Last Trading Session Recap

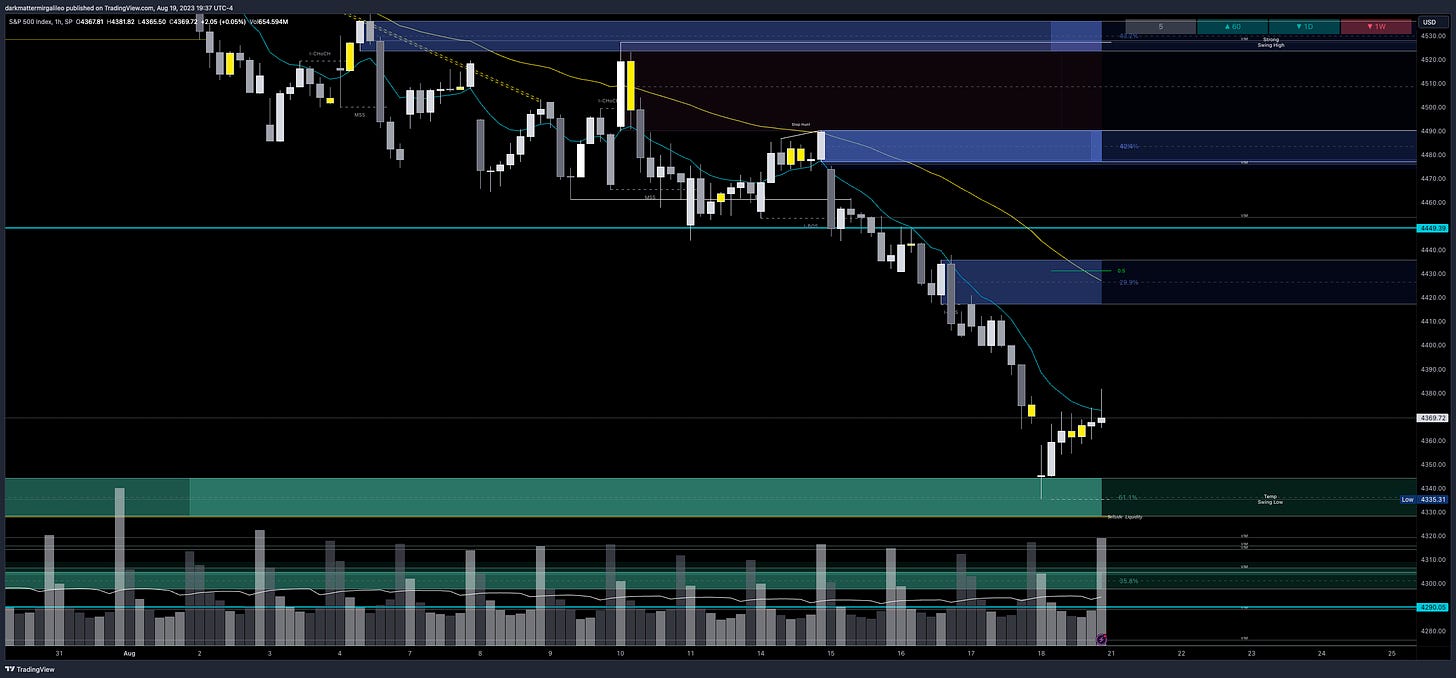

We opened with a gap down near our key target level of 4330 and a major orderblock where I cautioned any trades/puts below this level.

This is exactly what we got where SPX found footing at 4335 and took off towards 4370 and then 4380. The move down occurred overnight and as I mentioned any bullish bias needed to come out of failed breakdowns.

This is a major week in terms of volatility. So expect a bit of what we got last week, but could be more explosive as the end of the week we have Jackson Hole and Powell speaking and prior to that earlier in the week we will have key data on PMI.

Let’s talk about some key zones for next week:

4380-4385 is now an important zone for continuation above

4378 was a naked POC until it was breached last week

4384 is also where we had a change of character breaking a bullish trend

We have also formed $27B of dark pool prints in this area

4328-4345 - this was the area of Friday’s low where we bounced from

It also has about $12B in dark pool print

A key orderblock on the 4hr timechart

This is the zone the bears want to attack and weaken for more downside

With that let’s jump into the trade plan.

SPX/SPY/ES Intraday Overview (TL;DR)

For the bears if they want continuation of last week’s selloff they need price below 4360 targeting 4345 then 4325.

For the bulls they want price above 4380-85 targeting 4395 then 4410.

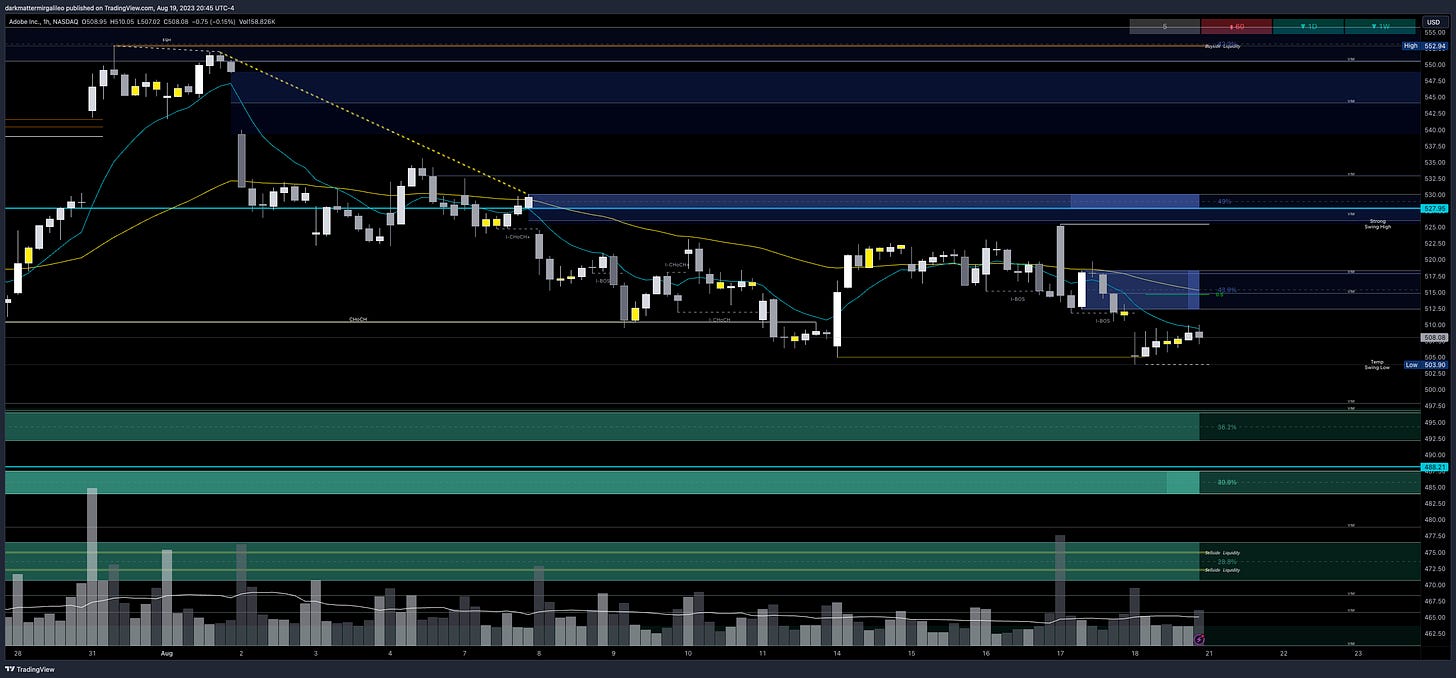

ADBE

510-515 is a tough zone for the bulls where as 500-505 continues to be troublesome for the bears.

Any push up into 510 or 515 could be met with resistance targeting 500 then 495. Let’s see where we open Monday.

Below 510 target 500

If there is a failed breakout of 515 target 505

If there is a failed breakdown of 500 target 510

ENPH

This ticker really needs to overtake that 131-132 level. If it rejects then 125 comes. For the bulls they are not out of the clear at 132 as it faces more resistance at 134-135. Break above 135 and there is more clarity and runway.

If there is a failed breakout of 131-132 target 125

If there is a breakout of 135 target 140 (not weekly expiry)

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

No news catalyst on the day…

This coming week though starting on Tuesday we have existing Home Sales, a slew of FOMC Members speaking, then on Wednesday we have Flash Manufacturing and Services PMI, Thursday is Unemployment Claims and the start of the Jackson Hole Symposium, and Friday is a big one with FED Members speaking including Powel and pre-market we have Consumer Sentiment and Inflation Expectations.

For more information on news events, visit the Economic Calendar

8/21 - SPX/ES/SPY Trade Plan

Bullish bias:

Above 4380 target 4395

If there is a breakout of 4395 target 4410

If there is a failed breakdown of 4360 target 4380

Bearish bias:

Below 4360 target 4345

If there is a failed breakout of 4380 target 4360

If there is a breakdown of 4345 target 4325

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 14pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4380 - negative vanna

4375-4384 - 436.20-437.18 - $27.82B

4395 - negative vanna

4405-4450 - negative vanna

4404-4411 - OB (30min chart)

4408 midline

4393-4410 - 438.06-439.72 - $25.04B

4425 - negative vanna

4417-4435 - OB (1hr chart)

4426 midline

4450 - negative vanna

4438-4447 - OB (30min chart)

4443 midline

4438-4453 - 442.52-444.02 - $18.79B

Below Spot:

4365-60 - negative vanna

4345 - negative vanna

4345-4328 - OB (1hr, 2hr, 4hr chart)

4336 midline

4349-4344 - 433.65-433.19 - $12.14B

4325-4320 - negative vanna

4305 - negative vanna

4304-4297 - OB (1hr chart)

4301 midline

4325-4292 - 431.26-427.92 - $18.46B

4290 - negative vanna

4280 - negative vanna

4276-4263 - OB (1hr, 2hr, 4hr chart)

4270 midline

Dark Pool Levels

We had over $5B added in dark pool prints at 4376 (436.30).

Above Spot:

4375-4384 - 436.20-437.18 - $27.82B

4393-4410 - 438.06-439.72 - $25.04B

4438-4453 - 442.52-444.02 - $18.79B

4467-4470 - 445.67-446.66 - $14.4B

4503-4522 - 449.03-450.89 - $24.68B

4534-4538 - 452.14-452.49 - $15.28B

4554-4567 - 454.08-455.41 - $19B

4577-4590 - 456.43-457.64 - $12.26B

Below Spot:

4349-4344 - 433.65-433.19 - $12.14B

4325-4292 - 431.26-427.92 - $18.46B

4214-4188 - 420.16-417.60 - $18.8B

I get my dark pool levels from Quant Data.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break. I use Sonarlab’s indicator on Tradingview to plot these.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4404-4411 - OB (30min chart)

4408 midline

4417-4435 - OB (1hr chart)

4426 midline

4438-4447 - OB (30min chart)

4443 midline

4473-4490 - OB (4hr chart)

4481 midline

4523-4536 - OB (1hr chart)

4529 midline

4534-4540 - OB (30min chart)

4537 midline

4572-4582 - OB (2hr, 4hr chart)

4577 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4345-4328 - OB (1hr, 2hr, 4hr chart)

4336 midline

4304-4297 - OB (1hr chart)

4301 midline

4276-4263 - OB (1hr, 2hr, 4hr chart)

4270 midline

4195-4166 - OB (4hr chart)

4181 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~79.67 points. SPY’s expected move is ~8.00. That puts us at 4449.39 to the upside and 4290.05 to the downside. For SPY these levels are 444.50 and 428.50.

Remember over 68% of the time price will resolve it self in this range by weeks end.

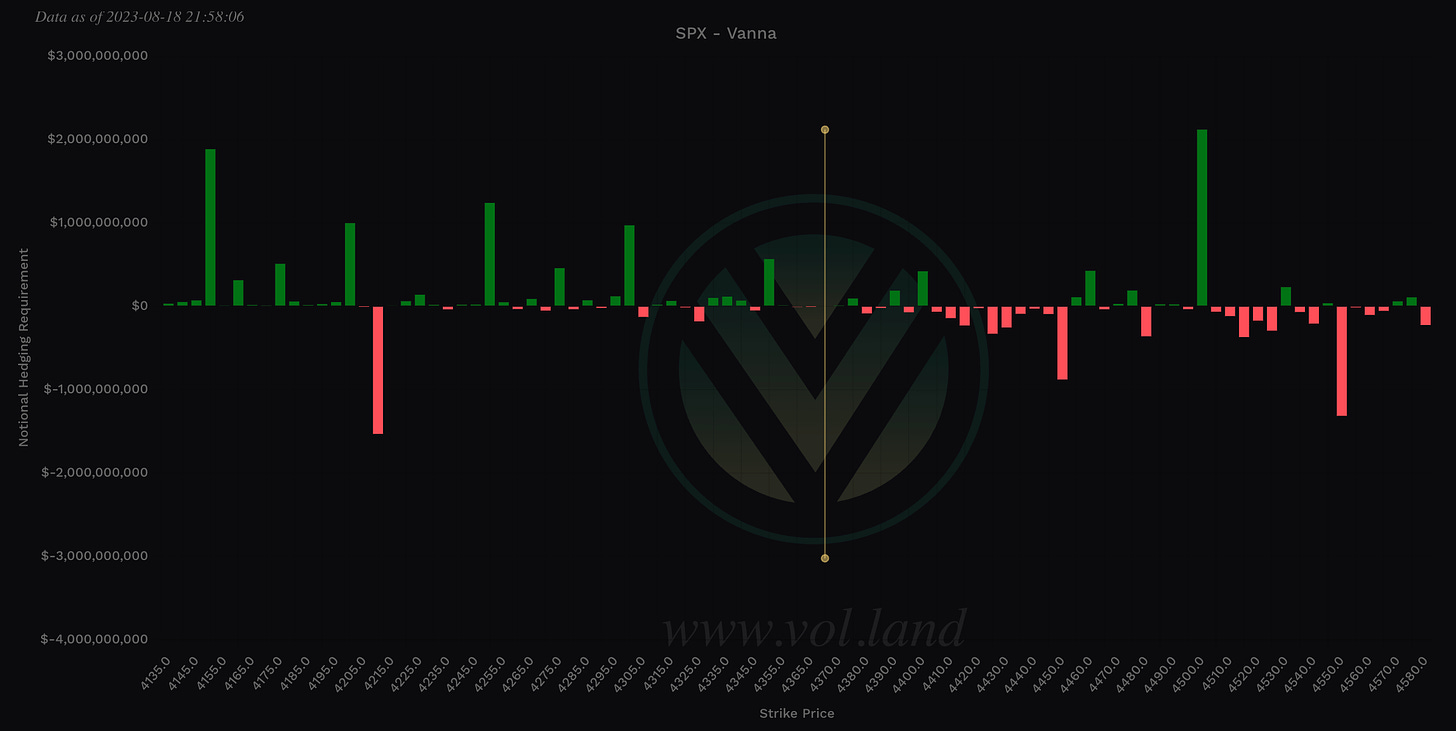

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4380 - negative vanna

4395 - negative vanna

4405-4450 - negative vanna

4425 medium

4450 major

Below Spot:

4365-60 - negative vanna

minor

4345 - negative vanna

4325-4320 - negative vanna

4305 - negative vanna

4290 - negative vanna

4280 - negative vanna

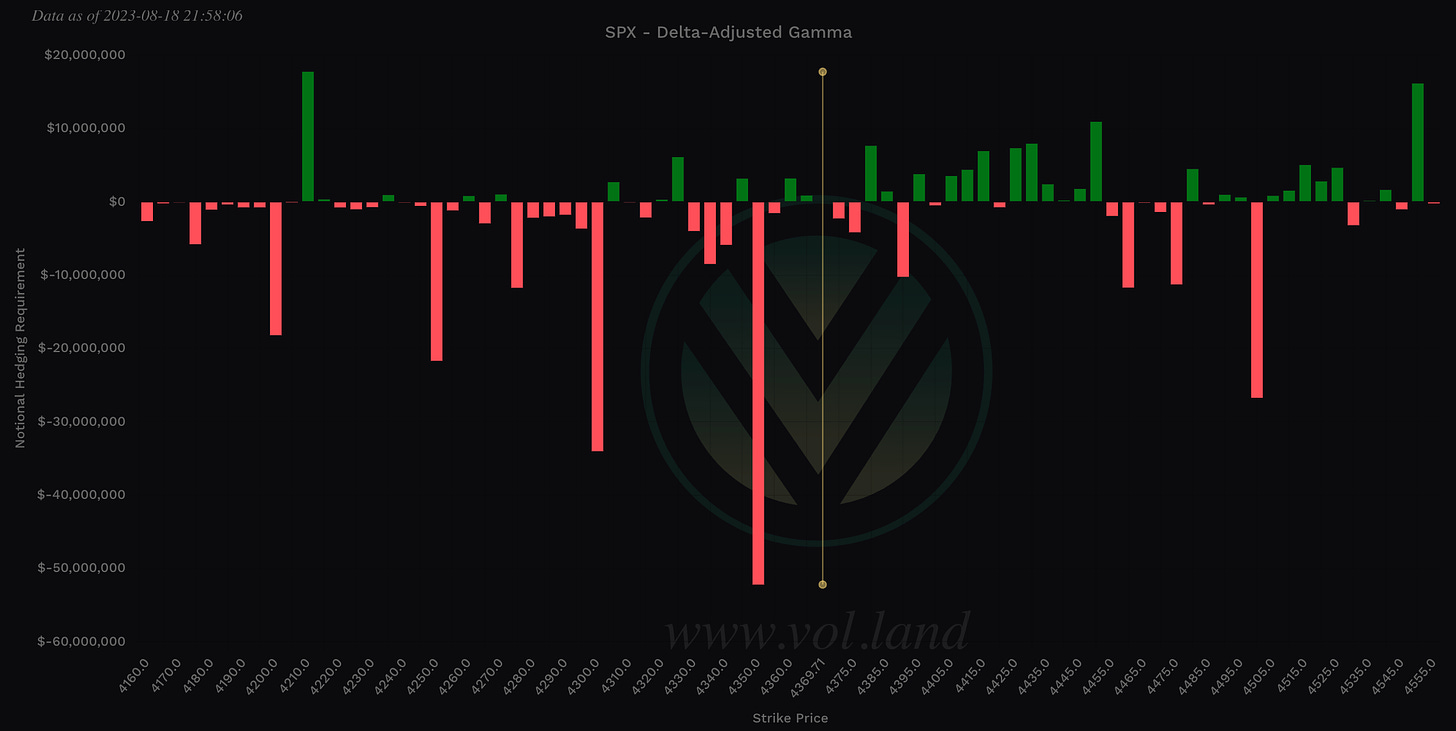

Delta-Adjusted Gamma (DAG)

DAG represents where dealers may assist a move in the markets. Positive DAG and dealers are buying. Negative DAG and dealers are selling. The larger the value the more dealers are buying or selling.

Above Spot:

4370-4375 - negative DAG

4380-4385 - positive DAG

4390 - negative DAG

4395 - positive DAG

4405-4415 - positive DAG

Below Spot:

4365-4360 - positive DAG

4355-4350 - negative DAG

4350 major

4345 - positive DAG

4340-4330 - negative DAG

4325-4320 - positive DAG

4315 - negative DAG

4305 - positive DAG

4300-4275 - negative DAG

4300 major

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.