Readers,

Market Makers (MMs) Weekly Expected Range

The MMs are expecting a weekly move in SPY of 6.22 this week. Last week we finally closed inside the expected move for the first time in a few weeks.

458.40 High

445.96 Low

Monthly Volume Profile Levels

Current Value Area

450.81 Value Area High (VAH)

439.48 Point of Control (POC)

437.06 Value Area Low (VAL)

June’s Value Area

438.25 VAH (breached)

436.18 POC

427.52 VAL

Notable Naked Levels

457.83 April 22’ VAH

411.56 May POC

409.77 May VAL

On the monthly profile you can see we are still at a imbalance to the upside trading above the current VAH. In my opinion, I believe we have some unfinished business in these lower volume areas under the current VAH. The question is, do we take out April 22’s VVAH first? Or do we can a pullback to balance in these low volume nodes? I already said that I was in favor of a pullback to these levels, I think 444-443 could be a really attractive level for the bulls to defend and if these area trades again I will be looking to be a buyer as well.

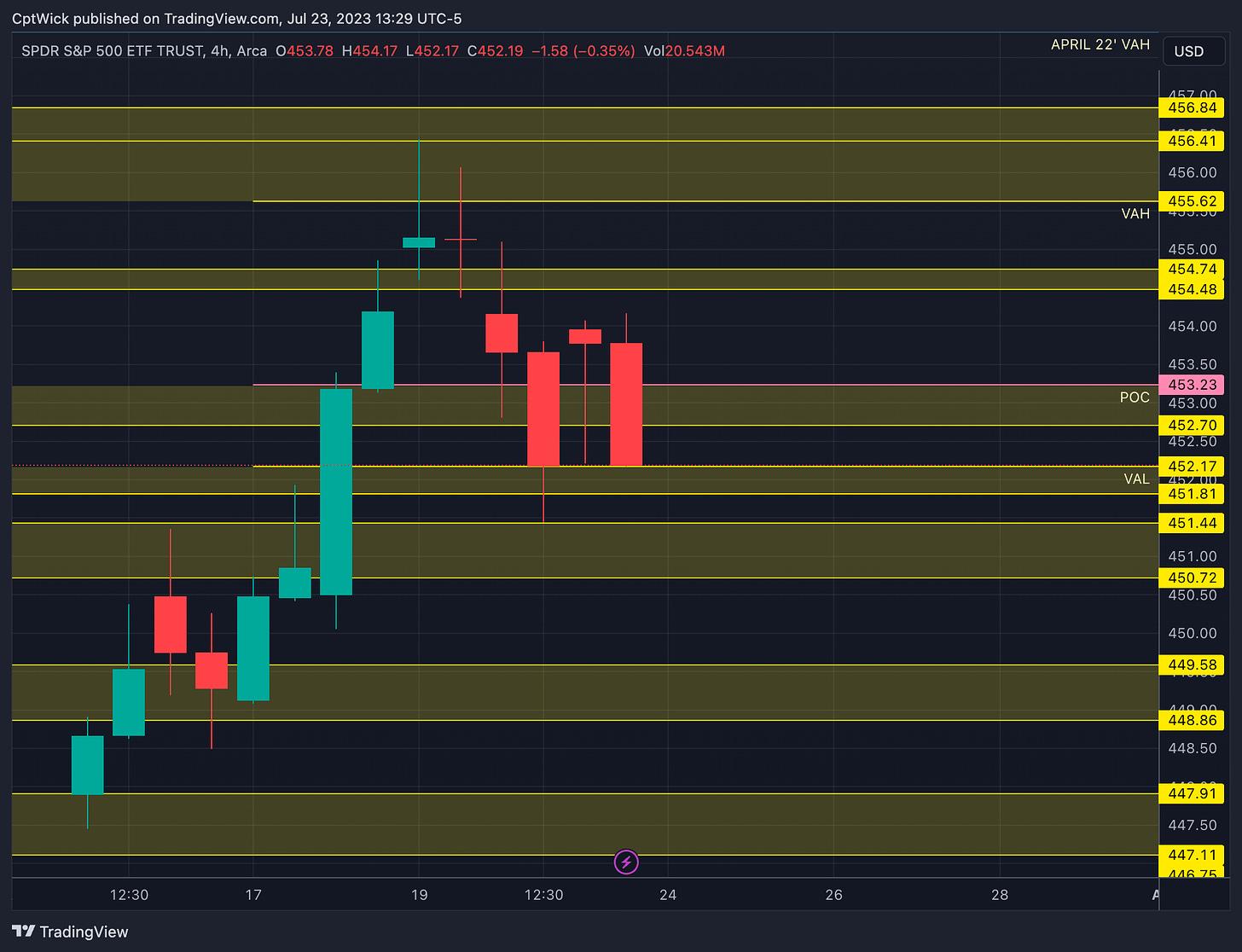

Weekly Volume Profile Levels

Last Week's Levels

455.62 VAH

453.23 POC

452.17 VAL

Notable Naked Levels

436.24 POC

441.72 VAL

443.48 POC

444.08 VAH

446.06 POC

458.32 VAH

462.82 POC

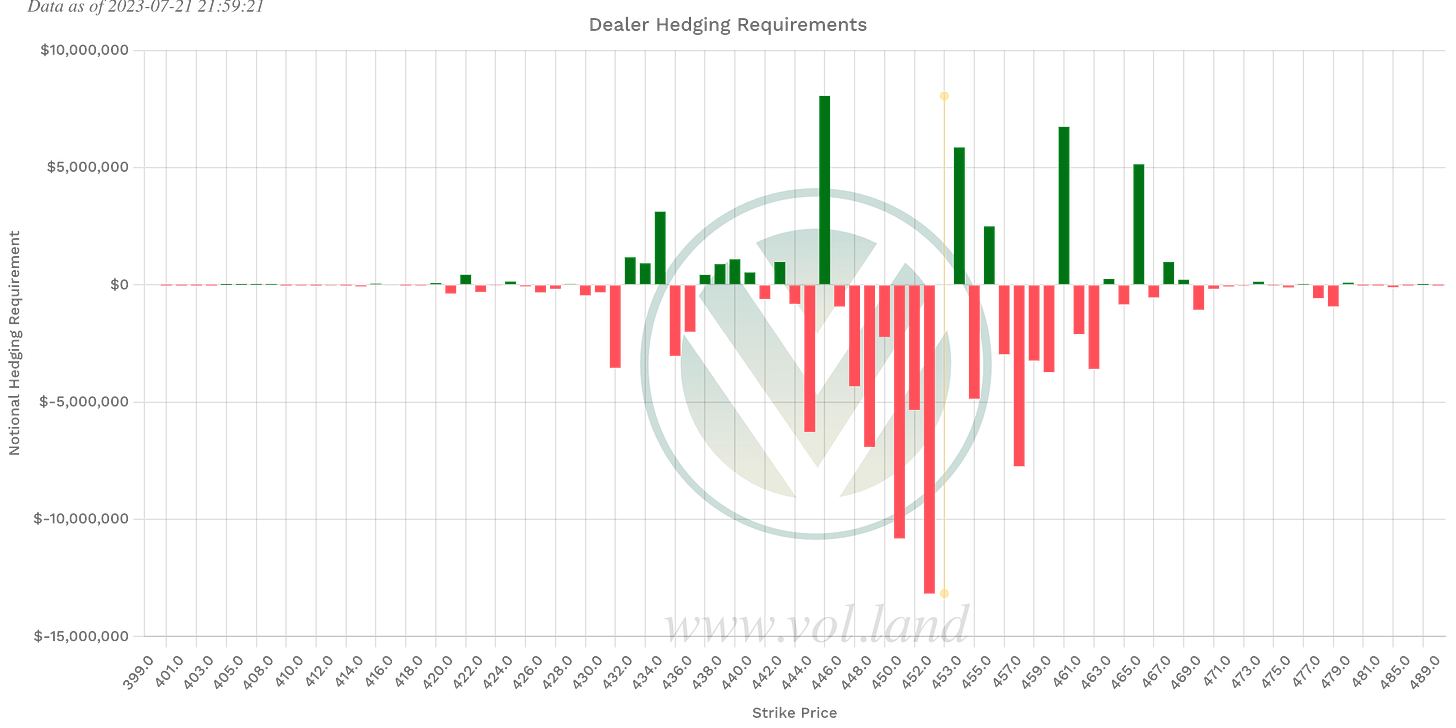

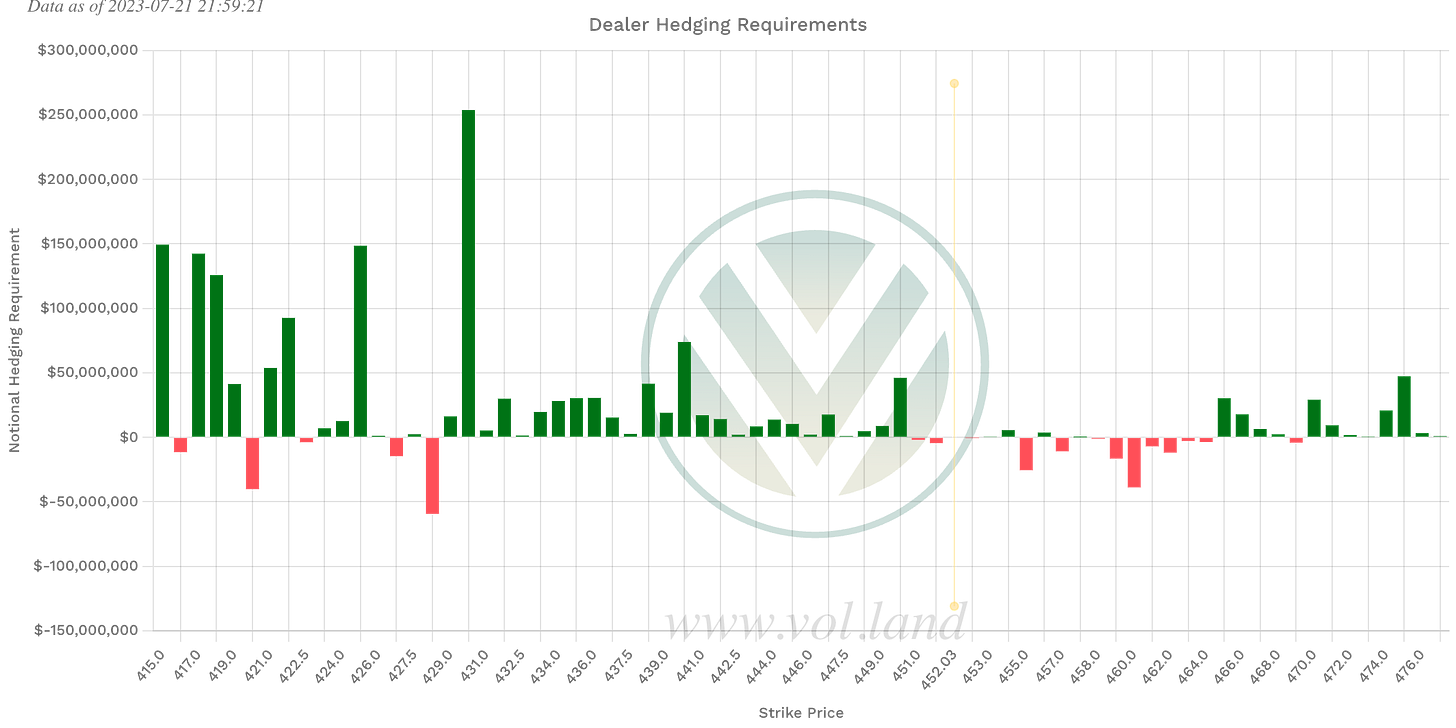

Bigger picture I am interested in how price reacts in these two areas. Based on the Volland data I think it might be tough to push up to 455 again, 445-443 could bring a nice bounce opportunity. If you are a bull here you can’t get mad a pullback to these levels. If we keep pushing up, the harder we will fall, a pullback here is healthy for the market imo. Ideally we open around 450, we then come up to test last weeks value area 452-455 (could open here too), reject and trade down towards 445, a man can dream I guess.

If price stays within 452 and 456 I think the conditions could be choppy.

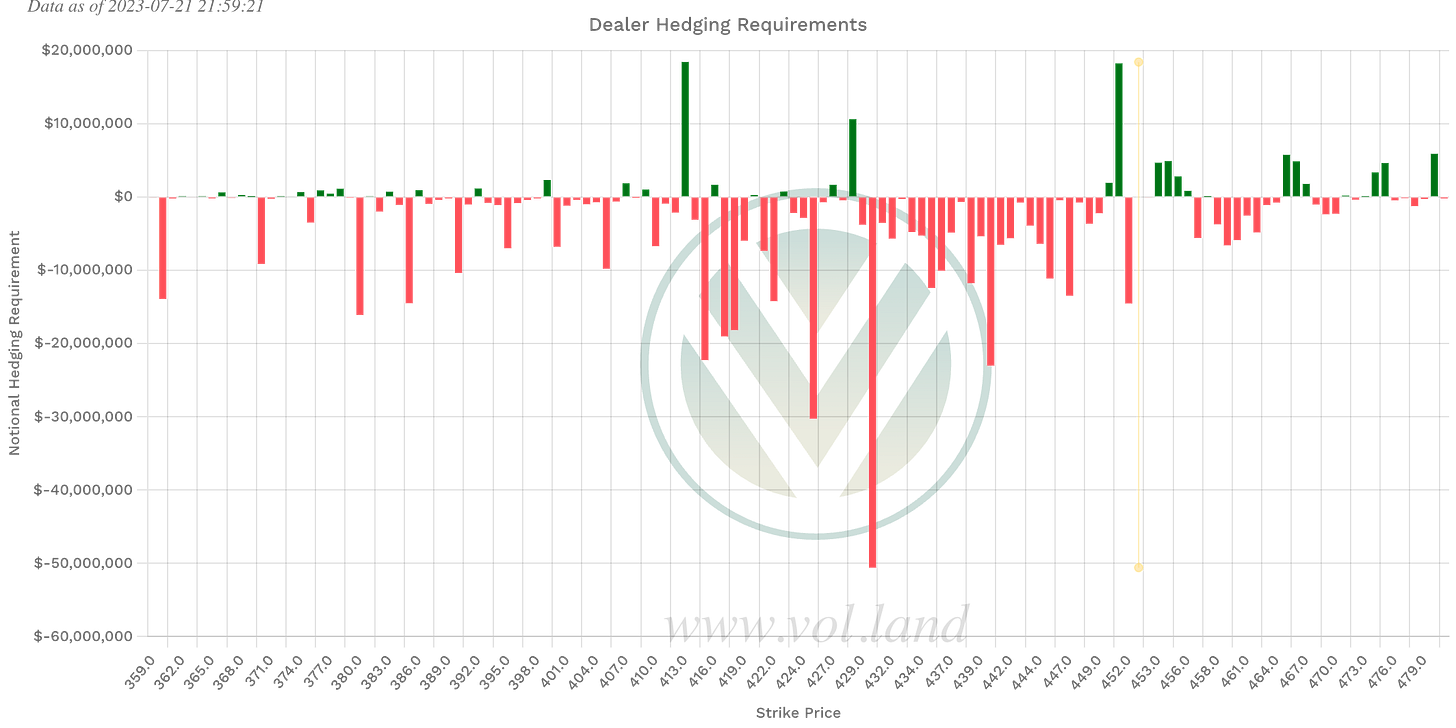

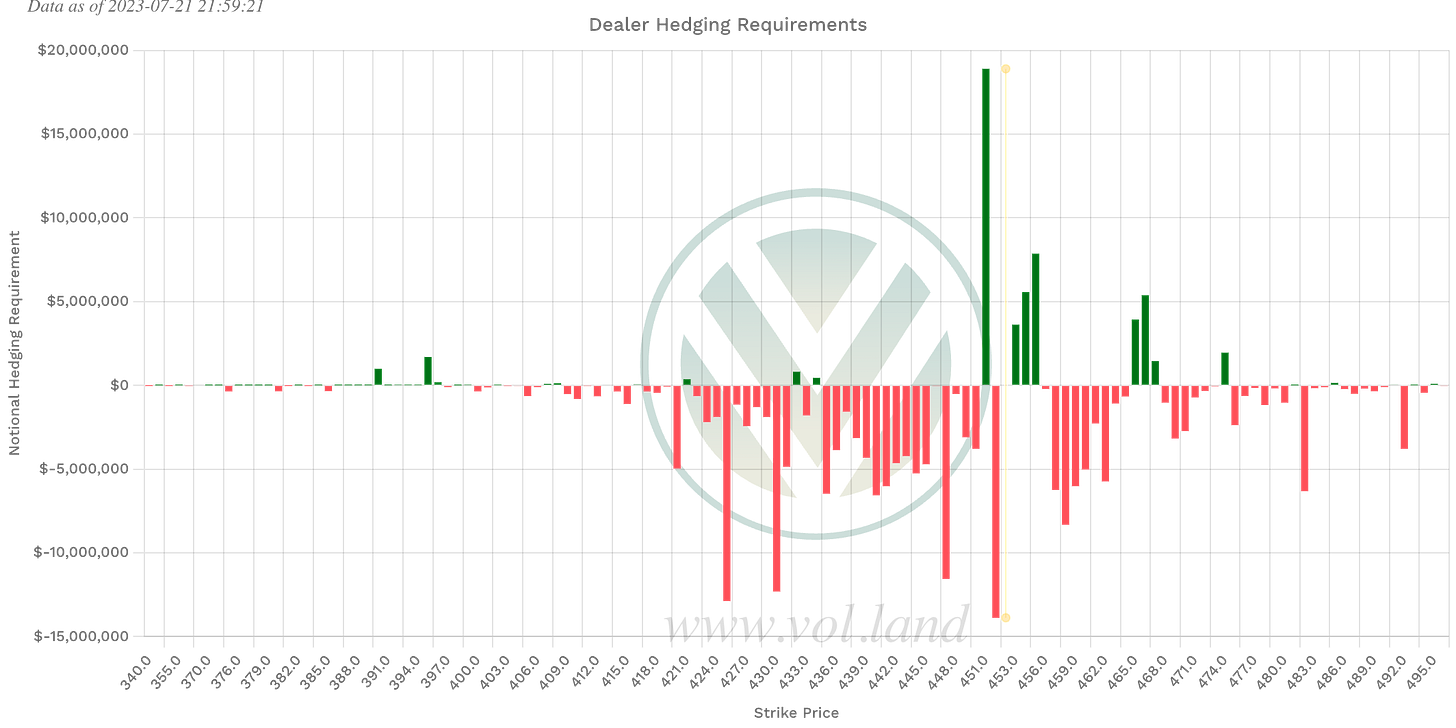

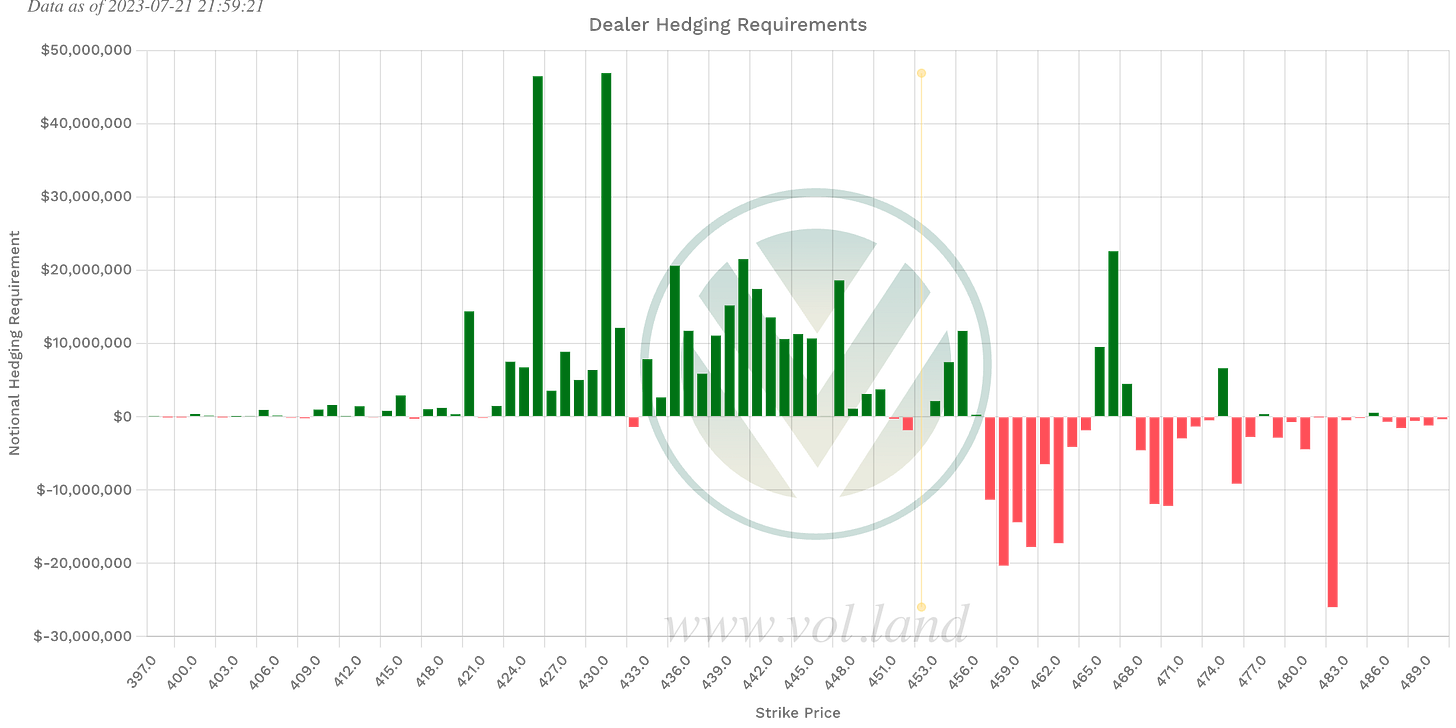

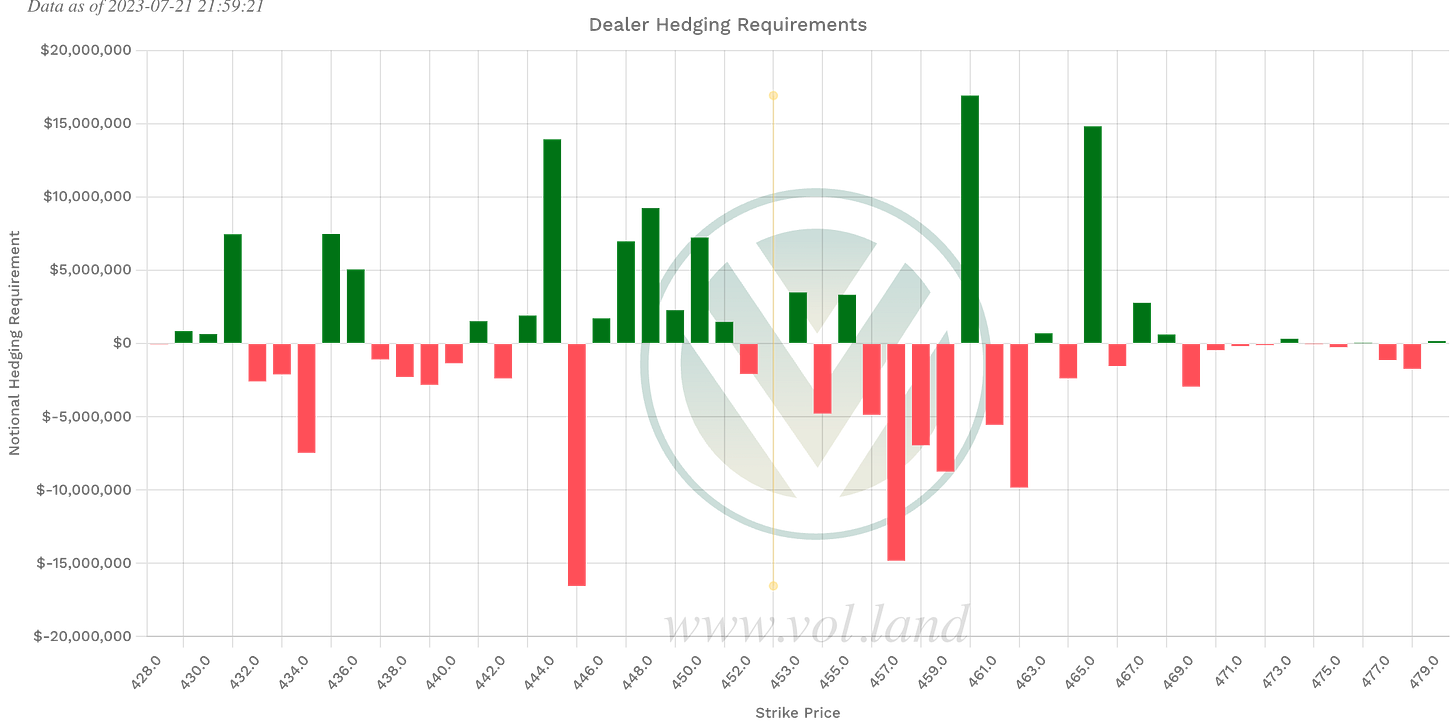

Positive Gamma

Aggregate

428, 450, 451, 453-456

This week

432, 434, 451, 453-455, 465

1DTE (tomorrow’s expiration)

445, 453, 455, 460, 465

Negative Vanna

Aggregate

427, 428, 452, 455, 457, 459+

This week

432, 452, 457-464

1DTE (tomorrow’s expiration)

445, 452, 454, 456-459

The market has more big tech ER this week. QQQ has a weekly implied move of 8.75. I have my levels ready for that and I think I will share on Twitter later. So with the ER’s this week the Volland data could shift, also OPEX was last week, anything can happen. Although I am favoring a pullback, I won’t rule out another bullish leg up, play smart!

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.