Readers,

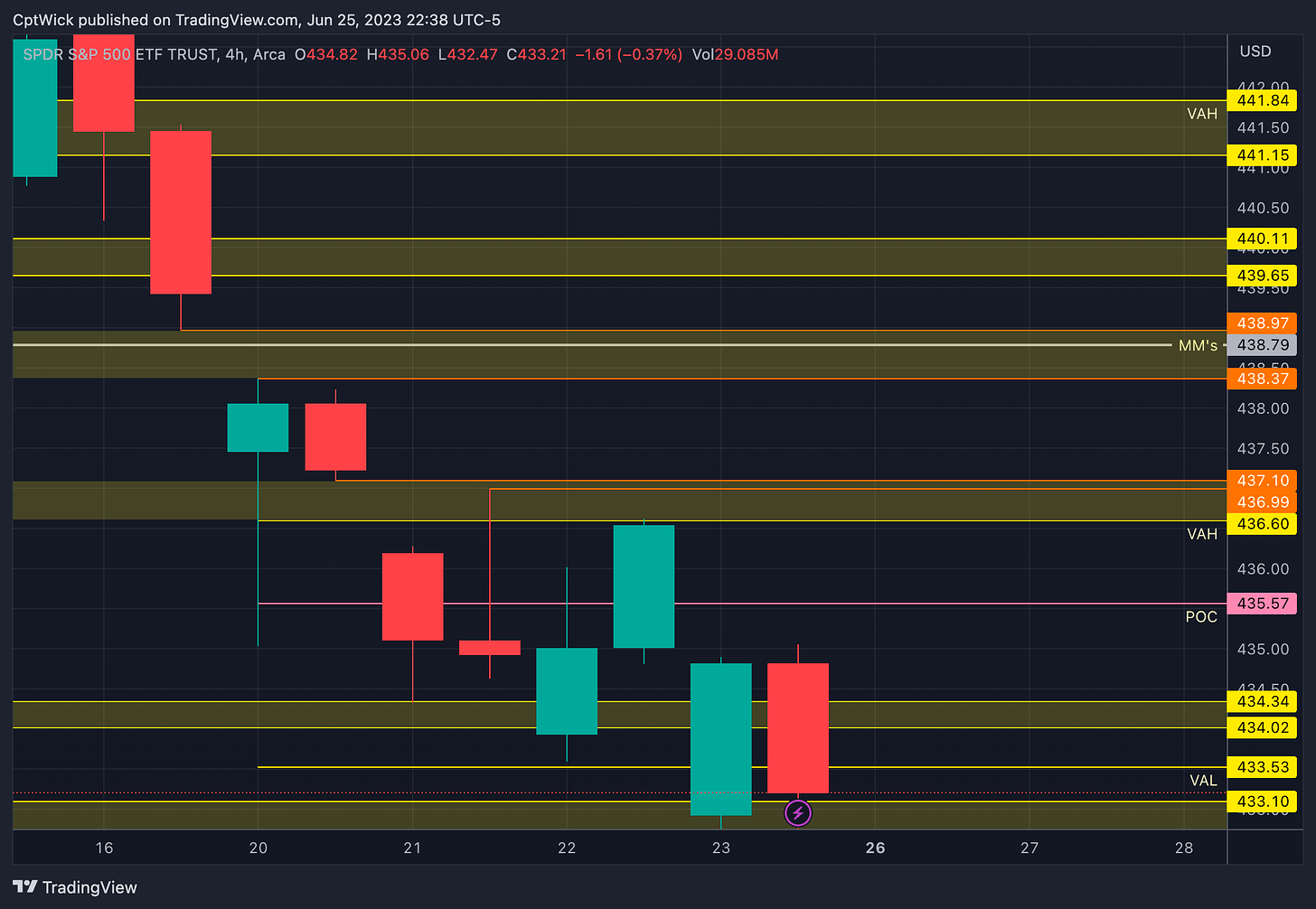

The market makers are expected a weekly move of $5.58, that gives us a upper range of 438.79 and a lower range of 427.63

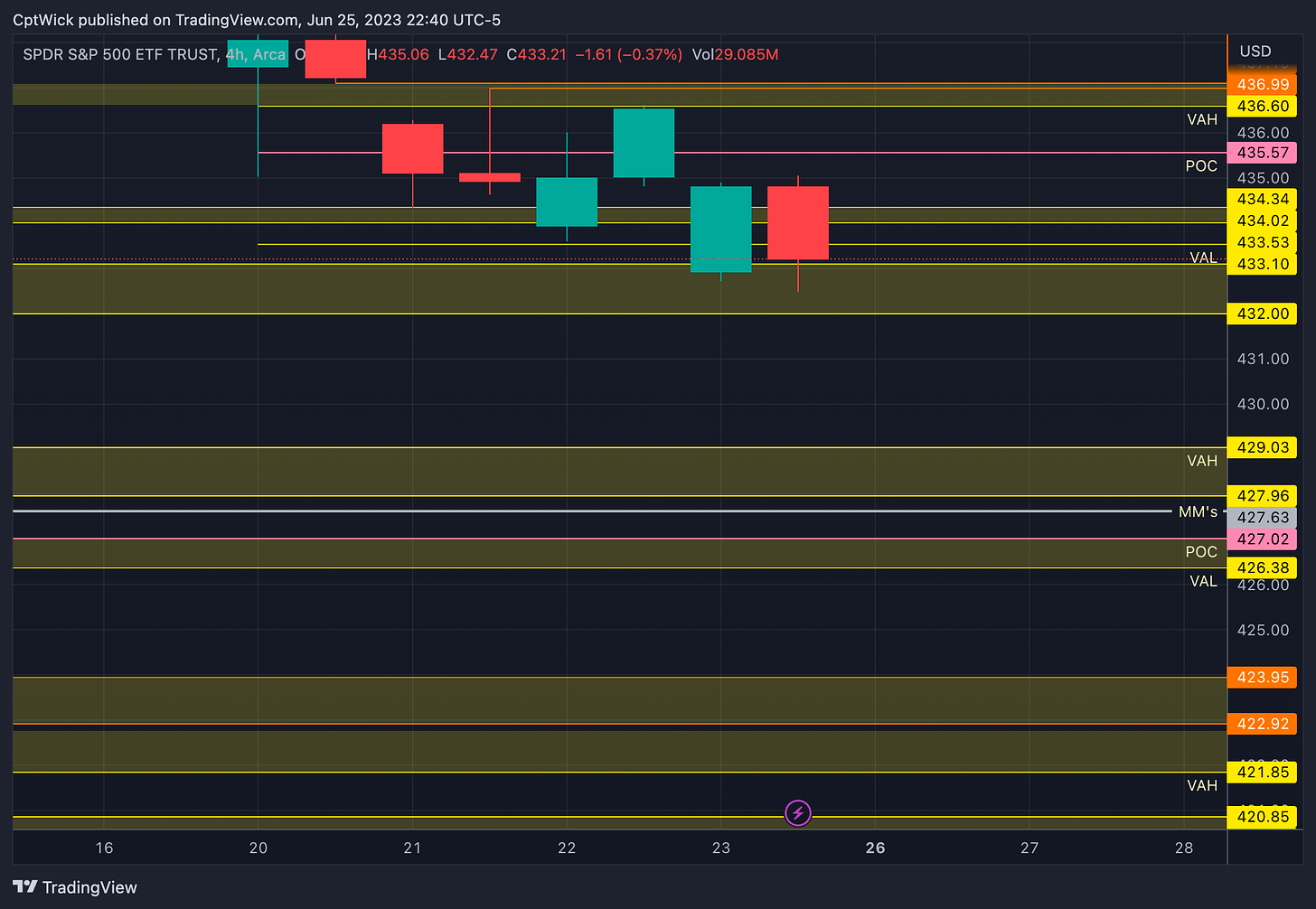

On the monthly profile we fell back into balance, we price is now trading back inside its value area. We have a current VAH at 436.58, POC is at 428.04 and the VAL is 424.11. This is that last trading week for this monthly profile, these values are still dynamic. On this profile we have some really nice supply and demand zones that I will highlight later on in the plan.

On the weekly profile we really need to watch this zone that continues to build volume. Look at the last two weeks and you can see we have ~70% of the trading “volume” between this zone. I bet if you go and look at @Darkmattertrade's plan you will probably see a good amount of dark pool trades around this zone.

One thing that is concerning for the bulls here is this, if you look at the monthly profile you can see that we are back inside of value and the current monthly POC sits right around 428. Last week the weekly profile ended at an imbalance to the downside, meaning we closed “outside” of value or underneath the VAL of 433.53. If price stays below 433.53 we can probably expect a retest of 429/428, which would be healthy in my honest opinion, but we know that this market will do whatever it wants so the only thing we can do is prepare and have a game plan. If we stay within last weeks value area I will more than likely stay lighter on size because we can expect more chop.

We also have some gaps to fill to the upside above this value area. there is a small one at 436.99-437.10 and we also have one at 438.37 and 438.97. The closest gap to the downside sits at 423.95-422.92 as we highlighted last week. Here is a wider view.

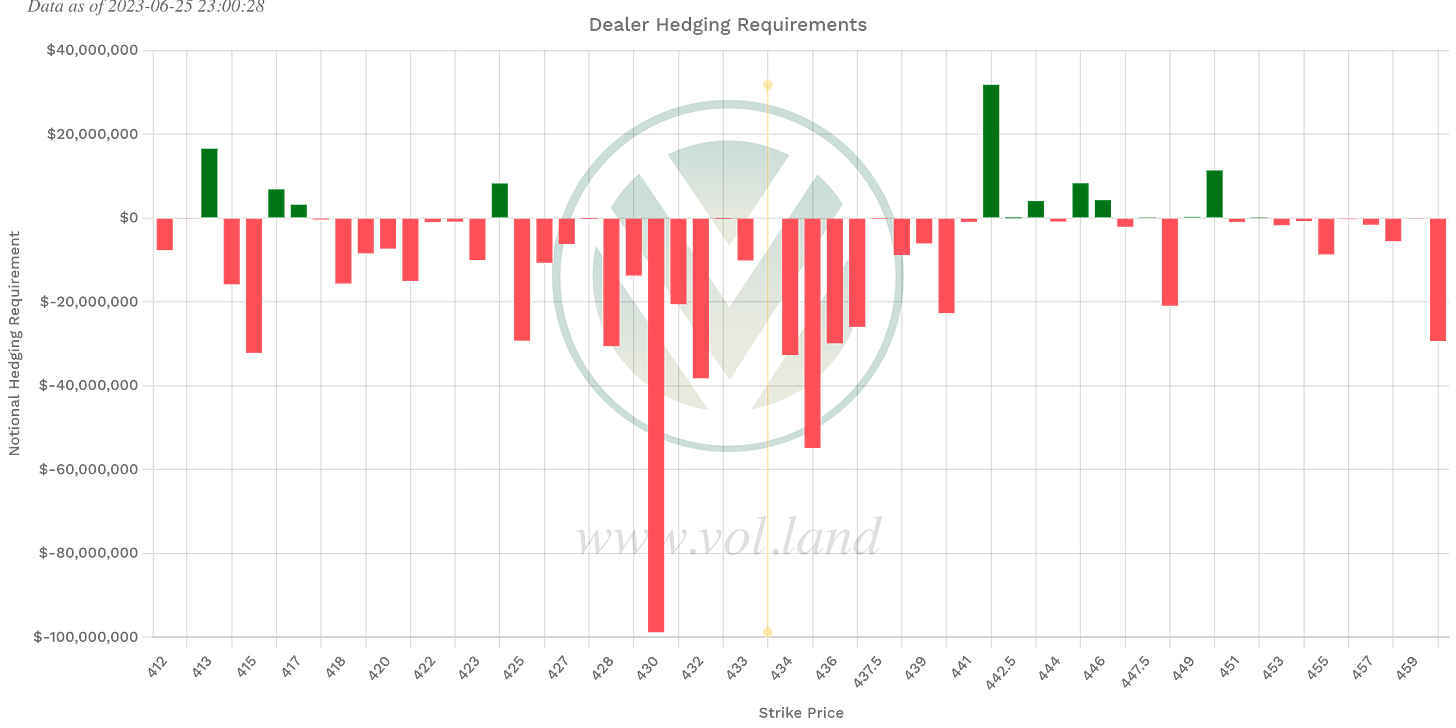

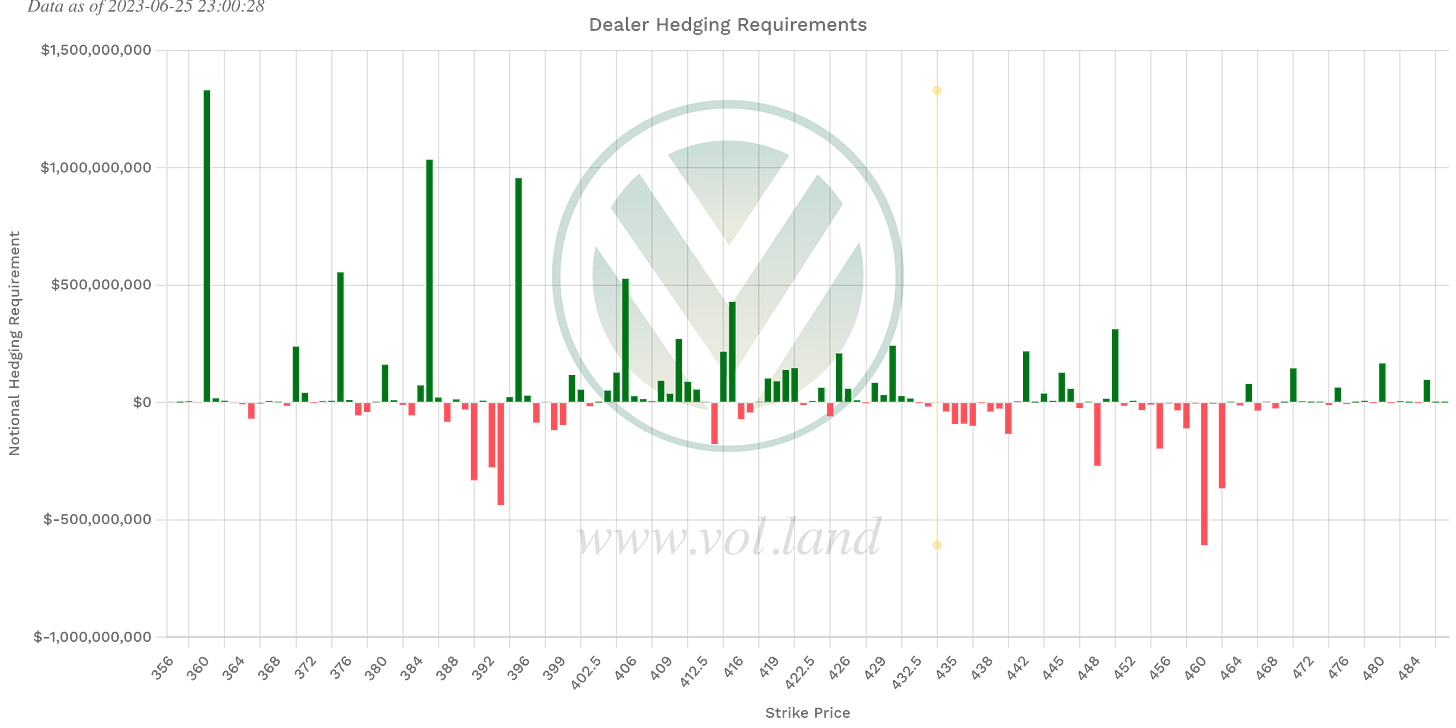

Positive Gamma

424, 442, 443, 445

Negative Vanna

417, 424, 433-440, 447, 448

Key levels above

Key levels below

The big area that I am interested in this week is last weeks value area from 433.53 to 436.60 and I think this area is the key going forward. Pay attention to how price reacts to this zone. We want t be short under it and long above it, be careful trading within it because it could be choppy.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.

good morning. Thank you for sharing. I was wondering, you use Session Volume Profile or Session Volume Profile HD?