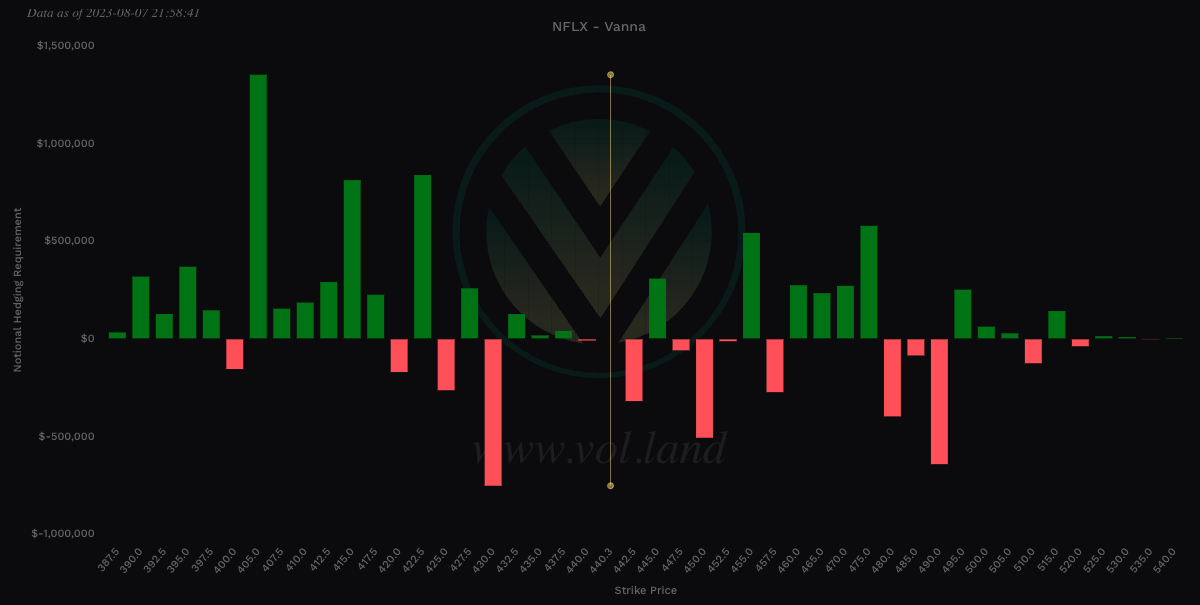

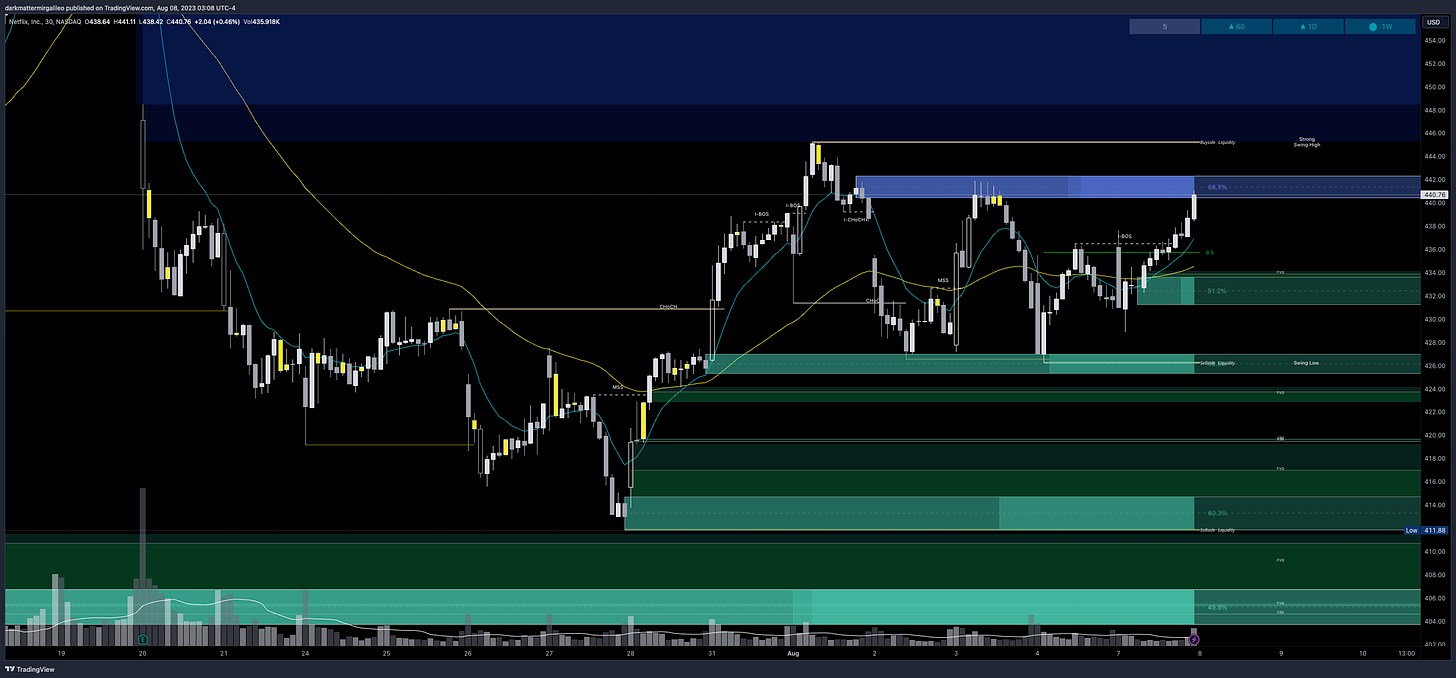

NFLX

I think this one got a bit of a rally as DIS went up. At a key point and a good trade opportunity.

Below 440 sends it to 430. Above 442.5 targets 447.5 or 450 with higher volume.

Below 440 target 430

Above 442.5 target 450

If there is a failed breakout of 442.5 target 430

ENPH

Above 136 and we see 138, but don’t hold recapture 136 or hold it we see 132 followed by 128. I don’t like playing any upside plays on this ticker yet…

Below 136 target 132

Above 132 target 128

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

8:15am est - FOMC Member Harker Speaks

For more information on news events, visit the Economic Calendar

8/8 - SPX/ES/SPY Trade Plan

Bullish bias:

Above 4520 target 4545

If there is a failed breakdown of 4500 target 4520

Bearish bias:

Below 4500 target 4480

If there is a breakdown of 4480 target 4465

If there is a failed breakout of 4520 target 4500

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 20pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4520 - negative vanna - minor

4523-4536 - OB (1hr chart)

4529 midline

4534-4540 - OB (30min chart)

4537 midline

4534-4538 - 452.49-452.14 - $15.81

4545 - negative vanna

4565 - negative vanna

4554-4567 - 455.41-454.08 - $19B

4580-4585 - negative vanna

4572-4582 - OB (2hr, 4hr chart)

4577 midline

4577-4590 - 457.64-456.43 - $12.26B

Below Spot:

4510-4505 - negative vanna - minor

4500 - negative vanna

4522-4503 - 450.89-449.03 - $23.8B

4480 - negative vanna

4481-4465 - OB (1hr & 2hr chart)

4474 midline

4479-4471 - 446.65-445.79 - $8.32B

4465 - negative vanna

4453-4444 - 444.02-443.15 - $8.93B

4425-4416 - OB (1hr chart)

4421 midline

Dark Pool Levels

Above Spot:

4534-4538 - 452.49-452.14 - $15.81

4554-4567 - 455.41-454.08 - $19B

4577-4590 - 457.64-456.43 - $12.26B

Below Spot:

4522-4503 - 450.89-449.03 - $23.8B

4479-4471 - 446.65-445.79 - $8.32B

4453-4444 - 444.02-443.15 - $8.93B

4438 - 442.52 - 6.46B

4410-4397 - 439.74-438.47 - $15.96B

I get my dark pool levels from Quant Data.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break. I use Sonarlab’s indicator on Tradingview to plot these.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4523-4536 - OB (1hr chart)

4529 midline

4534-4540 - OB (30min chart)

4537 midline

4572-4582 - OB (2hr, 4hr chart)

4577 midline

4638-4660 - FVG (4hr chart)

4652-4665 - OB (1hr, 2hr chart)

4658 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4481-4465 - OB (1hr & 2hr chart)

4474 midline

4425-4416 - OB (1hr chart)

4421 midline

4408-4399 - OB (2hr chart)

4404 midline

4393-4380 - OB (1hr, 2hr chart)

4387 midline

4344-4328 - OB (2hr chart)

4336 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~77.87 points. SPY’s expected move is ~7.86. That puts us at 4555.89 to the upside and 4400.15 to the downside. For SPY these levels are 454.67 and 438.95.

Remember over 68% of the time price will resolve it self in this range by weeks end.

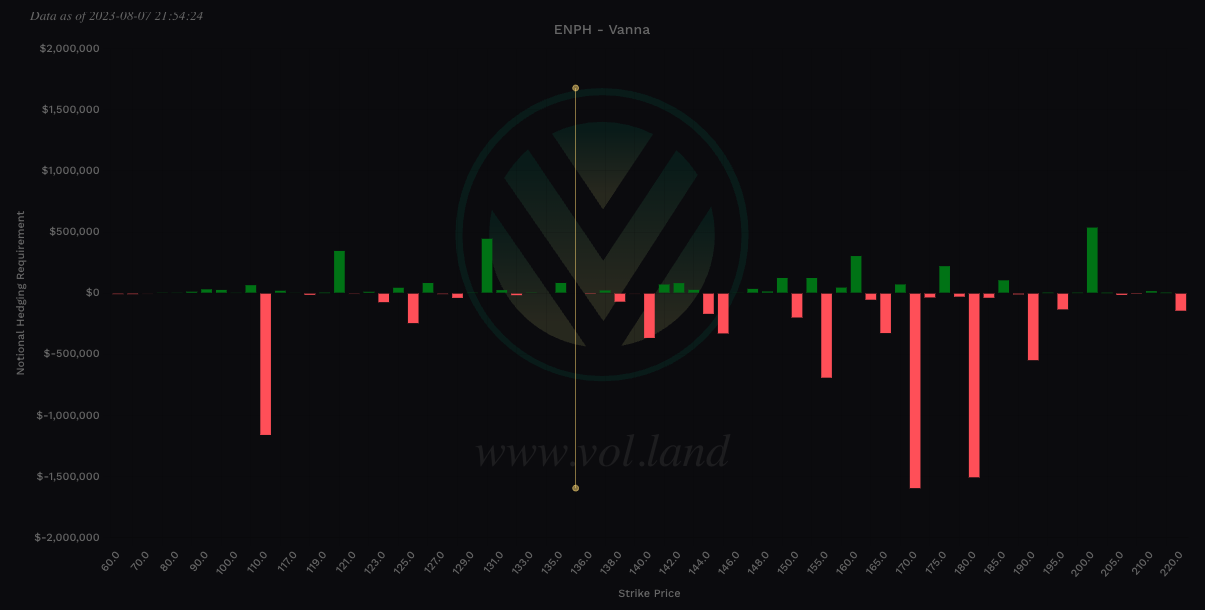

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4520 - negative vanna - minor

4545 - negative vanna

4565 - negative vanna

4580-4585 - negative vanna

Below Spot:

4510-4505 - negative vanna - minor

4500 - negative vanna

4485 - negative vanna - minor

4480 - negative vanna

4465 - negative vanna

Charm

Remember if IV is not expanding Charm will start to overtake Vanna especially 0DTE as it comes closer to expiration.

For all expiry’s, Charm total notional value is bullish - negative is bullish and positive bearish - take the total of the far left and far right values. This is a longer term view of the market and suggests we find key dips to buy to long.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.