8/10 Trading Session Review

Another day where the market rallied after the release of July’s CPI only for it to then selloff.

Let’s recap first what we said in yesterday’s trade plan…

Above 4475 target 4490

If there is a breakout of 4495 target 4510

If there is a failed breakout of 4490 or 4495 target 4465

Below 4465 target 4455

SPX gapped up and opened at 4492 where it then tested 4490 and took off from there breaking our first target at 4510 and went as high as 4527. I didn’t like how the data looked above 4510 and thought the risk/reward was not worth it and boy did it prove itself.

After hitting the highs of 4527 SPX turned right around and began to sell closing its gap and hitting 4457 - 2 points shy of one of our price targets.

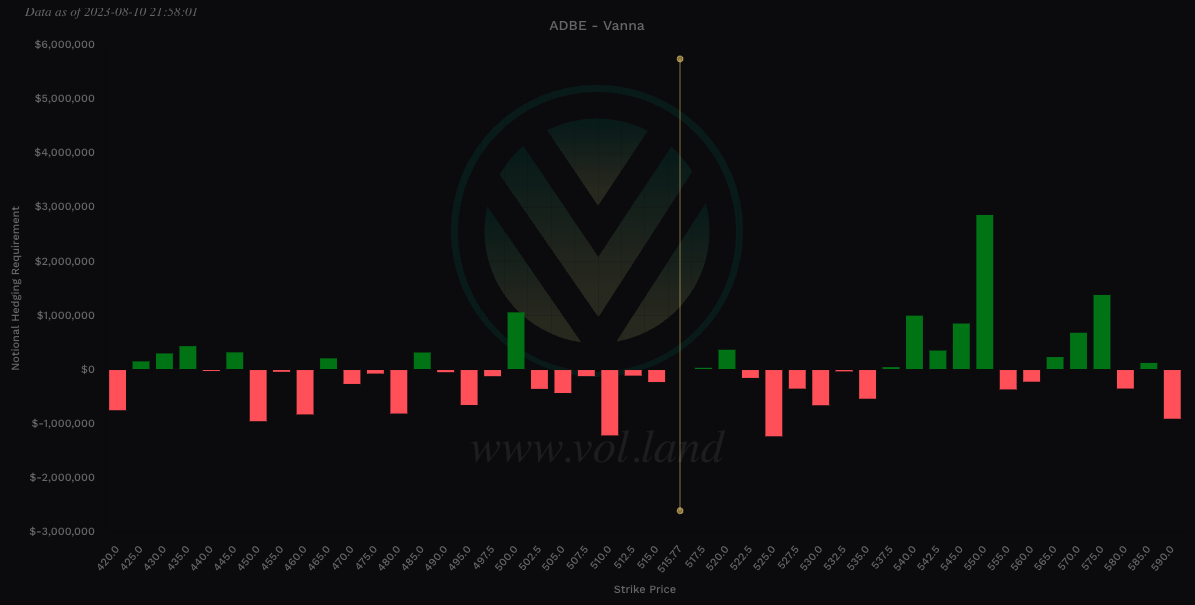

Reviewing our other ticker ideas ADBE hit a high of 523 where it found resistance and began to selloff towards the low of 512 missing our target by 2 points. Nice trade though overall.

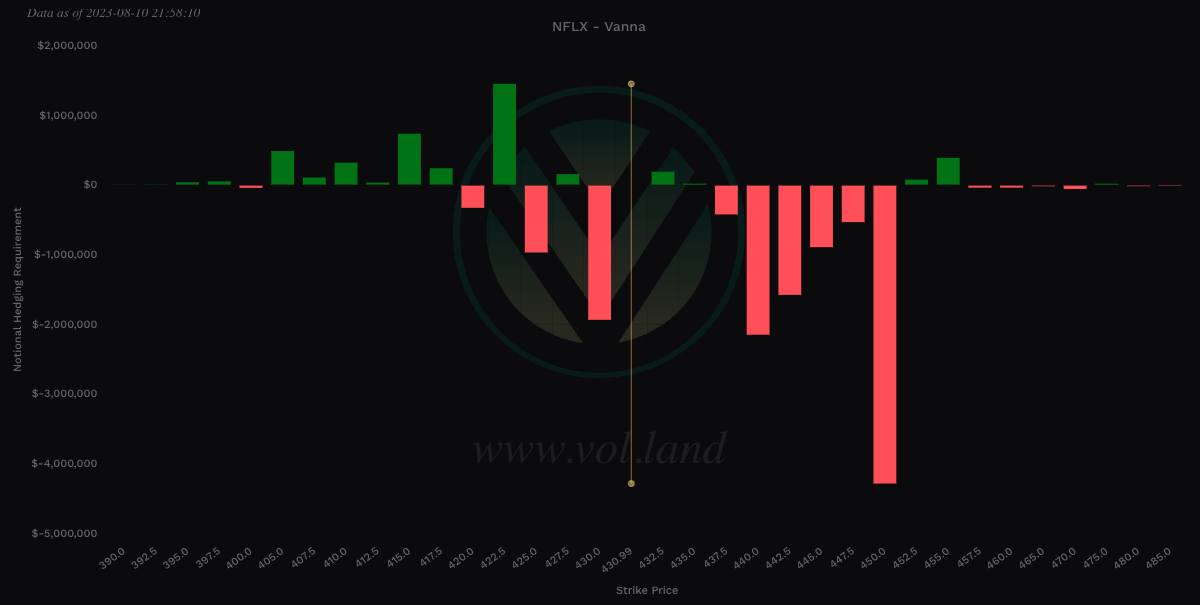

NFLX came back to our previous key level on the week of 440 where it immediately faced resistance and sold off with a low of 427.

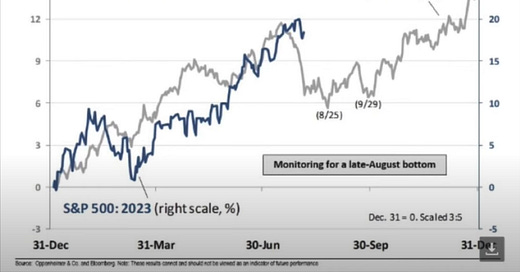

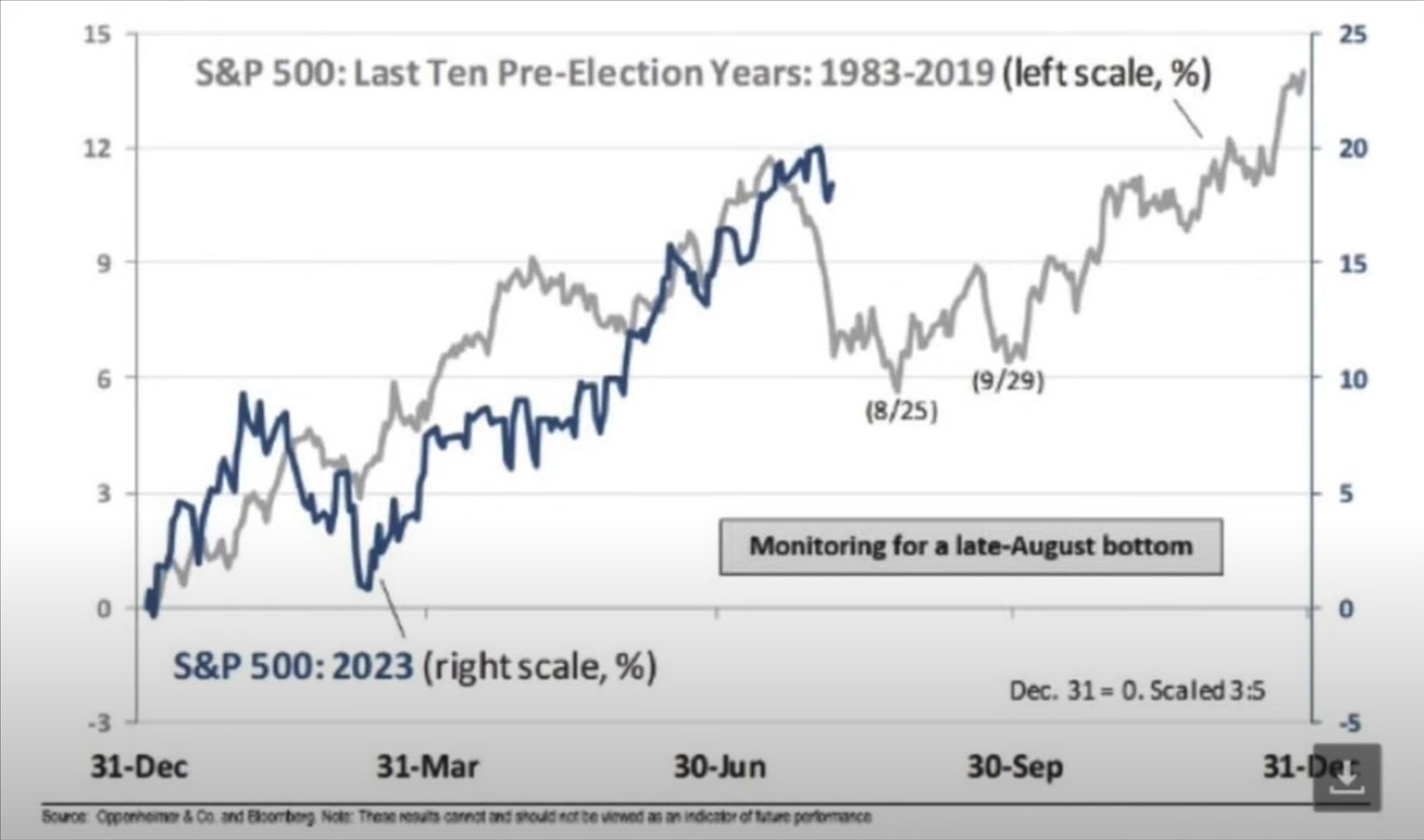

Additionally, we discussed this in our trade plan 2 weeks ago about seasonality. Here is a bit more insight and where a bottom may occur in August and then September. Another data point so we need to continue to play level-by-level. In this market failed breakouts or breakdowns are the way to go and why I include on them in our trade plan.

With that let’s jump into the trade plan.

SPX/SPY/ES Overview (TL;DR)

The bulls have their work cutout for them after the constant beat down on any rallies. Tomorrow we have PPI that could bring more volatility to the market.

Bulls want price above 4475 to target 4495.

Bears want price below 4460 to target 4440.

Regardless of today’s intraday action that 4500 area becomes an area of interest to short again…

ADBE

510 is major support, but if 510 holds target 522 then 525.

Above 510 target 525

If there is a failed breakdown of 515 target 525

Below 510 target 505

NFLX

432.5 is a key level. If we break it target 432.50 then 435 then 440. Below it target 425 then 420. I don’t prefer longs at these levels as it could be choppy and decay premiums on options.

Above 430 target 437

Below 430 target 426

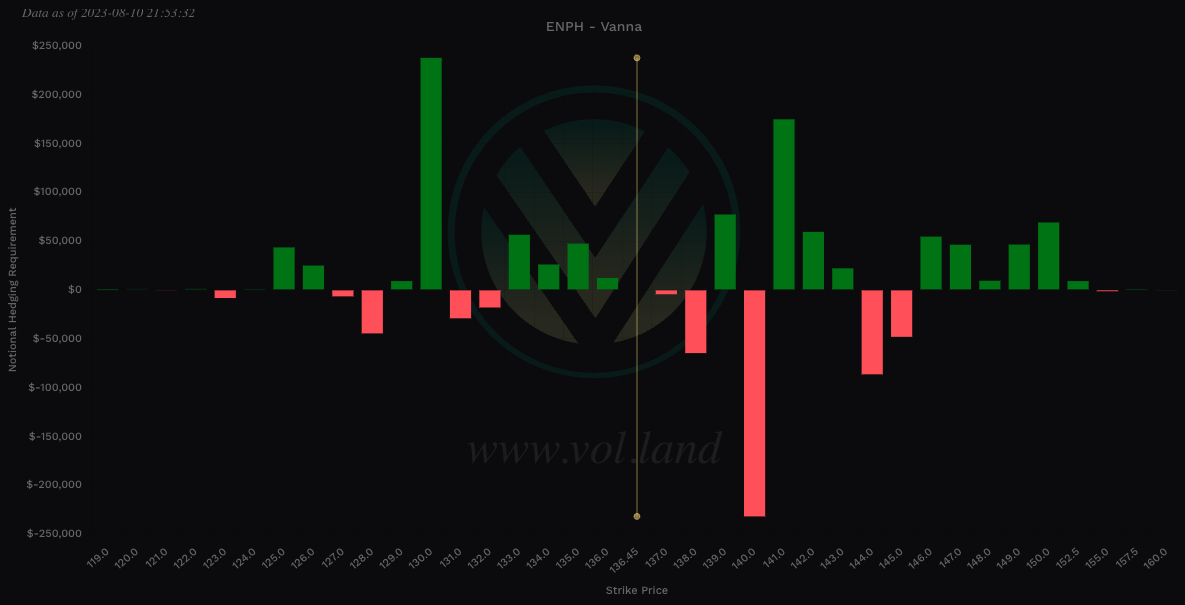

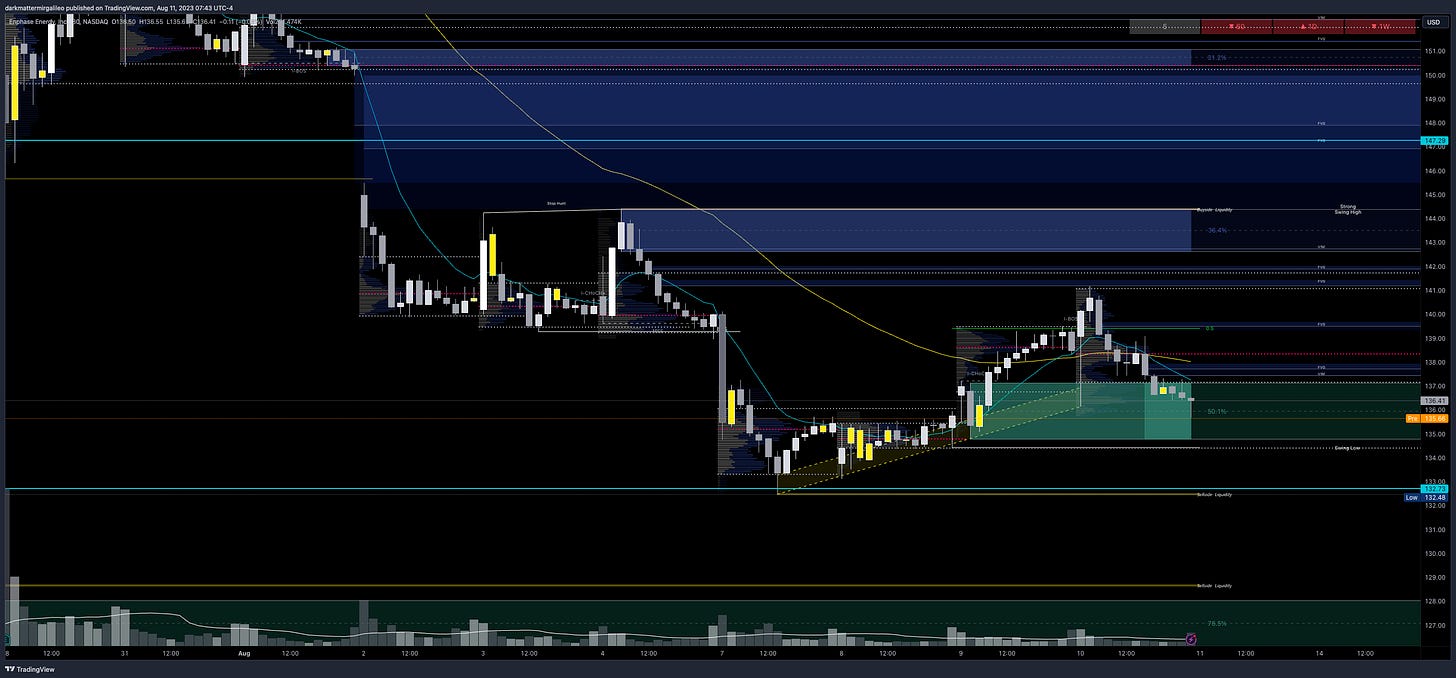

ENPH

136 is the pivotal level taking you to 138. Below 136 targets 132.

Below 136 target 132

Above 136 target 138 then 140

If there is a failed breakout of 138 or 140 target 132

For intraday updates please follow me on Twitter @DarkMatterTrade.

News Catalyst

8:30am est - PPI

10:00am est - Prelim UoM Consumer Sentiment

10:00am est - Prelim UoM Inflation Expectations

For more information on news events, visit the Economic Calendar

8/11 - SPX/ES/SPY Trade Plan

Bullish bias:

Above 4475 target 4495

If there is a breakout of 4500 target 4515

Bearish bias:

Below 4460 target 4440

If there is a breakdown of 4440 target 4415

If there is a failed breakout of 4475 target 4460

As always keep an eye on Volland30, VOLD indicator, and the VIX for trend continuation or reversals.

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 18pts more than the SPX levels shared. To get SPY levels simply take the SPX levels and divide by 10.03.

SPX - The Why Behind the Plan

Key Levels

Above Spot:

4470-4475 - negative vanna

4477-4486 - OB (15min chart)

4482 midline

4470-4479 - 446.65-445.67 - $14.4B

4495 - negative vanna

4500 - positive gamma - major

4490-4522 - OB (30min chart)

4506 midline

4503-4522 - 450.89-449.03 - $24.68B

4505-4525 - negative vanna

4523-4536 - OB (1hr chart)

4529 midline

4534-4538 - 452.49-452.14 - $15.28B

Below Spot:

4460 - negative vanna

4453-4444 - 444.02-443.15 - $8.93B

4440 - negative vanna

4438 - 442.52 - $6.46B

4415 - negative vanna

4425-4416 - OB (1hr chart)

4421 midline

4405 - negative vanna

4408-4399 - OB (2hr chart)

4404 midline

4410-4393 - 439.74-438.06 - $22.02B

4390 - negative vanna

4393-4380 - OB (1hr, 2hr chart)

4387 midline

4384-4375 - 437.18-436.20 - $22.33B

Dark Pool Levels

Whales target near the lows of 4470 where we had $2.46B of dark pool printed today.

Above Spot:

4470-4479 - 446.65-445.67 - $14.4B

4503-4522 - 450.89-449.03 - $24.68B

4534-4538 - 452.49-452.14 - $15.28B

4554-4567 - 455.41-454.08 - $19B

4577-4590 - 457.64-456.43 - $12.26B

Below Spot:

4453-4444 - 444.02-443.15 - $8.93B

4438 - 442.52 - $6.46B

4410-4393 - 439.74-438.06 - $22.02B

4384-4375 - 437.18-436.20 - $22.33B

4349-4344 - 433.65-433.19 - $12.14B

I get my dark pool levels from Quant Data.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break. I use Sonarlab’s indicator on Tradingview to plot these.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4477-4486 - OB (15min chart)

4482 midline

4490-4522 - OB (30min chart)

4506 midline

4523-4536 - OB (1hr chart)

4529 midline

4534-4540 - OB (30min chart)

4537 midline

4572-4582 - OB (2hr, 4hr chart)

4577 midline

4638-4660 - FVG (4hr chart)

4652-4665 - OB (1hr, 2hr chart)

4658 midline

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4425-4416 - OB (1hr chart)

4421 midline

4408-4399 - OB (2hr chart)

4404 midline

4393-4380 - OB (1hr, 2hr chart)

4387 midline

4344-4328 - OB (2hr chart)

4336 midline

Weekly Option Expected Move

SPX’s weekly option expected move is ~77.87 points. SPY’s expected move is ~7.86. That puts us at 4555.89 to the upside and 4400.15 to the downside. For SPY these levels are 454.67 and 438.95.

Remember over 68% of the time price will resolve it self in this range by weeks end.

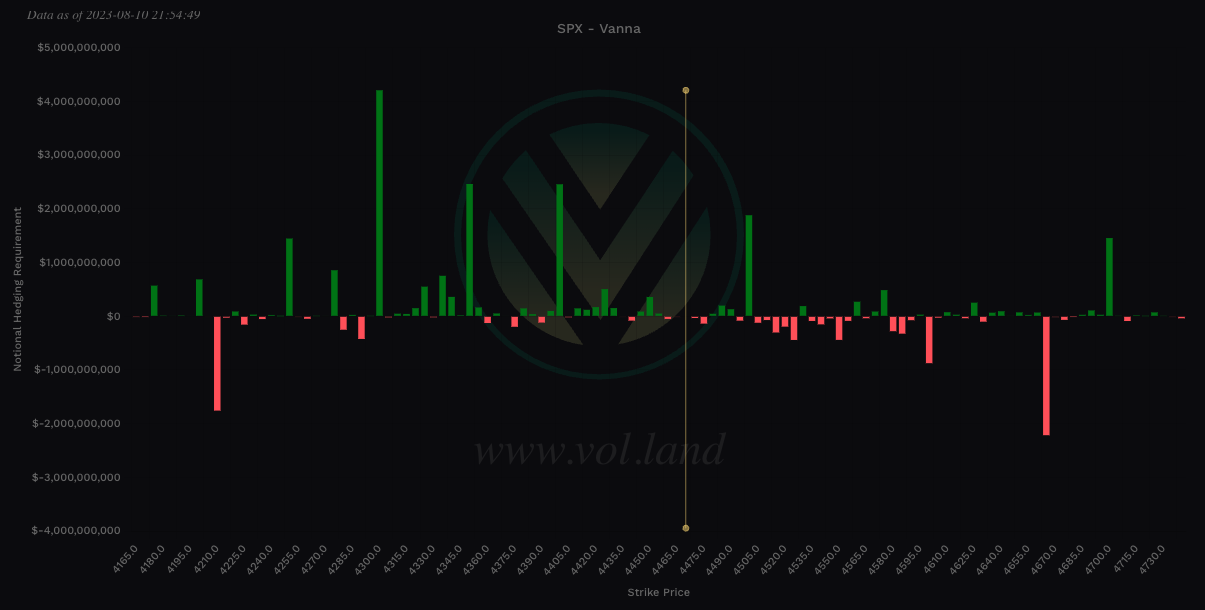

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4470-4475 - negative vanna

4495 - negative vanna

4505-4525 - negative vanna

4535-4555 - negative vanna

Below Spot:

4460 - negative vanna

4440 - negative vanna

4415 - negative vanna

4405 - negative vanna

4390 - negative vanna

Charm

Remember if IV is not expanding Charm will start to overtake Vanna especially 0DTE as it comes closer to expiration.

For all expiry’s, Charm total notional value is bullish - negative is bullish and positive bearish - take the total of the far left and far right values. This is a longer term view of the market and suggests we find key dips to buy to long.

What I am interested in looking at though is the current composition of the 0DTE charm where this greek closer to expiry has the biggest impact. Looking at this it seems it is GEXy with a target of 4500.

This could change especially with PPI data coming pre-market so we need to wait until new 0DTE data comes into Volland.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.