Good evening/day/morning traders. Well don’t say I didn’t tell you that OPEX is a grind, requires #paytience, and waiting for the exact levels to hit and react to them.

Last session trading recap

Today we had two great trading opportunities. The first in the morning presented us with…

Below 4140 target 4125

This was a slow grind, decaying premiums along the way. The lone reason why I always suggest that you trade at least 1DTE. This push by retail into 0DTE trades is a very risky and dangerous one. If you can’t afford SPX 1DTE’s than you should be trading SPY 1-2 DTE’s if not weeklies. You will feel less emotional, get less heat, especially in similar trading conditions as today.

The second half of the day near 2pm est we got our second trade idea…

If there is a failed breakdown of 4125 target 4140

Wow what a ride this was…we had a change of character on the 5min timeframe to further add conviction to our trade at the 4133 level on the 2:40pm est 5min candle. From here it was just a waiting game for the level to hit and leave runners at the price target.

Congrats to everyone who was able to use the trade plan to turn it into a green profitable day. Let’s get into the trade plan and review our key levels…

I enjoy interacting and learning from other traders so continue to share your trades, ideas, and how you use this trade plan by messaging me on Twitter @DarkMatterTrade.

News Catalyst

8:30am est - Building Permits - minor catalyst

8:30am est - Housing Starts - minor cataylst

1:00pm est - FOMC Member Bowman Speaks - medium catalyst

While we have a slower than expected week of news, we do have the continuation of earnings reports coming out. Tuesday brings us the likes of Bank of America, Goldman Sachs premark while we have Netflix and United Airlines after hours.

For more information on news events, visit the Economic Calendar

SPX/ES/SPY Trade Plan

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 27-30pts more than the SPX levels shared below.

Bullish bias:

Above 4150 target 4165

If there is a breakout of 4165 target 4190

If there is a failed breakdown of 4130 target 4150

Bearish bias:

Below 4145 target 4130

If there is a breakdown of 4125 target 4100

If there is a failed breakout of 4165 target 4150

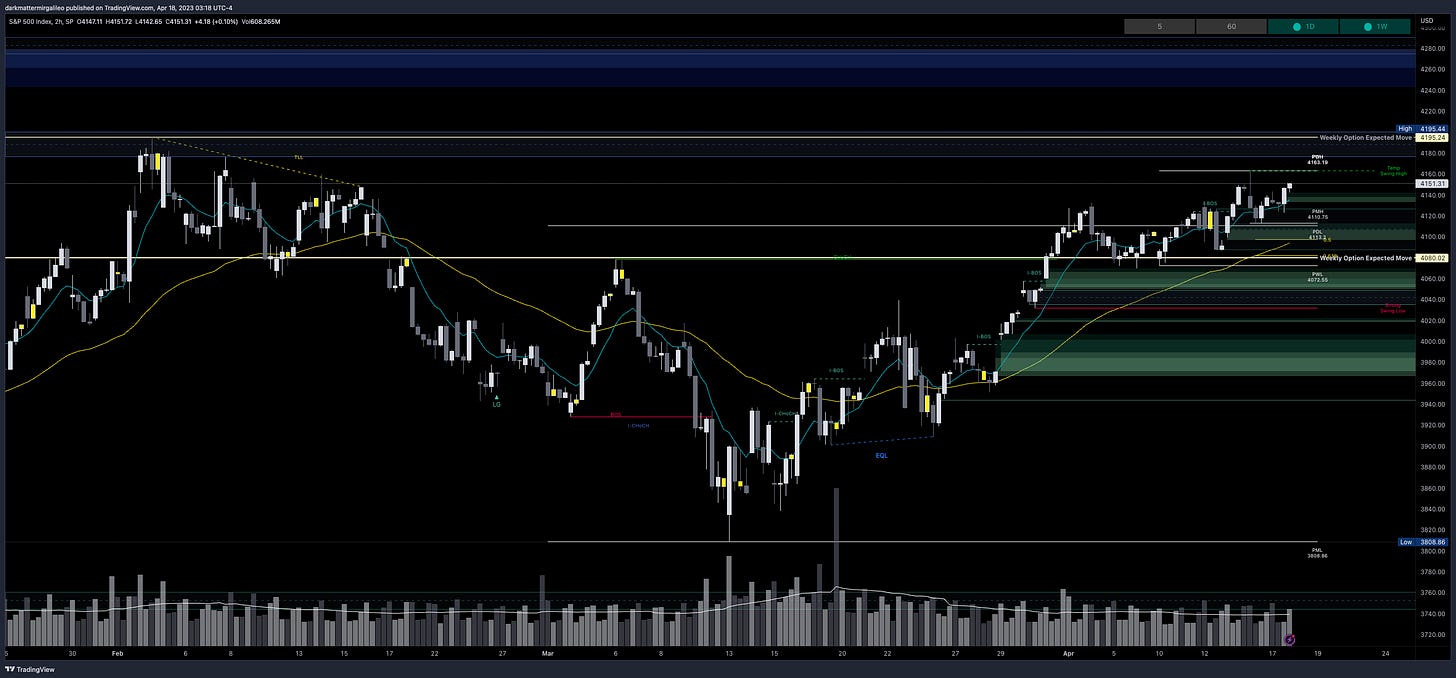

SPX - The Why Behind the Plan

Key Levels

Below Spot - support:

4150 - negative vanna

4142-4133 - FVG (2hr chart)

4137-4146 - $8.08B has printed at this level

4140 - negative vanna

4132-4124 - OB (30min chart)

4130-25 - negative vanna

4130 - positive gamma

4127-4087 - OB (2hr chart)

4104-08 - Over $13.91B has printed at this level

4113-4097 - FVG (2hr chart)

4108-4088 - OB (1hr chart)

4100 - positive gamma

Above Spot - resistance:

4153-4176 - OB (1hr chart)

4155-4190 - positive vanna

4155-4190 - positive gamma

4176-4200 - OB (2hr chart)

4195 - negative vanna

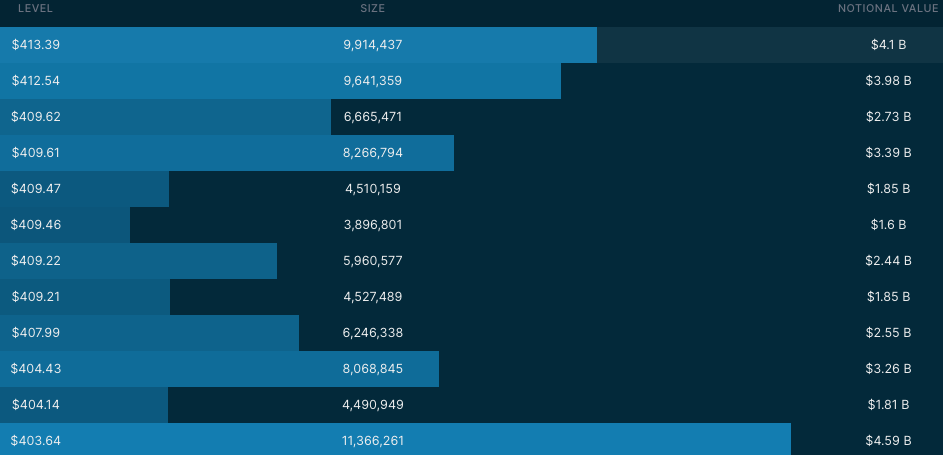

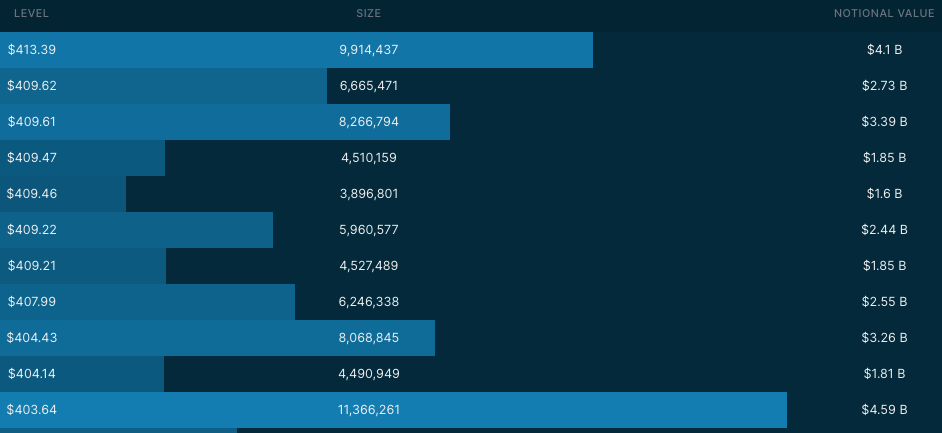

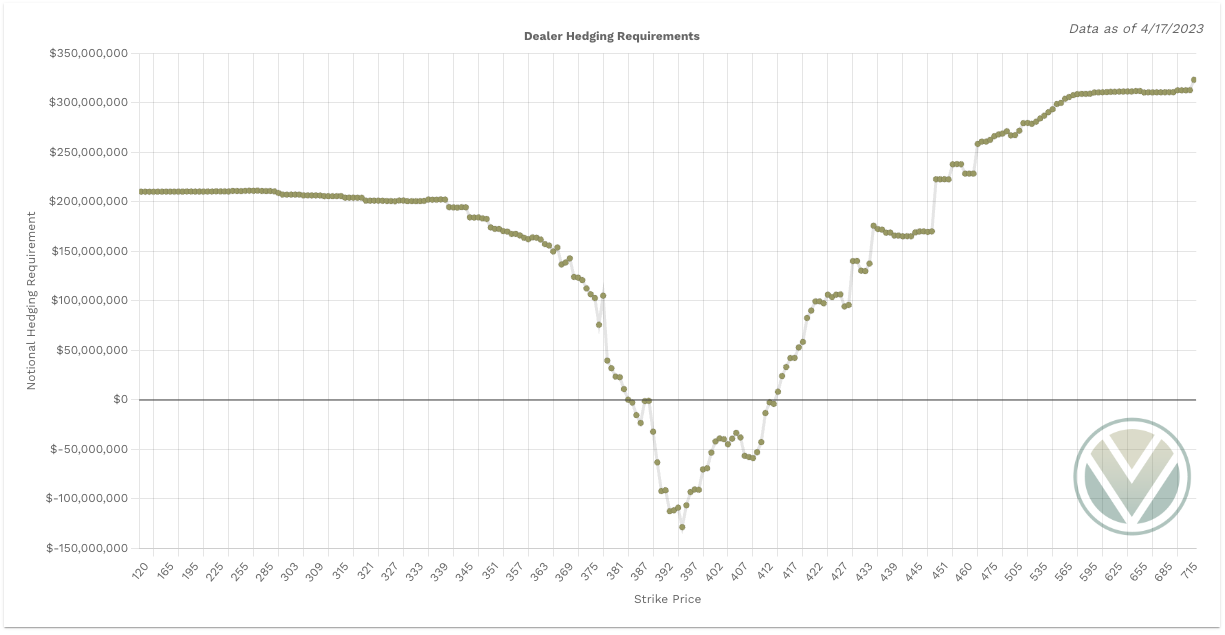

Dark Pool Levels

We need to pay attention to some key levels that have Dark Pool buildup. Mark them on your chart as key levels that we should pay attention to. I get my dark pool levels from Quant Data.

4137-4146 - (412.54 & 413.39) - $8.08B has printed at this level

4104-08 - (409.21, 409.46, 409.61) - Over $13.91B has printed at this level

4092 - (407.99) - $2.55B was printed at this level

4045-55 - (403.63) - $6B has printed at this level

4000 - (398.76) - $5.77B has printed at this level

3950-70 - (395.62) - Over $8B has printed at this zone

3910-15 - (390.11) a key dark pool level that kept the market supportive

Here is a summary chart from Quant Data that shows the key levels that have been bought up in dark pool prints since the beginning of March 1, 2023. Remember the levels where we see dark pool prints greater than $2B should peak our interest.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4153-4176 - OB (1hr chart)

4176-4200 - OB (2hr chart)

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4142-4133 - FVG (2hr chart)

4132-4124 - OB (30min chart)

4127-4087 - OB (2hr chart)

4113-4097 - FVG (2hr chart)

4108-4088 - OB (1hr chart)

4084-4072 - OB (1hr chart)

4070-4060 - FVG (1hr chart)

4060-4051 - FVG (2hr chart)

The 2HR chart is also showing a growing order block growing in the 4127-4087. This is a key critical demand zone to mark on your charts - once this demand zone breaks I think that is when we will see us target 4050.

Volume Profile

Let’s review the volume profile and some key levels there. If you are unfamiliar with the Volume Profile I highly suggest reviewing some YouTube videos or reading this quick overview on it.

Some keywords to be aware of:

VAH = value area high

VAL = value area low

POC = point of control

A naked POC means it hasn’t been tested after it was formed - these will typically act as magnets

For a thorough review of the Volume Profile visit Captain’s SPY trade plan…You can take his levels and multiple by 10.03 to get SPX levels.

Weekly Option Expected Move

SPX’s weekly option expected move is ~57.61 points. SPY’s expected move is ~5.95. Remember over 68% of the time price will resolve it self in this range by weeks end.

VIX Update

Let’s review the VIX chart and its key levels…

Above Spot:

17.03-17.13

17.19-17.34

17.38-17.57

17.58-17.78

18.29-18.51

18.96-19.32

19.41-20.10

Below Spot:

17.32-16.92

We are right in the middle of this OB

16.40-16.00

16.04-15.44

15.44-14.95

14.13-12.95

Remember, typically VIX going down correlates with a uptrend in the market and vice versa for a downtrend in the market.

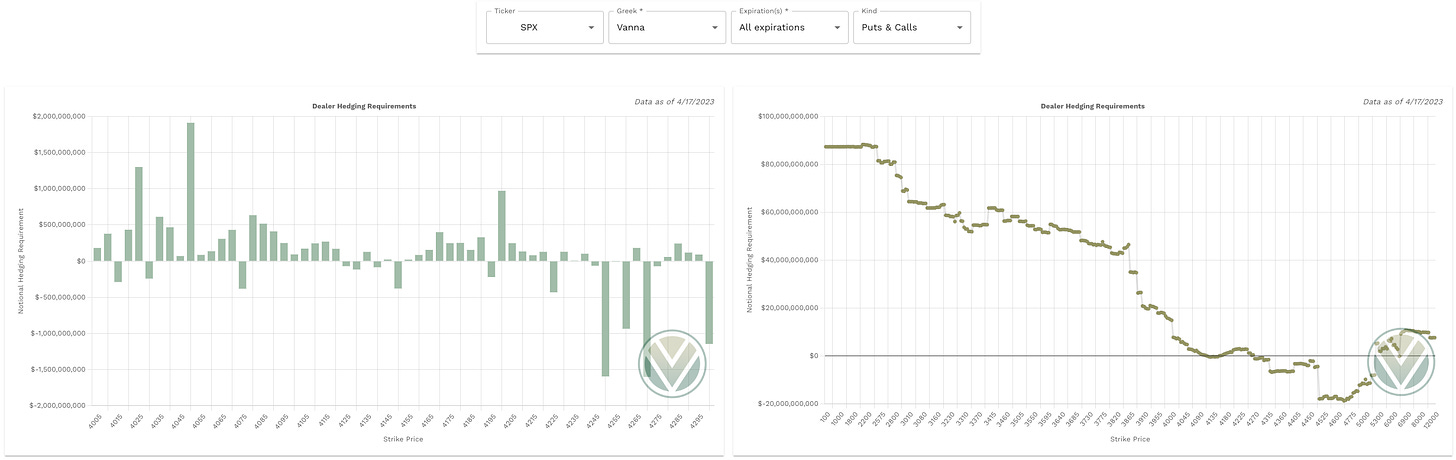

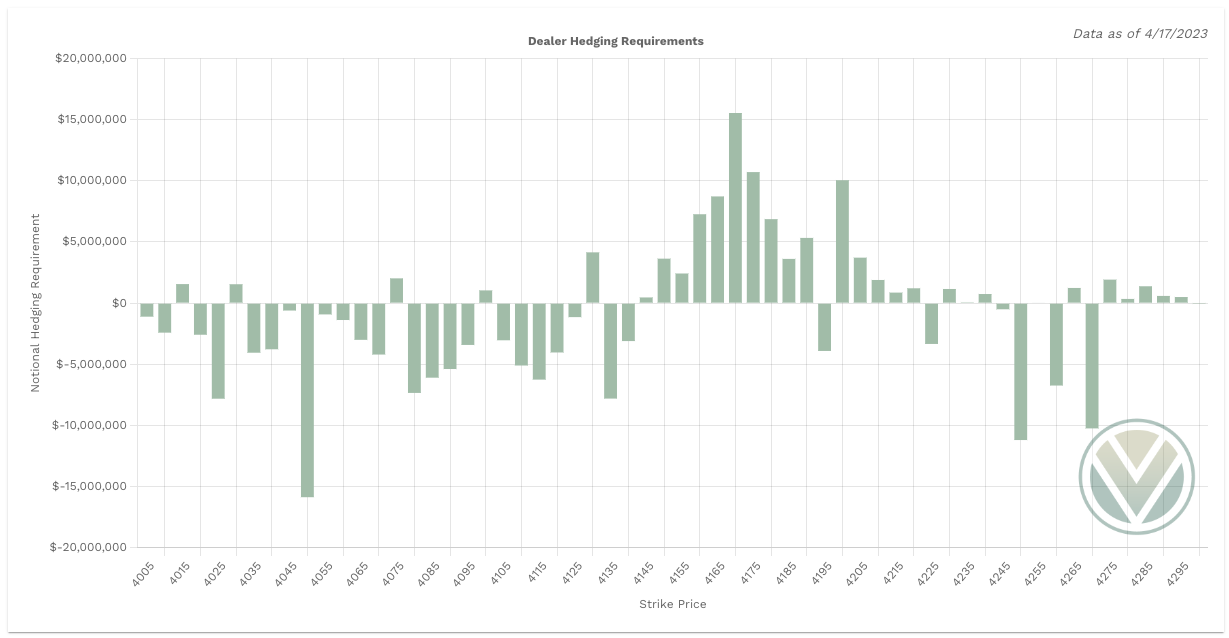

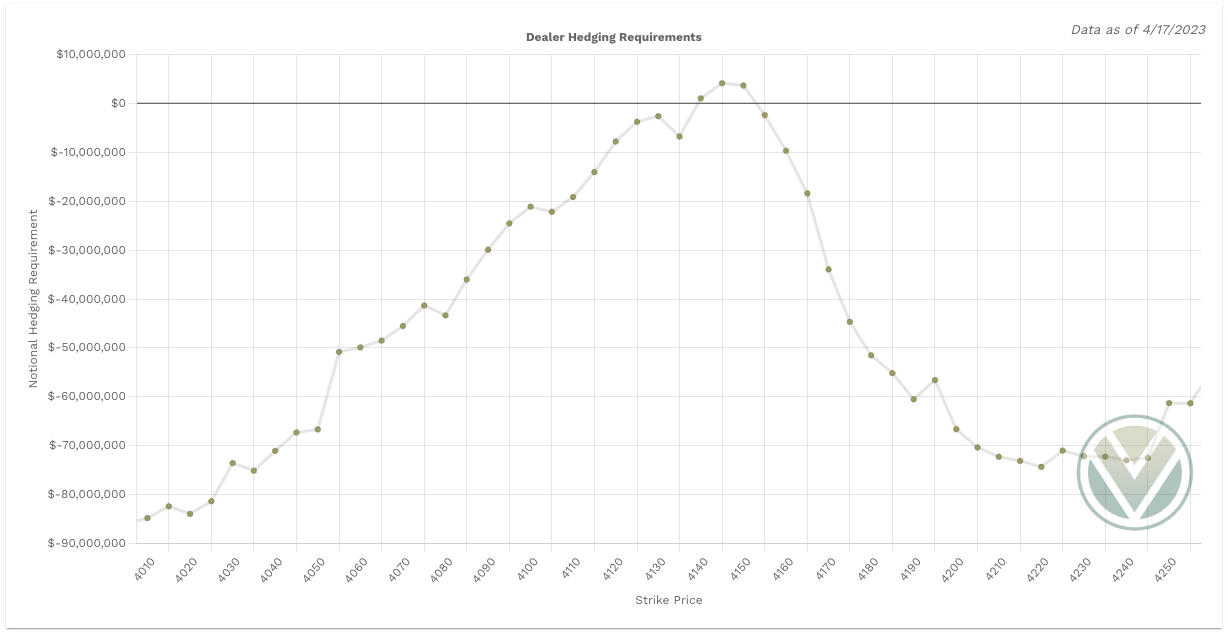

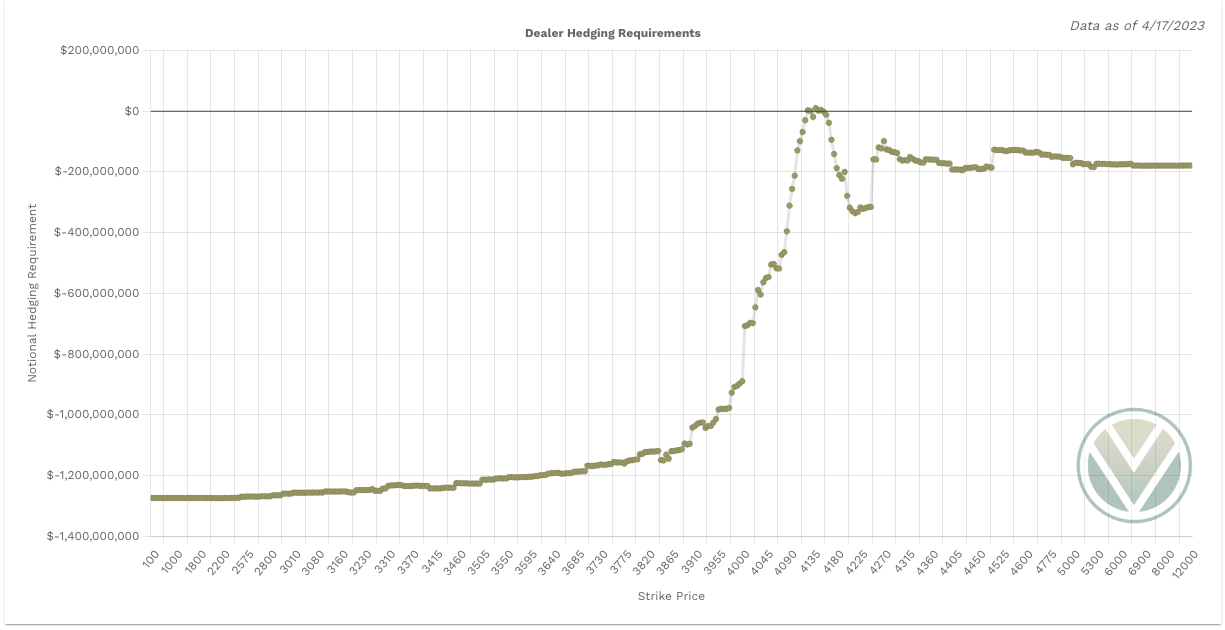

Volland Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4155-4190 - positive vanna

4195 - negative vanna

4200-4220 - positive vanna

4225 - negative vanna

Below Spot:

4150 - negative vanna

4140 - negative vanna

4130-25 - negative vanna

4120-4080 - positive vanna

4075 - negative vanna

Gamma and Delta-Adjusted Gamma (DAG)

Positive Gamma Above Spot - acts as resistance

Positive Gamma Below Spot - acts as support

Negative Gamma - becomes permissive to price as it moves there - aka neither resistance nor support - simply just chillin and watching what’s happening…

Above Spot:

4155-4190 - positive gamma

Dealers must buy between 4140-4150

Below Spot:

4130 - positive gamma

4100 - positive gamma

4075 - positive gamma

Dealers must sell below 4135 and above 4155

Charm

Charm is negative on SPX. This suggests that Charm will have little a more bullish impact on SPX, but the total notional value is minimal. While bullish I don’t see major upside from any charm effect. Again this is an aggregate view of SPX - doesn’t guarantee 0DTE bullish bias.

When reviewing Charm we also need to account for SPY’s charm. It is leaning bearish and continues to grow from last week.

For the full charm effect to play out ideally we want to see SPX and SPY in sync.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.