Multi-Ticker Trade Plan

Welcome officially to our first trade plan where we incorporate additional tickers. Let’s set some baselines here in terms of options selection and some of my past experiences trading individual tickers using similar strategies as we do with intraday plans for the SPX.

Monday’s trade plans for individual tickers typically provides the best results - most times I have been able to get to my desired PnL before ending the trade if it was a weekly or swing even

In other words I either under expected the move or made my profit targets too low

As you all know for me it is all about base hits, add to the bank and just continue to take profits which allows me to go stronger in future trades with profits

How SPX moves will typically guide most of the tickers we share mainly ones in tech so keep your SPX and these tickers trade plans together in mind

The more correlation - ie tech - has to an index it will most likely guide that way - for example if QQQ is going down most like AAPL, ADBE, MSFT, etc are going down

You must trade weeklies - ideally I recommend trading expiry’s 2 weeks out - I have a tested both ways and let me share

I have even selected the next OPEX expiry - typically the 3rd Friday of each month

Playing weeklies on Monday & Tuesday are acceptable

You can also find some nice lottos that have hit as 0DTE trades on Friday, but I always go light and treat it as such - a lotto

Beyond Tuesday you want to play into next week at minimum to at least give your trade a chance to play out

Depending on the ticker do not play too far OTM. At max select the first target as the strike and if we get further moves we ride it out then or roll up to the next target

For example, if I am trading ADBE I am not looking to go past 10pts on a strike otherwise strikes further OTM will further decay because their probability to hit that strike to expiry will decrease especially if we get any chop or sideways action - this sometimes leads you to cutting trades sooner than you wanted to and watching it go finally the way you wanted

Have an exit plan in the event the trade doesn’t go as expected

This is all on you and your management of your risk appetite

We will share updates on the trades if anything major changes to them, but as targets are hit consider them wrapped up and manage your own trades

We will include any updates via X as well so please be sure to subscribe if you haven’t

Here is an example:

After December 19th I was looking for shorts on this ticker. For long time readers if you remember I sent a trade plan for ADBE stating the below:

If there is a failed breakout of 600 target 590

Below 590 target 585

Knowing that we were in holidays and low volume instead of taking weeklies and even 2 weeks out I decided to opt for the January opex expiry - in this case the 1/19 expiry. I entered at around $9.00 in premium on the trade. Sat on this trade where I exited at around $15.00 avg premium - it’s high went to $19 that day. I did get some heat on the trade - meaning it went red once on 12/29 with a low of $8.75. Not a bad drawdown and what I had with me was the key levels and when I should cut the trade if I was wrong. I wasn’t, decay and low volume during the holidays…

I did have more time on the contracts, but it hit my profit target and I was ready to take another trade. The high of this contract went to $27.00 in premium.

Remember, today is the last day of our free preview to all members - paid or not paid. Trade plans like these and our SPX/SPY/ES trade plans will only be made available to paid subscribers.

We put a lot of effort into this daily trade plans and for only $15/month - less than $1 a day that is not to high of a price to support us.

Subscribe now for as little as $15/month to receive daily trade plans, interactive chat room, and educational content.

ADBE Trade Plan

Since its ER ADBE has just taken a beating. Is it done? I am not so sure…This will trade as SPX does especially the tech sector. The options market seems to want to contain it between 530 and 590 on the week.

At a high level I want to see 555-560 hold on ADBE and for an interim bounce to 575 and then to 590.

So what is the trade idea?

Trade Idea:

Above 555-560 target 575 then 587.5-590

Be patient with this one - we could open near Friday’s levels even push up to 565 or 567.5 to then sell back down

At 575 I would recommend locking in your trade as we will face some resistance/consolidation at 575

There will be consolidation and some resistance at 575

Trade is invalidated below 550 daily close

Strike Ideas:

575 call - 1/19 expiry

580 call - 1/19 expiry

Vanna Levels

Volume Profiles

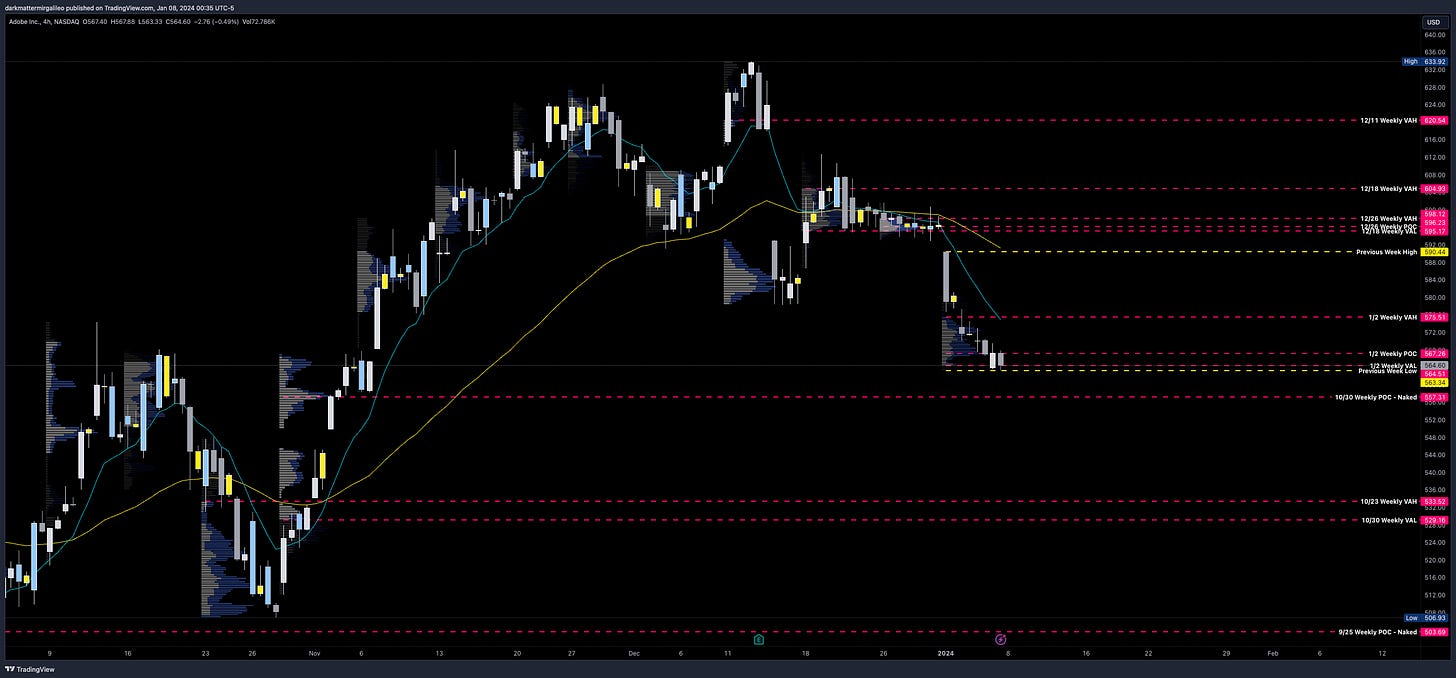

Let’s review the key weekly profile levels on the 4hr chart…

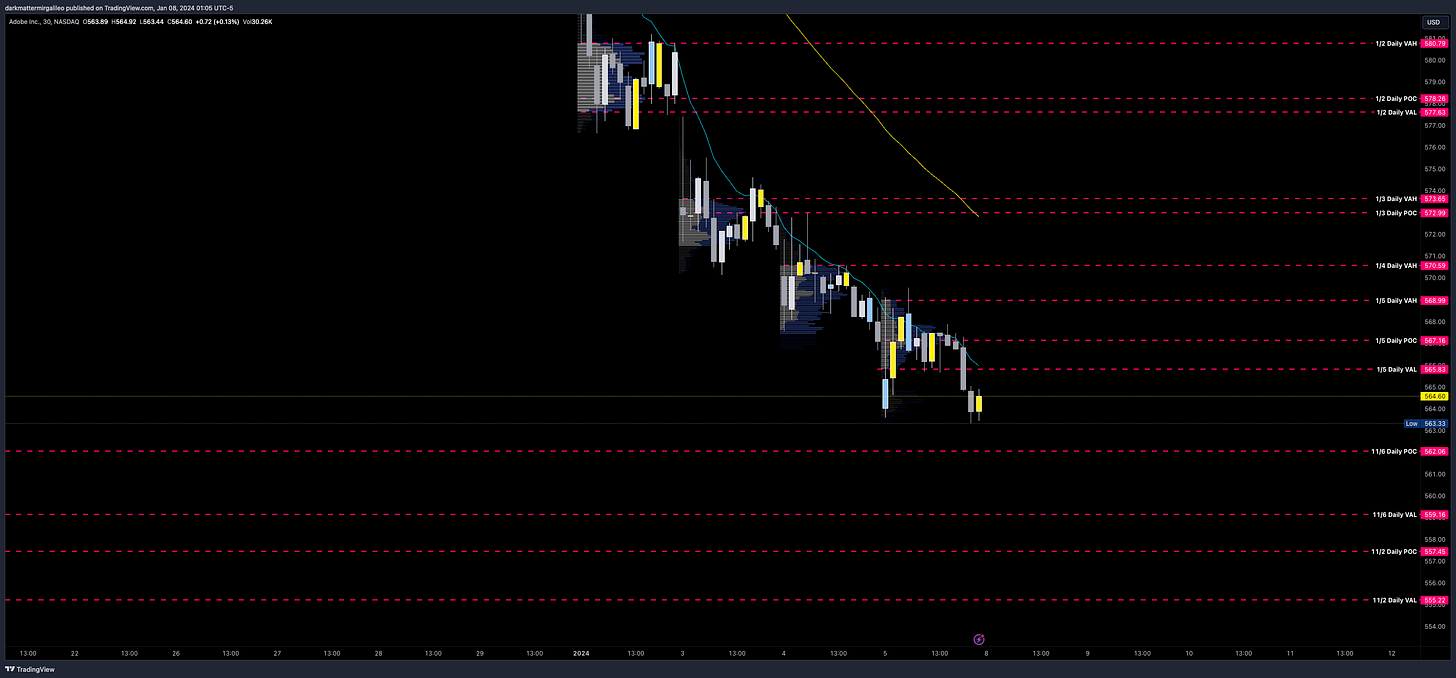

Here is the key daily profile levels on the 30min chart…

Orderblocks

My spidey senses tell me they take out this orderblock where liquidity resides and then push price up, which will give us an opportunity for a better short trade to take later in the month and into February.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.