Readers,

As you have probably heard NFLX and TSLA, two major players reported after the close. TSLA finished its after hours move with a bid of 279 (closed at 291.26) and NFLX’s current bid is 438 (closed at 477.59). Does this mean we crash? No. There are still many more companies to report. I am in the camp that thinks there needs to be a little bit of a selloff, maybe a retest of 447-444 could be a good spot to reload. But then I look at the volume profile and I think we might have a little more room up before we get that selloff. I am not going to predict, I am going to react and take what the market gives me.

Market Makers (MMs) Weekly Expected Range

Here is an update to the MMs expected weekly move. I will remind you that it is only Wednesday and we have hit this move again. There is another opportunity that the market gets it wrong again and closes outside of this range. Trading is fun isn’t it!

Monthly Volume Profile Levels

Current Value Area

449.46 Value Area High (VAH)

439.48 Point of Control (POC)

437.06 Value Area Low (VAL)

June’s Value Area

438.25 VAH (violated)

436.18 POC

427.52 VAL

Notable Naked Levels

457.83 April 22’ VAH

411.56 May POC

409.77 May VAL

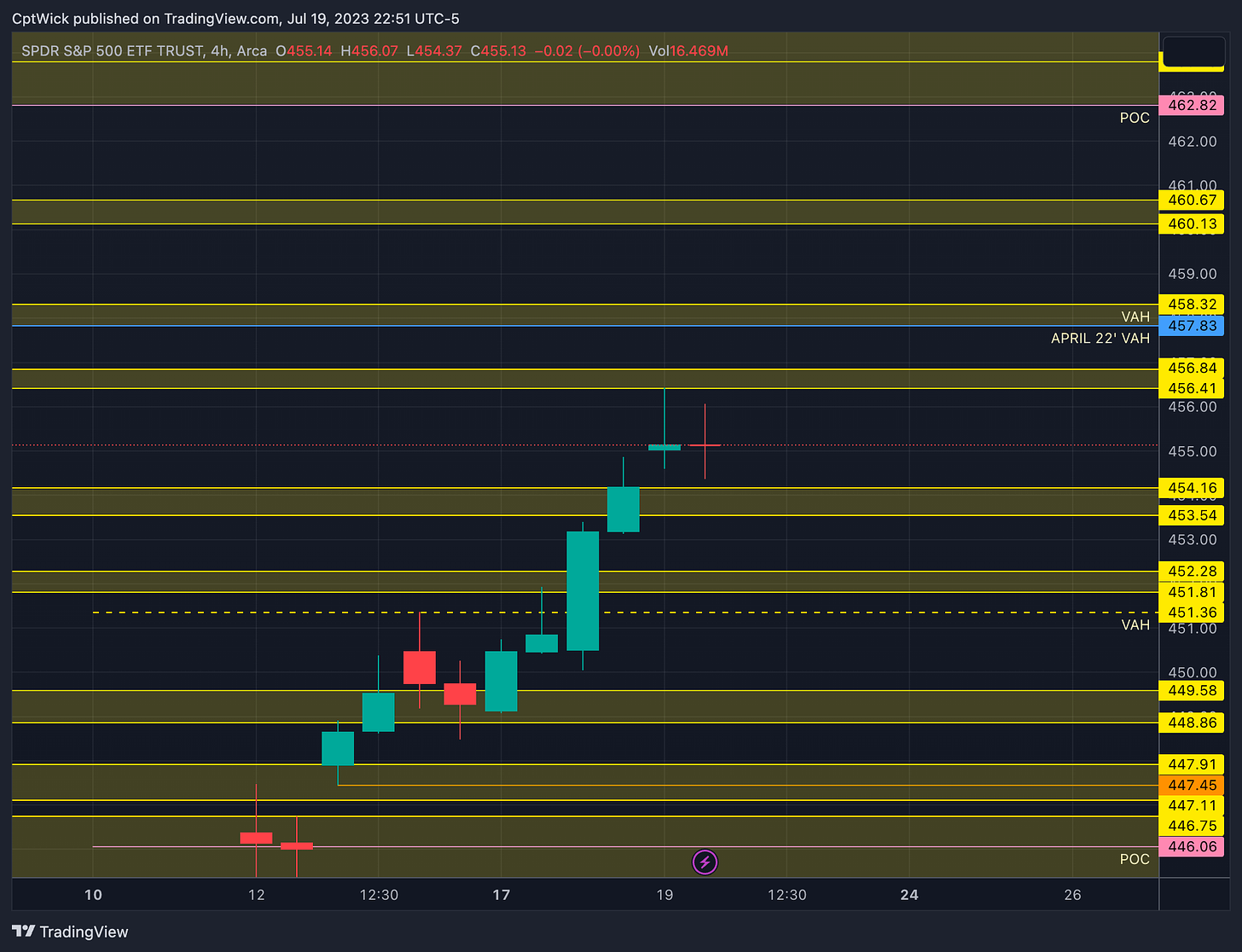

Regarding the monthly profile, a notable observation is the current imbalance to the upside and the profile is “thin”, the VAL and POC have not moved. If you look at the cluster of volume at the current POC you can see that 450-449 could easily be the new POC if price trades there again. Additionally, we are approaching April 22's VAH, representing the last naked value level to the upside according to the monthly profile.

Weekly Volume Profile Levels

Current Levels

456.43 VAH

455.14 POC

451.73 VAL

Last Week's Levels

451.36 VAH (violated)

446.06 POC

441.72 VAL

Notable Naked Levels

444.08 VAH

443.48 POC

436.24 POC

458.32 VAH

462.82 POC

467.89 VAH

We are building value above last weeks value area after breaching it on Tuesday. In the last plan I gave you 451.36 as the key level to break for more upside with a chance of hitting 458.32, I still think that might be the case but we need to be cautious if the market wants to dip for a retest of 446.06.

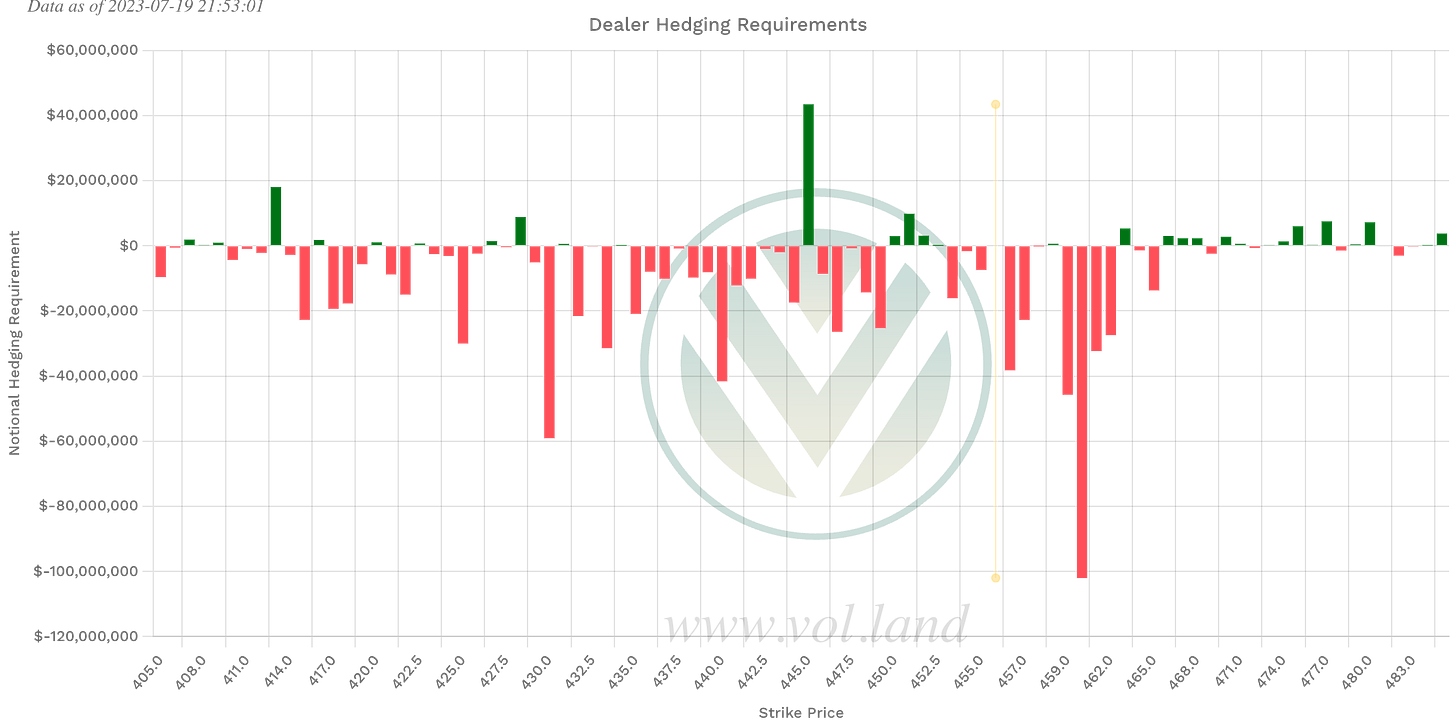

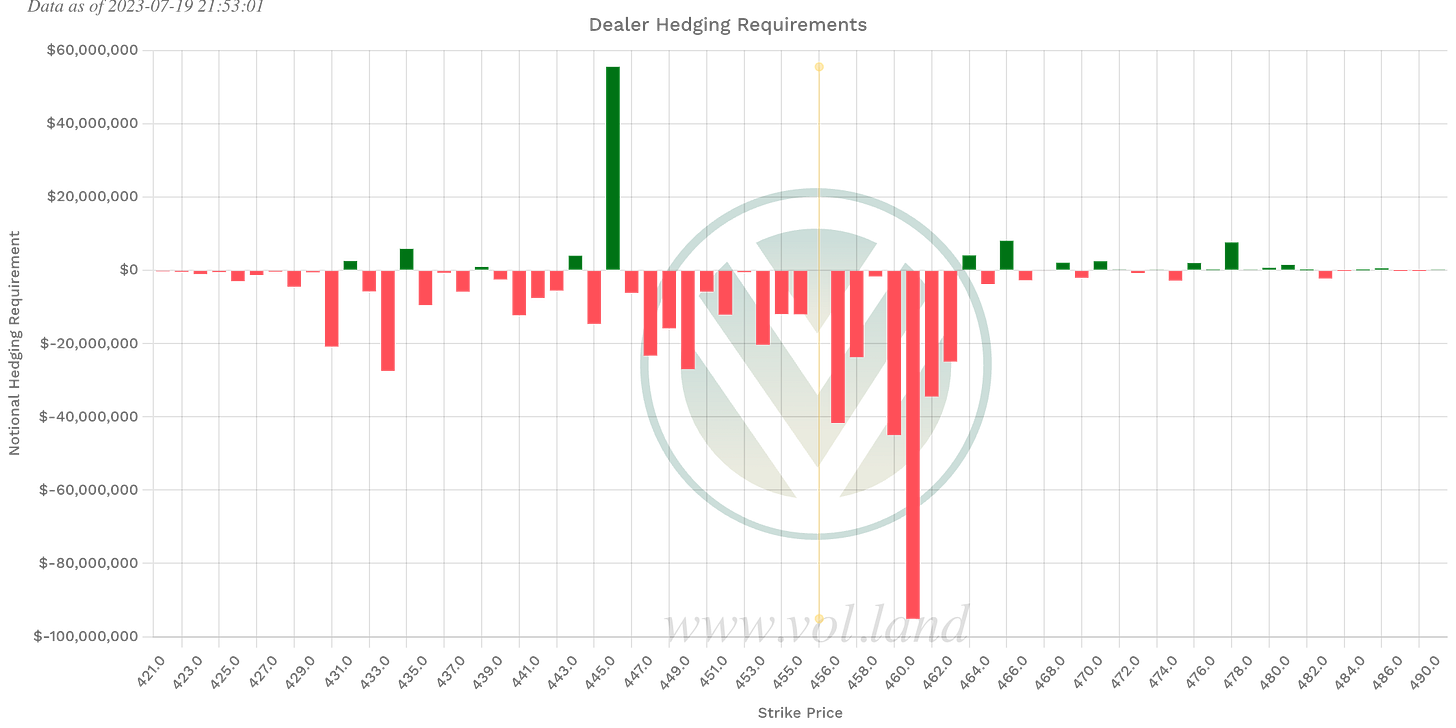

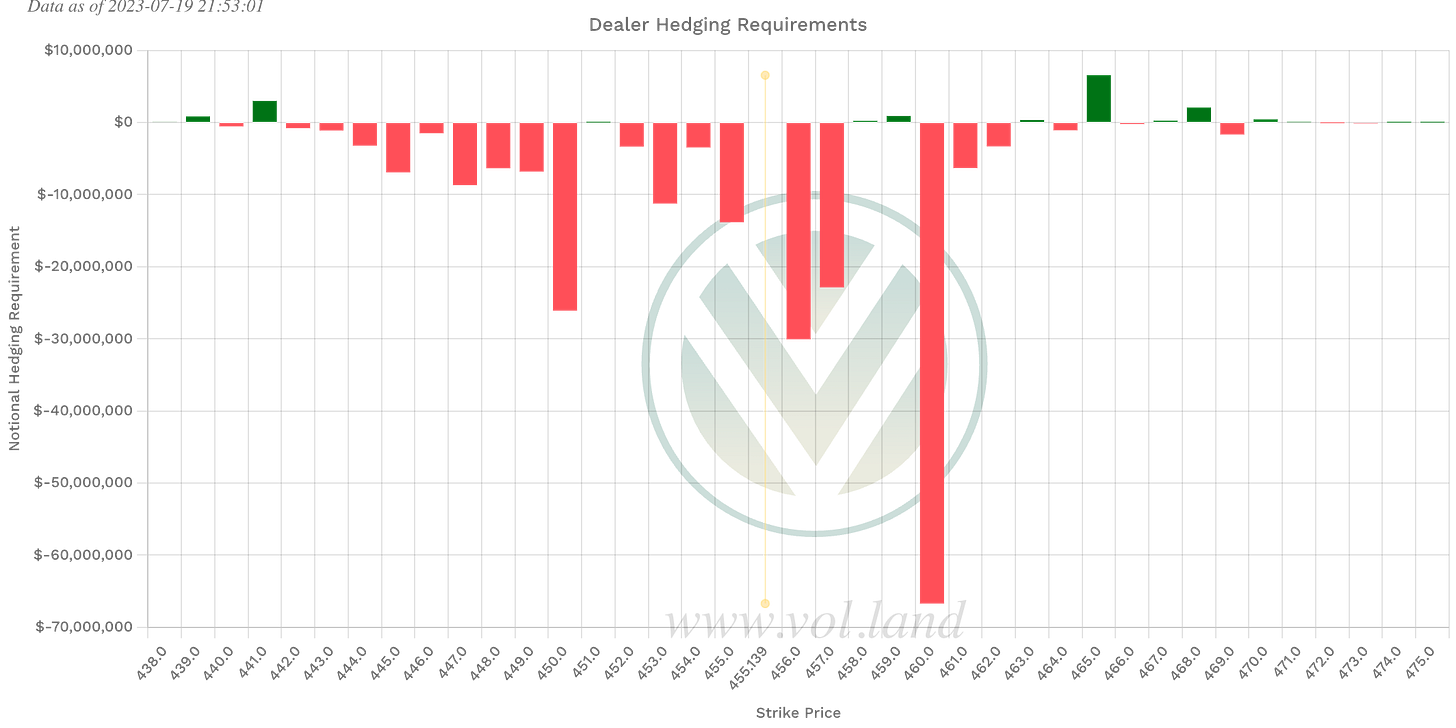

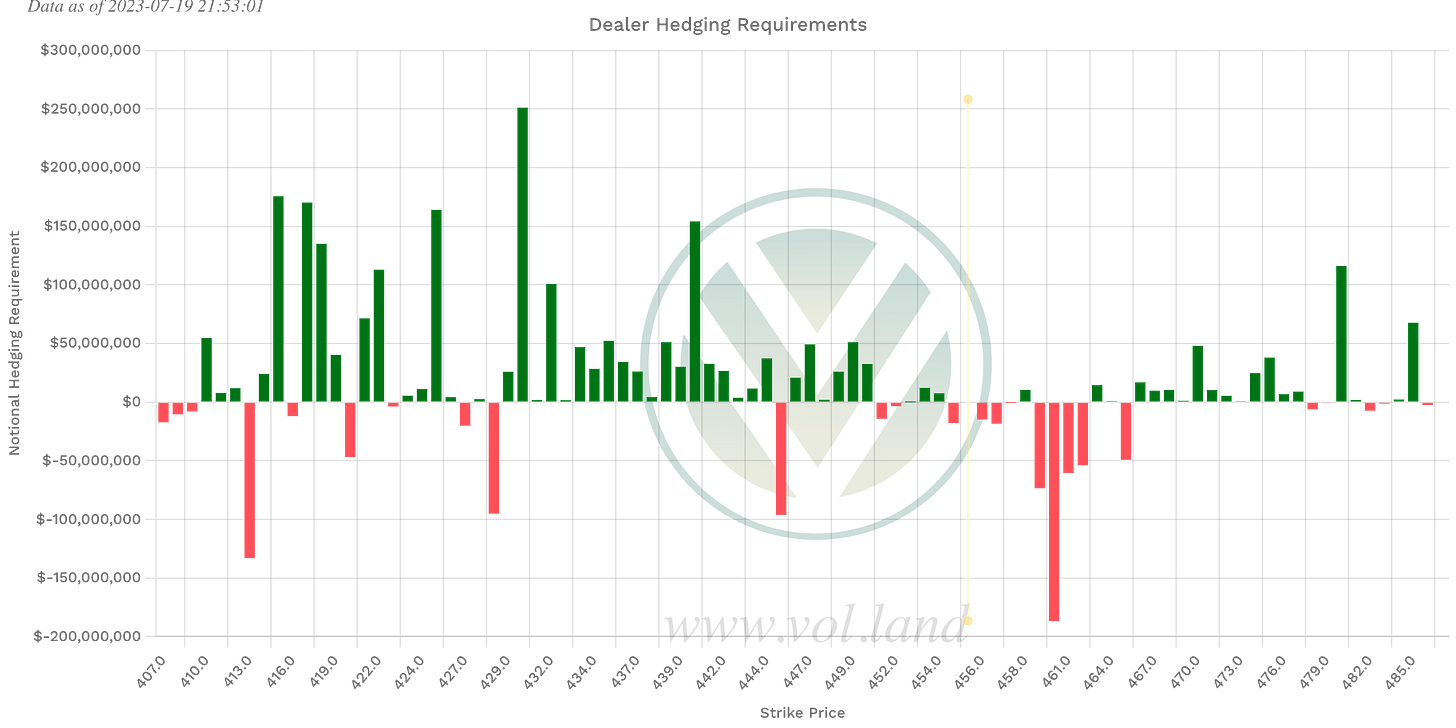

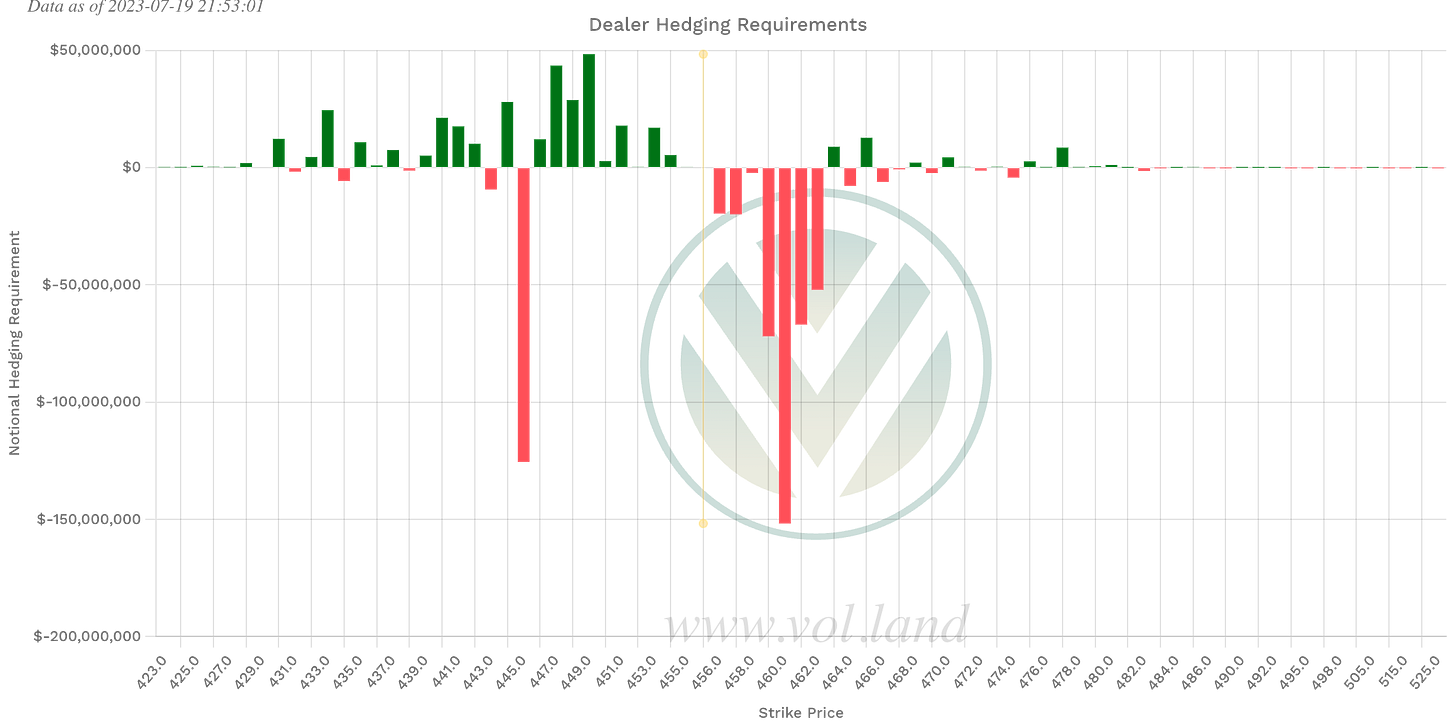

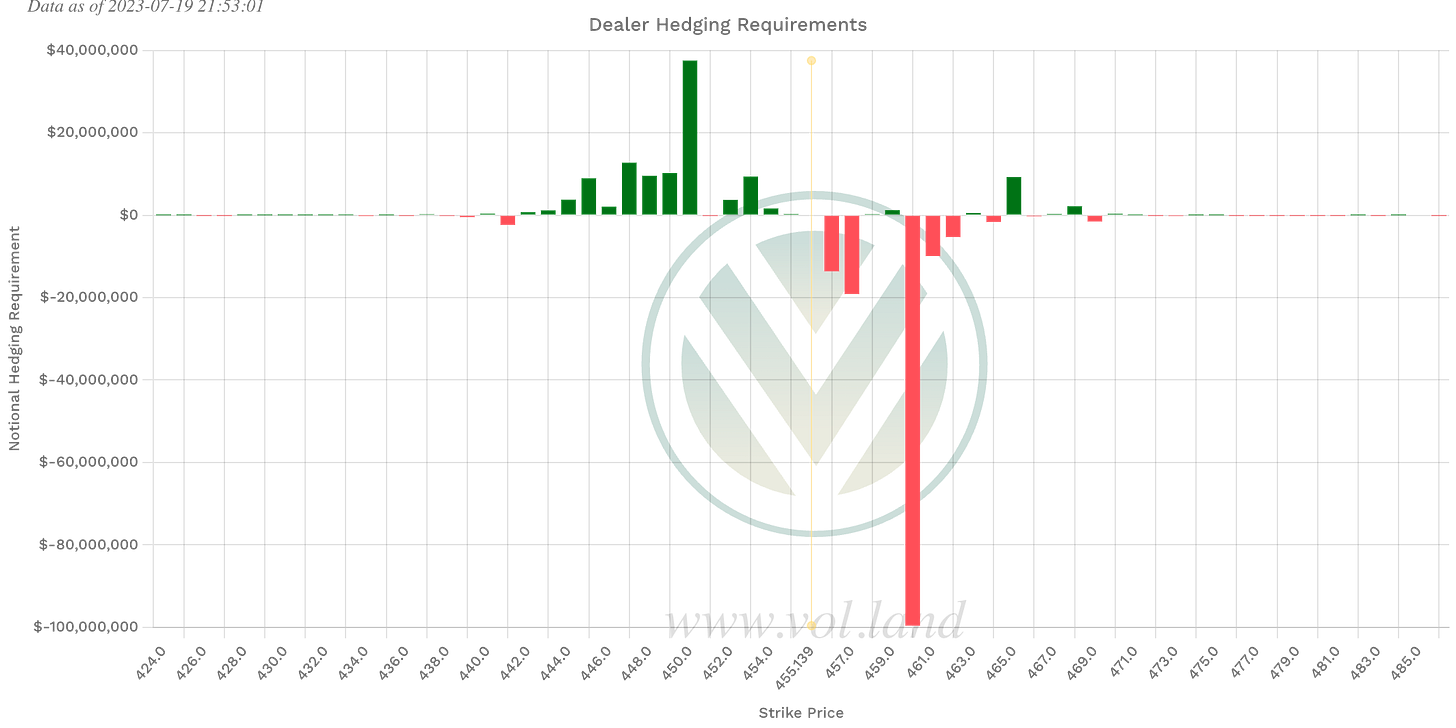

Positive Gamma

Aggregate

428, 445, 450, 451, 452, 463

This week

434, 443, 445, 463

1DTE (tomorrow’s expiration)

441, 459, 465

Negative Vanna

Aggregate

428, 445, 451, 455, 456, 457, 459-462

This week

443-445, 456-462

1DTE (tomorrow’s expiration)

441, 456, 457, 460-462

Levels

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.