Good evening/day/morning traders. CPI is in full effect and will come into play majorly today.

Last session trading recap

Yesterday was a tough day to trade, but one thing our group did discuss and test is the difference in 0DTE vs 1DTE options. Had you opened the 4125c strike call on SPX yesterday at the open, the 0DTE decayed and you lost a lot of money whereas with the 1DTE you never faced much heat and on top of that it actually went higher netting a cool 10 pts in premium on the option going from 7.70 at its low to over 17.

I enjoy interacting and learning from other traders so continue to share your trades, ideas, and how you use this trade plan by messaging me on Twitter @DarkMatterTrade.

News Catalyst

8:30am est - CPI

1:00pm est - 10-y Bond Auction

2:00pm est - FOMC Minutes

For more information on news events, visit the Economic Calendar

SPX/ES/SPY Trade Plan

Remember you can use this SPX trade plan to trade ES or SPY. ES value is approx. 27-30pts more than the SPX levels shared below.

Bullish bias:

Above 4125 target 4135

If there is a failed breakdown of 4075 target 4100

Bearish bias:

Below 4110 target 4080

If there is a failed breakout of 4135-40 target 4115

SPX - The Why Behind the Plan

Dark Pool Levels

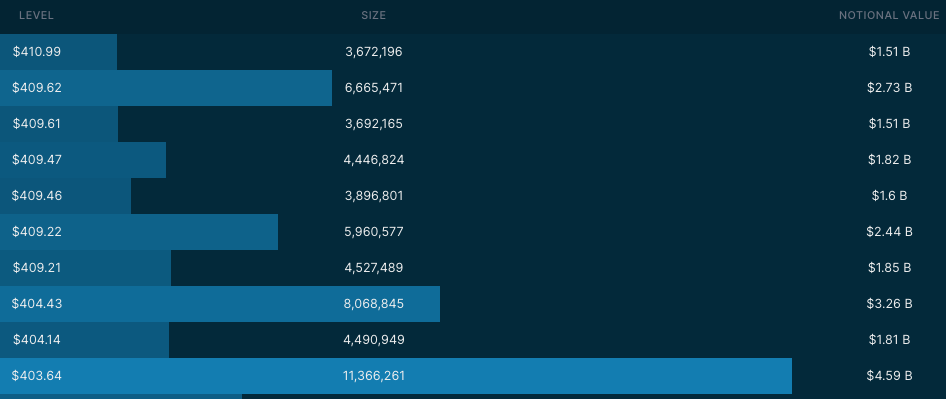

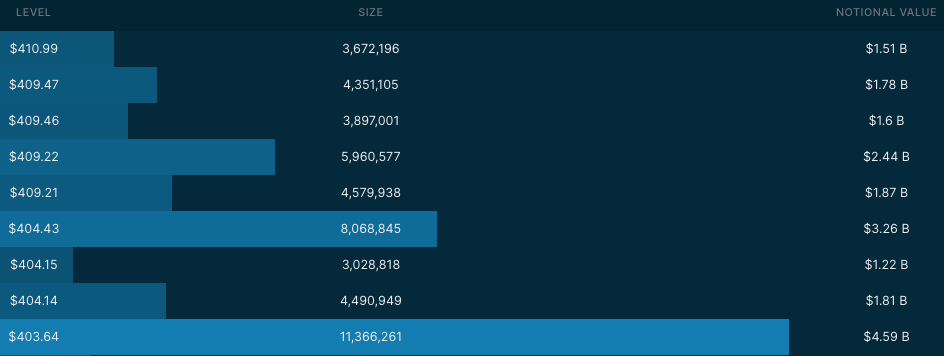

We need to pay attention to some key levels that have Dark Pool buildup. Mark them on your chart as key levels that we should pay attention to. Note I get my dark pool levels from Quant Data.

4104-10 - (409.21, 409.46, 409.61) - Over $11.95B has been printed at this level

4045-55 - (403.63) - $6B has printed at this level

3950-70 - (395.62) - Over $8B has been printed at this zone

3910-15 - (390.11) a key dark pool level that kept the market supportive

Here is a summary chart from Quant Data that shows the key levels that have been bought up in dark pool prints since the beginning of March 1, 2023. Remember the levels where we see dark pool prints greater than $2B should peak our interest.

Orderblocks (OB) and Fair Value Gaps (FVG)

These are smart money concepts and some areas I am looking to see how price reacts. I will give higher credence to OB’s whereas FVG’s could be areas of basing/consolidation if they break.

Resistance levels - at these levels I want to see if price rejects to short or consolidates for a push up. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4121-4134 - OB (1HR chart)

4135-4148 - OB (2HR chart)

4153-4176 - OB (1HR chart)

4176-4200 - OB (2HR chart)

Support levels - at these levels I want to see if price rejects to long or consolidates for a push down. I couple this data with Volland, intraday option flows, and Dark Pool levels. Higher timeframe OB’s or FVG will be harder to break. OB’s are the stronger levels over FVG’s.

4094-4088 - FVG (2HR chart)

4085-4070 - OB (1HR chart)

4070-4060 - FVG (1HR chart)

4060-4051 - FVG (2HR chart)

4049-4035 - OB (2HR chart)

4018-4007 - OB (1HR chart)

Volume Profile

Let’s review the volume profile and some key levels there. If you are unfamiliar with the Volume Profile I highly suggest reviewing some YouTube videos or reading this quick overview on it.

Some keywords to be aware of:

VAH = value area high

VAL = value area low

POC = point of control

A naked POC means it hasn’t been tested after it was formed - these will typically act as magnets

No major changes to our volume profile levels. Would suggest you view the 4/10 plan below for details.

Weekly Option Expected Move

SPX’s weekly option expected move is ~60.78 points. SPY’s expected move is ~7.64. Remember over 68% of the time price will resolve it self in this range by weeks end.

VIX Update

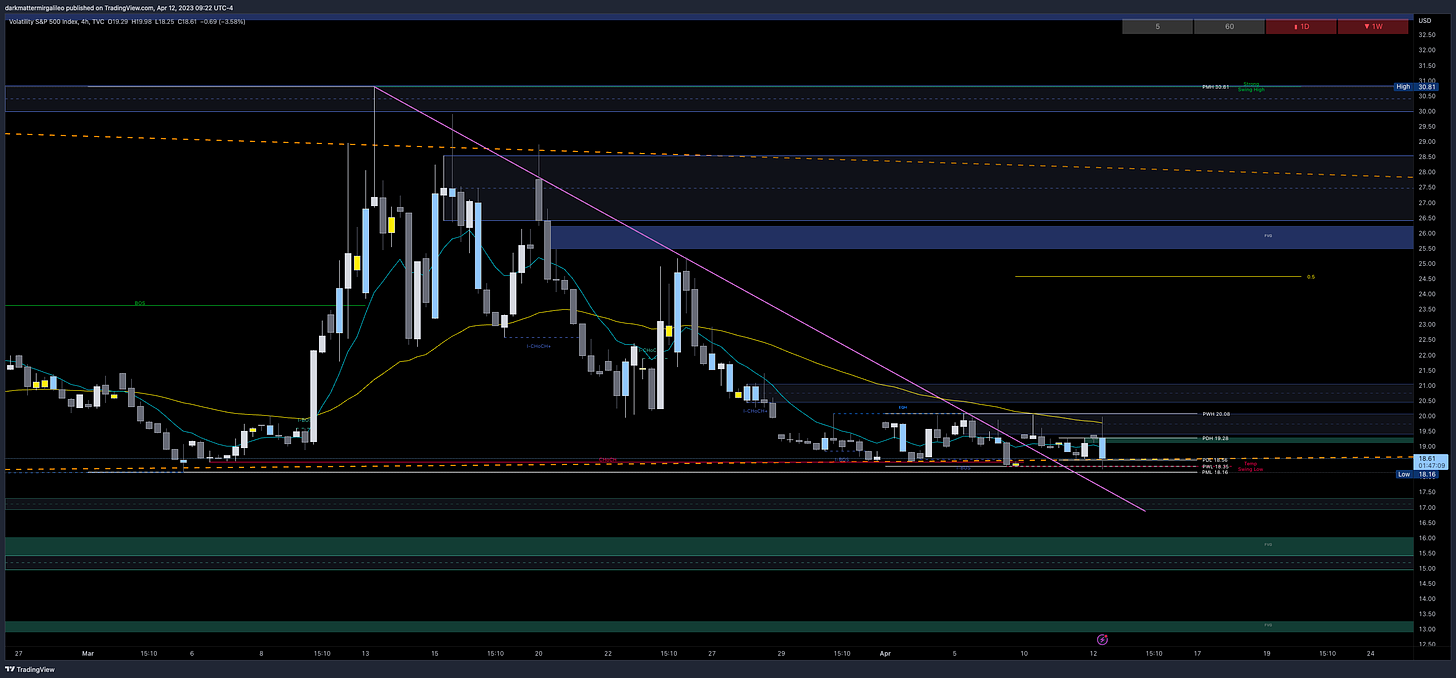

Let’s review the VIX chart. The VIX finally broke above the downward trendline and tapped a high of 20.05 before selling off and setting a new low of day LOD prior to close.

Above Spot:

19.42-20.09

20.45-21.06

Below Spot:

17.32-16.92

16.40-16.00

16.04-15.44

15.44-14.95

14.13-12.95

Remember, typically VIX going down correlates with a uptrend in the market and vice versa for a downtrend in the market.

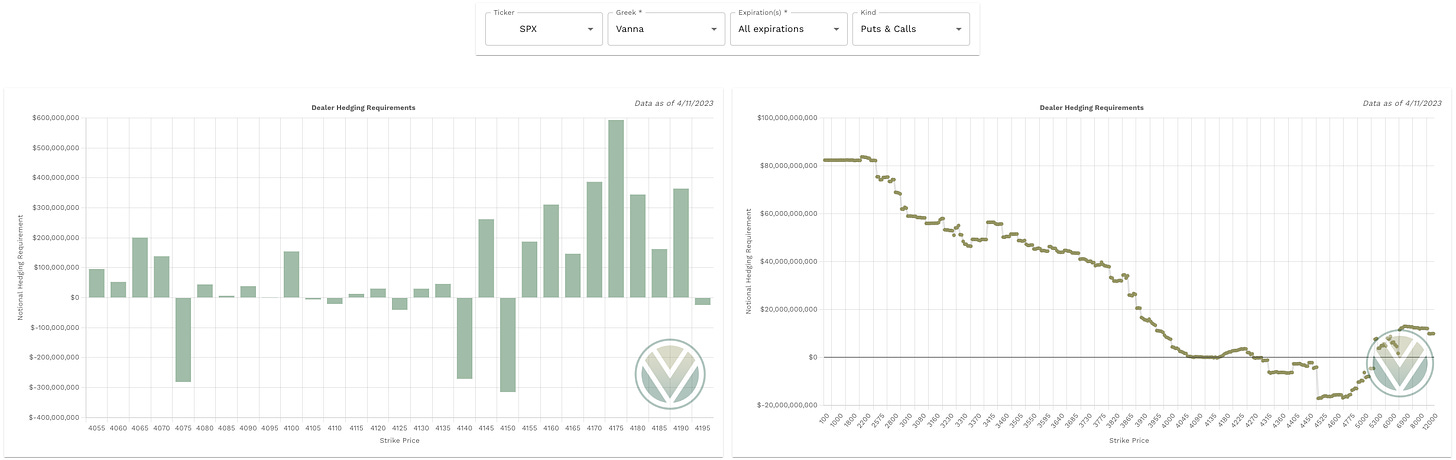

Vol.land Data

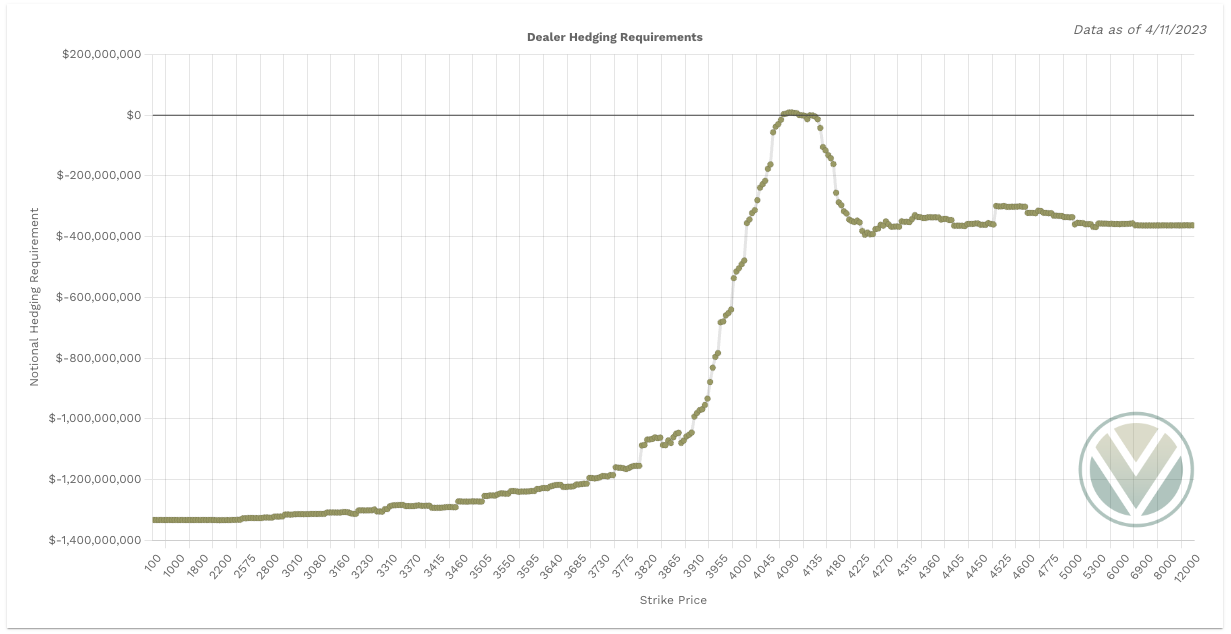

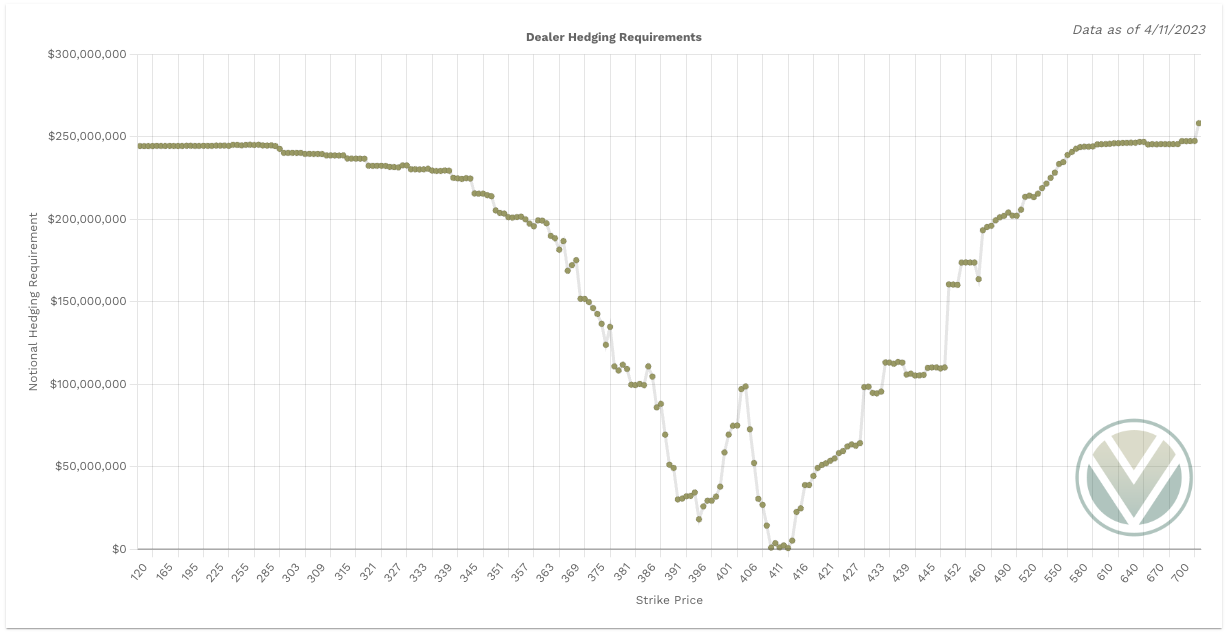

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Positive vanna - will act as magnet

Negative vanna - will act as repellent

When price goes through a positive or negative level it will flip it - ie negative becomes positive and vice versa.

Above Spot:

4125 - negative vanna

4140 - negative vanna

4150 - neagtive vanna

Below Spot:

4110 - negative vanna

4100-4080 - positive vanna

4075 - negative vanna

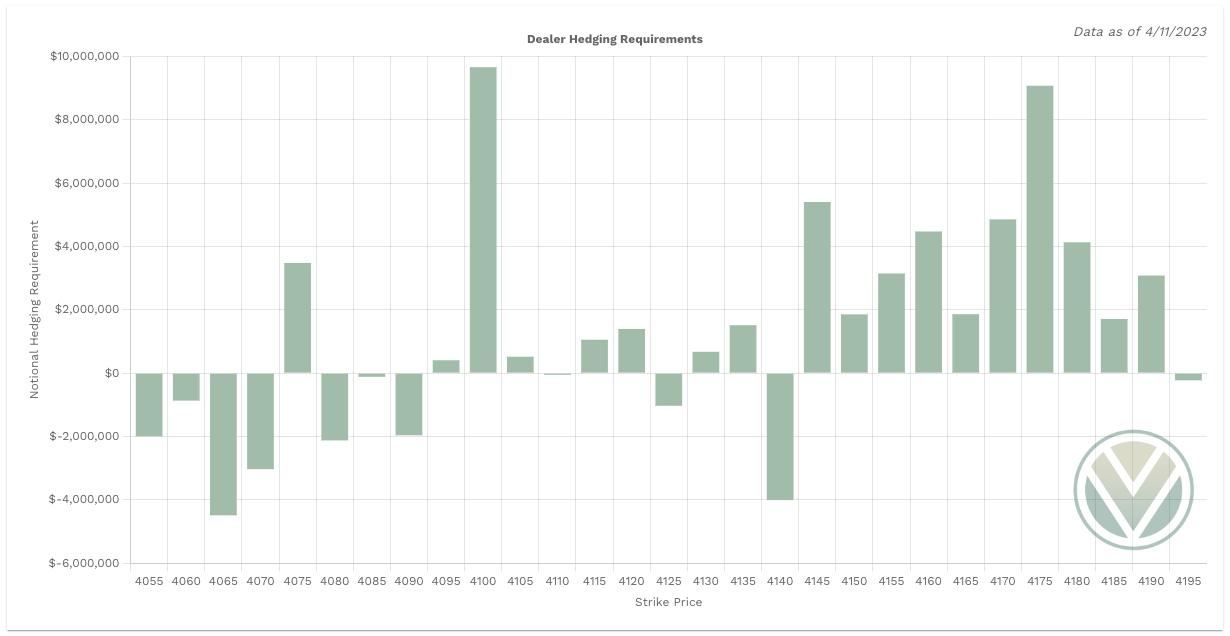

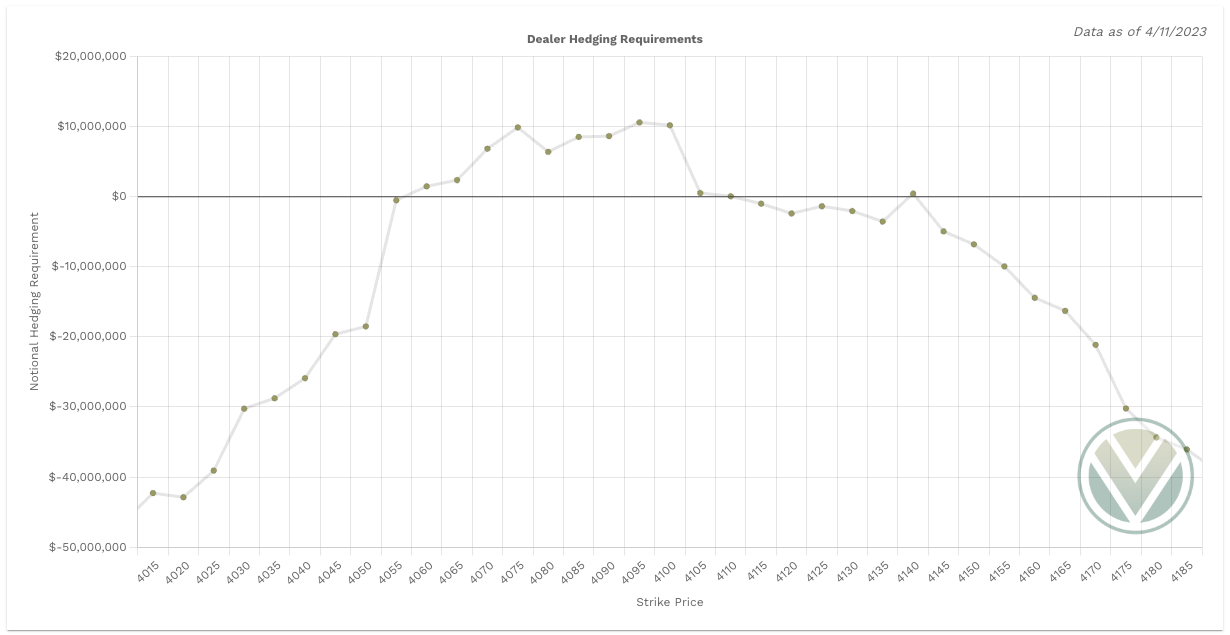

Gamma and Delta-Adjusted Gamma (DAG)

Positive Gamma Above Spot - acts as resistance

Positive Gamma Below Spot - acts as support

Above Spot:

4125 - positive gamma

4140 - positive gamma

Dealers must buy between 4060 and 4100

Below Spot:

4100 - positive gamma

4075 - positive gamma

Dealers must sell all levels below 4055 and above 4145

Charm

Charm is negative on SPX. This suggests that Charm will have little a more bullish impact on SPX. Again this is an aggregate view of SPX - doesn’t guarantee 0DTE bullish bias.

When reviewing Charm we also need to account for SPY’s charm. It is leaning bearish.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.