Readers,

Last week was wild to say the least, I was looking at a pretty big loss swinging puts into Friday, but I had conviction with my levels, and everything turned out fine.

Going forward I will be laying out my weekly plan here on Substack before each trading week and I will be doing updates and commentary over on X (formally known as Twitter) @CaptainWick

The reason I am only doing my weekly plan is because, if you guys have noticed the information/levels I put out on Sunday’s usually holds true for the entire week. Yes, it does change day to day but overall, the levels stay fairly similar. If we trade a major level or we enter a new value area I will be doing those updates via X. My partner in crime aka @DarkMatterTrade does a fantastic job of keeping us all informed with the news and events going on day to day. I am sure you guys read his content as well and if you don’t, I highly suggest you do, his levels day to day are a scalpers dream! Keep up the good work my brother!

My goal is to paint a picture of what I think the weekly outlook is going to look like and so far, I would say we are doing a pretty good job!

Market Makers (MMs) Weekly Expected Range

The MMs are expecting a weekly move in SPY of 7.86 this week. They got it wrong last week as we closed way under the expected low. This could be in favor of the bears, but we will have to find out. The last few weeks they were getting it wrong to the upside.

Notice that the expected move is greater than 7. This is higher than any week last month basically. Keep a look out for Dark’s post on the news/events we have coming up.

454.67 High

438.95 Low

Monthly Volume Profile Levels

Current Value Area

452.53 Value Area High (VAH)

450.50 Point of Control (POC)

447.70 Value Area Low (VAL)

July’s Value Area

458.54 VAH

454.18 POC

446.24 VAL

Notable Naked Levels

411.56 May POC

409.77 May VAL

Notice that on the July’s profile all of the levels are still naked, meaning they have not been breached during the live session. We came really close to the VAL sitting at 446.24 but missed it by .03. If 446 holds, we could slingshot back up to the dreadful 454 level in my opinion. It can get nasty under 446-44, but there is one key area of support that I will cover later on in the post that could possibly keep the market up for another push to all-time highs.

I hate to say it but if we stay in July’s value area we could be dealing with some choppy trading. Get in and get out, take your profit or your loss and move on. Options expire worthless majority of the time, don’t marry your positions.

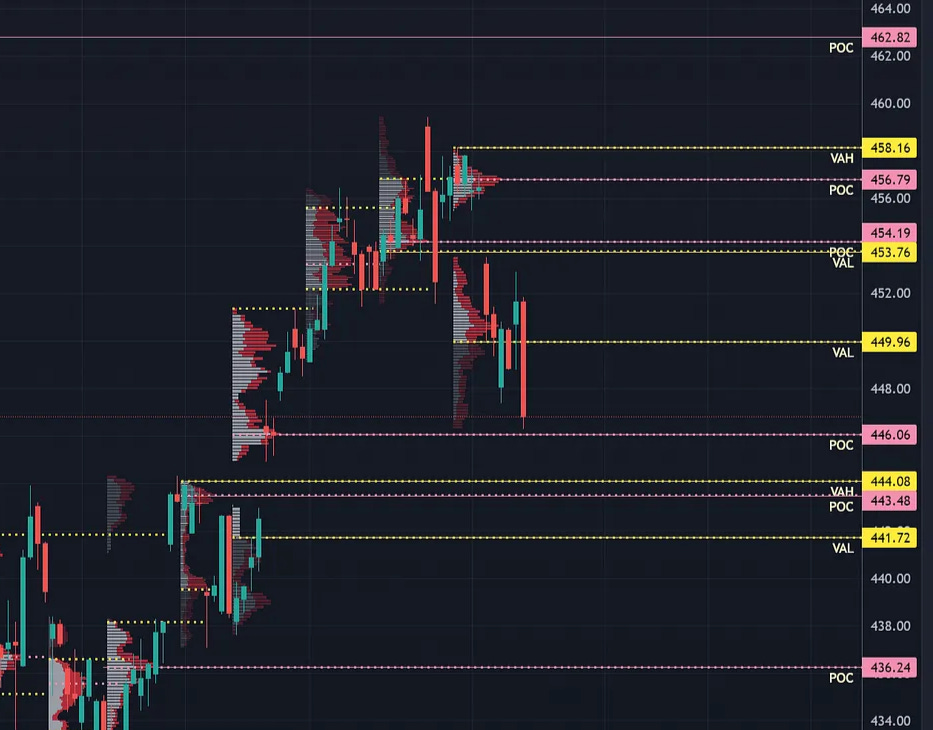

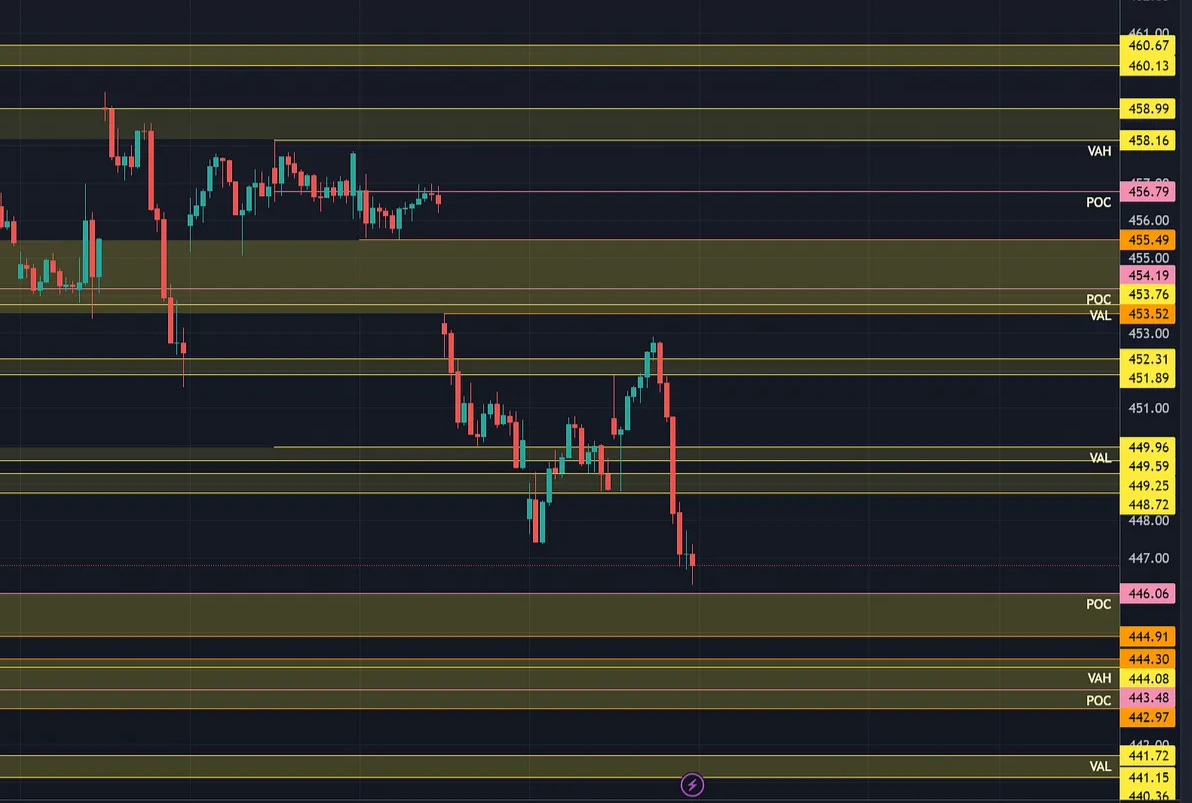

Weekly Volume Profile Levels

Last Week's Levels

458.16 VAH

456.79 POC

449.96 VAL

Notable Naked Levels

467.89 VAH

462.82 POC

454.19 POC

453.76 VAL

446.06 POC

444.08 VAH

443.48 POC

441.72 VAL

436.24 POC

This could be one of the more interesting looks we have seen in a while. I posted about this on X last week but let’s go over it again for context.

Notice the gap that happened on July 12th, on that profile we took out the previous weeks VAL on Monday and gapped above the POC and VAH on a Wednesday keeping them untested and we rallied another ~14 points. We have a very similar situation here but it's the other way around. We took out last week’s VAH on Monday and then on Wednesday we gapped under the POC and VAL leaving them open at 453.76-454.19 I believe if the bears let the bulls take back 454.19, we will trade at 462+, but me personally I would like to see those levels at 446-443.50 tested before we go to 462. I will be targeting that area as long as we stay under last week’s value low at 449.96. They are basically the same profile but flipped.

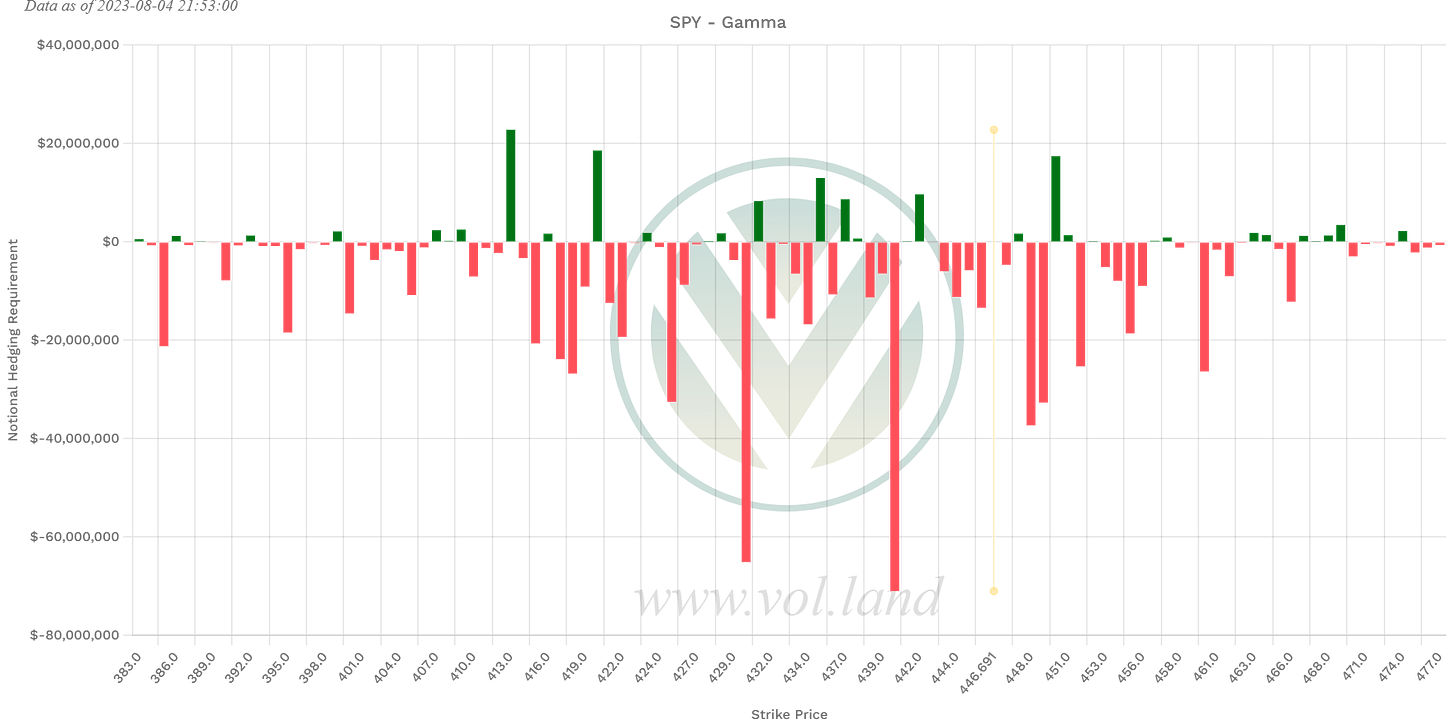

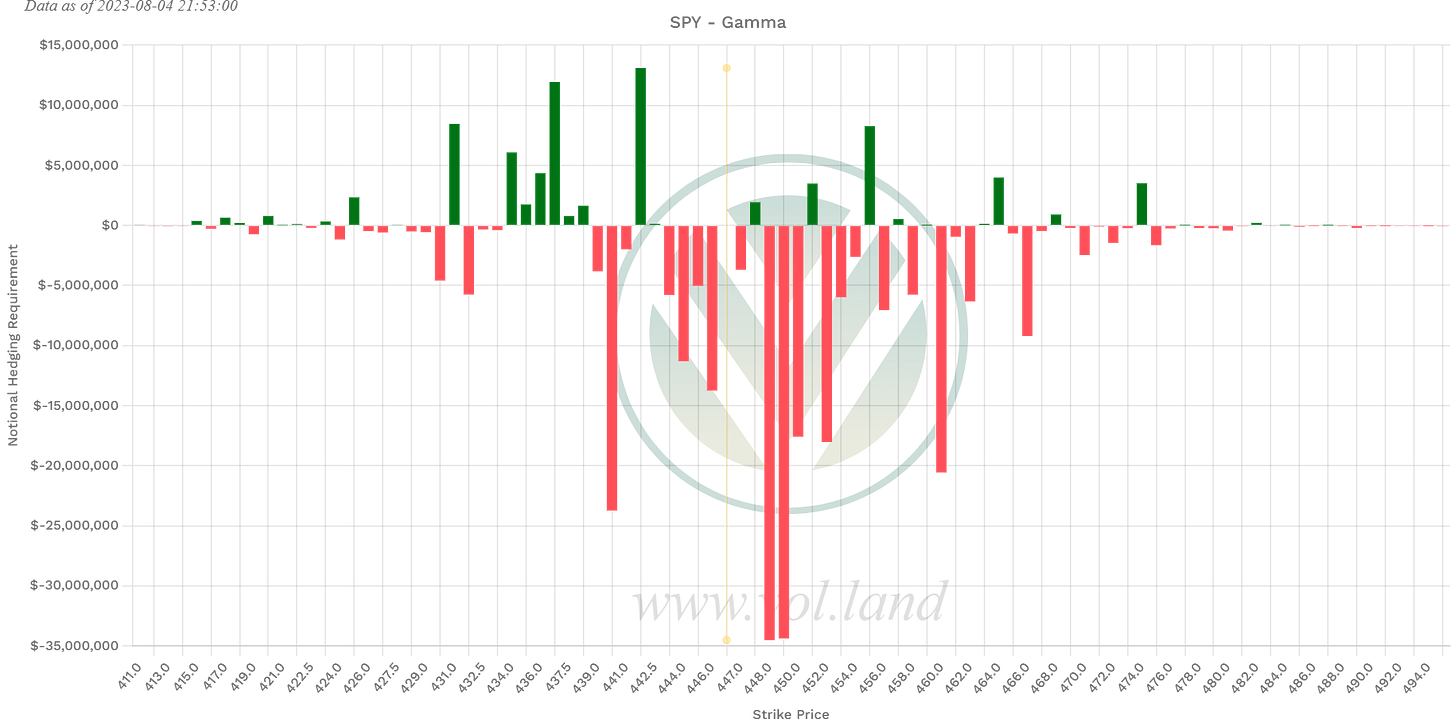

Positive Gamma

Aggregate

431, 435, 437, 442, 447.50, 450

This week

431, 434-438, 442, 447.50, 451, 455

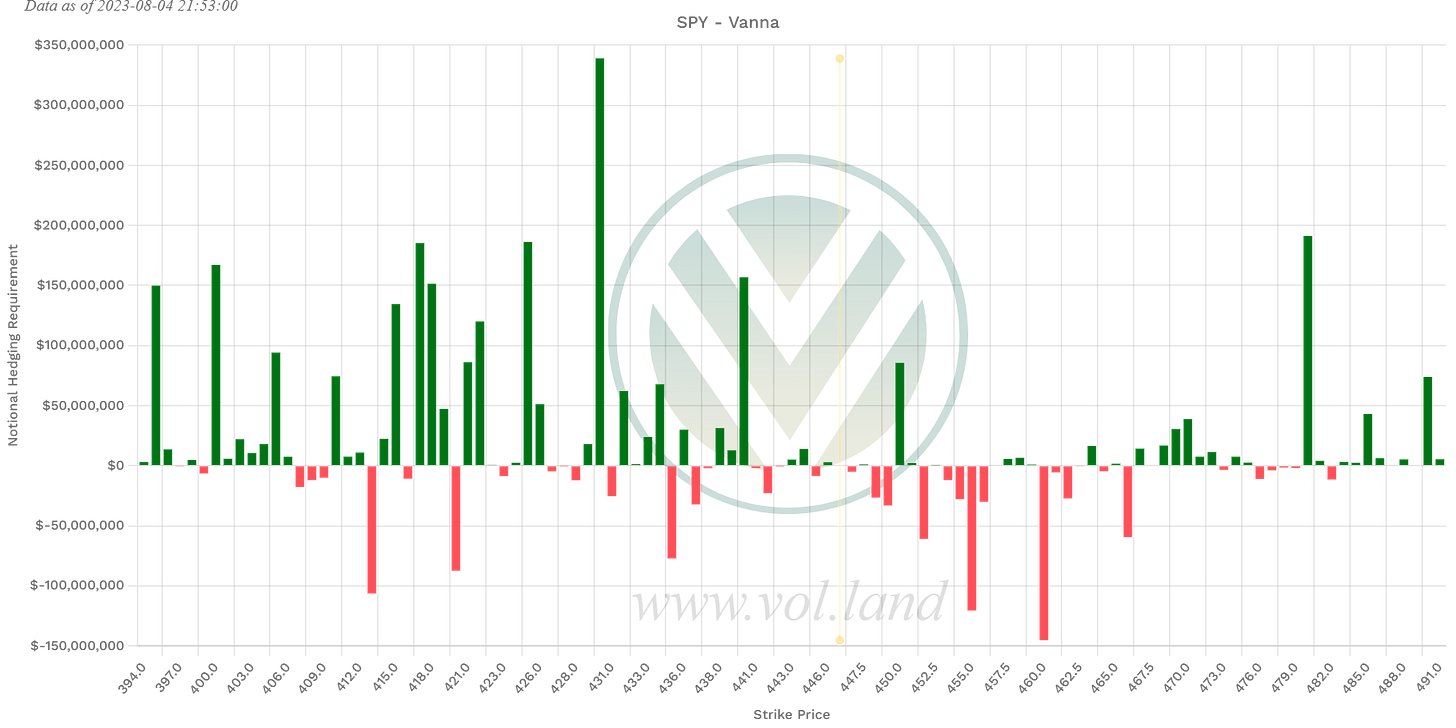

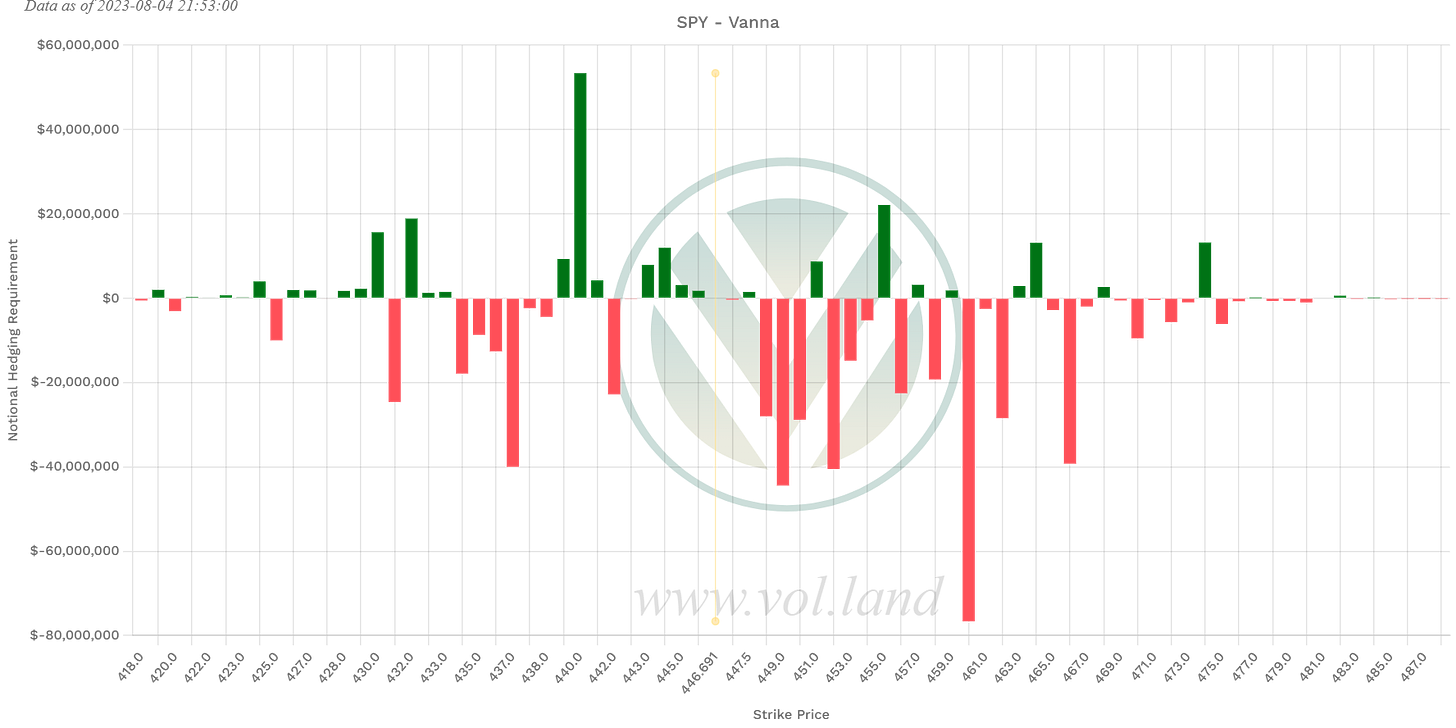

Negative Vanna

Aggregate

431, 435, 437, 442, 445, 447, 448, 449, 452, 453-456

This week

431, 434-438, 448-450, 452-454, 456, 458, 460

See this gap sitting at 444.91-444.30, this area is also near that weekly VAH and POC we discussed earlier. I think that a strong bounce out of this area could send us to 462. This is the area that I have been seeking and we are very close. If this area trades, we have to be cautious on if it will remain support or if it turns into resistance.

My plan this week is to see what happens at 445-441 or see what happens at 450-458, I will obviously be trading within these levels but for any swing type action I am looking for a reaction in or at one of these zones. From a lot of the content that I have seen on X it seems to me that there are a lot of bears all of a sudden, some are even calling for a black Monday.

All I have to say on that subject is this, don’t let someone else’s bias make you deviate from your own strategy, unfortunately for me I let this happen to myself this week, and I missed out on a HUGE opportunity on a big big trade. When your setup presents itself, you have to take that trade because it fits the criteria of your trade plan.

Trust yourself and the process you are going to take losses, it happens, but it’s how you bounce back from those losses that separate’s you from greatness. Opportunity cost is part of the game, if you are entering a trade you need to know why you took said trade, and when to get out of said trade whether it’s for a gain or a loss.

Please don’t risk a lot of hard-earned capital on a gamble because you saw someone post a trade they took. One of your worst trading days could potentially be someone else’s best trading days and vice versa, so be humble!

Don’t forget to have a stop loss whether its mental or hard, for me I don’t like hard stop losses because I can’t calculate in my head fast enough on what the price of my strike would be if the trade goes against me but stays close to a key level. I use price line alerts on the underlying to notify me if price is headed towards my target or my stop. I also don’t want to get stopped out if they stop loss hunt as a fake out and I will usually wait for the candle to close before making that decision.

Stop holding onto positions that you think will “come back”. I am guilty of this, and this is why I am including it here, because I need to write it down so I can hold myself accountable get better at preventing this bad habit. Cut your losses and move on, there is ALWAYS another trade!

One more! Stop being greedy by thinking your position is going to keep going in your favor, set your target and take profit. If you want to stay in the trade, make sure you position yourself to hold runners, or by rolling out.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.