Readers,

We had a pretty impressive bullish CPI print that pushed us above some major key levels. In our most recent SPY trade plan we said we were watching to see if this was a double top at 444 or were we going to breakout above 445.

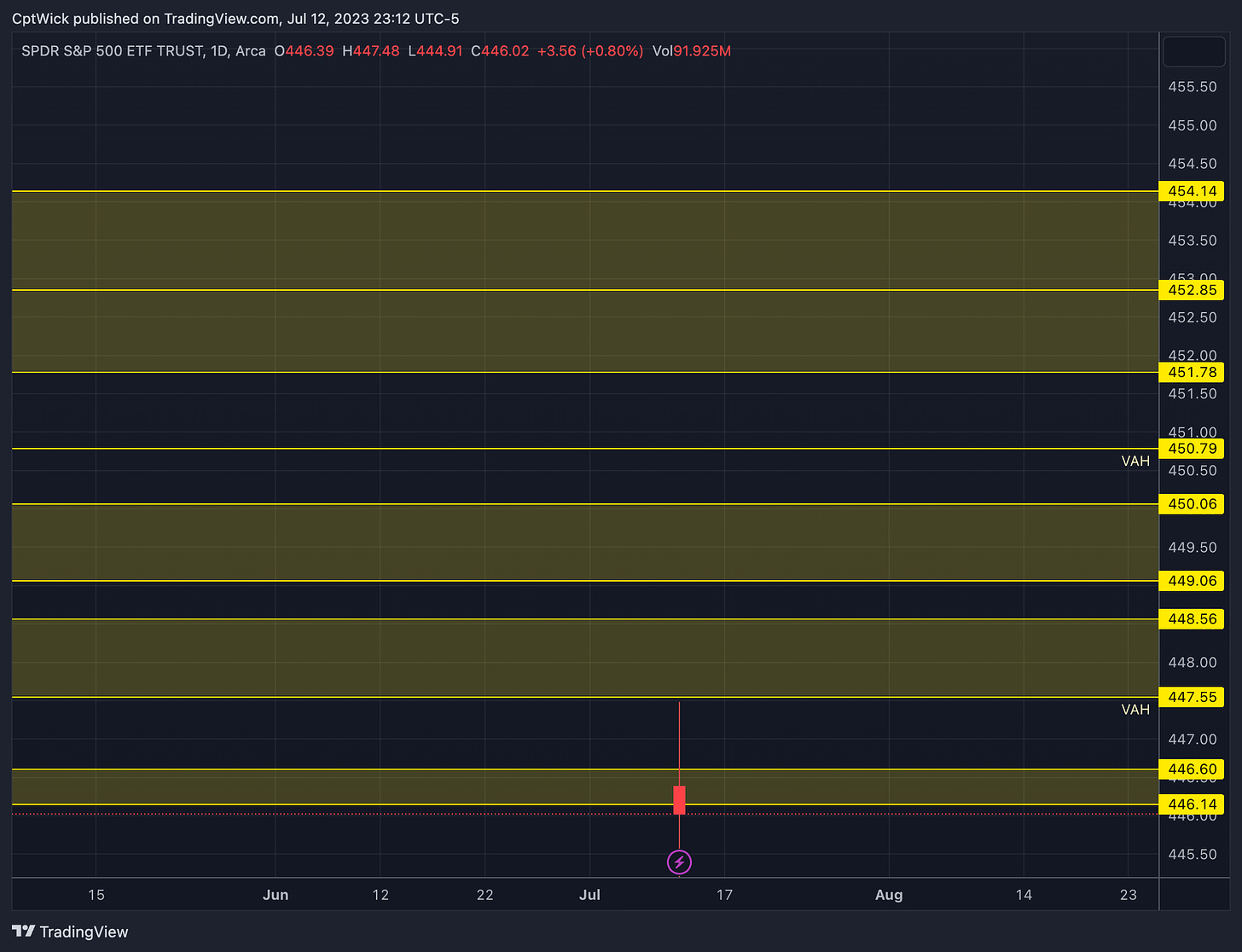

Look at the weekly volume profile, we are three trading sessions into this profile and it has a decent size range. The value area low is at 440.26, point of control is at 446.14, and value area high is at 447.48. Notice how we gapped above last weeks naked VAH and POC and these values are still naked? We also have an unfilled gap from 444.91 to 444.30. We are also trading above the market makers weekly expected move at 444.48. This 443.48-444.08 area will be very important if SPY wants to trade there again.

Here is a chart with the profile values.

Positive Gamma

431, 444, 447, 450, 452

Negative Vanna

431, 444, 451, 455

Key levels above - (previous close 446.02)

Key levels below - (previous close 446.02)

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.