Multi-Ticker Trade Plan

As the indices may go through a period of consolidation and sideways action I wanted to focus on a few tickers and share some trade ideas on them. With that said let’s begin…

Of these two tickers I prefer AVGO than I do ADBE. Feel like ADBE is going to go through more of a consolidation phase before it finds its next path up or down.

Subscribe now for as little as $15/month to receive daily trade plans, interactive chat room, and educational content.

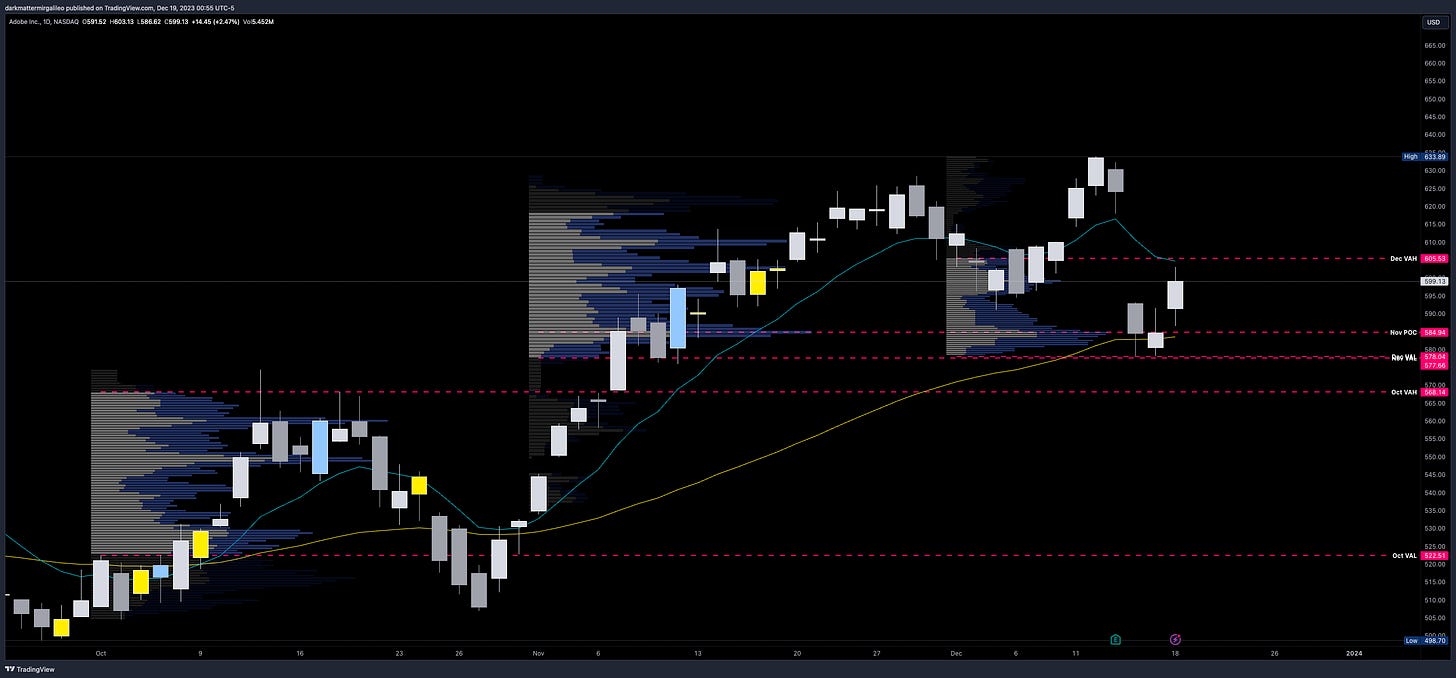

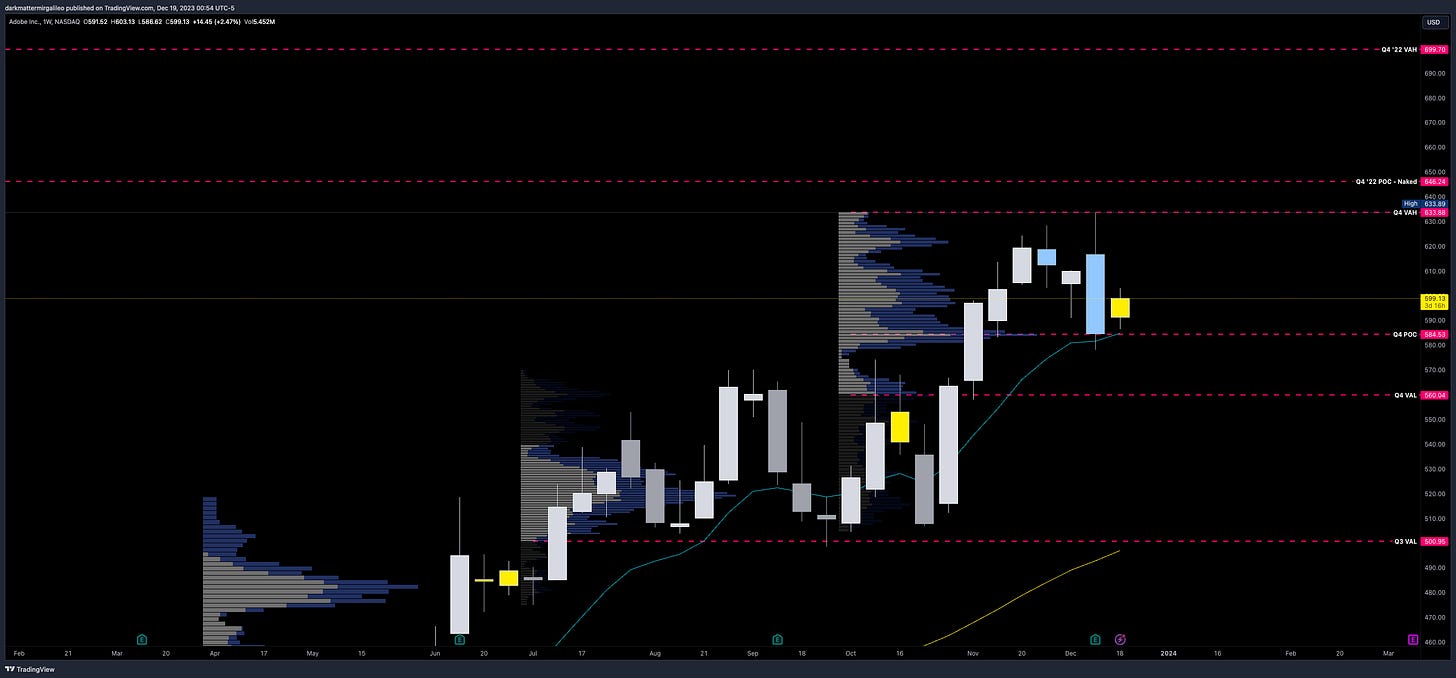

ADBE Trade Plan

This ticker took a beat down after its earnings report. It has since found some support around 580 where it rallied from Friday’s close and hit as high as 602 before it sold off in this mornings action. As price traded back near 585 we found support and off it went to chase the highs of the day - although it came short intraday.

So what is the trade idea?

Bullish Bias:

If there is a failed breakdown of 590 target 600

If there is a failed breakdown of 585 target 600

Bearish Bias:

If there is a failed breakout of 600 target 590

Below 590 target 585

Vanna Levels:

Volume Profiles:

Daily Profile…

Weekly Profile…

Monthly Profile…

Quarterly Profile…

Orderblocks…

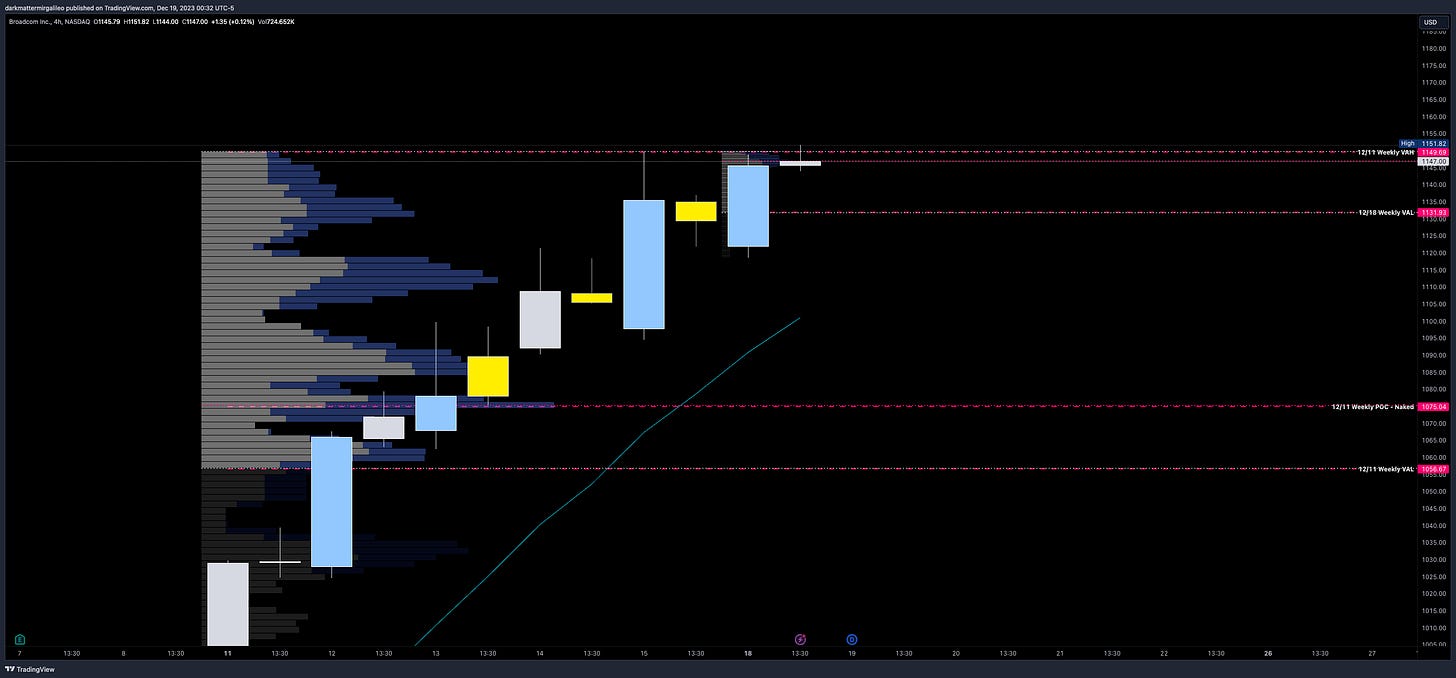

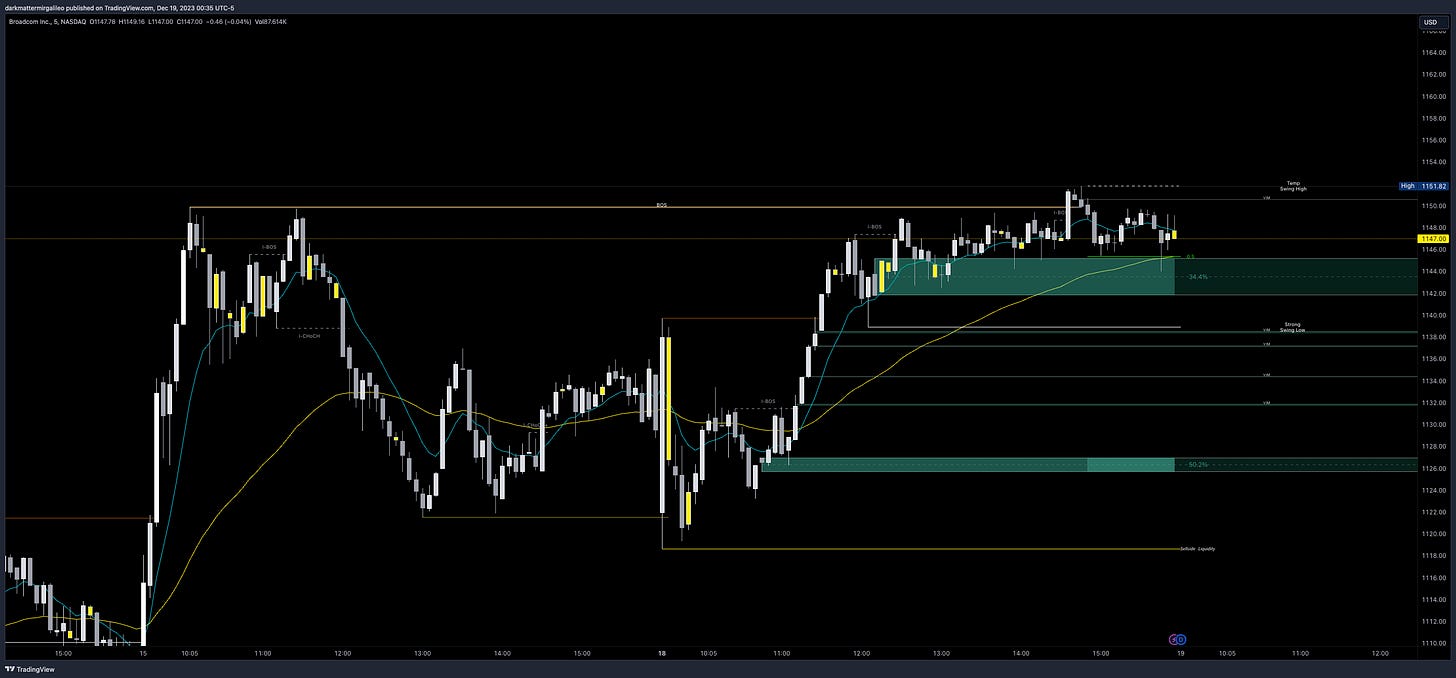

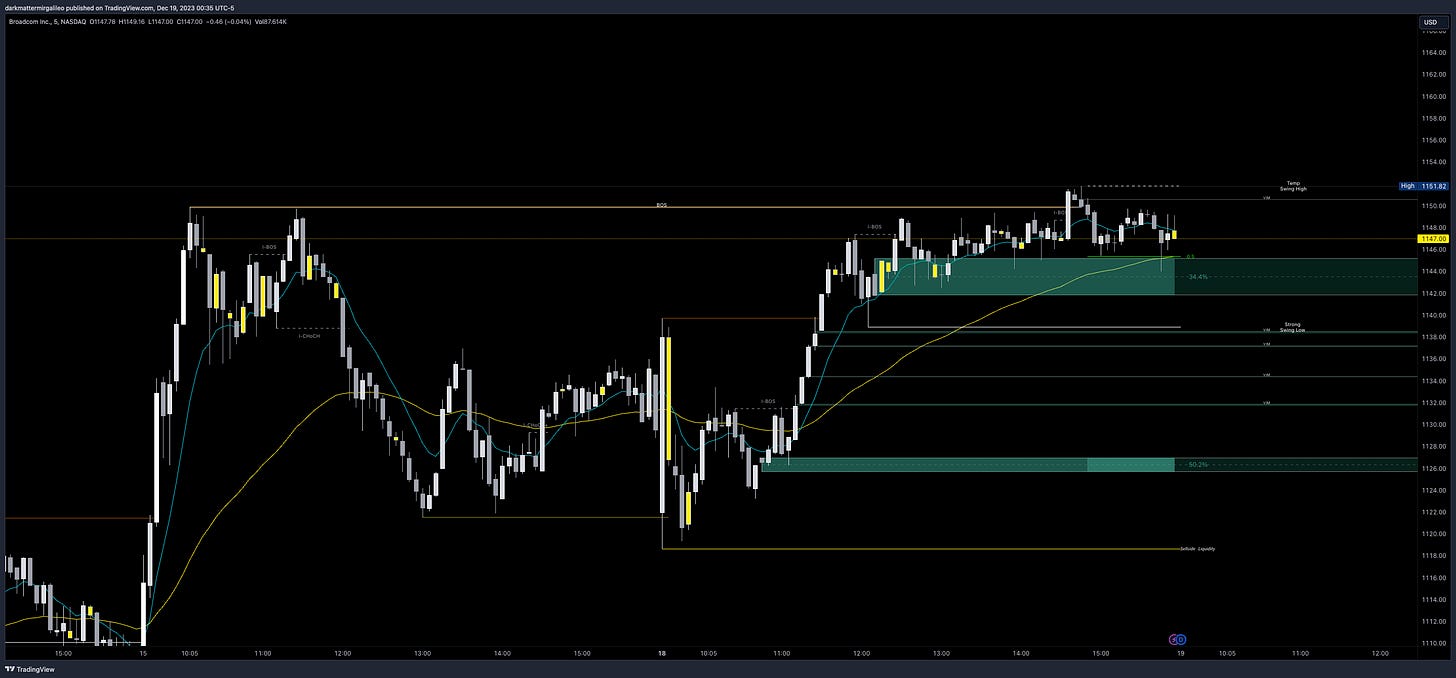

AVGO Trade Plan

This ticker has been on a tear prior and post its earnings report. It is now going through a phase of consolidation and potentially looking to continue this rally up.

So what is the trade idea?

Bullish Bias:

If there is a failed break down of 1145 target 1160-1165

You could go long at 1150 to be safe as it breaks it’s ATH’s

If there is a failed break down of 1135 target 1160-1165

I want to see this trade occur in the first hour of the trading session

Above 1165 target 1175

Want to make sure that this is not a fake breakout so manage risk here and wait to have candles close above and ideally retest 1165 for further upside

Bearish Bias:

Below 1142 target 1135

Below 1135 target 1125

VIX must be going up to take this trade

The indices need to be going down and show continued weakness

Vanna Levels:

Volume Profiles:

Daily Profile…

Weekly Profile…

Monthly Profile…

Orderblocks…

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quant Data and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.