April 19, 2023 SPX, SPY, ES Trade Plan

Good evening/day/morning traders. Let’s jump right into tomorrow’s trade plan and review yesterday’s trades.

Last session trading recap

Today we had two great trading opportunities. The first trade presented itself for our ES futures trader overnight…

Above 4150 target 4165

This was an easy stress free trade to take in futures and by the time we opened you could have easily taken profits and be done on the day.

The next trade idea that presented itself was…

If there is a failed breakout of 4165 target 4150

Now at the open we saw the SPX push up to 4169. While this seems bullish and could have gone long please remember we try to avoid trading in the first half hour of the day. Why? We are simply small fishes in a large ocean full of big whales. That first half hour is a fight between the bears and bulls and one side trying to take over.

Thus if you waited until 10am est, price action stabilized and we broke under 4165 triggering our failed breakout scenario. This trade ended going as low as 4140 allowing you to leave runners at the price target of 4150.

Congrats to everyone who was able to use the trade plan to turn it into a green profitable day. Let’s get into the trade plan and review our key levels…

I enjoy interacting and learning from other traders so continue to share your trades, ideas, and how you use this trade plan by messaging me on Twitter @DarkMatterTrade.

News Catalyst

2:00pm est - Beige Book

While we have a slower than expected week of news, we do have the continuation of earnings reports coming out. Wednesday premarket brings us key earnings reports from ASML, Morgan Stanley while after market we have Tesla, IBM, and Lam Research.

For more information on news events, visit the Economic Calendar

SPX/ES/SPY Trade Plan

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 26pts more than the SPX levels shared below. To get SPY levels simply take the SPX levels below and divide by 10.03

Bullish bias:

If there is a failed breakdown of 4125 target 4150

If there is a failed breakdown of 4100 target 4115

If there is a breakout of 4150 target 4165

Bearish bias:

Below 4150 target 4130

If there is a breakdown of 4120 target 4100

If there is a breakdown of 4100 target 4080

SPX - The Why Behind the Plan

Key Levels

Below Spot - support:

4150 - negative vanna

4145 - positive gamma

4140-4133 - FVG (2hr chart)

4132-4124 - OB (30min chart)

4125 - negative vanna

4127-4087 - OB (2hr chart)

4113-4097 - FVG (2hr chart)

4108-4088 - OB (1hr chart)

4100 - positive gamma

4075 - negative vanna

4075 - positive gamma

Above Spot - resistance:

4153-4176 - OB (1hr chart)

4160 - positive gamma

4165 - negative vanna

4170 - positive gamma

4176-4200 - OB (2hr chart)

4175-80 - negative vanna

4185-90 - positive gamma

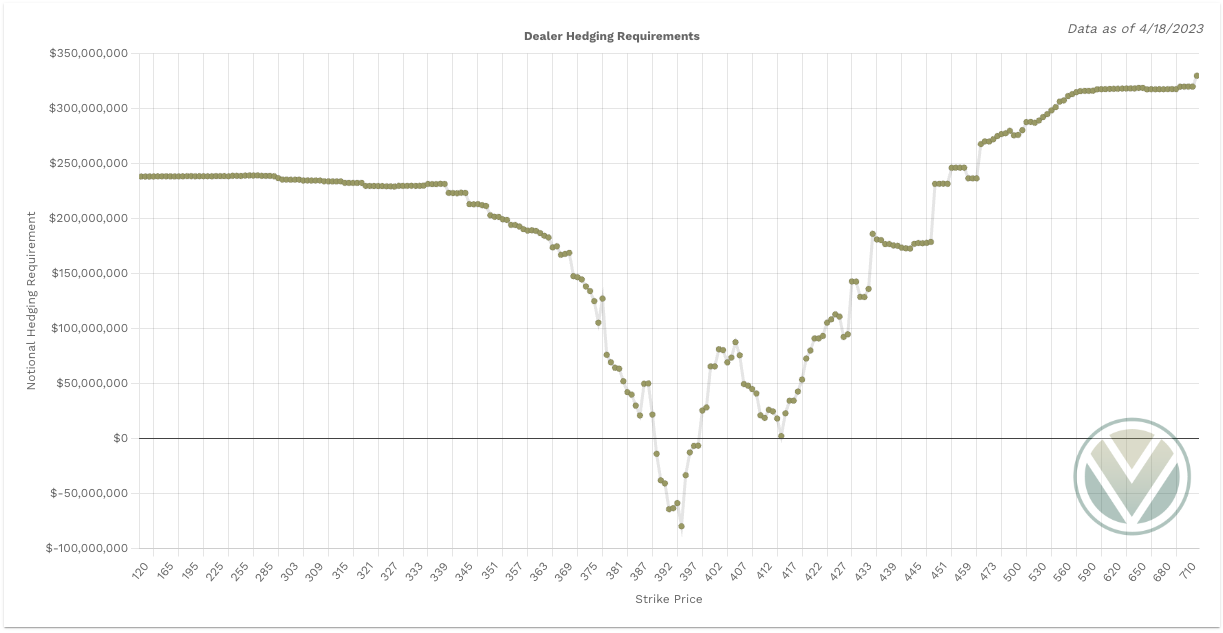

Dark Pool Levels

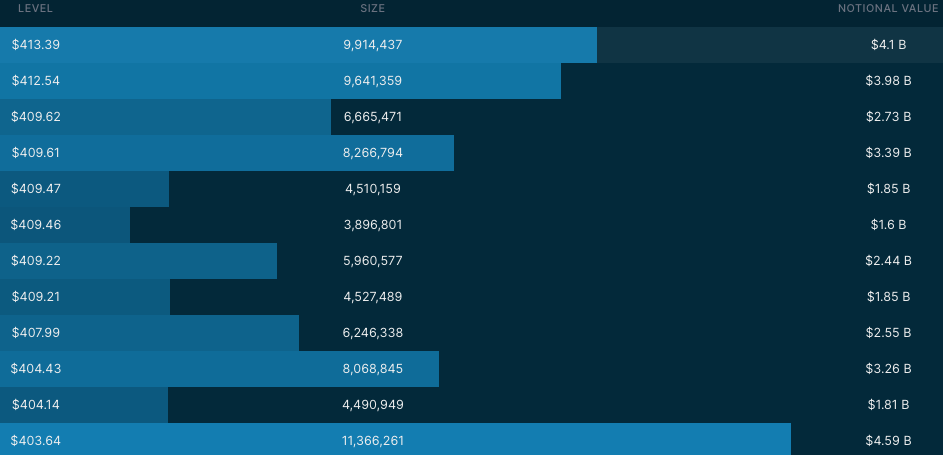

We need to pay attention to some key levels that have Dark Pool buildup. Mark them on your chart as key levels that we should pay attention to. I get my dark pool levels from Quant Data.

4137-4151 - (412.54, 413.39, 413.90) - $9.17B has printed at this level

4104-08 - (409.21, 409.46, 409.61) - Over $13.91B has printed at this level

4092 - (407.99) - $2.55B was printed at this level

4045-55 - (403.63) - $6B has printed at this level

4000 - (398.76) - $5.77B has printed at this level

3950-70 - (395.62) - Over $8B has printed at this zone

3910-15 - (390.11) a key dark pool level that kept the market supportive

Here is a summary chart from Quant Data that shows the key levels that have been bought up in dark pool prints since the beginning of March 1, 2023. Remember the levels where we see dark pool prints greater than $2B should peak our interest.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4153-4176 - OB (1hr chart)

4176-4200 - OB (2hr chart)

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4140-4133 - FVG (2hr chart)

4132-4124 - OB (30min chart)

4127-4087 - OB (2hr chart)

4113-4097 - FVG (2hr chart)

4108-4088 - OB (1hr chart)

4084-4072 - OB (1hr chart)

4070-4060 - FVG (1hr chart)

4060-4051 - FVG (2hr chart)

Weekly Option Expected Move

SPX’s weekly option expected move is ~57.61 points. SPY’s expected move is ~5.95. Remember over 68% of the time price will resolve it self in this range by weeks end.

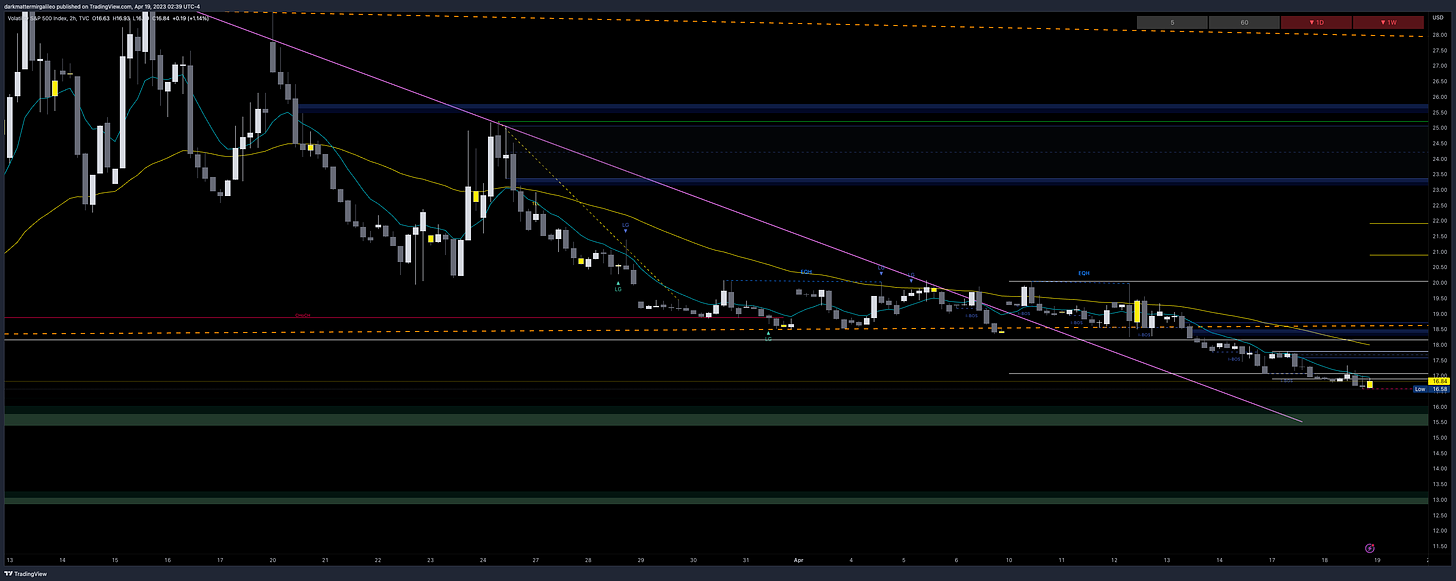

VIX Update

Let’s review the VIX chart and its key levels…

Above Spot:

17.58-17.77

18.29-18.51

18.96-19.32

19.41-20.10

Below Spot:

16.40-16.00

16.04-15.44

15.44-14.95

13.26-12.95

Remember, typically VIX going down correlates with a uptrend in the market and vice versa for a downtrend in the market.

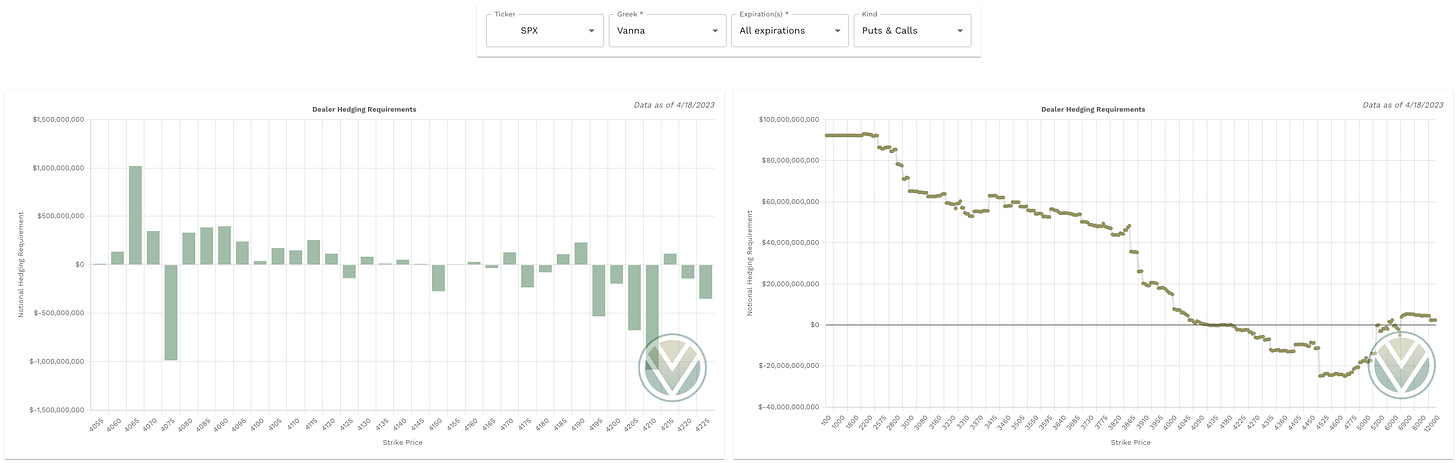

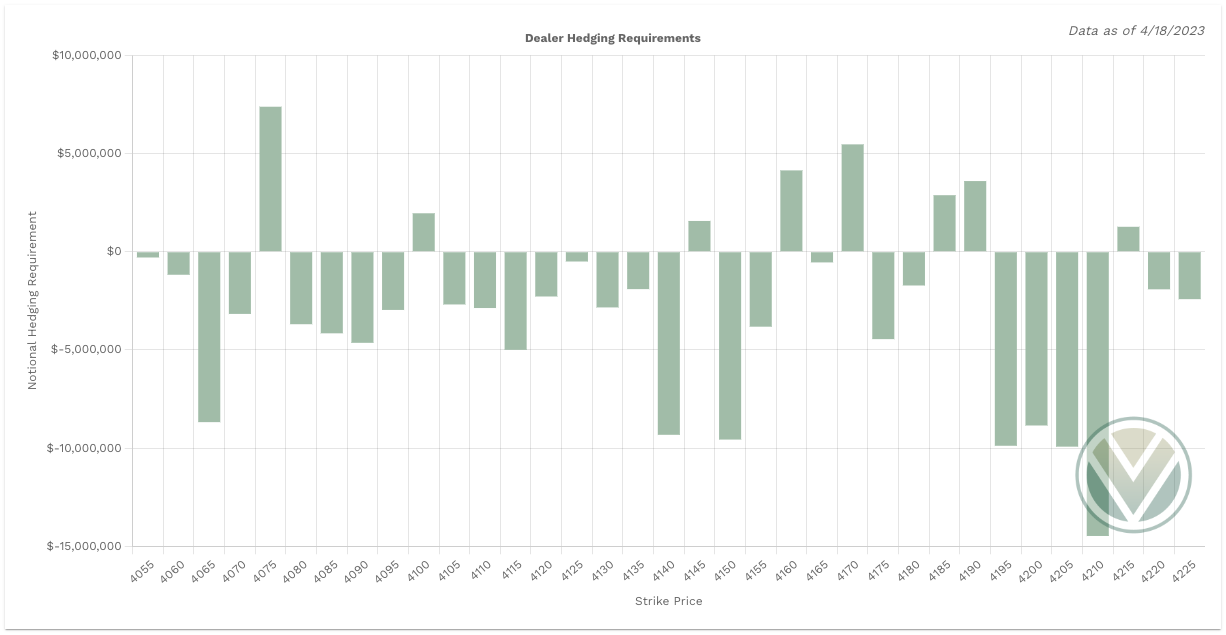

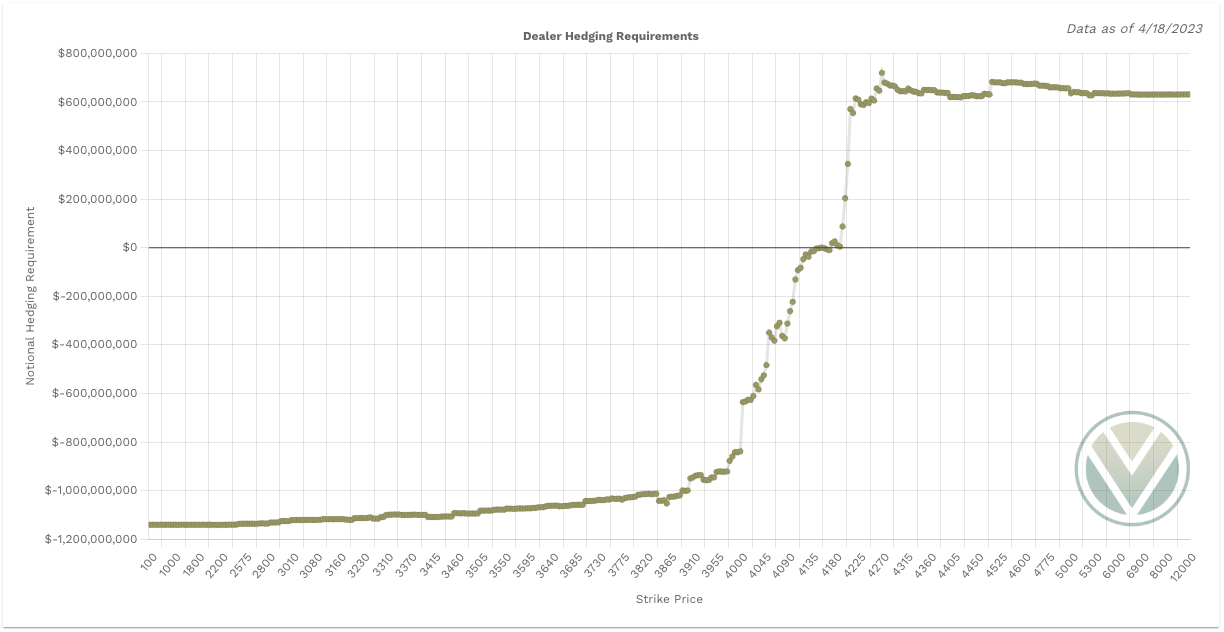

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4165 - negative vanna

4175-80 - negative vanna

Below Spot:

4150 - negative vanna

4125 - negative vanna

4075 - negative vanna

Gamma and Delta-Adjusted Gamma (DAG)

Positive Gamma Above Spot - acts as resistance

Positive Gamma Below Spot - acts as support

Negative Gamma - becomes permissive to price as it moves there - aka neither resistance nor support - simply just chillin and watching what’s happening…

Above Spot:

4160 - positive gamma

4170 - positive gamma

4185-90 - positive gamma

Dealers must buy at 4155 and above 4195

Below Spot:

4145 - positive gamma

4100 - positive gamma

4075 - positive gamma

Dealers must sell below 4150 and between 4180-4195

Charm

Charm is negative on SPX. This suggests that Charm will have little a more bullish impact on SPX, but the total notional value has been decreasing since the start of the week. After the end of this week the charm impact lessens which could bring an end to these minimum selloffs.

When reviewing Charm we also need to account for SPY’s charm. It is leaning bearish and continues to grow from last week.

For the full charm effect to play out ideally we want to see SPX and SPY in sync.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.